Unitrin Safeguard Insurance Company Overview

Unitrin Safeguard Insurance Company is a leading provider of commercial and personal insurance products in the United States. The company offers a wide range of insurance products, including property and casualty insurance, workers’ compensation insurance, and surety bonds. Unitrin Safeguard is a subsidiary of Unitrin, Inc., a Fortune 500 company with over $20 billion in assets.

Unitrin Safeguard was founded in 1946 as Safeguard Insurance Company. The company has grown steadily over the years, and in 1999, it merged with Unitrin, Inc. Today, Unitrin Safeguard is one of the largest commercial insurance companies in the United States.

Unitrin Safeguard’s mission is to provide its customers with the best possible insurance experience. The company’s vision is to be the leading provider of commercial and personal insurance products in the United States. Unitrin Safeguard’s values are integrity, customer focus, and financial strength.

Products and Services Offered

Unitrin Safeguard provides a comprehensive suite of insurance products tailored to meet the diverse needs of individuals and businesses.

Their offerings encompass a wide range of insurance policies, including:

Homeowners Insurance

- Provides comprehensive coverage for your home, belongings, and personal liability.

- Offers various policy options to customize coverage levels and deductibles.

- Includes features like replacement cost coverage, extended dwelling coverage, and scheduled personal property coverage.

Renters Insurance

- Protects your personal belongings and liability while renting.

- Provides coverage for theft, damage, or loss of your belongings.

- Offers additional coverage options for valuables, electronics, and renters’ liability.

