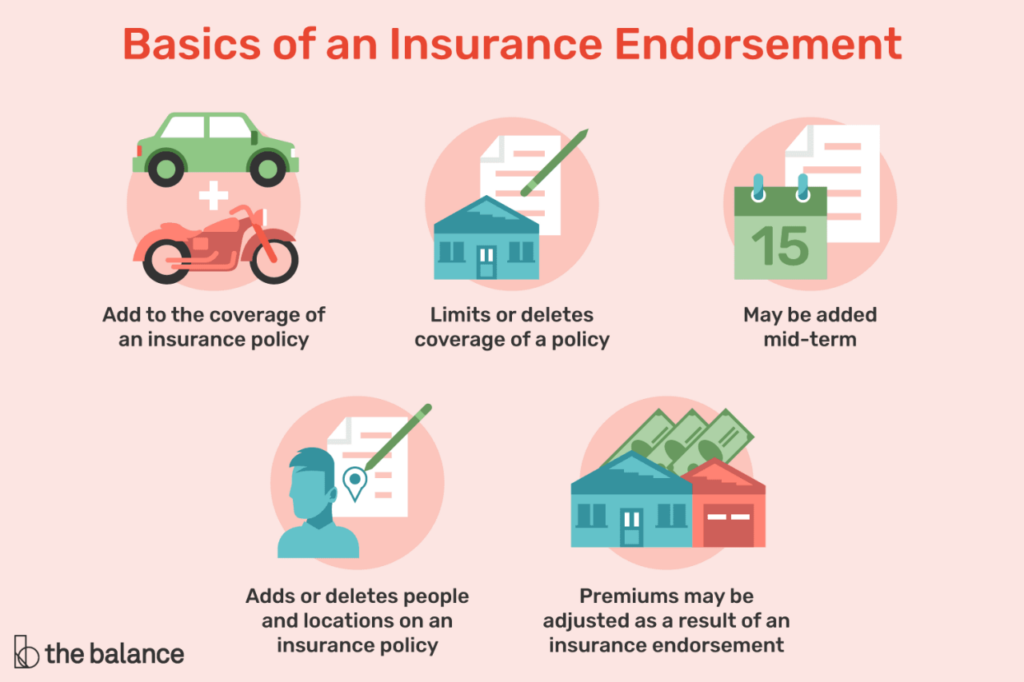

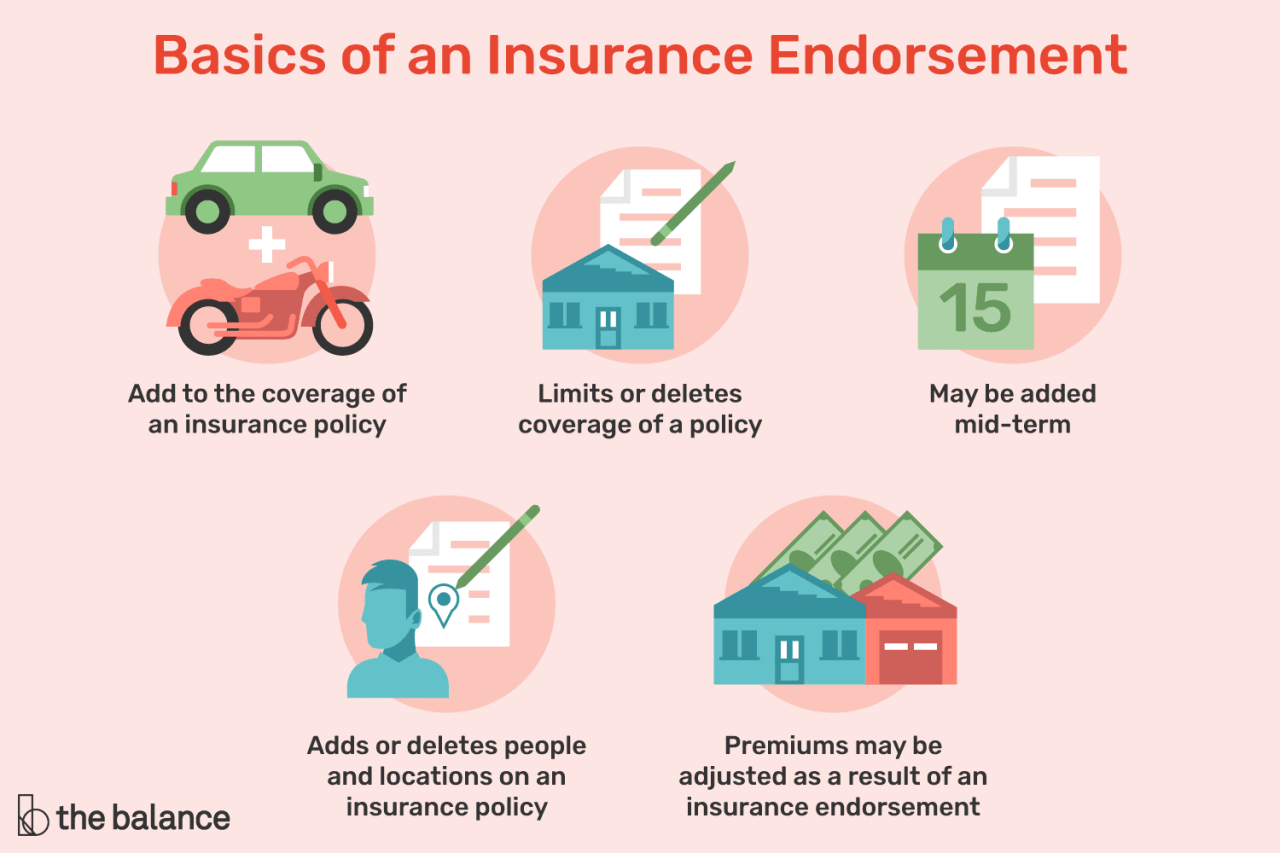

Definition of Endorsements in Insurance

Endorsements in insurance are modifications or amendments to an existing insurance policy. They are used to alter the terms, conditions, or coverage of the policy.

Endorsements serve several purposes. They can be used to:

- Add or remove coverage for specific risks or perils.

- Increase or decrease the policy limits.

- Change the deductible or premium.

- Add or remove named insureds or beneficiaries.

- Correct errors or omissions in the original policy.

Types of Endorsements

Endorsements are versatile tools that insurance companies offer to tailor policies to meet specific needs. They come in various types, each with unique features and purposes.

Named Insured Endorsement

This endorsement adds or removes individuals or entities as named insureds on the policy. It ensures that the coverage extends to the specified parties, clarifying their rights and responsibilities under the policy.

Additional Interest Endorsement

This endorsement extends coverage to entities with a financial interest in the insured property but are not named insureds. It protects their interests in the event of a covered loss.

Mortgage Endorsement

This endorsement protects the lender’s interest in the insured property in the event of a loss. It ensures that the lender’s mortgage is paid off before any other claims are settled.

Replacement Cost Endorsement

This endorsement provides coverage for the full replacement cost of damaged or destroyed property, regardless of its actual cash value. It eliminates the need for depreciation deductions, ensuring that the policyholder receives the necessary funds to replace the lost or damaged items.

Agreed Value Endorsement

This endorsement sets a specific value for the insured property, which is agreed upon by both the insurer and the policyholder. It eliminates the need for an appraisal in the event of a total loss, ensuring a swift and hassle-free settlement.

Scheduled Personal Property Endorsement

