Coverage and Benefits

Scott & White Health Insurance offers a range of comprehensive health insurance plans designed to meet the diverse needs of individuals, families, and businesses.

These plans provide coverage for a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care.

Plan Types

Scott & White offers several types of health insurance plans, including:

- Preferred Provider Organization (PPO): PPO plans offer a network of preferred providers, such as doctors and hospitals, that offer discounted rates for services.

- Health Maintenance Organization (HMO): HMO plans require members to choose a primary care physician (PCP) who coordinates all medical care. HMOs typically have lower premiums than PPOs but may have more restrictions on coverage.

- Point-of-Service (POS): POS plans combine features of PPOs and HMOs, allowing members to choose providers both within and outside of the network.

- High-Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles. They may be paired with a Health Savings Account (HSA) to save for medical expenses.

Coverage and Benefits

The specific coverage and benefits included in each plan vary depending on the plan type and level of coverage selected.

However, all Scott & White health insurance plans include:

- Preventive care, such as annual physicals and screenings

- Doctor visits

- Hospital stays

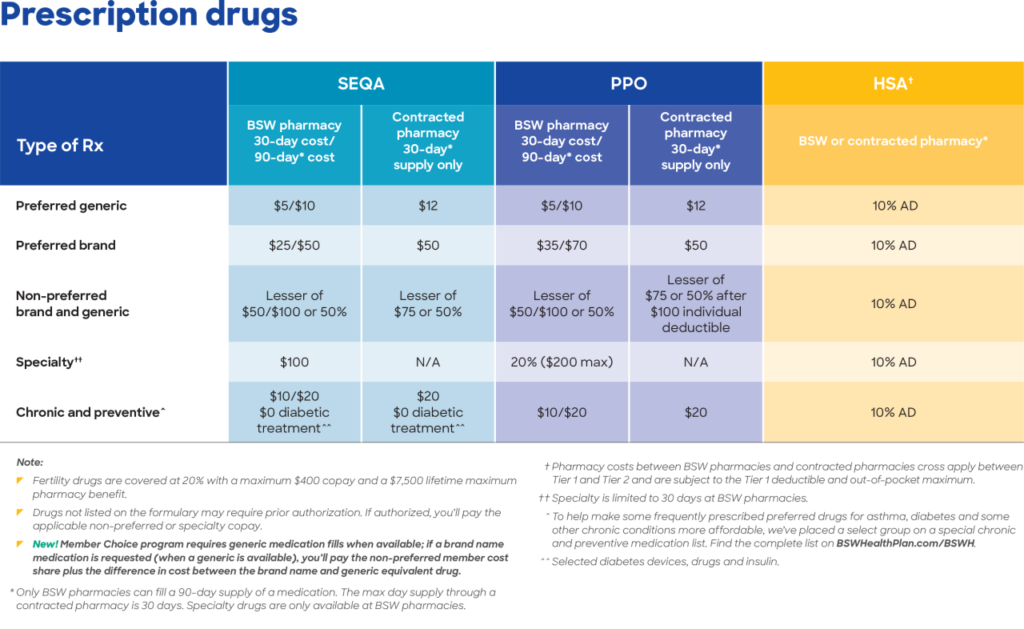

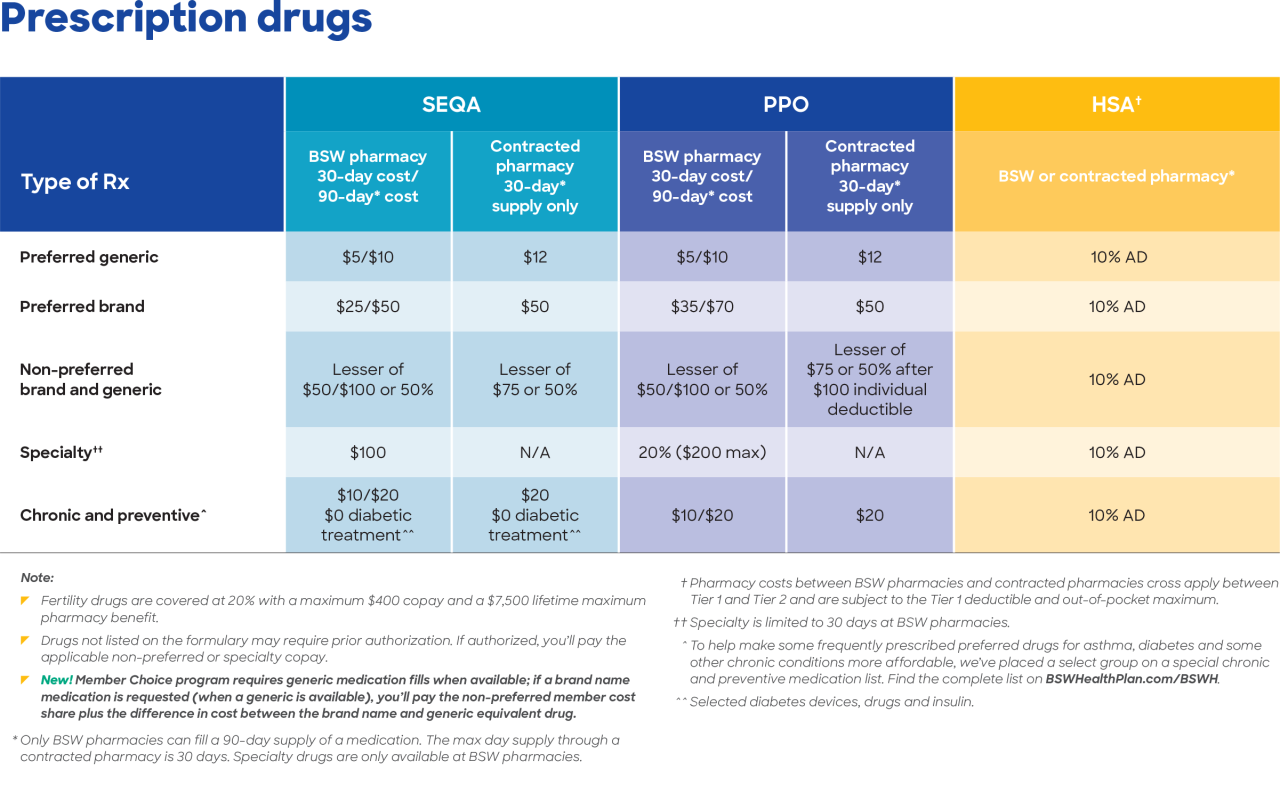

- Prescription drugs

- Emergency care

Some plans may also include additional benefits, such as dental and vision coverage, mental health services, and chiropractic care.

Limitations and Exclusions

All health insurance plans have certain limitations and exclusions, which may vary depending on the plan type and level of coverage.

Common limitations and exclusions include:

- Deductibles: The amount you must pay out-of-pocket before your insurance coverage begins.

