The Concept of Risk Transfer

The foundational principle of insurance lies in the concept of risk transfer. Insurance serves as a mechanism through which individuals or businesses can shift the financial burden of potential losses to an insurance company. By doing so, insurance provides a safety net, mitigating the impact of unforeseen events and offering financial protection against uncertainties.

Insurance plays a crucial role in safeguarding individuals and businesses from the financial consequences of adverse events. Whether it’s a natural disaster, an accident, or an illness, insurance provides a means to manage risk and minimize financial losses. By spreading the risk across a larger pool of policyholders, insurance companies can offer financial protection at a more affordable cost than if individuals were to bear the risk alone.

Types of Insurance Policies

Insurance policies are designed to provide financial protection against various risks and uncertainties. There are several types of insurance policies available, each tailored to specific needs and offering unique coverage and benefits.

The primary types of insurance policies include:

Life Insurance

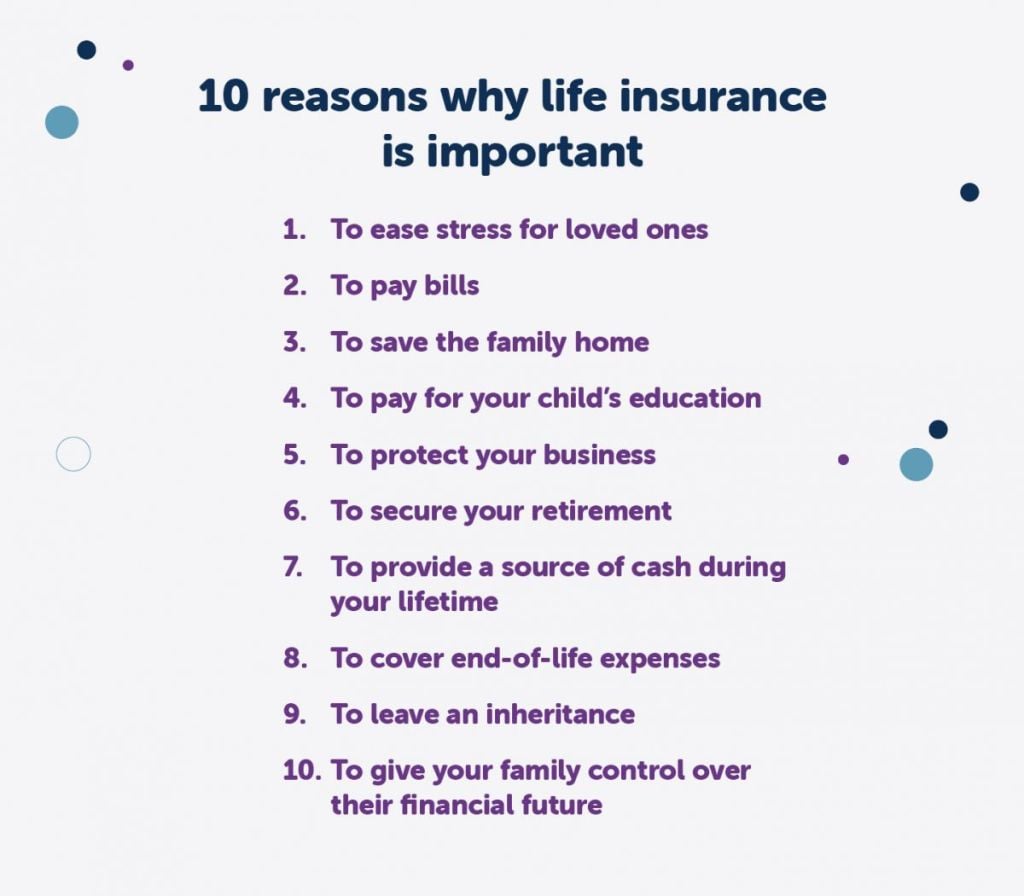

- Provides financial protection for the policyholder’s beneficiaries in the event of their death.

- Offers a death benefit that can be used to cover expenses such as funeral costs, outstanding debts, or income replacement.

- May include additional benefits such as cash value accumulation or riders for specific needs.

Health Insurance

- Covers medical expenses incurred due to illness, injury, or hospitalization.

- Provides benefits such as hospital stays, doctor’s visits, prescription drugs, and preventive care.

- Can help reduce the financial burden associated with healthcare costs.

Property Insurance

- Protects against damage or loss to property, such as homes, vehicles, or businesses.

- Covers risks such as fire, theft, vandalism, and natural disasters.

- Provides financial compensation to repair or replace damaged property.

Liability Insurance

- Protects against legal liability for damages or injuries caused to others.

- Covers costs such as medical expenses, property damage, and legal defense.

- Can be essential for businesses, professionals, and individuals who face potential liability risks.

These are just a few examples of the many types of insurance policies available. It is important to assess individual needs and risks to determine the appropriate coverage and benefits for each situation.

The Insurance Contract

An insurance contract, often referred to as an insurance policy, is a legally binding agreement between two parties: the policyholder and the insurer. It Artikels the terms and conditions under which the insurer agrees to provide financial protection to the policyholder in the event of a covered loss or event.

