Job Market Overview

The insurance risk management job market is experiencing steady growth, driven by increasing demand for risk assessment and mitigation services. Industry trends such as digital transformation, climate change, and regulatory changes are creating new challenges and opportunities for risk managers.

In-Demand Skills

In-demand skills for insurance risk management professionals include:

- Quantitative and analytical skills

- Data analysis and modeling

- Understanding of insurance products and risk assessment techniques

- Strong communication and presentation skills

- Knowledge of regulatory and compliance requirements

Roles and Responsibilities

Insurance risk management professionals play a critical role in safeguarding insurance companies against financial losses and ensuring their long-term viability. They identify, assess, and mitigate risks that may arise from various sources, such as underwriting, investments, and operational activities.

The roles and responsibilities of insurance risk management professionals vary depending on their level of experience and qualifications.

Entry-Level Roles

- Conducting risk assessments and developing risk management plans.

- Analyzing insurance policies and contracts to identify potential risks.

- Monitoring claims data and trends to identify emerging risks.

- Participating in the development and implementation of risk management strategies.

Mid-Level Roles

- Managing risk management teams and overseeing the implementation of risk management programs.

- Developing and maintaining risk management frameworks and policies.

- Conducting risk audits and reviews to ensure compliance with regulatory requirements.

- Representing the insurance company in negotiations with regulators and other stakeholders.

Senior-Level Roles

- Leading the insurance company’s risk management function and reporting directly to the CEO or board of directors.

- Developing and implementing enterprise-wide risk management strategies.

- Managing the insurance company’s capital and surplus.

- Advising the insurance company on strategic decisions related to risk management.

Industry Sectors

Insurance risk management professionals are employed across a diverse range of industry sectors, each presenting unique risk management challenges and opportunities.

Let’s explore some key industry sectors that hire these professionals:

Financial Services

- Risk Management: Managing financial, operational, and compliance risks within banks, investment firms, and insurance companies.

- Actuarial Science: Analyzing and quantifying financial risks, particularly in the insurance and pension industries.

- Regulatory Compliance: Ensuring adherence to industry regulations and mitigating compliance risks in financial institutions.

Healthcare

- Medical Malpractice Risk Management: Mitigating risks associated with healthcare providers’ negligence or errors.

- Patient Safety: Implementing measures to minimize patient harm and improve patient outcomes.

- Health Insurance Risk Management: Managing risks related to health insurance policies, including claims processing and fraud prevention.

Manufacturing

- Product Liability Risk Management: Managing risks associated with defective products or product-related injuries.

- Operational Risk Management: Identifying and mitigating risks in manufacturing processes, including safety hazards and supply chain disruptions.

- Environmental Risk Management: Managing risks related to environmental compliance and potential environmental accidents.

Technology

- Cybersecurity Risk Management: Protecting against cyberattacks and data breaches.

- Intellectual Property Risk Management: Managing risks associated with protecting and exploiting intellectual property.

- Data Privacy Risk Management: Ensuring compliance with data protection regulations and mitigating privacy risks.

Government and Non-Profit

- Public Risk Management: Managing risks faced by government agencies and public entities.

- Non-Profit Risk Management: Identifying and mitigating risks in non-profit organizations, including financial, reputational, and operational risks.

Career Paths

Insurance risk management professionals can pursue various career paths within the industry. By developing specialized expertise and taking on leadership roles, they can advance their careers and make significant contributions to the field.

To advance in the field, insurance risk management professionals should continuously develop their knowledge and skills through formal education, professional development programs, and on-the-job training. They should also seek opportunities to take on new challenges and responsibilities, demonstrate their leadership abilities, and build a strong network within the industry.

Specialized Expertise

Insurance risk management professionals can develop specialized expertise in various areas, such as:

- Underwriting

- Claims management

- Risk assessment and modeling

- Regulatory compliance

- Data analytics

By focusing on a particular area of expertise, professionals can become subject matter experts and increase their value to their organizations.

