Definition of a Unilateral Contract

A unilateral contract is a legal agreement that is formed when one party makes an offer to another party, and the other party accepts the offer by performing the act requested in the offer.

The key characteristic that distinguishes a unilateral contract from other types of contracts is that the offer is not made to a specific person or group of people. Instead, the offer is made to the general public, and anyone who performs the act requested in the offer can accept the contract.

Key Characteristics

- The offer is made to the general public.

- The offer is accepted by performing the act requested in the offer.

- There is no need for the offeree to communicate their acceptance to the offeror.

Elements of an Insurance Policy

An insurance policy is a contract between an insurer and a policyholder that Artikels the terms and conditions of insurance coverage. To form a unilateral contract, an insurance policy must contain certain essential elements:

1. Offer and Acceptance: The insurer makes an offer of coverage through the policy, and the policyholder accepts the offer by paying the premium.

Subject Matter

The subject matter of an insurance policy is the risk being insured against. This can include property, life, health, or any other insurable interest.

Insurable Interest

The policyholder must have an insurable interest in the subject matter of the policy. This means that the policyholder will suffer a financial loss if the insured event occurs.

Premium

The premium is the amount of money paid by the policyholder to the insurer in exchange for coverage. The premium is typically based on the risk being insured against.

Policy Period

The policy period is the period of time during which the insurance coverage is in effect.

Offer and Acceptance in Insurance Policies

In the context of insurance policies, the process of offer and acceptance is crucial in forming a legally binding contract. Let’s delve into the specifics of how an offer and acceptance occur in the insurance context.

The insured’s application for insurance serves as an offer to enter into a contract with the insurer. This offer includes the details of the risk to be insured, the coverage desired, and the terms and conditions under which the insured is willing to accept coverage. The insurer, upon reviewing the application, either accepts or rejects the offer.

Issuance of the Policy

If the insurer accepts the offer, it issues an insurance policy to the insured. This policy is a written document that Artikels the terms of the contract, including the coverage provided, the premiums to be paid, and the conditions under which the policy may be terminated or modified. The issuance of the policy by the insurer constitutes acceptance of the insured’s offer.

It’s important to note that the offer and acceptance process in insurance policies is generally governed by the principles of contract law. This means that the offer must be clear and definite, and the acceptance must mirror the terms of the offer. Any deviation from the original offer may result in a counteroffer, which requires further negotiation and acceptance to form a valid contract.

Consideration in Insurance Policies

Consideration is a crucial element of a unilateral contract, and insurance policies are no exception. In insurance policies, consideration involves the exchange of promises between the insured and the insurer.

The insured’s consideration is the payment of premiums, which represents their financial contribution towards the insurance coverage. The insurer’s consideration, in turn, is the promise to provide the agreed-upon coverage in the event of a covered loss or event.

Exceptions to the Unilateral Nature of Insurance Policies

Insurance policies are generally considered unilateral contracts, but there are certain exceptions to this rule. In some situations, the policyholder may have some bargaining power or influence over the terms of the contract.

One exception is when the policyholder is a large corporation or organization. In these cases, the policyholder may have the ability to negotiate the terms of the contract with the insurer. For example, a large corporation may be able to negotiate a lower premium rate or a broader coverage.

Another exception is when the policy is a group policy. Group policies are typically issued to a group of individuals, such as employees of a company or members of an organization. In these cases, the policyholder (the group) may have some input into the terms of the contract. For example, the group may be able to negotiate a lower premium rate or a broader coverage.

Finally, there may be some exceptions to the unilateral nature of insurance policies in cases of fraud or misrepresentation. If the insurer can prove that the policyholder lied about or misrepresented material facts on the application, the insurer may be able to void the contract.

Implications of a Unilateral Contract

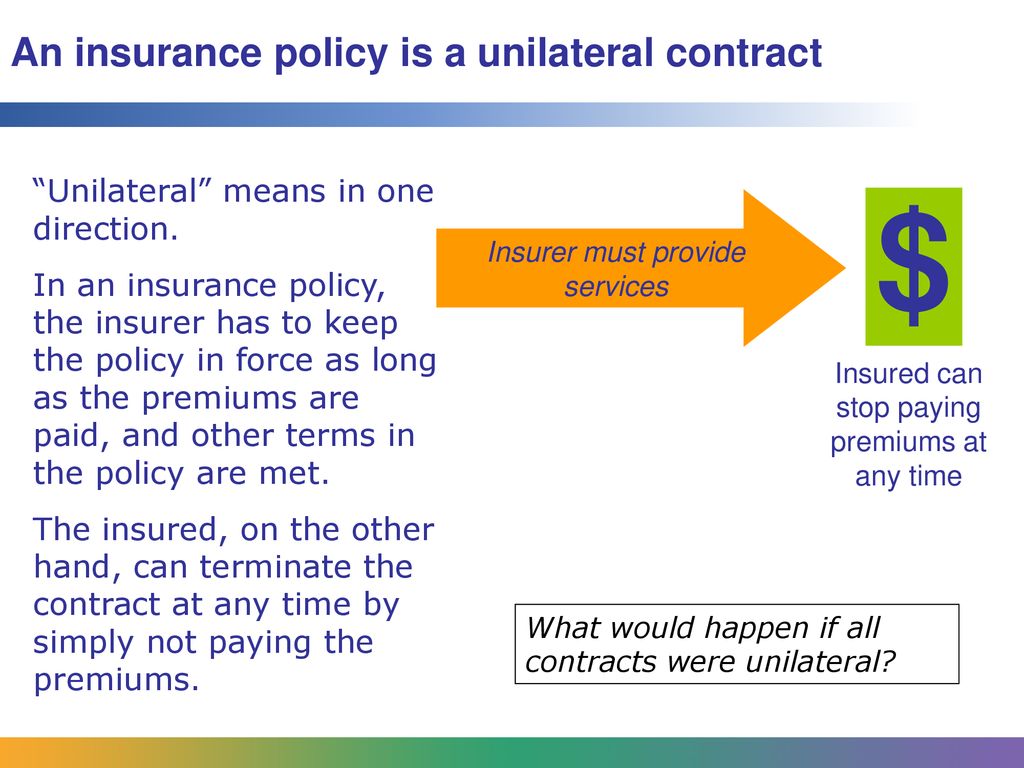

A unilateral contract in insurance implies that the insurer makes an offer to provide coverage, and the insured accepts this offer by performing the act specified in the policy. This act could be paying the premium, submitting an application, or fulfilling other requirements as Artikeld by the insurer.

Under a unilateral contract, the insured is obligated to perform the specified act to create a binding contract. The insurer, on the other hand, is only obligated to provide coverage if the insured fulfills their obligation.

Rights and Obligations of the Insured

The insured has the right to receive coverage from the insurer once they have performed the act specified in the policy. They are also obligated to pay the premiums on time and comply with the terms and conditions of the policy.

Rights and Obligations of the Insurer

The insurer has the right to collect premiums from the insured and to deny coverage if the insured fails to fulfill their obligations. The insurer is also obligated to provide coverage to the insured as long as they meet the terms of the policy.