Reddit Community Analysis

Reddit communities serve as vibrant platforms for car insurance discussions, providing valuable information to users. These communities foster engagement and knowledge sharing among individuals seeking insights and advice related to car insurance.

User Demographics and Engagement

Reddit communities dedicated to car insurance attract a diverse user base, including drivers of all ages, experience levels, and insurance needs. Engagement levels within these communities are typically high, with users actively participating in discussions, sharing experiences, and seeking recommendations.

Most Active and Influential Communities

Several Reddit communities have emerged as prominent hubs for car insurance discussions. These include:

- r/Insurance: A general insurance subreddit with a dedicated section for car insurance, covering a wide range of topics.

- r/CarInsurance: A subreddit specifically focused on car insurance, offering in-depth discussions and advice on various aspects of coverage.

- r/PersonalFinance: A subreddit covering personal finance topics, including car insurance, with a focus on budgeting and cost-saving strategies.

Sentiment Analysis

Reddit users generally express a range of sentiments towards cheap car insurance options. While some users appreciate the affordability of these policies, others raise concerns about coverage limitations and potential hidden costs.

Common themes emerging from user discussions include:

Affordability

- Users often seek out cheap car insurance options to save money, especially those on a tight budget or with limited driving experience.

- However, users should be aware that cheaper policies may have higher deductibles or limited coverage, which could lead to higher out-of-pocket expenses in the event of an accident.

Coverage

- Users emphasize the importance of understanding the coverage details of cheap car insurance policies to ensure they meet their specific needs.

- Some users express concerns about potential gaps in coverage, such as limited liability coverage or lack of comprehensive and collision coverage, which could leave them financially vulnerable in certain situations.

Factors Influencing User Satisfaction

- Users report higher satisfaction with their current car insurance providers when they have experienced prompt and helpful customer service, easy claims processing, and competitive rates.

- Negative experiences, such as delayed claims settlements, poor communication, or unexpected premium increases, can significantly impact user satisfaction.

Comparative Analysis

Among the car insurance providers discussed on Reddit, several key players emerge with distinct user feedback patterns. This comparative analysis delves into the strengths and weaknesses of these providers based on user experiences.

Positive Feedback

Providers receiving consistently positive feedback include:

- Geico: Praised for its competitive rates, easy-to-use online platform, and responsive customer service.

- State Farm: Valued for its extensive coverage options, financial stability, and personalized service.

- Progressive: Recognized for its innovative features, such as usage-based insurance and accident forgiveness, and its wide range of discounts.

Negative Feedback

Providers facing criticism on Reddit include:

- Allstate: Users express concerns about higher premiums compared to competitors and inconsistent customer support.

- Nationwide: Some users report difficulties with claims processing and lack of transparency in policy terms.

- Farmers: While offering competitive rates, Farmers receives mixed reviews regarding customer service and claims handling.

Affordability Considerations

Redditors have shared valuable strategies and tips for finding the cheapest car insurance options. Understanding the factors that influence insurance premiums and utilizing discounts and promotions can significantly reduce costs.

Minimizing Costs

- Maintain a good driving record: Accidents and traffic violations increase premiums.

- Consider a higher deductible: Opting for a higher deductible lowers premiums but requires paying more out-of-pocket for claims.

- Bundle policies: Combining home and auto insurance with the same provider often offers discounts.

- Use a telematics device: Installing a device that monitors driving habits can earn discounts for safe driving.

Discounts and Promotions

Insurance providers offer various discounts and promotions to reduce premiums:

- Good student discount: Students with good grades may qualify for discounts.

- Loyalty discounts: Staying with the same provider for multiple years often earns discounts.

- Multi-car discounts: Insuring multiple vehicles with the same provider can lead to discounts.

- Referral bonuses: Referring new customers can earn rewards or discounts.