Leadership Roles

As insurance risk management professionals gain experience and develop their skills, they can move into leadership roles, such as:

- Risk manager

- Chief risk officer

- Insurance broker

- Underwriting manager

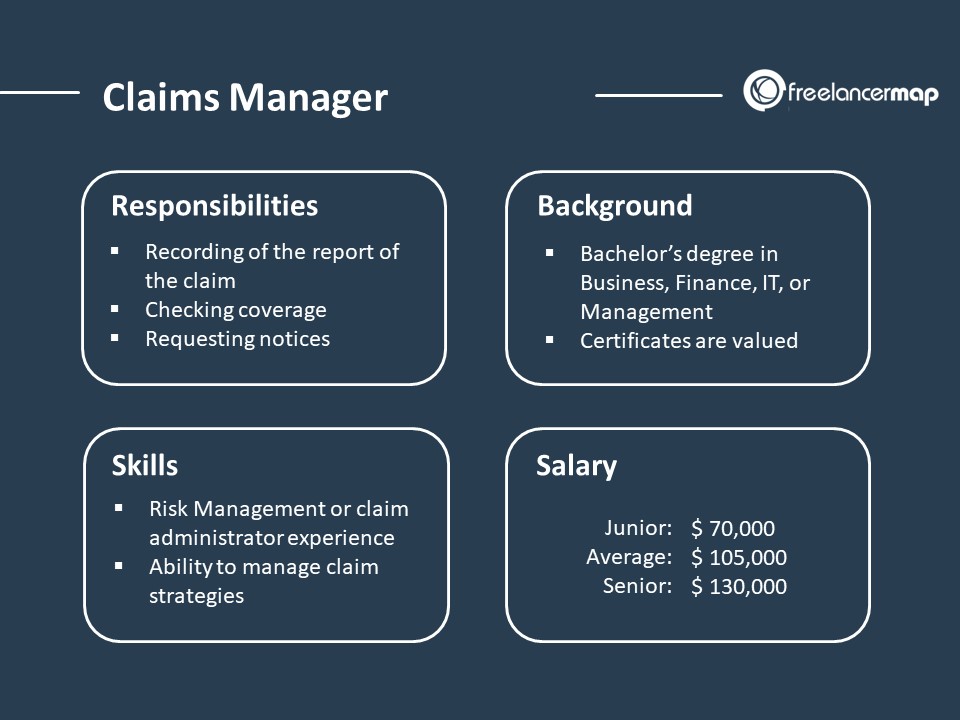

- Claims manager

In these roles, professionals are responsible for overseeing the risk management function within their organizations, developing and implementing risk management strategies, and ensuring compliance with regulatory requirements.

Educational Requirements

Insurance risk management professionals require a solid educational foundation in risk management principles and insurance practices. Most professionals hold a bachelor’s degree in risk management, insurance, finance, or a related field. These programs provide a comprehensive understanding of risk assessment, insurance policies, and risk management strategies.

Certifications and Professional Development

To enhance their credibility and advance their careers, many insurance risk management professionals pursue industry-recognized certifications. The Associate in Risk Management (ARM) and Fellow, Society of Risk Management (FSRM) designations are highly respected in the field. These certifications demonstrate a high level of knowledge and expertise in risk management.

Additionally, professional development programs offered by industry associations and educational institutions provide opportunities for continuous learning and staying abreast of industry trends and best practices. These programs cover topics such as emerging risks, data analytics in risk management, and cyber risk management.

Skills and Competencies

Insurance risk management professionals require a multifaceted skill set to effectively identify, assess, and mitigate risks. These include a combination of technical knowledge, analytical abilities, and communication skills.

Technical knowledge forms the foundation of risk management, enabling professionals to understand the complexities of insurance policies, underwriting processes, and risk assessment models. Analytical abilities are crucial for evaluating data, identifying patterns, and developing risk mitigation strategies. Communication skills are essential for effectively conveying risk assessments, presenting findings, and collaborating with stakeholders.

