Absolute Assignment of Life Insurance Policy

An absolute assignment is a permanent transfer of ownership of a life insurance policy from the policyholder (assignor) to another person (assignee). Unlike other types of assignments, the assignor relinquishes all rights and interests in the policy, including the right to change the beneficiary, surrender the policy, or borrow against its cash value. The assignee becomes the sole owner of the policy and is entitled to all benefits and proceeds.

Key Differences between Absolute and Other Assignments

– Irrevocable: An absolute assignment cannot be revoked by the assignor, while other assignments may be revocable.

– Complete Transfer of Ownership: The assignee becomes the legal owner of the policy, with all rights and responsibilities.

– No Right to Proceeds: The assignor has no right to any proceeds from the policy after the assignment.

– Tax Implications: Absolute assignments may have tax implications, depending on the circumstances.

Legal Implications of Absolute Assignment

An absolute assignment of a life insurance policy transfers complete ownership of the policy from the assignor (the original policyholder) to the assignee (the new owner). This has significant legal implications, including:

Rights of the Assignee

- Ownership of the policy: The assignee becomes the legal owner of the policy and has all the rights associated with it, including the right to receive the death benefit.

- Control over the policy: The assignee has the right to make changes to the policy, such as changing the beneficiary or surrendering the policy for cash.

- Right to proceeds: The assignee is entitled to receive the death benefit when the insured person dies.

Obligations of the Assignee

- Payment of premiums: The assignee is responsible for paying the premiums on the policy to keep it in force.

- Compliance with policy terms: The assignee must comply with all the terms and conditions of the policy, including any restrictions on the use of the death benefit.

Rights of the Assignor

- Relief from liability: The assignor is no longer responsible for paying premiums or complying with the terms of the policy.

- No further interest in the policy: The assignor has no further legal or financial interest in the policy once it has been absolutely assigned.

Tax Consequences of Absolute Assignment

An absolute assignment of a life insurance policy carries significant tax implications for both the assignor (the original policyholder) and the assignee (the new owner). It’s crucial to understand these consequences to make informed decisions about such assignments.

Tax Implications for the Assignor

– Gain or Loss: The assignor may realize a capital gain or loss on the assignment. The gain or loss is calculated as the difference between the policy’s cash surrender value and the amount received from the assignee.

– Tax Treatment: The gain or loss is generally treated as ordinary income or loss for tax purposes.

– Exceptions: There are exceptions to the ordinary income treatment. For instance, if the policy is assigned to a spouse or a charity, the gain may be tax-free.

Tax Implications for the Assignee

– Income Tax: The assignee is not subject to income tax on the death benefit received upon the insured’s death. However, the assignee may be subject to income tax on any interest earned on the policy’s cash value.

– Estate Tax: The death benefit may be included in the assignee’s estate for estate tax purposes if the assignment was made within three years of the insured’s death.

Practical Considerations for Absolute Assignment

Absolute assignment of a life insurance policy involves significant practical considerations to ensure a smooth and legally binding transaction.

Executing an Absolute Assignment

Proper execution of an absolute assignment is crucial to its validity. The following steps should be taken:

* Written Agreement: The assignment should be documented in a written agreement signed by both the assignor (policyholder) and the assignee.

* Policy Details: The agreement should clearly identify the life insurance policy being assigned, including the policy number, face amount, and insurance company.

* Assignment Language: The assignment should use unambiguous language that transfers ownership of the policy to the assignee.

* Notarization: In some jurisdictions, notarization of the assignment is required for legal validity.

* Delivery of Original Policy: The assignor should deliver the original life insurance policy to the assignee upon execution of the assignment.

Alternatives to Absolute Assignment

An absolute assignment of a life insurance policy is not the only option available to policyholders who wish to transfer ownership of their policy. Several alternative options exist, each with its own advantages and disadvantages.

