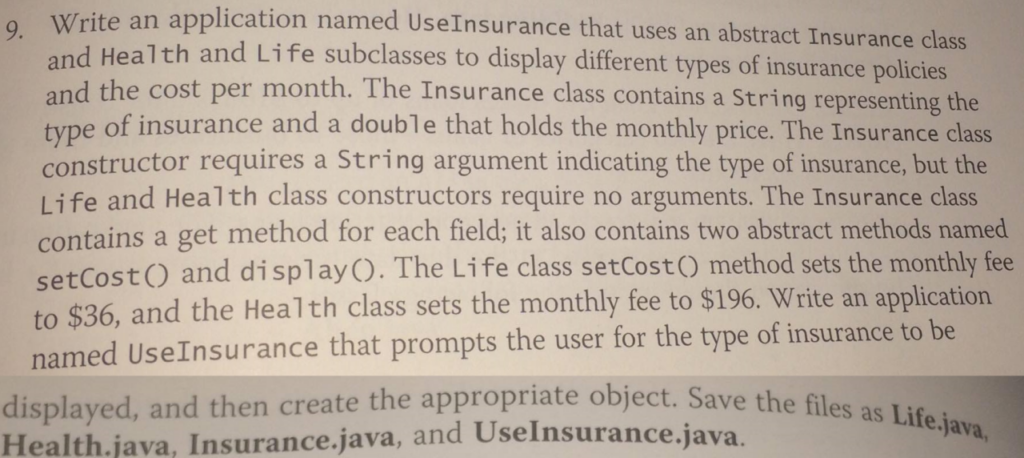

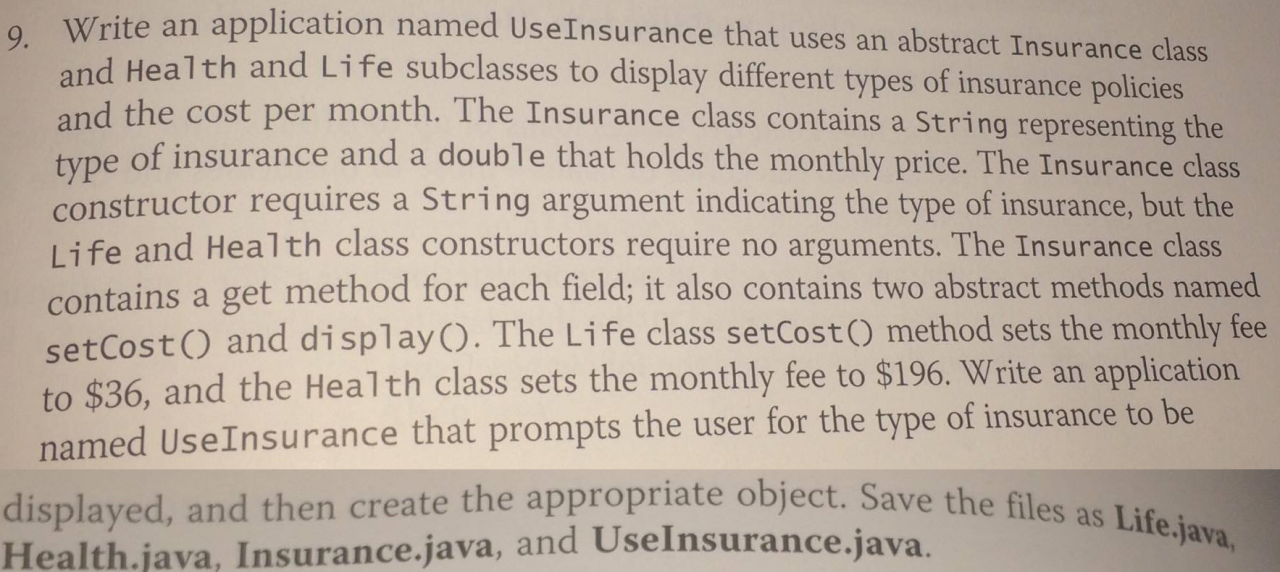

Application Process

When an insurance application is taken by a producer, it typically involves a series of steps to gather the necessary information and complete the application accurately.

The producer’s role is crucial in ensuring the application process is smooth and efficient. They act as a guide for the applicant, providing information, answering questions, and collecting the required documents.

Types of Applications

Producers can assist with various types of insurance applications, including:

- Life insurance applications

- Health insurance applications

- Disability insurance applications

- Property insurance applications

- Casualty insurance applications

Underwriting Considerations

Underwriting is the process of assessing and evaluating risk to determine the terms and conditions of an insurance policy. When an insurance application is taken by a producer, several underwriting considerations are taken into account to determine the risk profile of the applicant and the appropriate coverage and pricing for the policy.

The producer’s knowledge of the applicant’s risk profile can significantly impact the underwriting process. By understanding the applicant’s medical history, lifestyle, occupation, and other factors that may affect their insurability, the producer can provide accurate and relevant information to the underwriter. This information helps the underwriter make informed decisions about the applicant’s risk and the terms of the policy.

Underwriting considerations can affect the insurance policy that is issued in several ways:

– Policy Coverage: The type and extent of coverage provided by the policy may be affected by the underwriting considerations. For example, an applicant with a history of certain medical conditions may be offered a policy with limited coverage or exclusions.

– Policy Premiums: The premium charged for the policy may be adjusted based on the underwriting considerations. Applicants with higher risk profiles may be charged higher premiums to reflect the increased risk of claims.

– Policy Terms: The terms and conditions of the policy, such as the deductible and waiting period, may be affected by the underwriting considerations. Applicants with higher risk profiles may be subject to higher deductibles or longer waiting periods.

Understanding the underwriting considerations that are taken into account when an insurance application is taken is essential for producers and applicants alike. By providing accurate and relevant information about the applicant’s risk profile, producers can help ensure that the underwriter makes informed decisions and issues a policy that meets the applicant’s needs.

Producer Responsibilities

Producers play a critical role in the insurance application process, bearing the responsibility to ensure the accuracy and completeness of the information provided by applicants. Their duties extend beyond merely collecting data; they must also guarantee that applicants comprehend the terms and conditions of the insurance policy.

Obtaining Accurate and Complete Information

Producers are tasked with gathering precise and exhaustive information from applicants. This entails verifying personal details, health history, financial circumstances, and any other relevant data. Accurate information is crucial for insurers to assess the risk accurately and determine appropriate coverage and premiums.

Regulatory Compliance

Insurance producers are required to comply with a variety of regulations when taking insurance applications. These regulations are designed to protect consumers and ensure that they are treated fairly and equitably.

The most important regulatory requirement is the duty of good faith. This duty requires producers to act in the best interests of their clients and to provide them with all the information they need to make informed decisions about their insurance coverage.

Consequences of Non-Compliance

- Fines and penalties

- Loss of license

- Jail time