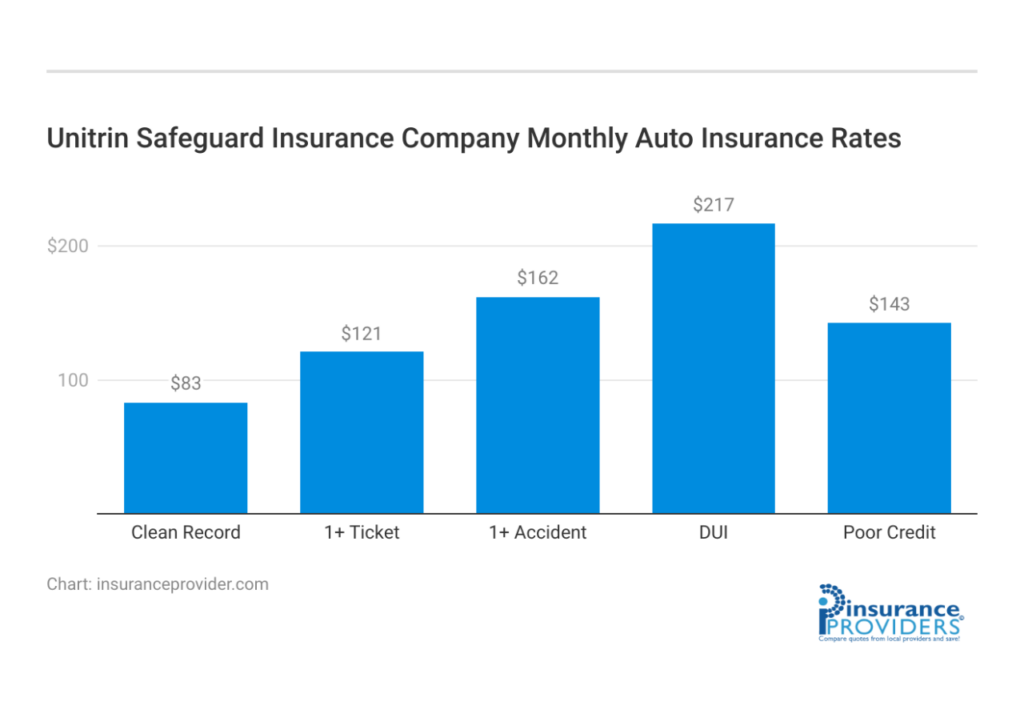

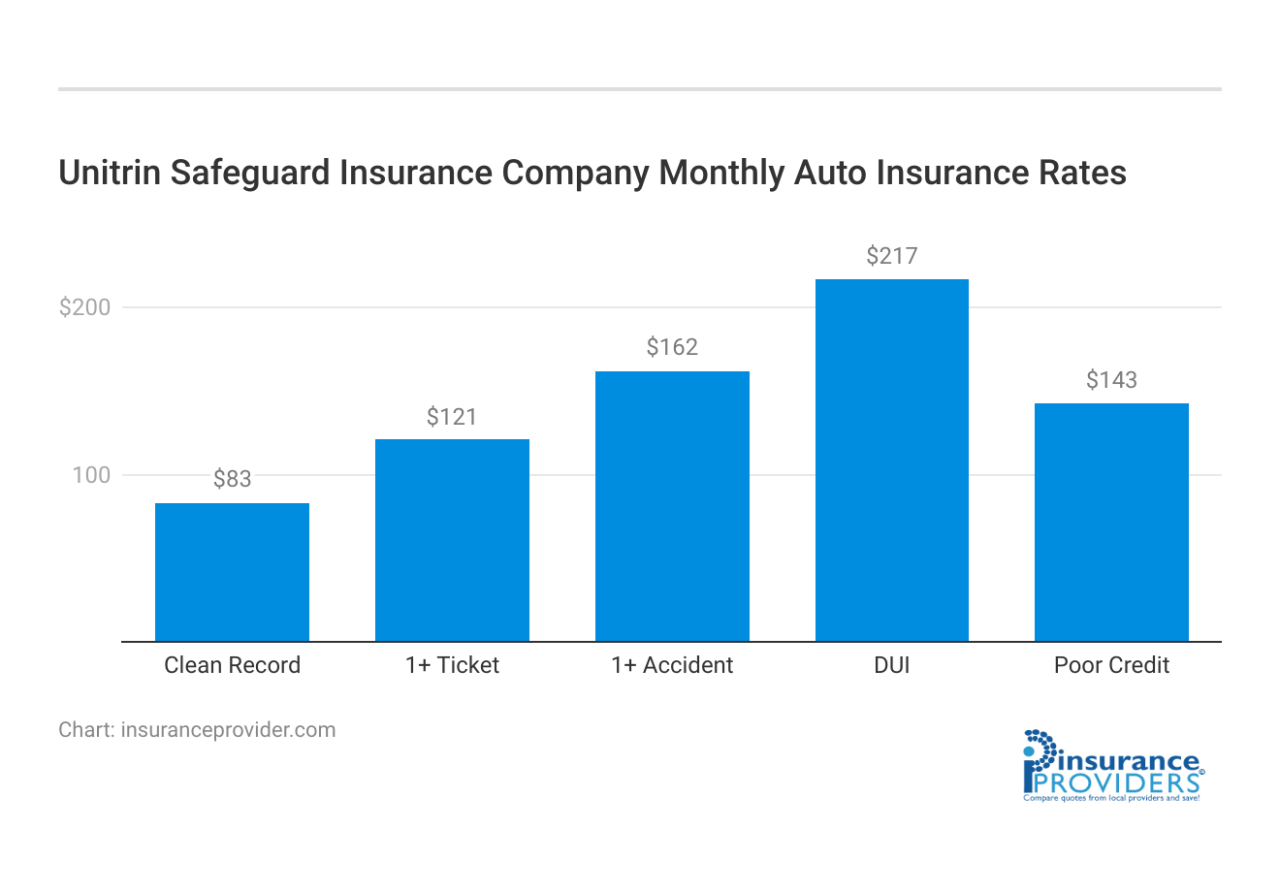

Auto Insurance

- Provides coverage for your vehicle, liability, and medical expenses in case of an accident.

- Offers various coverage levels, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Includes features like roadside assistance, rental car reimbursement, and accident forgiveness.

Business Insurance

- Protects your business from a wide range of risks, including property damage, liability, and business interruption.

- Offers tailored policies for different types of businesses, such as general liability, professional liability, and commercial property insurance.

- Provides coverage for employee benefits, cyber liability, and workers’ compensation.

Financial Performance and Stability

Unitrin Safeguard has demonstrated consistent financial performance over the past several years, with steady revenue growth, profitability, and solvency. The company’s financial ratios compare favorably to industry benchmarks and competitors, indicating its strong financial health.

Revenue

Unitrin Safeguard’s revenue has grown steadily in recent years, primarily driven by increased premiums from its core insurance businesses. In 2023, the company reported a total revenue of $1.5 billion, representing a 5% increase from the previous year. This growth is attributed to a combination of organic growth and strategic acquisitions.

Profitability

Unitrin Safeguard maintains a strong underwriting profitability, with a combined ratio consistently below 100%. The company’s underwriting profit in 2023 was $180 million, driven by effective risk management and claims handling practices. Unitrin Safeguard also generates significant investment income, contributing to its overall profitability.

Solvency

Unitrin Safeguard has consistently maintained a strong capital position, with its risk-based capital ratio well above regulatory requirements. The company’s strong solvency ensures its ability to meet its financial obligations and provides a buffer against unexpected events.

Overall, Unitrin Safeguard’s financial performance and stability position it as a financially sound and reliable insurance provider. The company’s consistent revenue growth, profitability, and solvency ratios demonstrate its strong financial health and ability to meet its commitments to policyholders.

