Definition and Purpose

Waiver of premium life insurance is an insurance policy rider that excuses the policyholder from paying premiums if they become disabled or critically ill.

Its purpose is to provide financial protection to policyholders and their families by ensuring that life insurance coverage continues even if they are unable to work and earn an income.

Eligibility Criteria

Eligibility criteria for waiver of premium life insurance vary depending on the insurance company and the specific policy. Generally, policyholders must meet certain requirements, such as:

- Being diagnosed with a covered disability or critical illness

- Meeting the definition of disability or critical illness as defined by the policy

- Providing proof of disability or critical illness

Eligibility Criteria

Obtaining a waiver of premium on life insurance is contingent upon fulfilling specific eligibility criteria. These requirements aim to ascertain the policyholder’s eligibility for premium exemption in the event of qualifying circumstances.

The eligibility criteria typically encompass the following factors:

Health Conditions

- Terminal illness with a life expectancy of less than 12 months

- Chronic or severe disabilities that significantly impair the policyholder’s ability to perform daily activities

- Mental or cognitive impairments that render the policyholder unable to manage their own affairs

Occupational Factors

- Job loss or involuntary unemployment for an extended period

- Disability that prevents the policyholder from working in their current or any suitable occupation

- Bankruptcy or financial hardship that makes it impossible to pay premiums

Types of Waivers

Waivers of premium come in different types, each with its own coverage and benefits. Understanding these variations is crucial for selecting the waiver that best suits your specific needs and financial situation.

The most common types of waivers include:

Total Disability Waiver

- Provides coverage if you become totally disabled and unable to work in any occupation for which you are reasonably qualified.

- The definition of “total disability” varies between policies, but generally requires you to be unable to perform the substantial and material duties of your occupation.

- Benefits may continue for a specified period, such as until you reach a certain age or for the rest of your life.

Occupational Disability Waiver

- Provides coverage if you become disabled and unable to work in your current occupation, but you may still be able to work in other occupations.

- The definition of “occupational disability” varies between policies, but generally requires you to be unable to perform the substantial and material duties of your occupation.

- Benefits may continue for a specified period, such as until you reach a certain age or for the rest of your life.

Own Occupation Disability Waiver

- Provides coverage if you become disabled and unable to work in your current occupation, even if you may be able to work in other occupations.

- The definition of “own occupation” is typically defined in the policy and may vary between policies.

- Benefits may continue for a specified period, such as until you reach a certain age or for the rest of your life.

Catastrophic Disability Waiver

- Provides coverage if you become disabled and unable to perform two or more activities of daily living, such as eating, bathing, or dressing.

- The definition of “catastrophic disability” varies between policies, but generally requires you to be unable to perform two or more activities of daily living.

- Benefits may continue for a specified period, such as until you reach a certain age or for the rest of your life.

Terminal Illness Waiver

- Provides coverage if you are diagnosed with a terminal illness and have a life expectancy of 12 months or less.

- Benefits may be paid in a lump sum or over a period of time.

