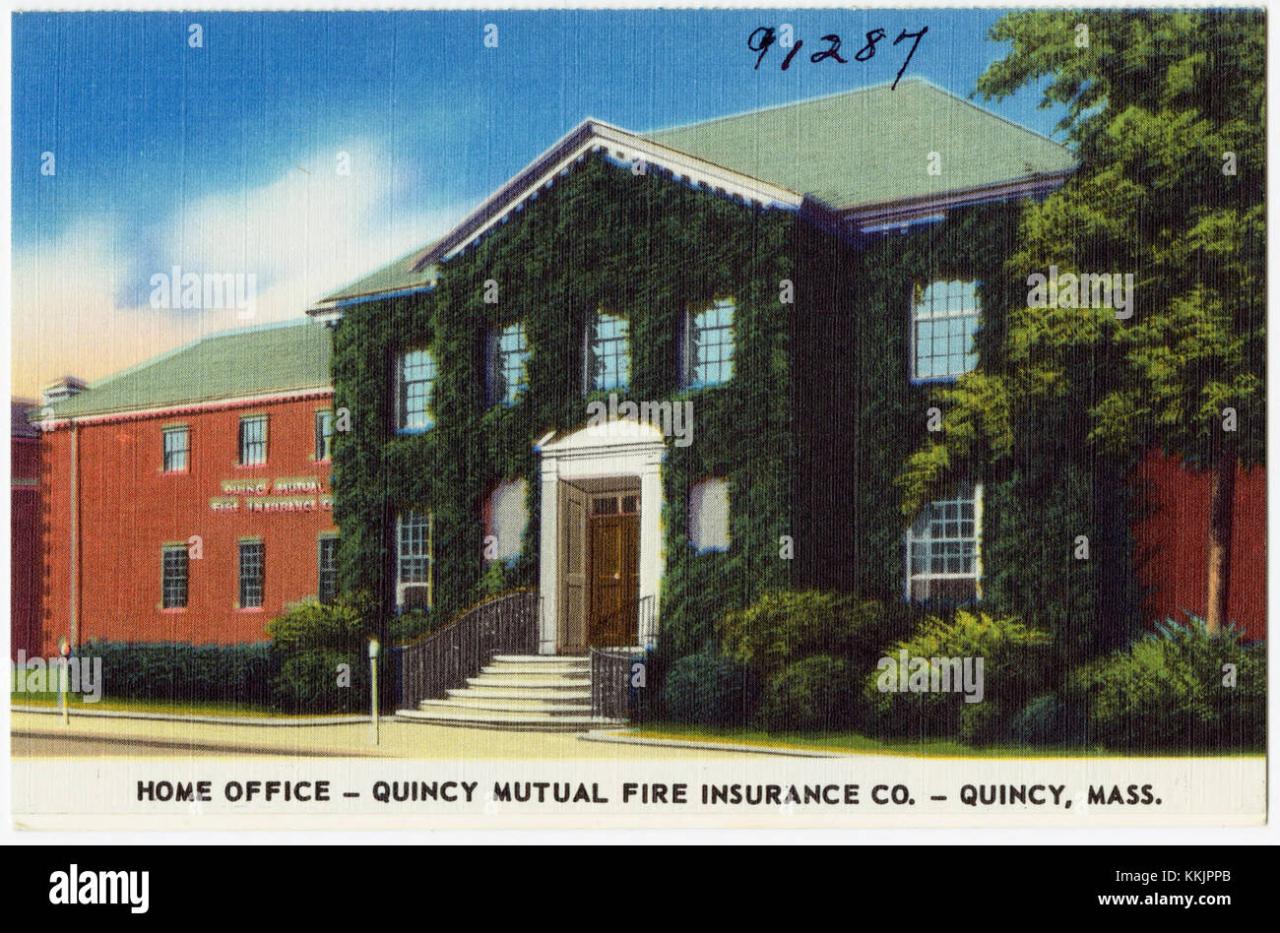

Company Overview

Quincy Mutual Fire Insurance Company, established in 1851, is a leading provider of property and casualty insurance in the United States. Headquartered in Quincy, Massachusetts, the company offers a wide range of insurance products and services to individuals, families, and businesses. Quincy Mutual is renowned for its financial strength, customer service, and commitment to its policyholders.

Mission, Vision, and Values

Quincy Mutual’s mission is to provide peace of mind and financial protection to its customers by offering reliable and affordable insurance solutions. The company’s vision is to be the most trusted and respected insurance provider in the industry. Quincy Mutual’s core values include integrity, customer focus, innovation, and financial responsibility.

