Types of Insurance in India

Insurance in India plays a crucial role in providing financial protection against various risks and uncertainties. There are numerous types of insurance available in India, each designed to address specific needs and provide coverage for different aspects of life. Understanding the different types of insurance can help individuals and businesses make informed decisions about their insurance requirements.

Life Insurance

Life insurance provides financial protection to the policyholder’s family in the event of their untimely demise. It ensures that the family receives a lump sum or regular income to maintain their standard of living and meet financial obligations. Life insurance policies can be term life insurance, whole life insurance, or endowment plans, each with its unique features and benefits.

Health Insurance

Health insurance provides coverage for medical expenses incurred due to illness or injury. It helps individuals and families manage the financial burden of healthcare costs, which can be substantial, especially in the case of critical illnesses or accidents. Health insurance policies cover various expenses, including hospitalization, doctor’s fees, and prescription drugs.

Auto Insurance

Auto insurance protects individuals against financial losses resulting from accidents involving their vehicles. It provides coverage for damage to the policyholder’s vehicle, as well as liability coverage for damages caused to other vehicles or property. Auto insurance is mandatory in India for all vehicles registered for use on public roads.

Home Insurance

Home insurance provides coverage for damages or losses to the policyholder’s home and its contents. It protects against risks such as fire, theft, natural disasters, and accidental damage. Home insurance policies can also include additional coverage for personal belongings and valuables.

Insurance Regulations in India

The insurance industry in India is governed by a comprehensive regulatory framework aimed at protecting policyholders’ interests and ensuring the smooth functioning of the sector. The Insurance Regulatory and Development Authority of India (IRDAI) is the apex regulatory body responsible for regulating and developing the insurance industry in the country.

IRDAI was established in 1999 under the Insurance Regulatory and Development Authority Act, 1999. It is an autonomous body that reports to the Ministry of Finance. IRDAI’s primary objectives include:

- Protecting the interests of policyholders

- Regulating and developing the insurance industry

- Promoting fair competition among insurers

- Ensuring the financial soundness of insurers

Timeline of Key Insurance Regulations in India

Over the years, IRDAI has introduced several key regulations to strengthen the insurance sector in India. Some of the most significant regulations include:

- 1999: The Insurance Regulatory and Development Authority Act was passed, establishing IRDAI as the regulatory body for the insurance industry.

- 2000: IRDAI issued the Insurance Regulatory and Development Authority (Licensing of Insurance Companies) Regulations, 2000, which set out the requirements for obtaining a license to operate as an insurance company in India.

- 2002: IRDAI issued the Insurance Regulatory and Development Authority (Protection of Policyholders’ Interests) Regulations, 2002, which aimed to protect the interests of policyholders by setting out minimum standards for insurance policies and claims handling.

- 2010: IRDAI issued the Insurance Regulatory and Development Authority (Investment) Regulations, 2010, which set out the investment guidelines for insurance companies.

- 2015: IRDAI issued the Insurance Regulatory and Development Authority (Health Insurance) Regulations, 2015, which aimed to regulate the health insurance sector and ensure the availability of affordable health insurance products.

Insurance Market in India

The insurance market in India is one of the fastest-growing in the world, with a projected growth rate of 12% per annum over the next five years. This growth is being driven by a number of factors, including the increasing awareness of insurance among the Indian population, the rising disposable income, and the government’s initiatives to promote financial inclusion.

The insurance industry in India is dominated by a few large players, including the Life Insurance Corporation of India (LIC), the New India Assurance Company, and the General Insurance Corporation of India (GIC). These companies account for over 80% of the market share.

Challenges and Opportunities

The insurance industry in India faces a number of challenges, including the low penetration of insurance, the high cost of insurance, and the lack of awareness about insurance among the population. However, there are also a number of opportunities for growth, including the increasing disposable income of the Indian population, the government’s initiatives to promote financial inclusion, and the growing demand for insurance products from the rural population.

Insurance Products and Services

Insurance companies in India offer a comprehensive range of insurance products and services tailored to meet the diverse needs of individuals and businesses. These products provide financial protection against various risks and uncertainties, enabling individuals to safeguard their financial well-being and secure their future.