- Copayments: A fixed amount you pay for certain medical services, such as doctor visits or prescription drugs.

- Coinsurance: The percentage of medical expenses you are responsible for paying after meeting your deductible.

- Out-of-network coverage: Coverage for medical services received from providers outside of your plan’s network may be limited or not covered at all.

It is important to carefully review the plan details to understand the specific limitations and exclusions that apply to your coverage.

Costs and Premiums

Scott & White offers a range of health insurance plans to meet different needs and budgets. Monthly premiums vary depending on factors such as age, location, and coverage level.

Estimated Costs

As an example, for a 40-year-old non-smoker living in Austin, Texas, the estimated monthly premiums for different plans are:

- Bronze Plan: $350

- Silver Plan: $450

- Gold Plan: $550

- Platinum Plan: $650

These estimates are subject to change based on individual circumstances and plan options selected.

Network and Providers

Scott & White health insurance offers an extensive network of healthcare providers to meet your medical needs. By using in-network providers, you can enjoy several benefits, including:

- Lower out-of-pocket costs

- Guaranteed coverage for essential health services

- Access to a wide range of specialists and facilities

Top Hospitals and Providers

Scott & White’s network includes top-rated hospitals and providers in the region. Here are a few examples:

- Baylor Scott & White Medical Center – Temple

- Baylor Scott & White Medical Center – College Station

- Baylor Scott & White Medical Center – Round Rock

- Dr. John Smith, Family Medicine

- Dr. Jane Doe, Pediatrics

Customer Service and Support

Scott & White health insurance is dedicated to providing its members with exceptional customer service. Members can access support through a variety of channels, ensuring their needs are met promptly and efficiently.

