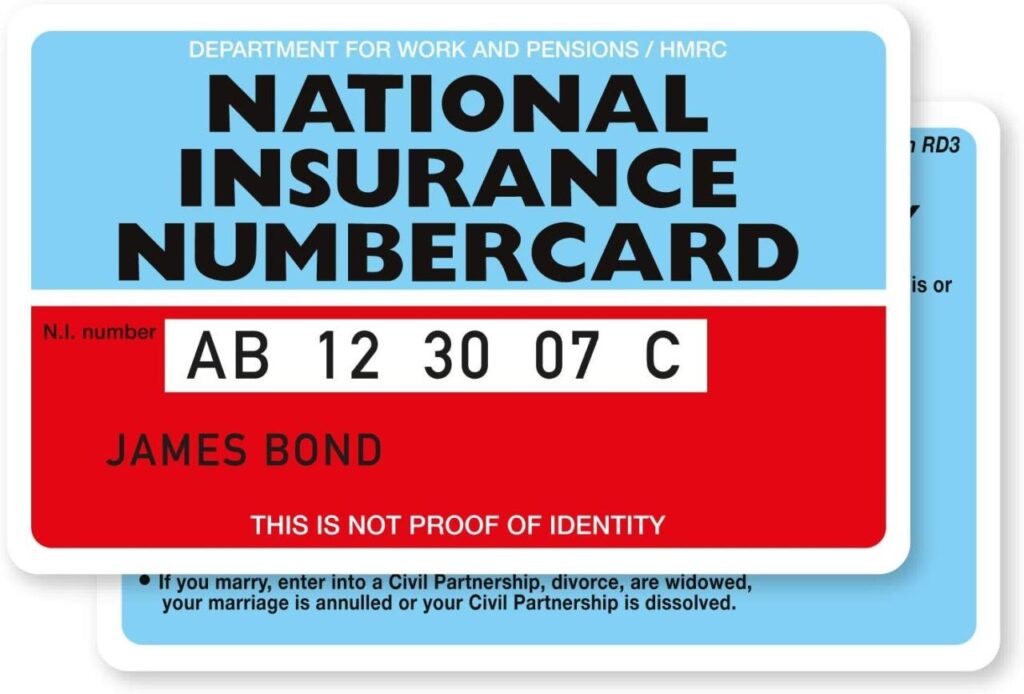

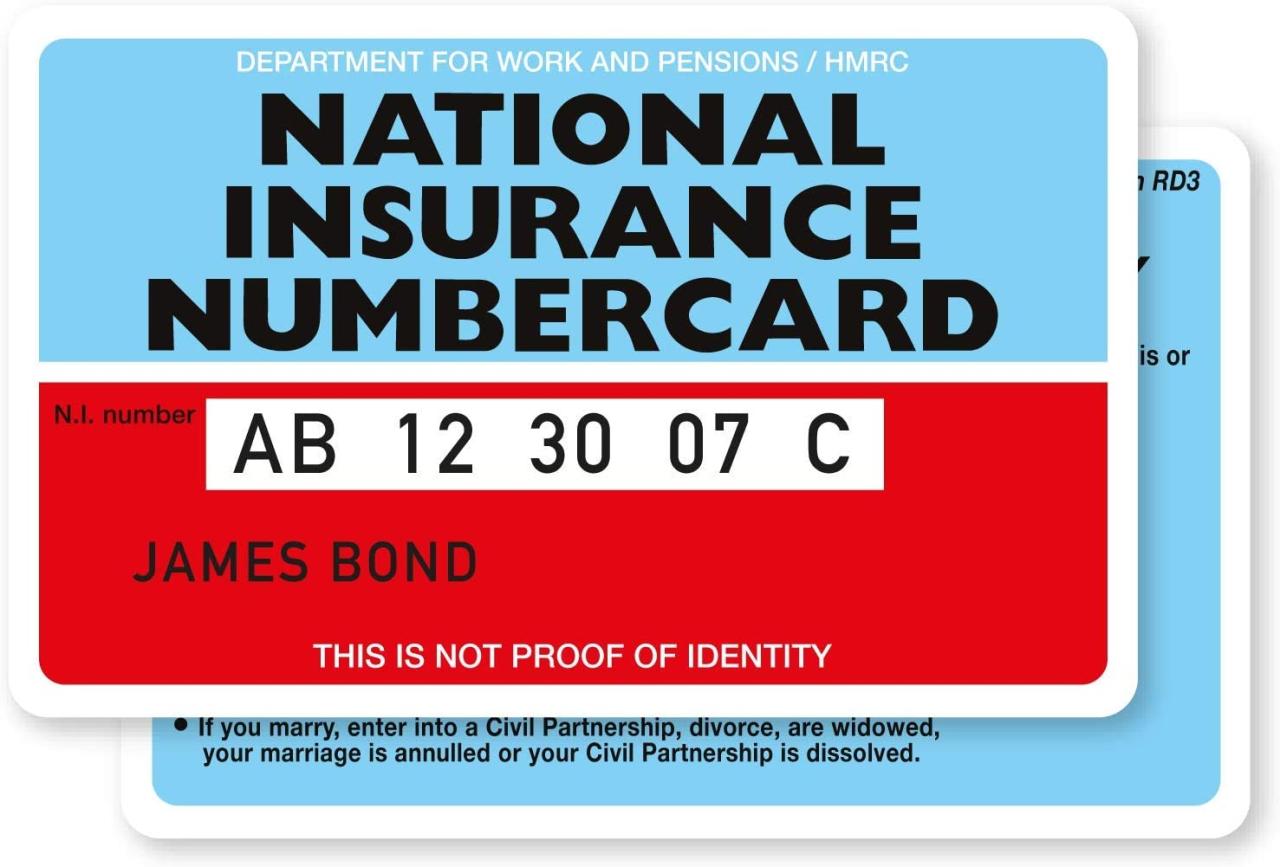

What is a UK National Insurance Number?

A UK National Insurance Number (NINo) is a unique identifier used by the UK government to track individuals’ contributions to the National Insurance system. It is a vital part of the UK’s social security system, as it determines an individual’s eligibility for various benefits and entitlements, such as state pension, unemployment benefits, and healthcare.

Eligibility Criteria

The eligibility criteria for obtaining a UK NINo are as follows:

- Be a UK citizen or have a legal right to work in the UK

- Be over the age of 16

- Not already have a NINo

Individuals Required to Have a NINo

The following individuals are required to have a UK NINo:

- UK citizens who are employed or self-employed

- Non-UK citizens who are legally entitled to work in the UK

- Individuals claiming benefits or entitlements from the UK government

How to Apply for a UK National Insurance Number

Obtaining a UK National Insurance Number is crucial for individuals who work or plan to work in the United Kingdom. The application process is straightforward and can be completed through various methods.

The required documents and information for the application include:

- Valid passport or other acceptable travel document

- Proof of address in the UK

- Evidence of employment or self-employment in the UK

There are two primary methods of applying for a UK National Insurance Number:

Online Application

Individuals can apply online through the government website. This method is convenient and allows applicants to track the status of their application.

Postal Application

Applicants can also submit their application by post by completing the relevant form and sending it to the address provided. This method may take longer to process.

Uses of a UK National Insurance Number

A UK National Insurance Number (NIN) serves various purposes in the United Kingdom. It plays a crucial role in:

Employment and Taxation

Your NIN is used by employers to report your earnings and deductions to Her Majesty’s Revenue and Customs (HMRC). This information forms the basis for calculating your income tax and National Insurance contributions, which fund public services like healthcare and social security.

Accessing Government Benefits and Services

Your NIN is required to access a range of government benefits and services, including:

- State Pension

- Jobseeker’s Allowance

- Child Benefit

- NHS healthcare