The key elements of an insurance contract include:

- Policyholder: The individual or entity that purchases the insurance policy and pays the premiums.

- Insurer: The insurance company that provides the coverage and assumes the risk of loss.

- Premium: The amount of money paid by the policyholder to the insurer in exchange for coverage.

- Coverage: The specific risks or events that the policy covers.

Legal and Ethical Obligations

Both the policyholder and the insurer have legal and ethical obligations under the insurance contract. The policyholder is obligated to:

- Pay the premiums on time.

- Provide accurate and complete information on the application.

- Notify the insurer of any changes that could affect the risk.

The insurer is obligated to:

- Provide the coverage as Artikeld in the policy.

- Pay claims promptly and fairly.

- Act in good faith and avoid conflicts of interest.

The Role of Insurance in Financial Planning

Insurance plays a crucial role in financial planning by providing a safety net against unforeseen events that can potentially disrupt financial stability. It offers individuals and businesses the means to protect their assets, income, and overall financial well-being.

By transferring risk to an insurance company, individuals and businesses can mitigate the financial impact of events such as accidents, illnesses, property damage, or legal liabilities. This ensures that they have the resources necessary to maintain their financial goals and commitments, even in the face of unexpected circumstances.

Protecting Assets and Income

Insurance provides comprehensive protection for individuals’ and businesses’ assets and income sources. Homeowners’ insurance, for instance, safeguards against property damage caused by events such as fire, theft, or natural disasters, ensuring that individuals can rebuild or repair their homes without facing significant financial burdens.

Similarly, health insurance covers medical expenses, including doctor visits, hospital stays, and prescription drugs, providing individuals with peace of mind knowing that they can access necessary healthcare without facing excessive financial strain.

Business Continuity and Protection

For businesses, insurance is essential for ensuring continuity and protecting against financial losses. Business interruption insurance, for example, provides coverage for lost income and expenses incurred due to events that force a business to temporarily close, such as a fire or natural disaster.

Commercial property insurance protects businesses against damage or loss of their physical assets, including buildings, equipment, and inventory. This coverage ensures that businesses can recover from unforeseen events and continue their operations without facing severe financial setbacks.

Liability Protection

Insurance also provides liability protection, safeguarding individuals and businesses against legal claims and financial responsibility for injuries or damages caused to others. Professional liability insurance, for instance, protects professionals against claims of negligence or errors in their work, while general liability insurance covers businesses against claims of bodily injury or property damage caused by their operations or products.

By providing liability protection, insurance helps individuals and businesses minimize their exposure to financial risks and legal liabilities, ensuring that they can continue their professional or business activities with confidence.

Insurance Regulation and Oversight

The insurance industry is subject to extensive regulation and oversight to ensure its stability and consumer protection. Regulatory bodies play a crucial role in ensuring that insurance companies operate fairly, responsibly, and in the best interests of policyholders.

Purpose and Methods of Insurance Regulation

Insurance regulation aims to:

– Maintain the solvency of insurance companies to protect policyholders from financial losses.

– Protect consumers from unfair or deceptive practices.

– Prevent fraud and abuse within the insurance system.

Methods of regulation include:

– Solvency requirements: Ensuring that insurance companies have sufficient assets to cover their liabilities.

– Consumer protection measures: Establishing rules to protect policyholders from unfair practices, such as misrepresentation or denial of claims.

– Fraud prevention: Implementing measures to detect and prevent insurance fraud, such as background checks and fraud investigation units.

Role of Regulatory Bodies

Regulatory bodies responsible for insurance oversight include:

– State insurance departments: Regulate insurance companies at the state level.

– National Association of Insurance Commissioners (NAIC): A non-profit organization that develops model laws and regulations for the insurance industry.

– Federal agencies: Such as the Securities and Exchange Commission (SEC) and the Federal Trade Commission (FTC), may have oversight over certain aspects of the insurance industry.

These bodies have the authority to investigate insurance companies, conduct audits, impose fines, and take other enforcement actions to ensure compliance with regulations.

Emerging Trends in Insurance

The insurance industry is constantly evolving, driven by technological advancements, changing risk profiles, and regulatory developments. Several emerging trends are shaping the future of insurance, including:

- Use of Technology: The use of technology is transforming the insurance industry. Insurers are using artificial intelligence (AI), machine learning (ML), and data analytics to improve underwriting, pricing, and claims processing. Telematics and wearable devices are also being used to monitor risk and provide personalized insurance products.

- Data Analytics: Data analytics is playing a crucial role in the insurance industry. Insurers are using data to better understand their customers, identify risks, and develop new products and services. Data analytics is also being used to improve fraud detection and prevention.

- Alternative Risk Transfer Mechanisms: Traditional insurance products are not always the best solution for all risks. As a result, insurers are exploring alternative risk transfer mechanisms, such as captives, risk pools, and catastrophe bonds. These mechanisms allow businesses to transfer risks to a broader pool of capital, potentially reducing their insurance costs.

These emerging trends are having a significant impact on the insurance industry. They are leading to new products and services, more efficient underwriting and claims processing, and a better understanding of risk. As these trends continue to develop, the insurance industry will continue to evolve to meet the changing needs of its customers.