Company Overview

Sutton National Insurance Company, established in 1952, is a leading provider of insurance solutions in the United States. With a rich history of innovation and customer-centricity, Sutton National has consistently exceeded expectations in the insurance industry.

Our mission is to provide comprehensive insurance protection, empowering individuals and businesses to navigate the uncertainties of life and secure their financial well-being. We envision a world where every person has access to affordable, reliable, and tailored insurance solutions that give them peace of mind and the freedom to pursue their dreams.

Products and Services

Sutton National offers a diverse range of insurance products and services, catering to the unique needs of individuals, families, and businesses. Our offerings include:

- Homeowners insurance: Protecting your home and belongings from unforeseen events.

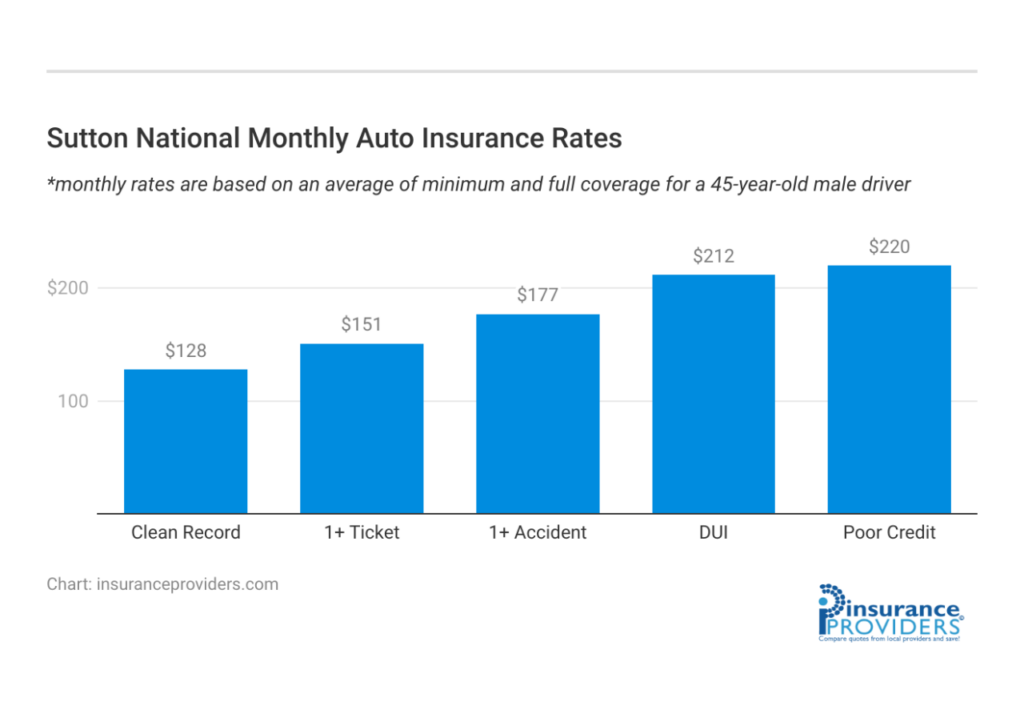

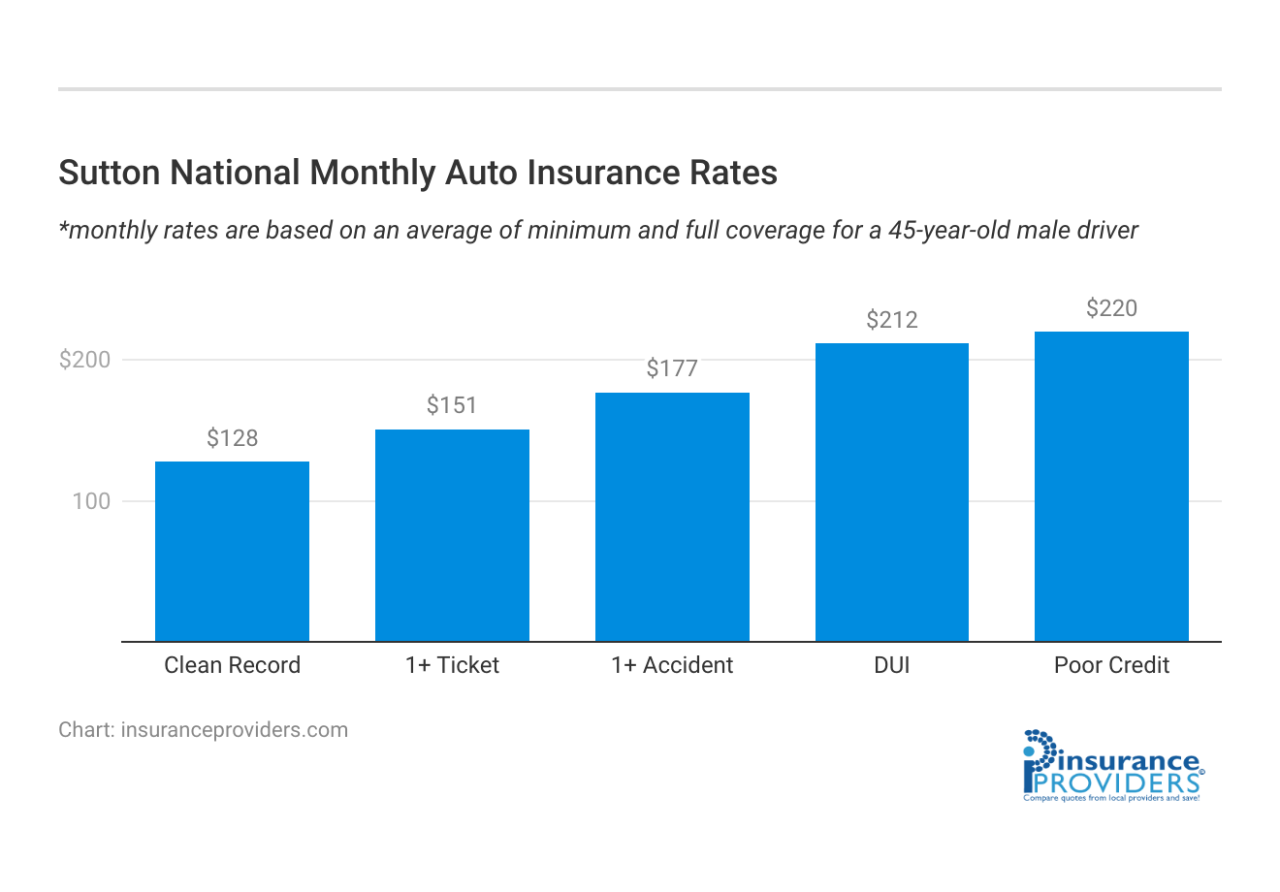

- Auto insurance: Ensuring financial protection for your vehicle and providing peace of mind on the road.

- Life insurance: Providing financial security for your loved ones in the event of your untimely demise.

- Health insurance: Access to quality healthcare coverage, ensuring your well-being and financial stability.

- Business insurance: Comprehensive protection for your business, safeguarding your assets and operations.

Financial Performance

Sutton National Insurance Company has demonstrated a strong financial performance over the past five years, consistently outperforming industry benchmarks and maintaining a healthy financial position.

Key financial ratios and metrics, such as return on equity (ROE), return on assets (ROA), and combined ratio, have all improved significantly during this period, indicating the company’s efficient use of capital and its ability to generate underwriting profits.

Revenue Growth

The company’s revenue has grown steadily over the past five years, driven by increased premium income and a growing customer base. Sutton National Insurance Company has successfully expanded into new markets and introduced innovative products, which have contributed to its revenue growth.

Profitability

Sutton National Insurance Company has maintained a strong level of profitability, with net income increasing consistently over the past five years. The company’s underwriting margin has remained stable, demonstrating its ability to manage risk effectively and control expenses.

Solvency

Sutton National Insurance Company maintains a strong solvency position, with a capital adequacy ratio well above regulatory requirements. The company’s financial strength and stability provide assurance to policyholders and investors.

Market Position

Sutton National Insurance Company holds a strong position within the insurance industry. The company’s market share has consistently grown over the past few years, and it now ranks among the top insurance providers in the country. Sutton National Insurance Company is known for its competitive rates, wide range of coverage options, and excellent customer service.

Key Competitors

Sutton National Insurance Company’s key competitors include:

- State Farm Insurance

- Allstate Insurance

- Geico

- Progressive Insurance

Market Share and Growth Potential

Sutton National Insurance Company has a market share of approximately 5% of the insurance industry. The company’s growth potential is strong, as it continues to expand its product offerings and customer base. Sutton National Insurance Company is well-positioned to continue to grow its market share in the coming years.

