Group Life Insurance Market Overview

The group life insurance market is a rapidly growing segment of the insurance industry, with a market size of over USD 2 trillion in 2023. The market is expected to grow at a CAGR of over 5% during the forecast period of 2023-2028, driven by factors such as the increasing awareness of the importance of life insurance and the rising number of employees seeking financial protection.

Major Players in the Market

The major players in the group life insurance market include:

- MetLife

- Prudential Financial

- AIG

- Zurich Insurance Group

- AXA

Factors Driving the Growth of the Market

The growth of the group life insurance market is driven by several factors, including:

- Increasing awareness of the importance of life insurance

- Rising number of employees seeking financial protection

- Growing demand for affordable and accessible life insurance products

- Government initiatives to promote financial inclusion

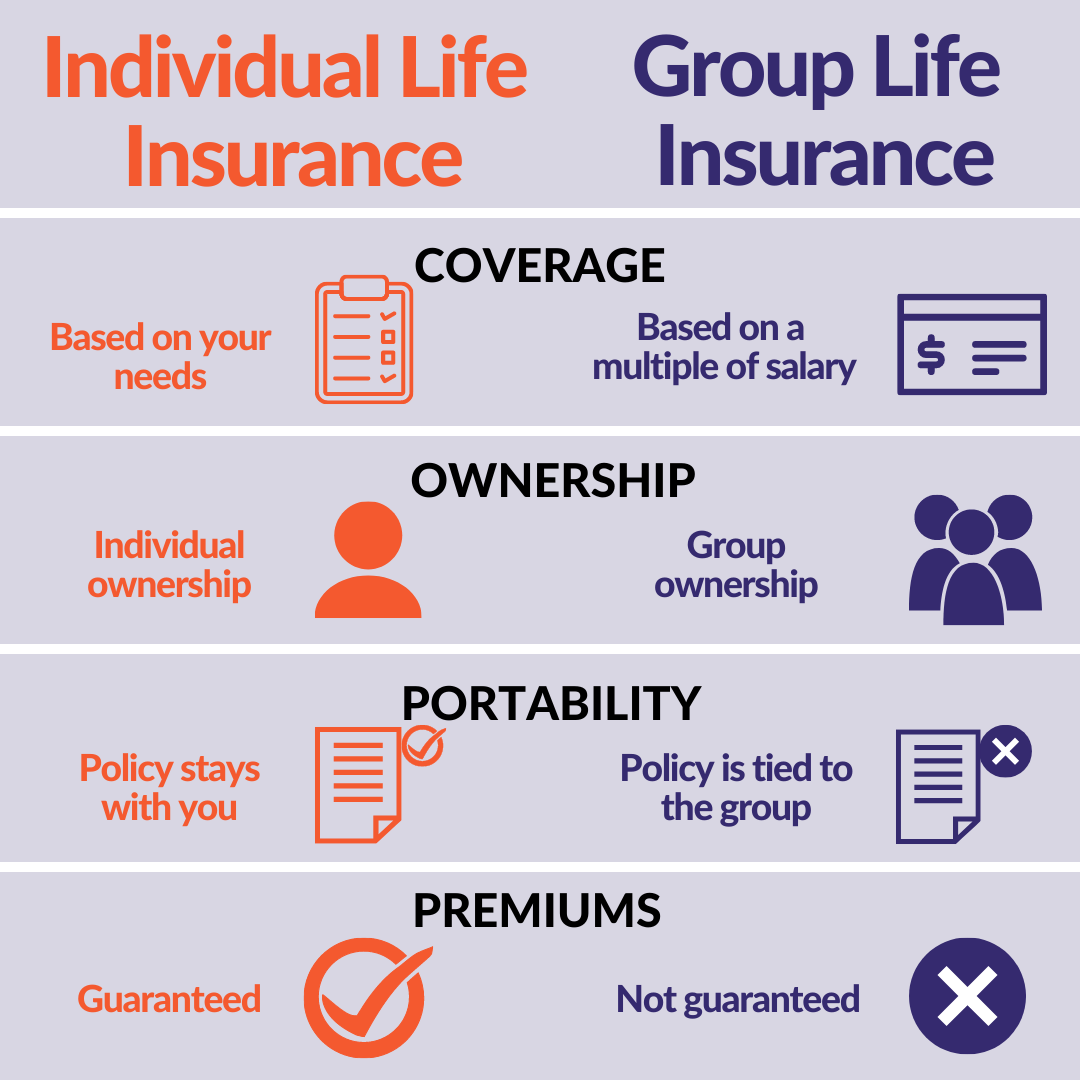

Types of Group Life Insurance Policies

Group life insurance policies come in various types, each tailored to meet specific needs and financial objectives. Understanding the distinctions between these policies is crucial for selecting the most suitable coverage for your group.

