Overview of Representations and Warranties Insurance

Representations and warranties insurance, also known as R&W insurance, is a type of insurance that protects businesses and individuals from financial losses resulting from breaches of representations and warranties made during transactions, such as mergers, acquisitions, and asset sales.

R&W insurance provides coverage for losses incurred due to inaccurate or misleading representations and warranties made by the seller or buyer of a business or asset. This insurance can help mitigate the risks associated with these transactions, which can be substantial, especially in complex or high-value deals.

Key Features and Benefits of R&W Insurance

- Provides financial protection against losses resulting from breaches of representations and warranties.

- Helps allocate risk between the buyer and seller, making transactions more feasible.

- Can facilitate smoother and more efficient transactions by reducing the need for extensive due diligence and negotiations.

- Provides coverage for both known and unknown breaches, offering comprehensive protection.

- Can enhance the credibility of the transaction by providing an independent assessment of the representations and warranties.

Common Representations and Warranties Covered

R&W insurance typically covers a wide range of representations and warranties, including:

- Financial statements and accounting records

- Compliance with laws and regulations

- Ownership and title to assets

- Tax status

- Environmental matters

Underwriting and Pricing of Representations and Warranties Insurance

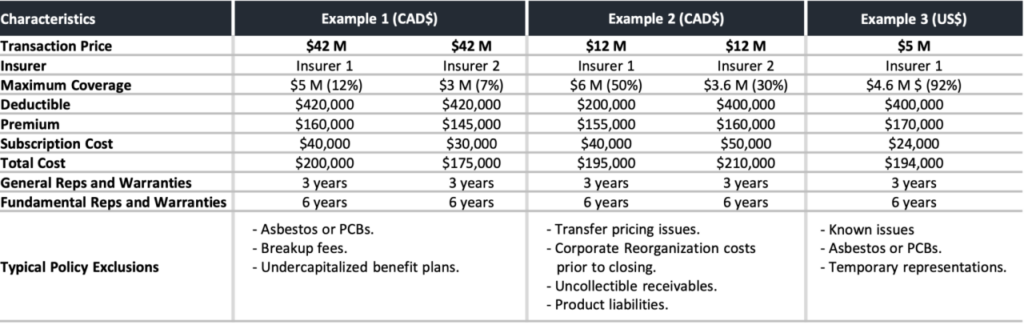

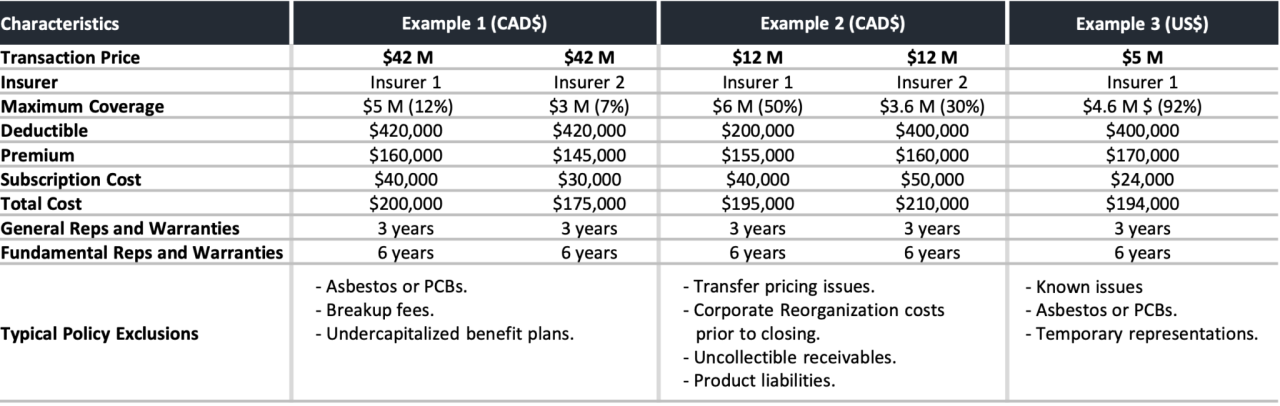

Underwriting representations and warranties (R&W) insurance involves assessing the risk associated with a transaction and determining the appropriate coverage and premium. This process considers factors such as the nature of the transaction, the financial condition of the parties involved, and the specific representations and warranties being made.

Factors Influencing Pricing

Several factors influence the pricing of R&W insurance, including:

- Transaction size and complexity: Larger and more complex transactions typically carry higher premiums.

- Industry and target company: Certain industries and target companies may pose higher risks, leading to higher premiums.

- Financial condition of the parties: The financial strength of the buyer and seller can impact the premium.

- Nature of representations and warranties: More extensive and specific representations and warranties generally result in higher premiums.

- Prior claims history: A history of prior claims can increase the premium.

- Insurance market conditions: The availability and pricing of R&W insurance can vary depending on market conditions.

Negotiating Favorable Terms and Premiums

To negotiate favorable terms and premiums for R&W insurance, consider the following tips:

- Provide comprehensive due diligence: A thorough due diligence process can help identify potential risks and strengthen your negotiating position.

- Shop around: Obtain quotes from multiple insurers to compare coverage and pricing.

- Negotiate coverage and exclusions: Carefully review the policy language and negotiate specific coverage and exclusions that meet your needs.

- Consider a deductible: A higher deductible can reduce the premium, but it also increases your out-of-pocket risk.

- Build a strong relationship with the insurer: Establishing a positive relationship with the insurer can facilitate negotiations and future claims handling.

Claims Handling and Dispute Resolution

Claims handling for representations and warranties insurance involves a systematic process to assess the validity and extent of the claim, investigate the circumstances, and determine the appropriate settlement.

Common disputes that arise in representations and warranties insurance include:

- Disagreements over the interpretation of representations and warranties

- Allegations of misrepresentation or breach of warranty

- Denial of coverage based on exclusions or limitations

Strategies for resolving disputes and maximizing recovery include:

- Open and timely communication between the policyholder, insurer, and their respective legal counsel

- Thorough investigation and documentation of the claim

- Negotiation and mediation to reach a mutually acceptable settlement

- Litigation as a last resort

Market Trends and Emerging Issues

The representations and warranties insurance market has witnessed significant growth in recent years, driven by increasing M&A activity and heightened awareness of potential liabilities. Key trends shaping the market include:

– Expansion into new markets: Insurers are expanding their offerings to cater to a wider range of industries and transaction types.

– Increased competition: The entry of new players and the expansion of existing insurers have intensified competition, leading to more favorable terms for policyholders.

– Technological advancements: The use of data analytics and artificial intelligence is enhancing underwriting capabilities and reducing costs.

Emerging Issues and Challenges

Despite the growth, the market faces several emerging issues and challenges:

– Regulatory changes: Evolving regulatory landscapes can impact the availability and coverage of representations and warranties insurance.

– Increased litigation: The rise in M&A litigation has increased the demand for insurance coverage, potentially leading to higher premiums and stricter underwriting standards.

– Cyber risks: The growing prevalence of cyber threats poses new risks to representations and warranties, requiring insurers to adapt their coverage and underwriting practices.

Future of Representations and Warranties Insurance

The future of representations and warranties insurance is expected to be characterized by:

– Continued growth: The market is projected to continue expanding as M&A activity remains strong and awareness of potential liabilities grows.

– Innovation: Insurers will continue to innovate their products and services to meet the evolving needs of policyholders.

– Risk mitigation: Insurers will focus on developing strategies to mitigate risks associated with representations and warranties, such as enhanced due diligence and the use of technology.