Healthcare and Social Security

Your NIN is linked to your NHS record, ensuring that you have access to free healthcare services in the UK. It also entitles you to social security benefits such as:

- Maternity Allowance

- Paternity Leave

- Disability Living Allowance

Consequences of Not Having a UK National Insurance Number

Individuals without a UK National Insurance Number (NIN) may face several negative consequences, including:

Difficulty Obtaining Employment

Most employers in the UK require job applicants to provide their NIN as part of the hiring process. Without a NIN, individuals may find it challenging to secure employment, as employers may be hesitant to hire someone who cannot legally work in the country.

Limited Access to Government Benefits and Services

A NIN is essential for accessing various government benefits and services, such as:

- Healthcare through the National Health Service (NHS)

- State pension

- Unemployment benefits

- Tax credits

Individuals without a NIN may face difficulties accessing these essential services.

Financial Penalties

In some cases, individuals who do not have a NIN may be subject to financial penalties. For example, they may be required to pay a surcharge when using the NHS or may be ineligible for certain tax reliefs.

Safeguarding Your UK National Insurance Number

Your UK National Insurance Number (NI number) is a vital piece of personal information that is used to track your National Insurance contributions and access various government services. It’s crucial to safeguard your NI number to prevent fraud and identity theft.

Here are some tips to protect your NI number:

Keep it confidential

Never share your NI number with anyone other than authorized government agencies or trusted individuals, such as your employer or financial advisor. Be wary of phone calls, emails, or letters asking for your NI number, as these may be phishing scams.

Use strong passwords

If you have to create online accounts that require your NI number, use strong and unique passwords. Avoid using easily guessable information, such as your name or birthdate.

Check your credit report regularly

Monitor your credit report for any suspicious activity, such as new accounts being opened in your name without your knowledge. This could be a sign that your NI number has been compromised.

Report lost or stolen NI numbers

If your NI number is lost or stolen, report it to the National Insurance Number Service immediately. They will issue you a new NI number and take steps to prevent fraud.