Life Insurance Policies

Life insurance policies provide financial protection to the policyholder’s family in the event of their untimely demise. Some common types of life insurance policies include:

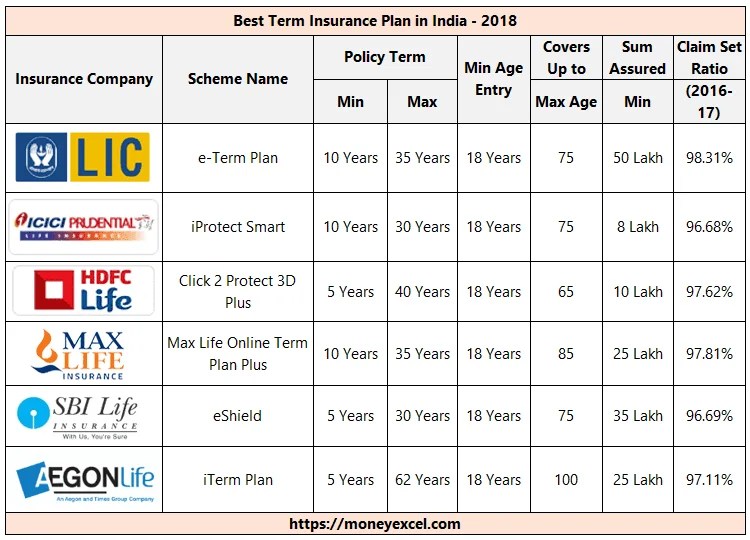

– Term Life Insurance: Offers coverage for a specified period, providing a lump sum payment to the beneficiaries upon the policyholder’s death within the policy term.

– Endowment Plans: Combine life insurance with savings, offering a maturity benefit along with death coverage. The policyholder receives the maturity amount at the end of the policy term if they survive.

– Whole Life Insurance: Provides lifelong coverage, ensuring financial security for the policyholder’s family throughout their life.

Health Insurance Plans

Health insurance plans provide coverage for medical expenses incurred due to illness or injury. They help individuals manage the financial burden of healthcare costs, ensuring access to quality medical care. Some common types of health insurance plans include:

– Individual Health Insurance: Covers the medical expenses of an individual, providing reimbursement for hospitalization, surgeries, and other medical treatments.

– Family Floater Health Insurance: Covers the medical expenses of all family members under a single policy, offering comprehensive protection for the entire family.

– Critical Illness Insurance: Provides a lump sum payment upon the diagnosis of a critical illness, such as cancer, heart attack, or stroke, helping individuals cope with the financial challenges associated with such illnesses.

Other Insurance Products

Apart from life and health insurance, insurance companies in India offer a wide range of other insurance products, including:

– Motor Insurance: Provides coverage for vehicles against damage, theft, or third-party liabilities.

– Home Insurance: Protects homes and their contents against risks such as fire, theft, or natural disasters.

– Travel Insurance: Covers expenses incurred during travel, such as medical emergencies, lost luggage, or trip cancellations.

Insurance Claims Process

Filing an insurance claim in India involves several steps to ensure a smooth and efficient process. Understanding these steps can help policyholders navigate the claim settlement process effectively.

Documentation Required

When filing an insurance claim, policyholders are required to submit specific documentation to support their claim. This documentation typically includes:

– Policy document

– Claim form

– Proof of loss (e.g., police report, medical records)

– Relevant invoices or receipts

Claim Submission Process

The claim submission process can vary slightly depending on the insurance company and the type of insurance policy. However, the general steps involved are as follows:

– Notification of claim: Policyholders must promptly notify their insurance company about the loss or damage.

– Claim form submission: The policyholder needs to complete and submit a claim form, providing detailed information about the incident.

– Documentation submission: Along with the claim form, policyholders must submit supporting documentation to substantiate their claim.

– Claim investigation: The insurance company will appoint an investigator to assess the loss or damage and gather necessary information.

– Claim settlement: Once the investigation is complete, the insurance company will determine the claim amount and issue payment to the policyholder.

Factors Affecting Claim Settlement

Several factors can influence the claim settlement process and the amount of payout received. These include:

– Timeliness of claim notification: Promptly reporting a claim can expedite the settlement process.

– Completeness of documentation: Providing all necessary documentation strengthens the claim and reduces delays.

– Accuracy of information: Providing accurate and consistent information throughout the claim process is crucial.

– Cooperation with the insurer: Maintaining open communication and cooperating with the insurer’s investigation can facilitate a smooth settlement.

Tips for Maximizing Claim Payouts

To maximize claim payouts, policyholders can follow these tips:

– Understand the policy terms: Familiarize yourself with the coverage details and exclusions of your insurance policy.

– Document the loss or damage: Take photographs, collect witness statements, and keep receipts to support your claim.

– Be honest and transparent: Provide accurate information and avoid exaggerating the extent of the loss or damage.

– Negotiate the settlement: If you believe the claim settlement offer is inadequate, you can negotiate with the insurance company.

– Seek professional advice: If necessary, consult an insurance lawyer or claims adjuster to assist with the claim process.