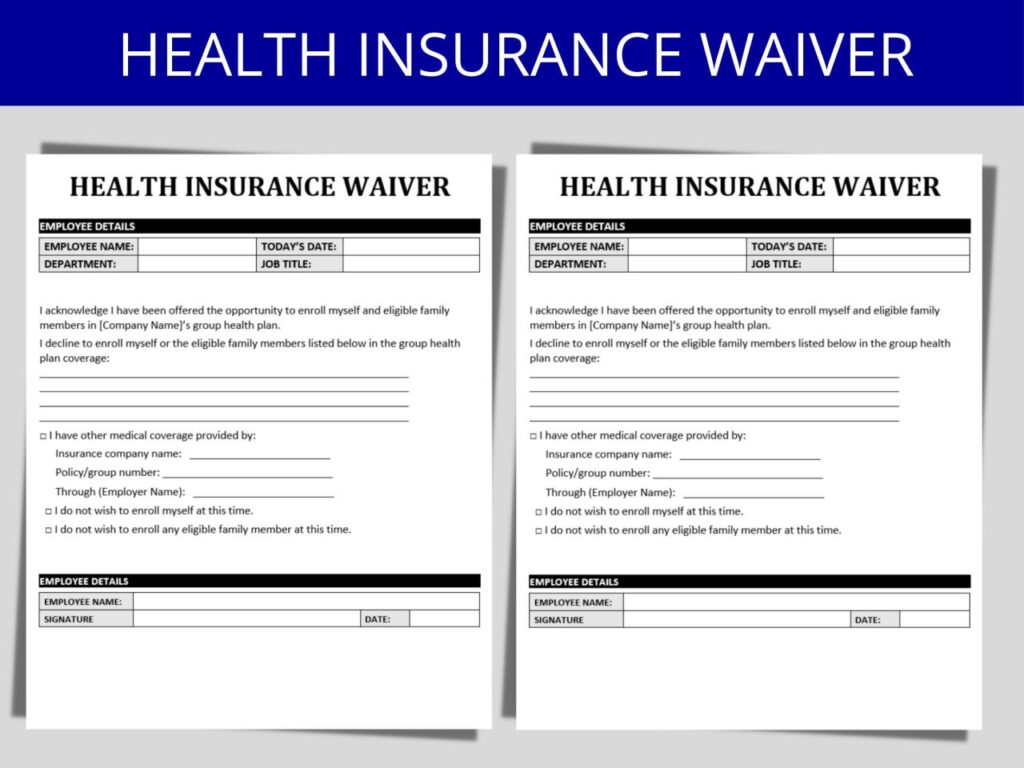

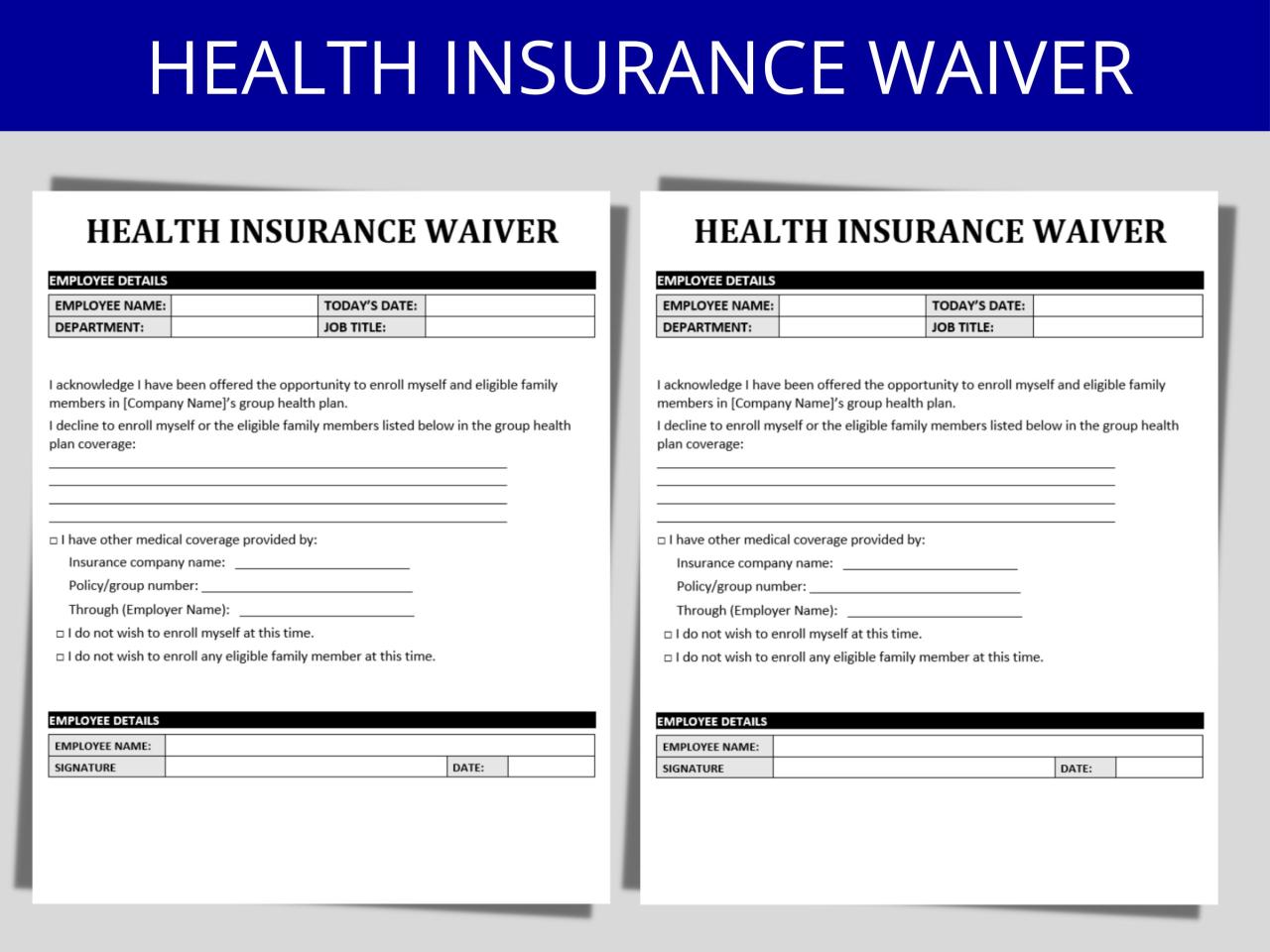

Application Process

Applying for a waiver of premium typically involves the following steps:

- Contact your insurance provider to obtain an application form.

- Complete the application form accurately and provide all required documentation.

- Submit the completed application to your insurance provider.

- The insurance provider will review your application and supporting documents to determine your eligibility.

- If you are approved for the waiver, your insurance provider will notify you and the waiver will be applied to your policy.

Required Documentation

When applying for a waiver of premium, you will typically be required to provide the following documentation:

- Proof of disability (e.g., a doctor’s statement)

- Proof of income (e.g., pay stubs or tax returns)

- Policy information (e.g., policy number and coverage amount)

It is important to provide all required documentation accurately and promptly to ensure that your application is processed efficiently.