This endorsement provides additional coverage for valuable personal belongings, such as jewelry, electronics, or artwork. It ensures that these items are adequately protected in the event of a covered loss.

Flood Endorsement

This endorsement extends coverage to losses caused by floods, which are typically excluded from standard homeowners or business insurance policies. It provides peace of mind for policyholders in flood-prone areas.

Earthquake Endorsement

This endorsement extends coverage to losses caused by earthquakes, which are also typically excluded from standard homeowners or business insurance policies. It provides protection against the devastating financial impact of earthquake damage.

Builder’s Risk Endorsement

This endorsement provides coverage for structures under construction, protecting the builder and the property owner against losses caused by weather events, vandalism, or theft.

Endorsement Process

Obtaining an endorsement typically involves a straightforward process that ensures the accurate reflection of changes to an insurance policy.

The process usually begins with the policyholder contacting their insurance agent to request the endorsement. The agent will then gather the necessary information and submit the request to the insurance company’s underwriting department.

Role of Insurance Agents

Insurance agents play a crucial role in the endorsement process by acting as intermediaries between policyholders and insurance companies. They provide guidance and assistance to policyholders throughout the process, ensuring that the requested changes are properly documented and submitted to the insurance company.

Role of Underwriters

Underwriters are responsible for assessing the risk associated with the requested endorsement. They review the policyholder’s information and determine whether the endorsement can be approved. Underwriters may request additional information or documentation to make an informed decision.

Benefits of Endorsements

Endorsements provide numerous advantages by customizing insurance policies to meet specific needs and enhancing coverage. They offer greater flexibility, ensuring optimal protection for individuals and businesses.