Online Support

Members can access a comprehensive online portal where they can manage their accounts, view their coverage details, and submit inquiries. The portal is user-friendly and offers 24/7 access to account information.

Phone Support

Members can also contact the customer service team by phone during business hours. Representatives are knowledgeable and can assist with a wide range of questions, including policy details, claims processing, and provider referrals.

In-Person Support

For those who prefer in-person support, Scott & White offers appointments at its member service centers. Members can schedule an appointment to discuss their coverage, ask questions, or resolve any issues they may have.

Testimonials

“The customer service team at Scott & White is incredibly helpful. They answered all my questions and went above and beyond to make sure I understood my coverage.” – Sarah J.

“I had a claim recently and the claims department was so easy to work with. They processed my claim quickly and I received my reimbursement within a week.” – John S.

Online Resources and Tools

Scott & White health insurance provides a suite of online resources and tools to help members manage their health insurance and access information conveniently.

These resources include an online member portal, a provider search tool, and a variety of other helpful resources. The online member portal allows members to view their coverage, pay their premiums, and access their claims history. The provider search tool helps members find providers in their area who accept their insurance. Other helpful resources include a library of health information, a prescription drug discount program, and a wellness program.

Online Member Portal

- View your coverage details

- Pay your premiums

- Access your claims history

- Update your personal information

- Request a new ID card

Provider Search Tool

- Find providers in your area who accept your insurance

- Search by specialty, location, or name

- View provider profiles and ratings

- Schedule appointments online

Other Helpful Resources

- Library of health information

- Prescription drug discount program

- Wellness program

- Customer service support

These online resources and tools can help members manage their health insurance and access information more easily and conveniently.

Health and Wellness Programs

Scott & White health insurance recognizes the importance of preventive care and offers a range of health and wellness programs to help members improve their overall health and well-being. These programs are designed to support members in adopting healthy habits, managing chronic conditions, and achieving their health goals.

Fitness Challenges

Scott & White’s fitness challenges encourage members to engage in regular physical activity. These challenges provide motivation and support through online platforms, tracking tools, and rewards for participation. Members can choose from various challenges, such as step-counting competitions, group workouts, and virtual races. By participating in these challenges, members can stay active, improve their fitness levels, and earn rewards for their efforts.

Nutrition Counseling

Scott & White offers personalized nutrition counseling services to help members make healthier food choices and improve their overall nutrition. Registered dietitians provide individualized guidance on meal planning, healthy eating habits, and managing specific dietary needs. Members can receive tailored nutrition plans, cooking demonstrations, and ongoing support to help them achieve their nutrition goals and improve their overall health.

Smoking Cessation Support

Scott & White understands the challenges of quitting smoking and provides comprehensive smoking cessation support programs. These programs offer a range of resources, including nicotine replacement therapy, counseling, and support groups. Members have access to trained professionals who provide guidance, motivation, and support throughout their journey to becoming smoke-free. By utilizing these programs, members can increase their chances of successfully quitting smoking and improving their overall health.

Employer-Sponsored Plans

Scott & White offers a range of health insurance plans tailored to meet the diverse needs of employers and their employees. By providing employer-sponsored health insurance, businesses can attract and retain valuable talent, improve employee well-being, and enhance productivity.

Plan Options for Employers

Scott & White offers a variety of plan options for employers, including:

- Preferred Provider Organization (PPO) plans provide flexibility and access to a wide network of healthcare providers.

- Health Maintenance Organization (HMO) plans offer lower premiums and out-of-pocket costs, but may have more limited provider networks.

- Point-of-Service (POS) plans combine features of both PPO and HMO plans, allowing members to access both in-network and out-of-network providers.

- High-Deductible Health Plans (HDHPs) paired with a Health Savings Account (HSA) can provide tax advantages and lower premiums.

Community Involvement

Scott & White Health Insurance actively engages in the communities it serves, fostering strong relationships and making a positive impact. Through various initiatives and partnerships, the company supports local organizations and initiatives, promoting health, wellness, and community well-being.

Community Outreach Programs

Scott & White Health Insurance collaborates with numerous community organizations to address critical needs and improve the health of residents. For example, the company partners with local food banks to provide nutritious meals to families in need, and supports health fairs and screenings to promote preventive care and early detection.