Underwriting Considerations

Underwriting for a waiver of premium involves assessing an individual’s health and lifestyle factors to determine their risk profile and the likelihood of future disability. Insurers evaluate various aspects to make informed decisions about coverage and premium rates.

Factors such as medical history, current health status, occupation, and lifestyle habits play a crucial role in the underwriting process. Individuals with a history of chronic illnesses or risky behaviors may face higher premiums or even ineligibility for coverage.

Health History

- Insurers review medical records and ask detailed questions about an applicant’s past and present health conditions.

- Pre-existing conditions, chronic diseases, and previous surgeries can impact the underwriting decision.

- Applicants with a history of severe or disabling conditions may be required to undergo additional medical examinations or provide more detailed medical information.

Lifestyle Habits

- Insurers consider lifestyle habits such as smoking, alcohol consumption, and physical activity.

- Individuals who engage in high-risk activities, such as extreme sports or hazardous occupations, may face higher premiums or coverage restrictions.

- Healthy lifestyle choices, including regular exercise, a balanced diet, and responsible alcohol consumption, can positively influence the underwriting decision.

Premiums and Benefits

Waivers of premium can significantly impact life insurance premiums and benefits.

When a waiver of premium is in effect, the policyholder is no longer responsible for paying premiums. This can provide significant financial relief, especially if the policyholder is unable to work due to a disability.

Impact on Premiums

- Premiums for policies with waivers of premium are typically higher than those without waivers.

- The additional premium cost reflects the increased risk that the insurance company assumes by agreeing to waive premiums in the event of a disability.

Impact on Death Benefits

- Waivers of premium do not affect the death benefit of a life insurance policy.

- The death benefit remains the same, regardless of whether or not a waiver of premium is in effect.

Impact on Other Policy Provisions

- Waivers of premium may affect other policy provisions, such as cash value accumulation and policy loans.

- Policyholders should carefully review their policies to understand the specific impact of a waiver of premium on their coverage.

Limitations and Exclusions

Waivers of premium are generally subject to certain limitations and exclusions. These can vary depending on the specific policy and insurer, but some common limitations include:

– Time limits: Waivers may only be available for a limited period of time, such as during the first year of the policy or until a certain age is reached.

– Pre-existing conditions: Waivers may not be available for pre-existing conditions or illnesses that are known to the insurer at the time of application.

– Certain types of disabilities: Waivers may not be available for certain types of disabilities, such as those that are self-inflicted or caused by substance abuse.

It is important to carefully review the policy terms and conditions to understand the specific limitations and exclusions that apply to a waiver of premium.

Comparison to Other Riders

Waiver of premium is not the only optional rider available for life insurance policies. Other common riders include:

- Accidental death benefit: Provides an additional death benefit if the insured dies due to an accident.

- Disability income rider: Provides monthly payments if the insured becomes disabled and unable to work.

- Critical illness rider: Provides a lump sum payment if the insured is diagnosed with a critical illness, such as cancer or heart disease.

Each of these riders has its own advantages and disadvantages. The best rider for you will depend on your individual needs and circumstances.

Advantages of Waiver of Premium

Waiver of premium has several advantages over other riders:

- It is relatively inexpensive.

- It is easy to understand.

- It can provide peace of mind knowing that your premiums will be waived if you become disabled.

Disadvantages of Waiver of Premium

However, waiver of premium also has some disadvantages:

- It only waives your premiums. It does not provide any additional death benefit or income replacement.

- It may not be available on all life insurance policies.

- It may have a waiting period before it takes effect.

Tax Implications

Understanding the tax implications of a waiver of premium rider is crucial for comprehensive financial planning. Here’s an overview of how it affects income taxes and estate planning.

Income Taxes

Generally, premiums paid for life insurance policies are not tax-deductible. However, when a waiver of premium rider is triggered due to a qualifying disability, the premiums waived become tax-free income. This means that the policyholder does not have to pay income taxes on the waived premiums.

Estate Planning

Life insurance proceeds are generally tax-free to the beneficiaries. However, if the policyholder dies while receiving a waiver of premium, the amount of premiums waived may be subject to estate taxes. This is because the waived premiums are considered a transfer of wealth from the policyholder to the beneficiaries.

Consumer Considerations

Before obtaining a waiver of premium, consumers should consider their individual needs and circumstances. Here are some factors to weigh:

The primary benefit of a waiver of premium is the peace of mind it provides, knowing that premiums will be waived if the insured becomes disabled. However, there are also potential drawbacks to consider.

Factors to Consider

- Cost: Waivers of premium typically come at an additional cost, which can increase the overall cost of the insurance policy.

- Eligibility: Consumers should carefully review the eligibility criteria to ensure they meet the requirements for coverage.

- Limitations and exclusions: Waivers of premium may have limitations or exclusions, such as a waiting period or specific definitions of disability.

- Potential benefits: Consumers should consider the potential benefits of a waiver of premium, such as the financial relief it can provide if they become disabled.