Proof of Renters Insurance

Renters insurance is a crucial aspect of protecting your belongings and financial stability as a renter. It is a form of insurance that covers your personal property, liability, and additional living expenses in the event of a covered loss. Having renters insurance ensures that you have financial protection against unexpected events like theft, fire, or natural disasters.

Significance of Renters Insurance

Renters insurance is essential for several reasons. First, it provides coverage for your personal belongings, such as furniture, electronics, clothing, and appliances. In the event of a covered loss, your insurance will reimburse you for the value of your damaged or stolen items. Secondly, renters insurance protects you against liability claims. If someone is injured or their property is damaged while visiting your rental unit, your insurance will cover the legal and medical expenses. Finally, renters insurance can cover additional living expenses if your rental unit becomes uninhabitable due to a covered loss. This coverage includes expenses such as hotel stays, meals, and transportation.

Examples of Situations Requiring Proof of Renters Insurance

Many landlords require proof of renters insurance as a condition of the lease agreement. This is to protect the landlord’s property in case of a covered loss. Additionally, proof of renters insurance may be required when applying for a new rental unit. Landlords often view tenants with renters insurance as more responsible and desirable. Furthermore, some utility companies may require proof of renters insurance before connecting services to a new rental unit.

Obtaining Proof of Renters Insurance

Securing proof of renters insurance is a straightforward process. Here’s a step-by-step guide to assist you:

Contacting the Insurance Company

To initiate the process, reach out to your insurance provider. You can contact them via phone, email, or visit their office in person. Inform the agent that you require proof of insurance for your rental property.

Requesting a Certificate of Insurance

Once you’ve connected with the insurance company, request a certificate of insurance. This document serves as official proof of your renters insurance coverage.