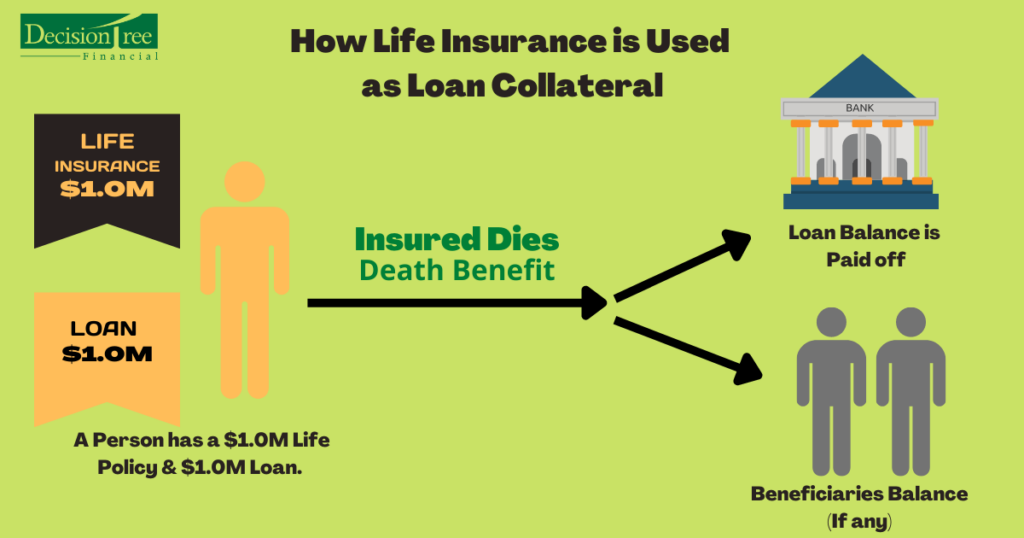

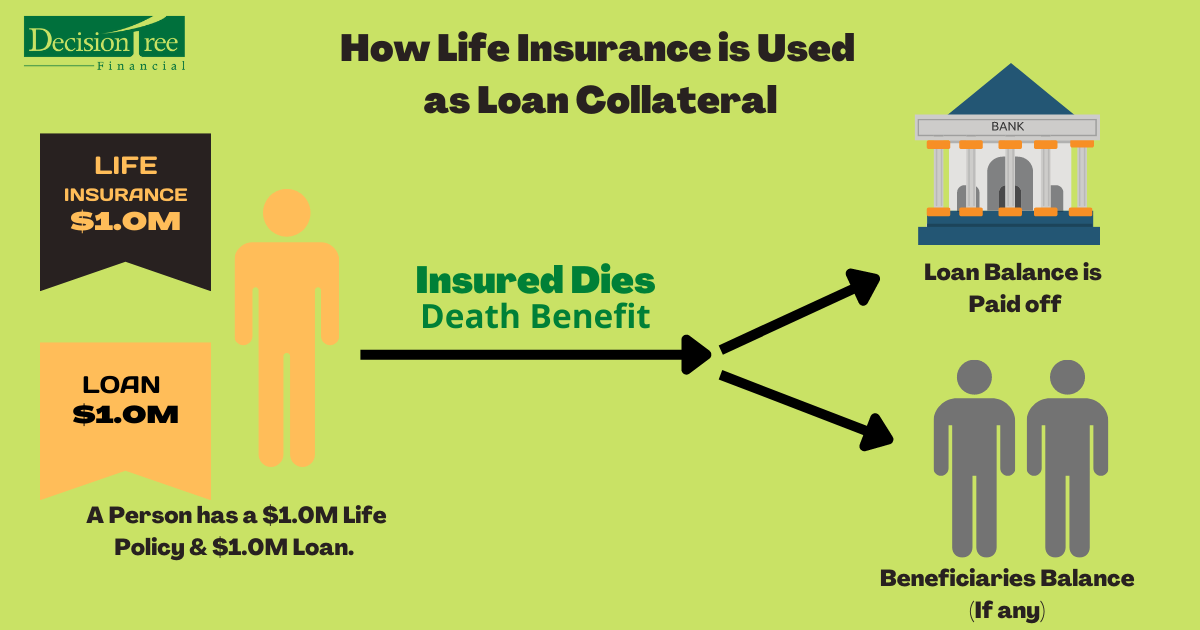

Policy Loan

A policy loan is a loan taken out against the cash value of a life insurance policy. The policyholder borrows money from the insurance company and uses the cash value as collateral. Policy loans have the advantage of being relatively easy to obtain and do not require the policyholder to give up ownership of the policy. However, policy loans accrue interest, which can reduce the cash value of the policy over time.

Viatical Settlement

A viatical settlement is a transaction in which a terminally ill policyholder sells their life insurance policy to a third party for a lump sum payment. The amount of the payment is typically less than the death benefit of the policy, but it can provide the policyholder with much-needed cash while they are still alive. Viatical settlements can be complex and expensive, and they may not be available to all policyholders.

Charitable Gift

A charitable gift of a life insurance policy is a donation of the policy to a qualified charity. The policyholder receives a tax deduction for the value of the policy, and the charity becomes the owner and beneficiary of the policy. Charitable gifts of life insurance policies can be a tax-efficient way to support a favorite charity.

Irrevocable Life Insurance Trust

An irrevocable life insurance trust (ILIT) is a trust that owns a life insurance policy. The policyholder transfers ownership of the policy to the trust, and the trust becomes the beneficiary of the policy. ILITs can be used to reduce estate taxes and provide for the distribution of the death benefit to specific beneficiaries. However, ILITs are complex and expensive to establish and maintain.