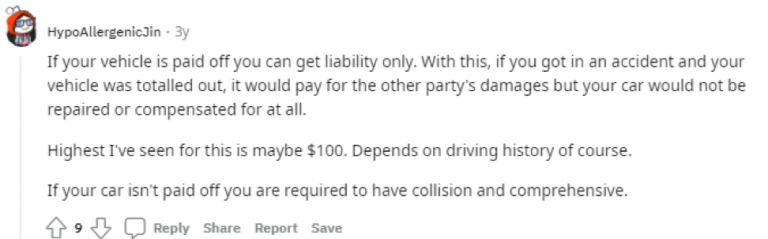

Coverage Comparison

Understanding the various coverage options available for car insurance is crucial for making informed decisions about your policy. Reddit discussions highlight the importance of tailoring coverage to meet individual needs and budgets.

Car insurance policies typically offer a range of coverage options, including:

- Liability coverage: Covers damages caused to others in an accident you are at fault for, including bodily injury and property damage.

- Collision coverage: Covers damages to your own vehicle in the event of an accident, regardless of fault.

- Comprehensive coverage: Covers damages to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you are involved in an accident with a driver who is uninsured or underinsured.

Coverage Limits and Exclusions

When choosing coverage options, it is essential to understand coverage limits and exclusions. Coverage limits refer to the maximum amount your insurance policy will pay for covered damages. Exclusions are specific events or situations that are not covered by your policy.

For example, if you have a liability coverage limit of $100,000 per accident, your insurance will cover up to $100,000 in damages caused to others in an accident you are at fault for. It is important to choose coverage limits that provide adequate protection without breaking your budget.

Tailoring Your Coverage

Tailoring your car insurance coverage to your specific needs involves considering factors such as the value of your vehicle, your driving habits, and your financial situation. By understanding the different coverage options and their implications, you can make informed decisions about which coverages to include and at what limits.

For instance, if you have an older vehicle with a low value, you may consider opting for liability-only coverage to save money on premiums. Conversely, if you have a newer or more expensive vehicle, comprehensive coverage may be a wise investment to protect your financial interests.

User Experience Analysis

Reddit users’ experiences with car insurance providers vary greatly. Some users praise certain providers for their user-friendly online portals, efficient claims processes, and responsive customer support, while others express frustration with different aspects of their experience.

The ease of use of online portals is a key factor in user satisfaction. Users appreciate portals that are well-organized, intuitive to navigate, and provide easy access to account information, policy details, and claims submission.

Claims Processes

The claims process can be a stressful experience, so users value providers that make it as smooth and painless as possible. Efficient claims handling, quick response times, and clear communication throughout the process are highly appreciated.

Customer Support

Responsive and helpful customer support is crucial for a positive user experience. Users want to be able to easily contact their provider, whether through phone, email, or live chat, and receive prompt and knowledgeable assistance with their queries or concerns.

Based on feedback from Reddit users, some areas where providers can improve their user experience include:

- Simplifying online portals to make them more user-friendly and accessible.

- Streamlining the claims process to reduce wait times and improve communication.

- Expanding customer support channels and improving response times.

- Providing more personalized and tailored experiences based on individual user needs.

Trustworthiness and Reputation

The trustworthiness and reputation of car insurance providers play a pivotal role in shaping user trust and loyalty. Reddit users often share their experiences and opinions on various insurance companies, providing valuable insights into their reliability, customer service, and overall standing in the industry.

Several factors contribute to user trust in car insurance providers. These include:

- Financial Stability: Users tend to trust providers with strong financial stability, ensuring their ability to meet claims and provide ongoing coverage.

- Customer Service: Responsive and helpful customer service is crucial in building trust. Users appreciate providers who handle inquiries promptly and resolve issues effectively.

- Industry Reputation: Companies with a positive reputation in the industry, as reflected in ratings and reviews, inspire greater trust among users.

However, users have also raised concerns regarding the trustworthiness of specific providers. These include:

- Unfair Claim Practices: Users have reported instances of providers denying or delaying claims without valid reasons, leading to distrust and frustration.

- Hidden Fees and Deductibles: Some providers have been criticized for undisclosed fees and high deductibles, which can increase the cost of coverage and erode user trust.

- Negative Customer Experiences: Poor customer service, long wait times, and unresolved issues have led users to question the trustworthiness of certain providers.

By carefully considering the trustworthiness and reputation of car insurance providers, Reddit users can make informed decisions about which company to choose, ensuring they receive reliable coverage and peace of mind.