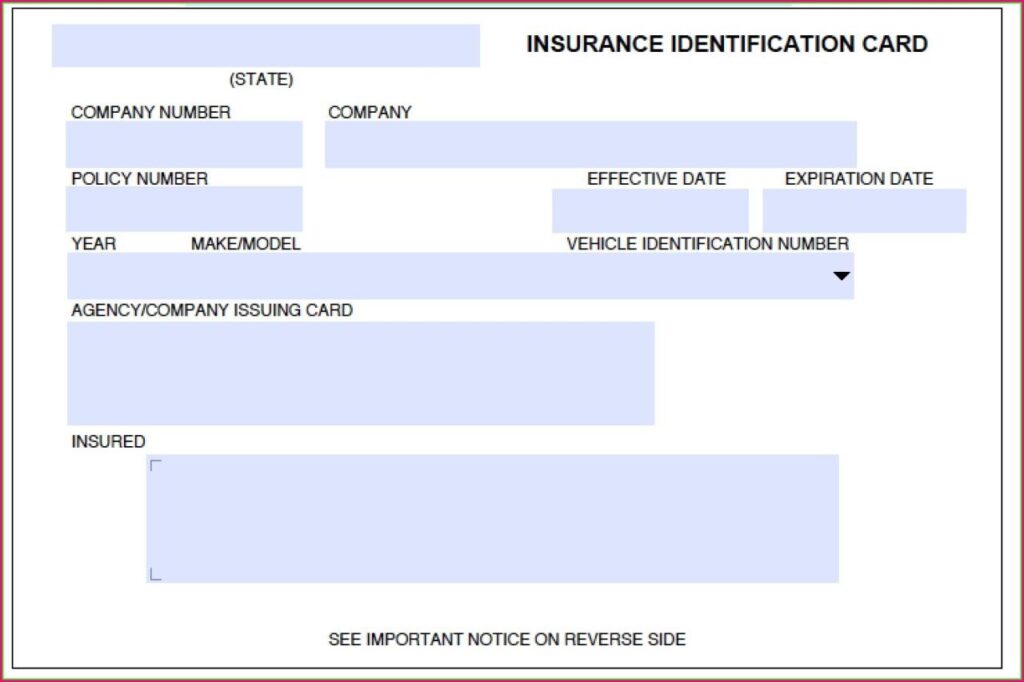

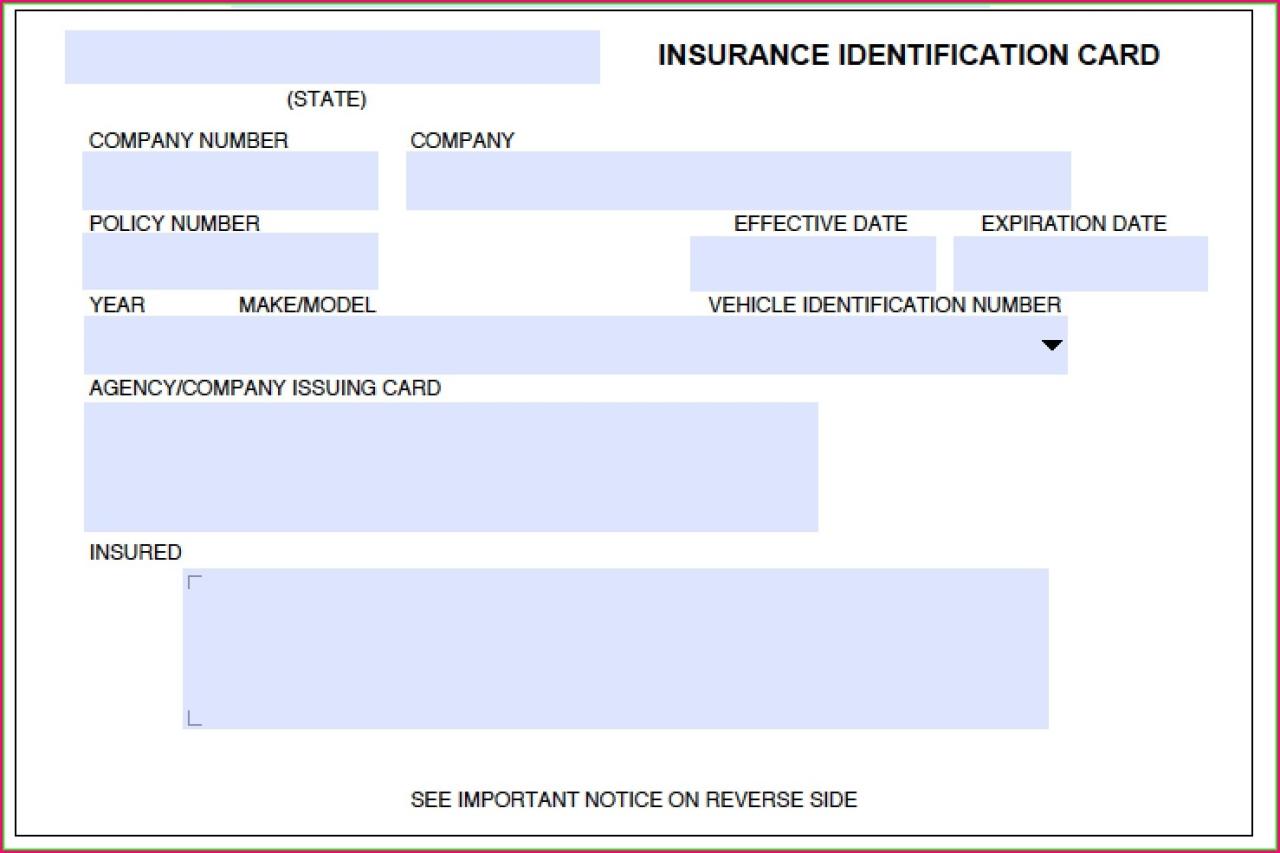

Sample Certificate of Insurance Template

A certificate of insurance typically includes the following information:

- Insurance company name and contact information

- Policyholder’s name and address

- Property address

- Policy number and coverage details

- Effective and expiration dates of coverage

Methods of Providing Proof of Renters Insurance

Providing proof of renters insurance to your landlord is a crucial step in securing your rental property. Several methods can be utilized to fulfill this requirement:

Submitting a Physical Copy of the Certificate of Insurance

This traditional method involves obtaining a physical copy of the certificate of insurance from your insurance provider. Ensure the certificate clearly displays your name, policy number, coverage details, and the effective dates of the policy. Deliver the original copy to your landlord for their records.

Sharing a Digital Copy of the Certificate of Insurance via Email or a Secure Online Portal

In the digital age, many insurance companies offer the option to download or share a digital copy of the certificate of insurance. You can email this document directly to your landlord or upload it to a secure online portal provided by your landlord or property management company.

Creating an Online Renters Insurance Account and Providing the Landlord with Access

Some insurance companies provide an online account management system where you can access your policy details and generate proof of insurance. You can invite your landlord to access your account and view the certificate of insurance, policy information, and payment history. This method offers real-time access to up-to-date insurance information.

Understanding the Coverage of Renters Insurance

Renters insurance protects your personal belongings and provides liability coverage in the event of an accident. It typically includes coverage for:

- Personal property: This covers your belongings, such as furniture, clothing, electronics, and appliances, in the event of theft, fire, or other covered events.

- Liability: This covers you if someone is injured or their property is damaged while on your rented property.

- Additional living expenses: This covers the cost of temporary housing if your rented property becomes uninhabitable due to a covered event.

It’s important to understand the policy’s coverage limits and exclusions. Coverage limits specify the maximum amount the insurance company will pay for each type of loss. Exclusions are events or items that are not covered by the policy.

Covered Events

Renters insurance typically covers a wide range of events, including:

- Theft

- Fire

- Water damage

- Vandalism

- Wind damage

- Hail damage

- Lightning damage

Importance of Understanding Coverage

Understanding the coverage of your renters insurance policy is essential because it ensures that you have adequate protection in the event of a covered loss. It also helps you avoid surprises or disputes with the insurance company if a claim is denied.

Benefits of Having Renters Insurance

Renters insurance provides numerous benefits that can protect your financial well-being and give you peace of mind.

-

Protection Against Financial Loss Due to Covered Events

Renters insurance covers personal property and belongings in the event of a covered loss, such as fire, theft, vandalism, or natural disasters. This coverage can help you replace or repair your belongings, protecting you from significant financial losses.

-

Peace of Mind Knowing That Personal Belongings Are Insured

With renters insurance, you can have peace of mind knowing that your personal belongings are protected. This can provide a sense of security and reduce stress in the event of an unexpected loss.

-

Meeting Landlord Requirements for Proof of Insurance

Many landlords require tenants to have renters insurance as a condition of their lease agreement. Having renters insurance demonstrates to your landlord that you are responsible and that you understand the importance of protecting your belongings.

Additional Considerations for Renters Insurance

When purchasing renters insurance, it’s essential to consider additional factors beyond the basic coverage. These factors can significantly impact the effectiveness and cost of your insurance policy.

Value of Personal Belongings

Determine the total value of your personal belongings, including furniture, electronics, clothing, and any other valuable items. This will help you determine the appropriate coverage amount to protect your possessions in case of a covered loss.

Deductible Amount

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically lowers your monthly premiums but increases the amount you pay for repairs or replacements in the event of a claim. Consider your financial situation and risk tolerance when selecting a deductible amount.

Insurance Company’s Reputation and Financial Stability

Choose an insurance company with a strong reputation for customer service, financial stability, and timely claims processing. Research the company’s financial ratings from reputable agencies such as AM Best or Standard & Poor’s to assess its financial strength and ability to pay claims.