Select Quote Auto Insurance Overview

Select Quote is an insurance comparison website that provides free quotes from multiple insurance companies. The company was founded in 1985 and is headquartered in Boston, Massachusetts. Select Quote’s mission is to help consumers find the best possible insurance rates by comparing quotes from a wide range of insurers.

Select Quote is one of the largest insurance comparison websites in the United States. The company has partnered with over 50 insurance companies to provide quotes for auto, home, health, and life insurance. In 2021, Select Quote generated over $1 billion in revenue.

Unique Features

- Select Quote offers a wide range of insurance products, including auto, home, health, and life insurance.

- Select Quote provides free quotes from multiple insurance companies.

- Select Quote has a team of licensed insurance agents who can help consumers find the best possible insurance rates.

Coverage Options

Select Quote offers a wide range of auto insurance coverage options to meet the diverse needs of drivers. These coverage types provide varying levels of protection and have distinct benefits and limitations.

Understanding the different coverage options available is crucial for making informed decisions about your insurance plan. Let’s delve into the specifics of each coverage type to help you tailor your policy to your unique requirements.

Liability Coverage

- Protects you financially if you cause an accident that results in injuries or property damage to others.

- Required by law in most states, with minimum coverage limits set by each state.

- Higher liability limits provide greater protection, but come with higher premiums.

Collision Coverage

- Covers damage to your own vehicle caused by a collision with another vehicle or object.

- Optional coverage, but recommended for newer or more valuable vehicles.

- Deductible applies to claims, reducing the amount you pay out-of-pocket.

Comprehensive Coverage

- Protects against non-collision related damages, such as theft, vandalism, weather events, and animal strikes.

- Optional coverage, but recommended for vehicles that are financed or leased.

- Deductible applies to claims, similar to collision coverage.

Uninsured/Underinsured Motorist Coverage

- Protects you financially if you are involved in an accident with a driver who is uninsured or underinsured.

- Covers medical expenses, lost wages, and pain and suffering.

- Optional coverage, but highly recommended in areas with high rates of uninsured drivers.

Medical Payments Coverage

- Covers medical expenses for you and your passengers, regardless of fault.

- Optional coverage, but provides peace of mind and additional protection.

- Has lower coverage limits compared to other types of coverage.

Personal Injury Protection (PIP) Coverage

- Provides coverage for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault.

- Required in some states, such as Florida.

- Can replace traditional medical insurance for accident-related expenses.

Rental Reimbursement Coverage

- Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Optional coverage, but can be valuable if you rely on your vehicle for transportation.

- Has daily and monthly limits on the duration of the rental period.

Pricing and Discounts

Select Quote’s auto insurance rates are influenced by various factors, including your driving history, age, location, and the type of vehicle you drive. Your driving record, including any accidents or violations, can significantly impact your premiums. Younger drivers and those living in urban areas tend to pay higher rates due to higher risk profiles.

Select Quote offers a range of discounts to help lower your premiums, such as:

Multi-policy Discount

- Bundling your auto insurance with other policies, such as homeowners or renters insurance, can qualify you for a discount.

Good Driver Discount

- Maintaining a clean driving record with no accidents or violations can earn you a discount.

Low Mileage Discount

- Drivers who drive fewer miles annually may be eligible for a discount.

Defensive Driving Course Discount

- Completing an approved defensive driving course can qualify you for a discount.

Customer Service and Claims Process

Select Quote provides multiple channels for customer support, ensuring prompt assistance when needed. Their customer service team is available via phone, email, live chat, and social media platforms.

The claims process at Select Quote is designed to be hassle-free and efficient. Policyholders can file claims online, over the phone, or through the mobile app. Once a claim is submitted, a dedicated claims adjuster is assigned to guide the policyholder through the process.

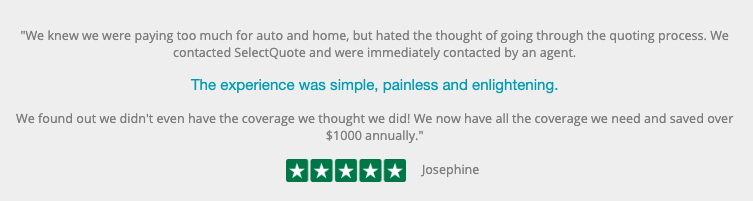

Customer Testimonials

- “I had a great experience with Select Quote’s customer service. They were very responsive and helpful in answering all my questions.”

