Coverage Overview

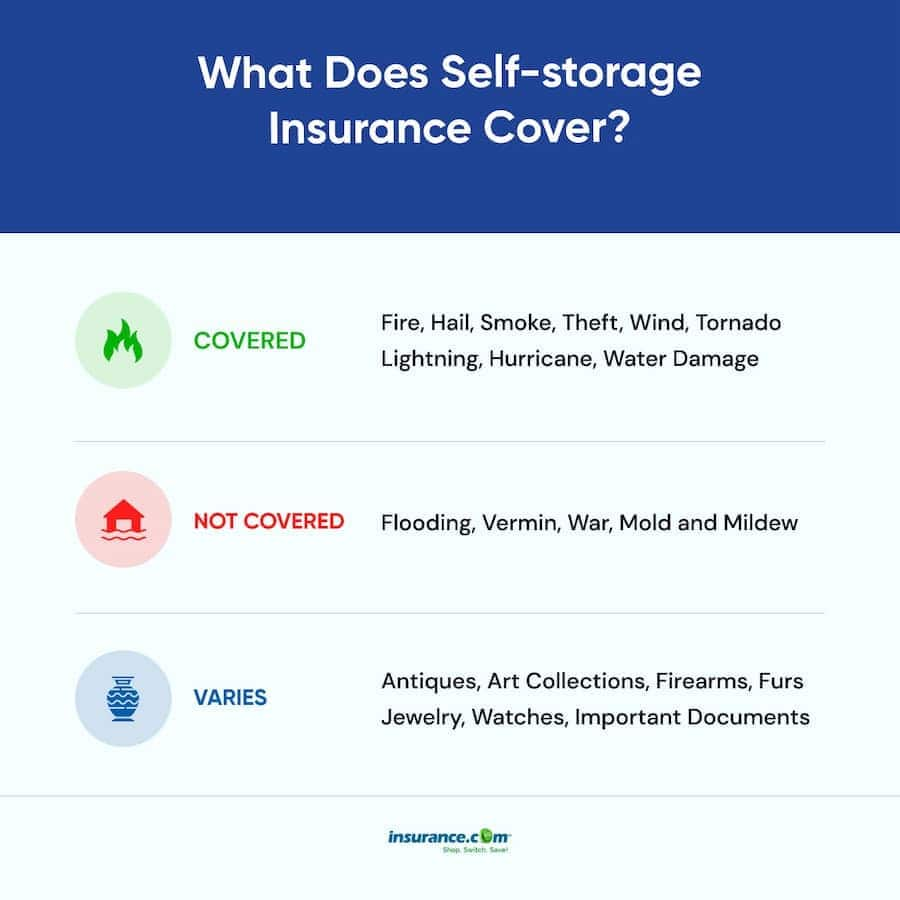

Renters insurance extends coverage to your belongings stored in a storage unit, providing peace of mind in case of unforeseen events. It typically covers perils like fire, theft, vandalism, and certain natural disasters.

- Covered Items: Renters insurance for storage units covers personal belongings such as furniture, electronics, clothing, and sentimental items.

- Value Limits: Most policies set value limits for different categories of items, ensuring that high-value items are adequately protected.

Exclusions and Limitations

Renters insurance policies for storage units typically exclude coverage for certain items or situations. It’s crucial to be aware of these exclusions and limitations to ensure adequate protection for your belongings.

Common Exclusions

- Cash and Precious Metals: Money, coins, gold, silver, and other precious metals are generally not covered.

- Collectibles and Artwork: Rare or valuable items, such as stamps, coins, artwork, and antiques, may have limited coverage or require additional riders.

- Perishables: Food, plants, and other perishable items are typically not covered.

- Illegal or Hazardous Materials: Items that are illegal to possess or hazardous, such as explosives, chemicals, or fireworks, are excluded.

- Vehicles and Boats: Cars, motorcycles, boats, and other motorized vehicles are not covered by renters insurance.

Limited Coverage

In some cases, coverage may be limited for certain items or situations. For example:

- High-Value Items: Expensive items, such as jewelry, electronics, or musical instruments, may have a maximum coverage amount or require additional coverage.

- Storage Unit Damage: The policy may not cover damage to the storage unit itself or its contents caused by events like flooding or theft.

- Wear and Tear: Gradual deterioration or damage to items due to normal use or aging is typically not covered.

Importance of Reviewing the Policy

It’s essential to carefully review your renters insurance policy to understand the specific exclusions and limitations that apply. This will help you determine if you need additional coverage or riders to protect your belongings adequately. If you have any questions or concerns, don’t hesitate to contact your insurance provider for clarification.

Value and Replacement Costs

Renters insurance determines the value of damaged or lost items in storage units based on two main methods: actual cash value (ACV) and replacement cost value (RCV).

Actual Cash Value (ACV)

ACV is the current market value of an item, taking into account its age, condition, and depreciation. This means that you will receive the depreciated value of your item, not the cost of replacing it with a new one.

Replacement Cost Value (RCV)

RCV is the cost of replacing an item with a new one of similar quality and function. This means that you will receive the full cost of replacing your item, regardless of its age or condition.

The difference between ACV and RCV can be significant, especially for items that have depreciated significantly over time. For example, if you have a 10-year-old laptop that you paid $1,000 for, the ACV may be only $200, while the RCV would be $1,000.

It is important to consider the type of coverage you need when choosing renters insurance. If you have valuable items in storage, you may want to opt for RCV coverage to ensure that you are fully compensated for any losses.

Deductibles and Premiums

When it comes to renters insurance for storage units, understanding deductibles and premiums is crucial. Deductibles refer to the fixed amount you pay out-of-pocket before your insurance coverage kicks in. The higher your deductible, the lower your insurance premium (the cost you pay for coverage). However, choosing a higher deductible means you’ll have to pay more upfront in the event of a claim.

Factors Affecting Premiums

- Size of the storage unit: Larger units typically cost more to insure.

- Location of the storage unit: Units in areas with higher crime rates may have higher premiums.

- Value of the belongings stored: The more valuable your belongings, the higher your premium will be.

- Coverage options: Additional coverage, such as replacement cost coverage, can increase your premium.

- Your insurance history: A history of claims can lead to higher premiums.

Filing a Claim

Experiencing a loss or damage to your belongings in a storage unit can be stressful. Filing a renters insurance claim promptly and accurately is crucial to ensure a smooth and successful reimbursement process.

Here’s a step-by-step guide to filing a claim for renters insurance coverage on a storage unit:

Contact Your Insurance Company

Notify your insurance company as soon as possible after discovering the loss or damage. You can usually do this by phone, email, or through their online portal.

Gather Documentation

Provide detailed documentation to support your claim, including:

- Proof of loss or damage, such as photos or a police report

- A list of damaged or lost items, including their estimated value

- Proof of ownership, such as receipts or appraisals

- Copy of your renters insurance policy

Submit Your Claim

Submit your claim to your insurance company along with the required documentation. They will review your claim and may ask for additional information.

Cooperate with the Claims Adjuster

An insurance adjuster will be assigned to your case. Cooperate fully with their investigation and provide any necessary information or documentation.

Review the Settlement Offer

Once the adjuster has completed their investigation, they will provide you with a settlement offer. Review the offer carefully and negotiate if necessary.

Importance of Timely Filing and Accurate Information

Filing your claim promptly and providing accurate information is essential for a successful outcome. Late filing may result in a denial of coverage or a reduced payout. Misrepresenting or omitting information can also jeopardize your claim.