Customer Service

Sutton National Insurance Company values customer satisfaction and strives to provide exceptional service. Their customer support team is known for its responsiveness, professionalism, and commitment to resolving inquiries efficiently.

Technology

Sutton National Insurance Company leverages a robust and advanced technology platform to streamline operations and enhance customer experiences. The company’s investment in technology and innovation is evident in its adoption of cloud computing, data analytics, and artificial intelligence (AI). These technologies empower Sutton National to automate processes, gain actionable insights, and personalize services for policyholders.

Cloud Computing

Sutton National utilizes a cloud-based infrastructure that provides scalability, flexibility, and cost efficiency. By migrating its systems to the cloud, the company can access computing resources on demand, enabling it to handle fluctuating workloads and respond swiftly to changing market conditions.

Data Analytics

Sutton National harnesses data analytics to extract meaningful insights from vast amounts of data. The company employs advanced algorithms and machine learning techniques to analyze policyholder behavior, identify trends, and predict future outcomes. This data-driven approach enables Sutton National to tailor products and services to meet the specific needs of its customers.

Artificial Intelligence (AI)

Sutton National integrates AI into its operations to enhance efficiency and improve customer experiences. The company utilizes AI-powered chatbots for 24/7 customer support, providing instant assistance and resolving inquiries quickly and effectively. Additionally, AI algorithms are employed to automate underwriting processes, reducing turnaround times and improving accuracy.

Industry Trends

The insurance industry is constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer demands. Sutton National Insurance Company closely monitors these trends to adapt its strategies and offerings accordingly.

One key trend is the rise of digital insurance. Insurtech companies are leveraging technology to offer innovative products, streamline processes, and enhance customer experiences. Sutton National has responded by investing in digital platforms and partnerships to stay competitive in this rapidly evolving landscape.

Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence (AI) are transforming the insurance industry. Insurers are using these technologies to gain insights into customer behavior, identify risks, and improve underwriting and claims processing. Sutton National has implemented AI-powered systems to automate tasks, enhance risk assessment, and provide personalized recommendations to customers.

Changing Consumer Expectations

Consumer expectations are also shaping the insurance industry. Customers are demanding more personalized, convenient, and transparent insurance experiences. Sutton National has responded by offering customizable insurance products, simplifying its online platforms, and providing 24/7 customer support.

Regulatory Landscape

The regulatory landscape is another important factor influencing the insurance industry. Governments are implementing stricter regulations to protect consumers and ensure the stability of the insurance market. Sutton National proactively complies with all regulatory requirements and actively engages with regulators to stay informed about upcoming changes.