- “The claims process was quick and easy. I was able to file my claim online and received a settlement within a few days.”

Comparison with Competitors

Select Quote Auto Insurance competes with several other major auto insurance providers, each offering its own range of coverage options, pricing, and customer service. To provide a comprehensive view, we compare Select Quote to two of its primary competitors, Geico and Progressive, in the table below:

| Feature | Select Quote | Geico | Progressive |

|—|—|—|—|

| Coverage Options | Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. | Provides a variety of coverage options, including liability, collision, comprehensive, rental car reimbursement, and roadside assistance. | Offers customizable coverage options, including liability, collision, comprehensive, gap insurance, and pet injury coverage. |

| Pricing | Generally offers competitive pricing, with discounts available for multiple vehicles, safe driving habits, and loyalty. | Known for its competitive pricing and offers discounts for various factors, such as bundling policies, military service, and defensive driving courses. | Provides competitive pricing and offers discounts for safe driving, multiple vehicles, and paperless billing. |

| Customer Service | Receives positive customer reviews for its user-friendly website, responsive customer support, and easy claims process. | Has a reputation for excellent customer service, with a dedicated claims team and 24/7 support. | Offers 24/7 customer support and provides online tools for managing policies and filing claims. |

Strengths of Select Quote

* Wide range of coverage options

* Competitive pricing with available discounts

* User-friendly website and responsive customer support

Weaknesses of Select Quote

* May not offer as many niche coverage options as some competitors

* Some customers may find the quote process to be lengthy

Pros and Cons of Select Quote Auto Insurance

Choosing Select Quote for auto insurance offers both advantages and disadvantages. Consider the following key pros and cons to make an informed decision.

Advantages

- Convenience and ease of use: Select Quote’s online platform and mobile app provide a seamless user experience for obtaining quotes, managing policies, and filing claims.

- Wide range of coverage options: Select Quote offers a comprehensive suite of coverage options, including liability, collision, comprehensive, and more, to meet diverse insurance needs.

- Competitive pricing: By comparing quotes from multiple insurance providers, Select Quote helps customers find affordable auto insurance rates that align with their budget.

- Discounts and savings: Select Quote offers various discounts, such as safe driver discounts, multi-policy discounts, and loyalty discounts, to help customers save money on their premiums.

Disadvantages

- Limited insurance carriers: Select Quote does not represent all insurance carriers in the market, which may limit customers’ options for finding the best coverage and rates.

- Potential for higher premiums: While Select Quote offers competitive rates, some customers may find that their premiums are higher than those offered by other insurance companies.

- Limited customer service hours: Select Quote’s customer service hours are limited compared to some other insurance providers, which may not be convenient for all customers.

Frequently Asked Questions

Here are some frequently asked questions about Select Quote auto insurance:

These questions and answers will help you make an informed decision about whether Select Quote is the right auto insurance provider for you.

What types of auto insurance coverage does Select Quote offer?

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP)

- Medical payments coverage

- Rental reimbursement coverage

- Towing and labor coverage

How much does Select Quote auto insurance cost?

The cost of Select Quote auto insurance varies depending on a number of factors, including your driving history, the type of coverage you choose, and the amount of coverage you need.

You can get a free quote from Select Quote by visiting their website or calling their customer service number.

What are the discounts that Select Quote offers?

- Multi-car discount

- Good driver discount

- Safe driver discount

- Accident-free discount

- Low mileage discount

- Paperless discount

- Online quote discount

How do I file a claim with Select Quote?

You can file a claim with Select Quote by visiting their website, calling their customer service number, or mailing them a claim form.

Select Quote has a 24/7 claims hotline that you can call to report an accident.

What is Select Quote’s customer service like?

Select Quote has a team of experienced customer service representatives who are available to help you with any questions or concerns you may have.

You can contact Select Quote’s customer service department by phone, email, or chat.