Technical Knowledge

- Insurance principles and practices

- Risk assessment and modeling techniques

- Underwriting guidelines and processes

- Data analysis and interpretation

- Regulatory compliance and reporting

Analytical Abilities

- Quantitative and qualitative analysis

- Statistical modeling and forecasting

- Problem-solving and decision-making

- Trend analysis and identification

- Risk quantification and estimation

Communication Skills

- Verbal and written communication

- Presentation and public speaking

- Active listening and empathy

- Negotiation and conflict resolution

- Collaboration and teamwork

Industry Outlook

The insurance risk management industry is poised for significant growth in the coming years, driven by a range of factors including increasing awareness of risks, regulatory changes, and technological advancements.

Emerging trends in the industry include the use of artificial intelligence (AI) and machine learning (ML) to improve risk assessment and underwriting, the development of new insurance products to address emerging risks, and the increasing importance of sustainability and climate change in risk management.

Regulatory Changes

Regulatory changes are also expected to impact the insurance risk management industry in the coming years. These changes include the implementation of new accounting standards, such as IFRS 17, and the increasing focus on climate-related financial disclosures.

Technological Advancements

Technological advancements are also expected to continue to shape the insurance risk management industry. These advancements include the use of AI and ML to improve risk assessment and underwriting, the development of new insurance products to address emerging risks, and the increasing importance of sustainability and climate change in risk management.

Salary and Benefits

Insurance risk management professionals are well-compensated for their expertise in assessing and mitigating risks. Their salaries and benefits packages vary depending on experience, qualifications, and the industry sector they work in.

According to a survey by the National Association of Insurance Commissioners (NAIC), the median annual salary for insurance risk managers with less than 5 years of experience is $75,000. Those with 5-10 years of experience earn an average of $100,000, while those with more than 10 years of experience can expect to earn over $125,000.

Salary Ranges and Benefits Packages

The table below provides a more detailed breakdown of salary ranges and benefits packages for insurance risk management professionals at different experience levels:

| Experience Level | Salary Range | Benefits Packages |

|---|---|---|

| Entry-Level (0-5 years) | $75,000 – $100,000 | Health insurance, dental insurance, vision insurance, life insurance, paid time off, retirement plan |

| Mid-Level (5-10 years) | $100,000 – $125,000 | Health insurance, dental insurance, vision insurance, life insurance, paid time off, retirement plan, performance bonuses |

| Senior-Level (10+ years) | $125,000+ | Health insurance, dental insurance, vision insurance, life insurance, paid time off, retirement plan, performance bonuses, stock options |

Job Search Strategies

Job hunting in the insurance risk management field demands a targeted approach. Follow these strategies to maximize your chances of success.

Network diligently, optimize your resume, and prepare thoroughly for interviews to stand out in the competitive job market.

Networking

Attend industry events, join professional organizations, and connect with recruiters on LinkedIn to expand your network.

- Join professional organizations such as the Risk Management Society (RIMS) and the American Society of Safety Professionals (ASSP) to meet professionals in the field.

- Attend conferences and industry events to connect with potential employers and learn about job openings.

- Use social media platforms like LinkedIn to connect with recruiters and professionals in the insurance risk management field.

Resume Optimization

Highlight your skills, experience, and certifications in a concise and compelling resume.

- Quantify your accomplishments with specific metrics to demonstrate your impact on previous roles.

- Tailor your resume to each job application, emphasizing the skills and experience that align with the specific requirements of the position.

- Proofread your resume carefully for any errors before submitting it to potential employers.

Interview Preparation

Research the company and the specific role to prepare insightful questions and demonstrate your knowledge of the industry.

- Practice answering common interview questions, such as “Tell me about yourself” and “Why are you interested in this role?”

- Be prepared to discuss your experience in risk management, including any specific projects or accomplishments.

- Dress professionally and arrive on time for your interview, demonstrating your respect for the company and the position.