Definition and Purpose of Workers Compensation Insurance Certificate

A workers compensation insurance certificate is an official document issued by an insurance company that provides proof of coverage for workers compensation insurance. This insurance is a crucial component of a comprehensive workplace safety program, as it helps protect both employers and employees in the event of a work-related injury or illness.

Workers compensation insurance is legally required in most jurisdictions. It provides financial benefits to employees who suffer work-related injuries or illnesses, regardless of fault. These benefits can include medical expenses, lost wages, and disability payments. In exchange for this coverage, employers are protected from lawsuits by employees who have been injured on the job.

Benefits of Having a Workers Compensation Insurance Certificate

- Protects employers from lawsuits by employees who have been injured on the job.

- Provides financial benefits to employees who suffer work-related injuries or illnesses.

- Helps employers comply with legal requirements.

- Can improve employee morale and productivity.

- Can help businesses attract and retain top talent.

When is a Workers Compensation Insurance Certificate Required?

A workers compensation insurance certificate is typically required in the following situations:

- When a business has employees.

- When a business is required to carry workers compensation insurance by law.

- When a business is bidding on a contract that requires workers compensation insurance.

- When a business is leasing a space that requires workers compensation insurance.

Elements of a Workers Compensation Insurance Certificate

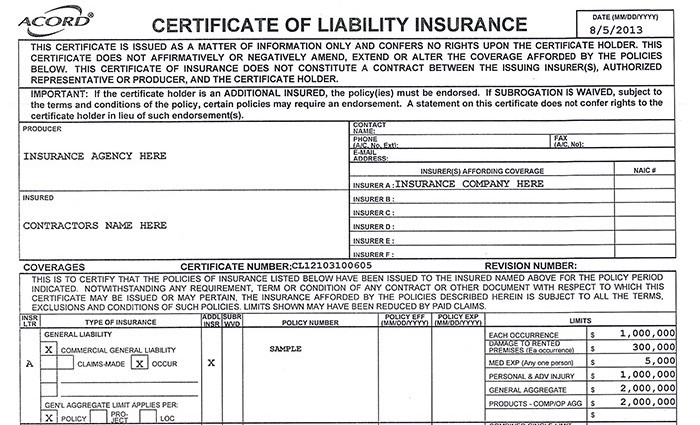

A workers compensation insurance certificate is a document that provides proof of insurance coverage for workers’ compensation benefits. It is issued by the insurance company to the insured employer and contains key information about the policy.

The following are the key elements of a workers compensation insurance certificate:

- Policy number: The policy number is a unique identifier for the insurance policy. It is used by the insurance company to track the policy and manage claims.

- Coverage period: The coverage period is the period of time during which the policy is in effect. It is important to note that the coverage period may not be the same as the policy term. The policy term is the period of time for which the policy is purchased, while the coverage period is the period of time during which the policy is actually in effect.

- Insured employer: The insured employer is the employer who is covered by the insurance policy. The insured employer is responsible for paying the premiums for the policy and for providing a safe workplace for their employees.

- Certificate holder: The certificate holder is the person or entity who is requesting the certificate. The certificate holder may be the insured employer, a contractor, or a government agency.

- Limits of liability: The limits of liability are the maximum amount of money that the insurance company will pay for claims. There are two types of limits of liability: per-occurrence limits and aggregate limits. Per-occurrence limits are the maximum amount that the insurance company will pay for a single claim. Aggregate limits are the maximum amount that the insurance company will pay for all claims during the policy period.

- Deductible: The deductible is the amount of money that the insured employer must pay before the insurance company begins to pay benefits. Deductibles can be either fixed amounts or a percentage of the claim amount.

- Exclusions: Exclusions are specific types of injuries or illnesses that are not covered by the policy. It is important to read the policy carefully to understand what is and is not covered.

There are different types of workers compensation insurance certificates, each with its own specific purpose. The most common type of certificate is the certificate of insurance. A certificate of insurance is used to provide proof of insurance to a third party, such as a contractor or a government agency. Other types of certificates include the endorsement and the rider. An endorsement is a change to the policy that is added to the certificate. A rider is a separate document that is attached to the policy and that provides additional coverage.

Obtaining and Maintaining a Workers Compensation Insurance Certificate

Securing a workers compensation insurance certificate is a crucial step in ensuring your business complies with legal obligations and protects its employees. To obtain a certificate, contact an insurance carrier authorized to provide workers compensation coverage in your state. They will guide you through the application process, which typically involves providing information about your business, payroll, and estimated number of employees.

Maintaining an Active Certificate

Maintaining an active workers compensation insurance certificate requires ongoing attention. Ensure timely premium payments to avoid coverage lapses. Report any changes to your business, such as increased payroll or additional employees, to your insurance carrier promptly. This ensures your coverage remains adequate and up-to-date.

Tips for Keeping Certificates Accessible

Keep digital and physical copies of your workers compensation insurance certificate readily available. Store digital copies securely and make multiple physical copies for distribution to relevant parties. Regularly review your certificate to ensure it remains valid and reflects your current business operations.

