Benefits of Personal Lines Insurance

Personal lines insurance offers a comprehensive suite of financial protections, safeguarding your assets, liabilities, and well-being. By mitigating financial risks, personal lines insurance provides peace of mind, allowing you to live life with confidence and financial security. Additionally, personal lines insurance may offer potential tax benefits, further enhancing its value.

Financial Protection

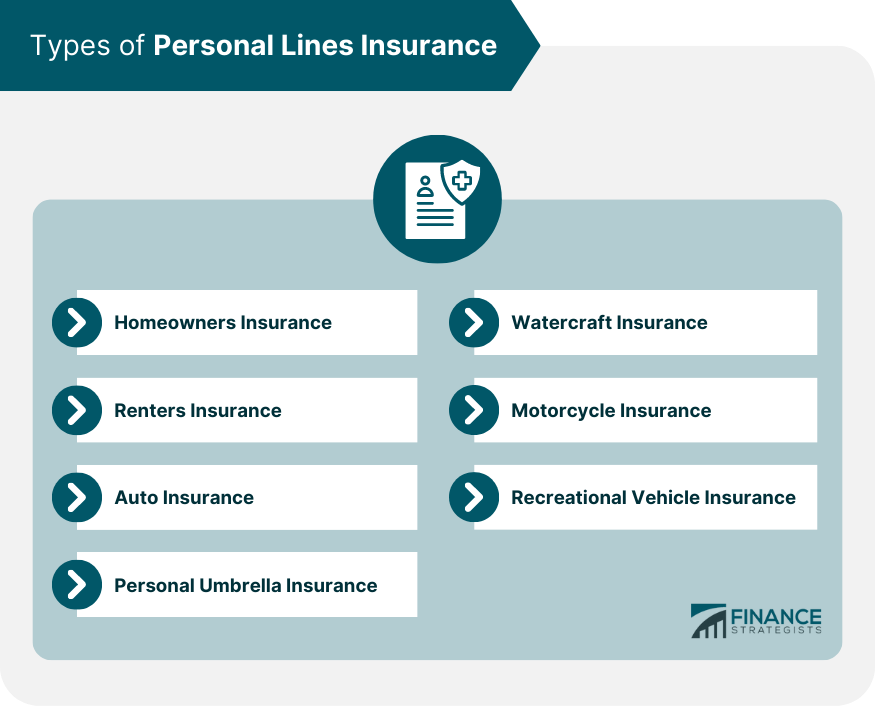

Personal lines insurance acts as a financial safety net, shielding you from unforeseen events that could otherwise result in significant financial losses. For instance, homeowner’s insurance protects your property and belongings from damages caused by fire, theft, or natural disasters. Similarly, auto insurance safeguards your vehicle and provides liability coverage in the event of accidents. By covering these potential expenses, personal lines insurance ensures that you are not left financially vulnerable in the face of unexpected setbacks.

Peace of Mind

Beyond financial protection, personal lines insurance provides invaluable peace of mind. Knowing that your assets and liabilities are protected can significantly reduce stress and anxiety, allowing you to focus on what matters most. The assurance that you and your loved ones are financially secure can contribute to a greater sense of well-being and contentment.

Potential Tax Benefits

Certain types of personal lines insurance may offer potential tax benefits. For example, premiums paid for health insurance and long-term care insurance may be eligible for tax deductions. Additionally, some states offer tax credits for purchasing homeowner’s insurance or renter’s insurance. By taking advantage of these tax benefits, you can further reduce the cost of your personal lines insurance coverage.

Considerations for Choosing Personal Lines Insurance

When choosing personal lines insurance coverage, there are several key factors to consider to ensure you have the protection you need at a price you can afford.

Understanding your insurance needs is essential. Determine the risks you face and the assets you want to protect. Consider your lifestyle, family situation, and financial circumstances. This will help you prioritize your insurance needs and choose coverage that aligns with your specific requirements.

Insurance agents can play a valuable role in helping you choose coverage. They can provide personalized advice based on your individual needs, explain different policy options, and help you understand the terms and conditions of your coverage. An agent can also help you compare quotes from different insurance companies to find the best coverage at the most competitive price.

Trends in Personal Lines Insurance

The personal lines insurance industry is constantly evolving, driven by emerging technologies, changing consumer behaviors, and regulatory shifts. Here are some key trends shaping the future of personal lines insurance:

Technology’s Impact

- Telematics and Usage-Based Insurance (UBI): Telematics devices track driving behavior, allowing insurers to offer personalized premiums based on actual driving habits.

- Smart Home Technology: Smart home devices provide real-time data on home security and energy consumption, enabling insurers to offer customized coverage and discounts.

- Artificial Intelligence (AI): AI algorithms are used for underwriting, claims processing, and fraud detection, improving efficiency and accuracy.

Changing Consumer Behaviors

- Increased Demand for Customization: Consumers expect personalized insurance policies tailored to their specific needs and risk profiles.

- Shift towards Digital Channels: Consumers prefer to purchase and manage their insurance policies online or through mobile apps.

- Growing Awareness of Insurance: Increased media coverage and financial literacy campaigns are raising awareness about the importance of personal lines insurance.

Regulatory Changes

- Increased Regulation: Governments are implementing stricter regulations to protect consumers and ensure fair insurance practices.

- Data Privacy Concerns: Insurers must comply with regulations regarding the collection and use of consumer data.

- Climate Change Adaptation: Insurers are developing new products and services to address the risks associated with climate change.

The Future of Personal Lines Insurance

The future of personal lines insurance is expected to be characterized by continued technological advancements, increased customization, and a focus on sustainability. Insurers will leverage AI, telematics, and smart home technology to provide more personalized and data-driven coverage. Consumers will have greater control over their insurance policies and will expect seamless digital experiences. Insurers will also play a more significant role in promoting financial well-being and mitigating the impact of climate change.