Some key benefits of endorsements include:

Enhanced Coverage

- Expand coverage limits, such as increasing property value or liability amounts.

- Add coverage for additional perils, such as earthquakes or floods.

- Extend coverage to additional individuals or properties.

Tailored Protection

- Address unique risks or exposures that are not covered under the standard policy.

- Provide specialized coverage for specific industries or occupations.

- Offer additional protection for valuable items, such as jewelry or collectibles.

Reduced Premiums

- In some cases, endorsements can lead to lower premiums by limiting coverage for certain risks.

- Adding endorsements that enhance safety or security measures may qualify for premium discounts.

Flexibility and Convenience

- Endorsements allow for easy adjustments to policies as needs change.

- They provide a convenient way to add or remove coverage without having to replace the entire policy.

Limitations of Endorsements

While endorsements offer flexibility in customizing insurance policies, they also come with certain limitations:

Exclusions and Restrictions

Endorsements may not cover all potential risks or circumstances. Insurance companies may exclude specific events, activities, or property from coverage under an endorsement. It’s crucial to carefully review the endorsement language to identify any exclusions or restrictions that may apply.

Limited Scope

Endorsements are designed to supplement the original insurance policy, and their coverage is typically limited to the specific terms Artikeld in the endorsement. They may not provide comprehensive protection for all potential risks associated with the insured asset or activity.

Cost Implications

Adding endorsements to an insurance policy can result in increased premiums. The cost of the endorsement will vary depending on the type of coverage provided and the risk associated with the insured item or activity.

Complexity

Insurance policies and endorsements can be complex documents, and it’s essential to fully understand the terms and conditions of an endorsement before agreeing to it. Failure to do so could lead to unexpected gaps in coverage or disputes with the insurance company.

Examples of Endorsements

Endorsements play a crucial role in customizing insurance policies to meet specific needs. Various types of endorsements are available across different insurance lines, each serving a unique purpose. The following table provides a few examples to illustrate the diversity and impact of endorsements.

Common Endorsements in Insurance Lines

| Insurance Line | Endorsement | Description | Impact on Coverage |

|---|---|---|---|

| Auto | Rental Reimbursement | Provides coverage for rental car expenses incurred due to an accident or theft. | Expands coverage to include rental costs. |

| Homeowners | Scheduled Personal Property | Covers specific high-value items, such as jewelry or artwork, for an additional premium. | Enhances protection for valuable possessions. |

| Commercial | Additional Insured | Extends coverage to third parties, such as contractors or subcontractors, working on the insured’s property. | Protects the policyholder from liability claims involving additional parties. |

| Health | Maternity Rider | Adds coverage for maternity expenses, including prenatal care, delivery, and postnatal care. | Expands coverage to include childbirth-related costs. |

| Life | Waiver of Premium | Waives premium payments if the insured becomes disabled or unable to work. | Ensures continued coverage without financial burden during times of disability. |

Impact of Endorsements on Premiums

Endorsements can significantly impact insurance premiums, affecting the cost of coverage. The type and scope of an endorsement play a crucial role in determining its impact on premiums.

Generally, endorsements that expand coverage or increase risk will result in higher premiums. For instance, adding a rider to cover valuables or hazardous activities can lead to a premium increase. Conversely, endorsements that restrict coverage or reduce risk may result in lower premiums, such as removing a driver from an auto insurance policy.

Premium Adjustments

Insurance companies assess the impact of endorsements on premiums based on several factors:

- Nature of the Endorsement: The type of endorsement and its impact on risk determine the premium adjustment. For example, an endorsement that adds a high-risk driver to an auto policy will result in a significant premium increase compared to an endorsement that adds a low-risk driver.

- Scope of Coverage: The extent of coverage provided by the endorsement affects the premium. Broader coverage typically leads to higher premiums, while narrower coverage may result in lower premiums.

- Risk Assessment: Insurance companies evaluate the increased or decreased risk associated with the endorsement. Higher-risk endorsements warrant higher premiums, while lower-risk endorsements may qualify for premium discounts.

Conclusion

In summary, endorsements play a crucial role in tailoring insurance policies to meet specific needs and circumstances. They provide flexibility and customization, allowing policyholders to adjust their coverage, enhance protection, and address potential risks.

By understanding the types, process, and benefits of endorsements, individuals and businesses can make informed decisions about their insurance coverage. Endorsements ensure that insurance policies align with the evolving needs and exposures, offering peace of mind and financial protection against unforeseen events.