Verification and Validation of Workers Compensation Insurance Certificates

Verifying the authenticity and validity of workers compensation insurance certificates is crucial to ensure compliance and protect your organization from financial liabilities. This process involves several key steps:

Verification Methods

* Insurance Carrier Verification: Contact the insurance carrier directly to confirm the certificate’s authenticity and validity.

* State Agency Verification: Some states have online portals or databases where you can verify certificates issued within their jurisdiction.

* Independent Verification Services: Third-party companies offer verification services to validate certificates and provide additional information.

Role of State Agencies and Insurance Carriers

State agencies regulate workers compensation insurance and may have specific requirements for certificate verification. Insurance carriers are responsible for issuing valid certificates and maintaining accurate records.

Consequences of Accepting Invalid Certificates

Accepting invalid or fraudulent certificates can have serious consequences, including:

* Financial penalties and legal liability

* Failure to comply with state regulations

* Increased risk of uninsured employees and workplace accidents

Best Practices for Managing Workers Compensation Insurance Certificates

Maintaining organized and accurate workers compensation insurance certificates is crucial for ensuring compliance and safeguarding your business. Implement the following best practices to effectively manage these certificates:

Centralized Storage and Organization

- Establish a centralized repository for all workers compensation insurance certificates, whether physical or digital.

- Maintain a filing system that allows for easy retrieval and organization based on factors such as policy number, expiration date, or contractor name.

Record Keeping and Accuracy

Ensure that all workers compensation insurance certificates are complete and accurate. Verify the following information:

- Policyholder’s name and address

- Insurer’s name and contact information

- Policy number and effective dates

- Coverage limits and exclusions

- Signature of the authorized representative

Expiration Tracking and Compliance

Monitor the expiration dates of all workers compensation insurance certificates to avoid lapses in coverage. Set up reminders or notifications to ensure timely renewal and compliance with legal requirements.

- Track expiration dates using a calendar, spreadsheet, or dedicated software.

- Contact contractors or subcontractors to request updated certificates well in advance of expiration.

- Verify that coverage is continuous to avoid gaps in protection.

Verification and Validation

Regularly verify the validity of workers compensation insurance certificates by contacting the insurer directly. This helps prevent fraudulent or outdated certificates from being accepted.

- Request confirmation letters from insurers to confirm coverage details.

- Use online verification tools or databases to check certificate authenticity.

Common Issues and Challenges Related to Workers Compensation Insurance Certificates

Businesses may encounter various issues and challenges regarding workers compensation insurance certificates. Understanding these challenges and finding effective solutions are crucial for maintaining compliance and protecting the rights of both employers and employees.

Common issues include:

- Inaccurate or Incomplete Information: Certificates may contain errors or missing data, such as incorrect policy numbers, coverage dates, or employee information. This can lead to confusion, delays in processing claims, and potential penalties.

- Non-Compliance with State Regulations: Each state has specific requirements for workers compensation insurance certificates. Failing to comply with these regulations can result in fines, penalties, and even legal action.

- Fraudulent Certificates: Unfortunately, fraudulent certificates can circulate, posing a significant risk to businesses. These certificates may appear legitimate but provide no actual coverage, leaving businesses vulnerable in the event of a claim.

- Lack of Understanding: Some businesses may not fully understand the purpose and importance of workers compensation insurance certificates, leading to improper handling or storage.

- Time-Consuming Verification Process: Verifying the validity of certificates can be a time-consuming and cumbersome process, especially for businesses that work with multiple contractors or vendors.

To resolve or mitigate these challenges, businesses should:

- Establish Clear Processes: Implement clear procedures for obtaining, reviewing, and storing certificates to ensure accuracy and compliance.

- Verify Certificates Regularly: Regularly check the validity of certificates through the insurer or state agencies to avoid relying on fraudulent documents.

- Educate Employees: Train employees on the importance of workers compensation insurance and their role in maintaining accurate certificates.

- Utilize Technology: Explore technology solutions that streamline the verification process, such as online databases or software that automates certificate tracking.

- Seek Professional Assistance: If needed, consult with insurance professionals or legal counsel for guidance on interpreting regulations and managing certificates effectively.

Advanced Considerations for Workers Compensation Insurance Certificates

Managing workers compensation insurance certificates can become more complex when dealing with multi-state operations or intricate coverage arrangements. Understanding certificate requirements in different jurisdictions and navigating complex insurance arrangements involving multiple carriers or layers of coverage are crucial for effective risk management.

Multi-State Operations

Businesses operating in multiple states must comply with the workers compensation insurance laws of each state where they have employees. Certificate requirements may vary across jurisdictions, including the required coverage amounts, policy types, and endorsement forms. Failure to obtain and maintain compliant certificates in each state can lead to penalties, fines, and coverage gaps.

Complex Coverage Arrangements

Some businesses may have complex insurance arrangements involving multiple carriers or layers of coverage. For example, a business may have a primary workers compensation policy with one carrier and an excess policy with another carrier. In such cases, it is essential to ensure that all relevant carriers are listed on the certificate and that the coverage limits and deductibles are clearly stated.