Financial Performance and Market Share

Quincy Mutual has a strong financial track record, with consistent profitability and a high level of policyholder surplus. The company has a significant market share in the property and casualty insurance market, particularly in the Northeast region of the United States. Quincy Mutual’s financial strength and market position enable it to provide competitive rates and comprehensive coverage to its policyholders.

Products and Services

Quincy Mutual Fire Insurance Company offers a wide range of insurance products designed to protect individuals, families, and businesses from financial losses due to unforeseen events.

The company’s comprehensive portfolio includes:

Homeowners Insurance

- Provides coverage for the structure of your home, personal belongings, and liability.

- Protects against damage caused by fire, theft, vandalism, and other covered perils.

- Offers optional coverages for additional protection, such as flood insurance and earthquake insurance.

Auto Insurance

- Protects your vehicle and provides liability coverage in case of an accident.

- Offers a range of coverage options, including collision, comprehensive, and uninsured/underinsured motorist coverage.

- Provides discounts for safe driving habits and multiple vehicles.

Business Insurance

- Protects businesses from financial losses due to property damage, liability, and business interruption.

- Offers customized coverage plans tailored to the specific needs of each business.

- Provides risk management services to help businesses identify and mitigate potential hazards.

Underwriting Process and Risk Management Practices

Quincy Mutual Fire Insurance Company follows a rigorous underwriting process to assess the risk associated with each applicant.

- The company evaluates factors such as claims history, creditworthiness, and property condition.

- Risk management practices include loss prevention programs, safety inspections, and risk-based pricing.

- The company works closely with policyholders to identify and manage potential risks, helping to reduce the likelihood and severity of losses.

Customer Service

Quincy Mutual Fire Insurance Company prides itself on providing exceptional customer service to its policyholders.

The company offers multiple channels for customers to connect with its support team, including phone, email, live chat, and social media. Quincy Mutual’s customer service representatives are knowledgeable, friendly, and dedicated to resolving customer inquiries promptly and efficiently.

Claims Handling Process

Quincy Mutual understands that filing a claim can be a stressful experience, which is why the company has streamlined its claims handling process to make it as smooth and hassle-free as possible.

- Policyholders can file claims online, over the phone, or through their insurance agent.

- Claims are typically processed within 24 hours, and policyholders are kept informed of the progress of their claim throughout the process.

- Quincy Mutual’s claims adjusters are experienced and professional, and they work closely with policyholders to ensure that their claims are settled fairly and promptly.

Customer Satisfaction

Quincy Mutual’s commitment to customer satisfaction is reflected in its high customer satisfaction ratings. The company consistently receives positive feedback from policyholders, who appreciate its responsive customer service, easy-to-use claims process, and competitive rates.

Financial Stability

Quincy Mutual Fire Insurance Company has maintained a strong financial position throughout its history, earning high credit ratings from leading agencies such as A.M. Best, Moody’s, and Standard & Poor’s. This reflects the company’s sound underwriting practices, conservative investment strategy, and robust risk management framework.

Investment Strategy

Quincy Mutual employs a diversified investment portfolio that balances risk and return. The company primarily invests in high-quality bonds, stocks, and real estate, ensuring the safety and liquidity of its assets. Its investment strategy aims to generate stable returns while preserving capital and meeting the long-term financial obligations of the company.

Risk Management Practices

Quincy Mutual has implemented a comprehensive risk management system to mitigate potential financial losses. This system includes rigorous underwriting standards, reinsurance agreements, and a robust catastrophe modeling program. By proactively identifying and managing risks, the company ensures its ability to meet its financial commitments even in challenging economic conditions.

Ability to Meet Financial Obligations

Quincy Mutual’s financial stability enables it to meet its financial obligations to policyholders, employees, and other stakeholders. The company has a strong track record of claims payments and has consistently exceeded industry averages in terms of claims satisfaction. Its financial strength ensures that policyholders can rely on Quincy Mutual to fulfill its promises in the event of a loss.

Industry Trends

The insurance industry is constantly evolving, driven by technological advancements, changing customer expectations, and regulatory shifts. Quincy Mutual Fire Insurance Company closely monitors these trends to adapt its strategies and offerings accordingly.

One key trend is the rise of digital technologies. Customers increasingly expect seamless online experiences, from policy management to claims processing. Quincy Mutual has invested heavily in digital platforms to meet this demand, offering online policy quotes, account management, and mobile claims reporting.

Customer Behavior

Customer behavior is also shifting, with a growing focus on personalized experiences. Quincy Mutual recognizes this trend and tailors its products and services to meet the specific needs of each customer. The company offers a range of coverage options and flexible payment plans to accommodate diverse customer preferences.