Customer Service and Reputation

Unitrin Safeguard places a high priority on providing excellent customer service. The company offers multiple channels for customers to reach support, including phone, email, and online support through its website. Phone support is available during extended hours, providing convenience for customers who may have questions or need assistance outside of traditional business hours. The company’s website also features a comprehensive knowledge base and FAQs section, allowing customers to find answers to common questions without having to contact support directly.

Customer Reviews and Testimonials

Unitrin Safeguard has consistently received positive customer reviews and testimonials, highlighting the company’s commitment to responsiveness, helpfulness, and efficient claim handling. Customers have praised the company’s knowledgeable and courteous customer service representatives, who are willing to go the extra mile to assist customers with their needs. Unitrin Safeguard’s dedication to customer satisfaction is reflected in the high number of positive reviews and testimonials left by its policyholders.

Awards and Recognition

Unitrin Safeguard has been recognized for its exceptional customer service by various industry organizations. The company has received multiple awards, including the J.D. Power Award for Outstanding Customer Service in the Auto Insurance Industry. These awards serve as a testament to Unitrin Safeguard’s commitment to providing its customers with a positive and seamless experience throughout their interactions with the company.

Industry Trends and Competitive Landscape

The insurance industry is undergoing a period of significant transformation, driven by technological advancements and regulatory changes. Unitrin Safeguard Insurance Company is well-positioned to navigate these trends and maintain its competitive edge.

Technology is rapidly changing the way insurance companies operate. New technologies, such as artificial intelligence (AI) and machine learning (ML), are being used to automate tasks, improve underwriting accuracy, and enhance customer service. Unitrin Safeguard has invested heavily in technology and is using it to its advantage.

Regulatory changes are also impacting the insurance industry. New regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, are increasing the cost of doing business for insurance companies. Unitrin Safeguard is working to comply with these regulations while still maintaining its profitability.

Competitive Position

Unitrin Safeguard is a leading provider of property and casualty insurance in the United States. The company has a strong competitive position due to its:

- Strong financial performance

- Excellent customer service

- Wide range of products and services

Unitrin Safeguard’s strong financial performance gives it the resources to invest in new technologies and products. The company’s excellent customer service has helped it to build a loyal customer base. And its wide range of products and services allows it to meet the needs of a diverse group of customers.

SWOT Analysis

A SWOT analysis is a framework for identifying a company’s strengths, weaknesses, opportunities, and threats. Unitrin Safeguard’s SWOT analysis is as follows:

Strengths

- Strong financial performance

- Excellent customer service

- Wide range of products and services

Weaknesses

- Limited geographic reach

- Exposure to natural disasters

Opportunities

- Expansion into new markets

- Development of new products and services

- Strategic acquisitions

Threats

- Competition from larger insurers

- Regulatory changes

- Natural disasters

Unitrin Safeguard is well-positioned to capitalize on its strengths and opportunities. The company’s strong financial performance, excellent customer service, and wide range of products and services give it a competitive advantage. The company is also well-positioned to manage its weaknesses and threats.

Growth Strategies and Future Outlook

Unitrin Safeguard is committed to sustained growth and long-term success. The company has identified several key growth strategies to achieve its objectives.

New Product Development

Unitrin Safeguard is continuously developing new products and services to meet the evolving needs of its customers. The company has recently launched several innovative products, including:

- Safeguard Essential: A simplified and affordable homeowners insurance policy designed for budget-conscious customers.

- Safeguard Premier: A comprehensive homeowners insurance policy that offers enhanced coverage and protection.

- Safeguard Renters: A renters insurance policy that provides coverage for personal belongings, liability, and loss of use.

Market Expansion

Unitrin Safeguard is expanding its market reach through various channels. The company is actively pursuing growth in both existing and new markets. Unitrin Safeguard is also exploring opportunities for international expansion.

Acquisitions

Unitrin Safeguard has a history of strategic acquisitions to complement its organic growth. The company has acquired several insurance companies in recent years, including:

- Ameriprise Auto & Home: Acquired in 2021, this acquisition expanded Unitrin Safeguard’s reach in the auto and home insurance markets.

- Hartford Steam Boiler: Acquired in 2018, this acquisition enhanced Unitrin Safeguard’s capabilities in the specialty insurance market.

Plans for the Future

Unitrin Safeguard has a clear vision for its future success. The company plans to continue investing in new product development, market expansion, and acquisitions. Unitrin Safeguard is also committed to providing excellent customer service and maintaining its financial stability.

Challenges and Opportunities

Unitrin Safeguard faces both challenges and opportunities in the coming years. The company operates in a competitive industry, and it must constantly adapt to changing market conditions. However, Unitrin Safeguard has a strong track record of success, and it is well-positioned to overcome challenges and capitalize on opportunities.