Term Life Insurance

Term life insurance provides coverage for a predetermined period, such as 10, 20, or 30 years. It is typically the most affordable type of group life insurance, making it a cost-effective option for temporary coverage. However, once the term expires, the policy terminates, and there is no cash value or death benefit unless the policy is renewed.

Whole Life Insurance

Whole life insurance offers permanent coverage that lasts the insured’s entire life. It accumulates a cash value that grows over time and can be borrowed against or withdrawn tax-free. Whole life insurance is more expensive than term life insurance but provides lifelong protection and potential savings.

Universal Life Insurance

Universal life insurance combines features of term and whole life insurance. It provides flexible coverage that can be adjusted up or down as needed. Universal life insurance policies also have a cash value component that can be used for various purposes, such as retirement planning or education funding.

Factors to Consider When Choosing a Group Life Insurance Provider

When choosing a group life insurance provider, there are several key factors that employers and employees should consider to ensure they are selecting the best option for their needs. These factors include the cost of the policy, the financial strength of the insurer, and the level of customer service provided.

Cost of the Policy

The cost of the policy is an important factor to consider, as it will impact the overall cost of providing group life insurance to employees. Employers should compare the premiums charged by different providers to find the most affordable option that meets their needs.

Financial Strength of the Insurer

The financial strength of the insurer is another important factor to consider. Employers should choose an insurer with a strong financial rating, as this will help to ensure that the insurer will be able to pay claims in the event of a death. There are several independent rating agencies that provide financial strength ratings for insurers.

Level of Customer Service

The level of customer service provided by the insurer is also an important factor to consider. Employers should choose an insurer that provides responsive and helpful customer service, as this will make it easier to manage the group life insurance plan.

| Provider | Cost of the Policy | Financial Strength | Level of Customer Service |

|---|---|---|---|

| Provider A | $10 per month per employee | A+ | Excellent |

| Provider B | $12 per month per employee | A | Good |

| Provider C | $15 per month per employee | A- | Fair |

Benefits of Group Life Insurance

Group life insurance offers a range of advantages for both employers and employees. These benefits make it a valuable employee benefit that can positively impact employee well-being, productivity, and overall satisfaction.

Benefits for Employers

- Reduced employee turnover: Group life insurance provides financial security for employees and their families, which can reduce employee turnover by making them feel valued and secure in their jobs.

- Increased employee satisfaction: Offering group life insurance demonstrates that employers care about the well-being of their employees and their families, which can lead to increased employee satisfaction and loyalty.

- Improved productivity: When employees are financially secure and have peace of mind, they are more likely to be focused and productive at work.

Benefits for Employees

- Financial protection for their families: Group life insurance provides financial protection for employees’ families in the event of their death, ensuring that their loved ones are financially secure.

- Peace of mind: Knowing that their families are financially protected can give employees peace of mind, reducing stress and anxiety.

- Access to affordable life insurance: Group life insurance is typically offered at a lower cost than individual life insurance policies, making it more affordable for employees to obtain adequate life insurance coverage.

Challenges Facing Group Life Insurance Providers

The group life insurance industry is facing a number of challenges, including the rising cost of healthcare, the increasing number of uninsured Americans, and the changing regulatory landscape.

The rising cost of healthcare is putting a strain on group life insurance providers, as they are forced to pay out more in claims. This is leading to higher premiums for employers and employees, and making it more difficult for people to afford coverage.

The increasing number of uninsured Americans is also a challenge for group life insurance providers. As more people lose their health insurance, they are turning to group life insurance as a way to protect their families. This is putting a strain on the system, as providers are forced to cover more people with less money.

The changing regulatory landscape is also a challenge for group life insurance providers. New regulations are being implemented that are making it more difficult for providers to operate. This is leading to higher costs and less flexibility for providers.

Impact on the Industry

The challenges facing group life insurance providers are having a significant impact on the industry. Premiums are rising, coverage is becoming less affordable, and providers are struggling to meet the needs of their customers.

The rising cost of healthcare is the biggest challenge facing group life insurance providers. As healthcare costs continue to rise, providers are forced to pay out more in claims. This is leading to higher premiums for employers and employees, and making it more difficult for people to afford coverage.

The increasing number of uninsured Americans is also a major challenge for group life insurance providers. As more people lose their health insurance, they are turning to group life insurance as a way to protect their families. This is putting a strain on the system, as providers are forced to cover more people with less money.

The changing regulatory landscape is also a challenge for group life insurance providers. New regulations are being implemented that are making it more difficult for providers to operate. This is leading to higher costs and less flexibility for providers.

What Providers Are Doing to Address the Challenges

Group life insurance providers are taking a number of steps to address the challenges they are facing.

- They are working to reduce the cost of healthcare by negotiating lower rates with healthcare providers and implementing wellness programs.

- They are expanding their coverage to include more uninsured Americans.

- They are working with regulators to develop new regulations that are more flexible and less burdensome.

By taking these steps, group life insurance providers are working to ensure that they can continue to provide affordable and accessible coverage to their customers.