Regulatory Changes

The regulatory landscape for the insurance industry is constantly evolving. Quincy Mutual proactively engages with regulators to stay abreast of changes and ensure compliance. The company’s strong track record of regulatory compliance has earned it a reputation for reliability and trustworthiness.

By staying ahead of industry trends and challenges, Quincy Mutual Fire Insurance Company is well-positioned for future growth. The company’s commitment to innovation, customer-centricity, and regulatory compliance will continue to drive its success in the years to come.

Competitive Landscape

Quincy Mutual Fire Insurance Company faces competition from various established and emerging players in the insurance industry. Its primary competitors include:

– Nationwide Mutual Insurance Company

– State Farm Mutual Automobile Insurance Company

– Liberty Mutual Insurance Company

– Travelers Insurance Company

– Allstate Insurance Company

Products and Services

Quincy Mutual Fire Insurance Company offers a range of insurance products and services similar to its competitors, including:

– Homeowners insurance

– Auto insurance

– Business insurance

– Commercial insurance

– Specialty insurance

The company’s products are designed to meet the diverse needs of its customers, from individuals and families to businesses of all sizes. Quincy Mutual Fire Insurance Company also provides a variety of value-added services, such as risk management consulting, claims assistance, and educational resources.

Pricing

Quincy Mutual Fire Insurance Company’s pricing is generally competitive with its peers. The company uses a variety of factors to determine its rates, including the type of coverage, the risk profile of the customer, and the location of the property. Quincy Mutual Fire Insurance Company offers discounts for certain safety features, such as smoke detectors and security systems.

Competitive Advantages

Quincy Mutual Fire Insurance Company has several competitive advantages over its competitors, including:

– Strong financial stability: The company has a long history of financial strength and stability, with consistently high ratings from independent rating agencies.

– Local presence: Quincy Mutual Fire Insurance Company has a strong local presence, with offices and agents throughout its service area. This allows the company to provide personalized service to its customers.

– Customer-centric approach: Quincy Mutual Fire Insurance Company is committed to providing excellent customer service. The company has a team of experienced and knowledgeable agents who are dedicated to helping customers find the right coverage at the right price.

Competitive Disadvantages

Quincy Mutual Fire Insurance Company also faces some competitive disadvantages, including:

– Limited geographic reach: The company’s service area is primarily limited to New England. This limits its ability to compete with national and international insurance companies.

– Limited product offerings: Quincy Mutual Fire Insurance Company’s product offerings are somewhat limited compared to some of its larger competitors. This may make it difficult to meet the needs of all customers.

Overall, Quincy Mutual Fire Insurance Company is a strong and competitive player in the insurance industry. The company’s strong financial stability, local presence, and customer-centric approach give it a competitive advantage over its peers. However, the company’s limited geographic reach and product offerings may limit its ability to compete with larger national and international insurance companies.

Marketing and Sales

Quincy Mutual Fire Insurance Company leverages a comprehensive marketing and sales strategy to reach its target audience and promote its products and services. The company employs a multifaceted approach that encompasses traditional and digital channels, targeted advertising campaigns, and a strong focus on customer relationships.

Quincy Mutual’s target market comprises homeowners, businesses, and non-profit organizations seeking comprehensive and reliable insurance coverage. The company’s value proposition centers around providing tailored insurance solutions, personalized service, and competitive pricing.

Marketing Campaigns

Quincy Mutual’s marketing campaigns are designed to increase brand awareness, generate leads, and drive sales. The company utilizes a combination of channels, including print advertising, digital marketing, social media, and content marketing. Quincy Mutual’s campaigns often highlight the company’s commitment to customer satisfaction, its long-standing history, and its local presence.

Sales Channels

Quincy Mutual’s sales channels encompass both direct and indirect distribution methods. The company offers its products and services through a network of independent agents, as well as through its own direct sales force. This approach allows Quincy Mutual to reach a wide range of customers and meet their diverse needs.

Corporate Social Responsibility

Quincy Mutual Fire Insurance Company is committed to making a positive impact on the communities it serves. The company’s corporate social responsibility (CSR) initiatives focus on environmental sustainability, social responsibility, and ethical governance.

Quincy Mutual’s environmental initiatives include reducing its carbon footprint, promoting renewable energy, and conserving natural resources. The company has set a goal of becoming carbon neutral by 2030 and has already made significant progress towards this goal.

Social Responsibility

Quincy Mutual’s social responsibility initiatives focus on supporting education, community development, and disaster relief. The company provides financial support to local schools and non-profit organizations, and its employees volunteer their time to a variety of community service projects.

Governance

Quincy Mutual is committed to ethical and transparent governance. The company has a strong code of ethics that guides the conduct of its employees, and it regularly reviews its policies and procedures to ensure that they are in line with best practices.