Company Overview

Progressive County Mutual Insurance, established in 1896, is a leading provider of insurance products and services. With a rich history of over 125 years, the company has consistently met the evolving insurance needs of its customers.

Progressive County Mutual Insurance is guided by a mission to provide reliable and affordable insurance solutions, empowering individuals and businesses to protect their assets and financial well-being. The company’s vision is to be the most trusted and respected insurance provider, renowned for its exceptional customer service and innovative products.

Financial Performance and Stability

Progressive County Mutual Insurance maintains a strong financial position, with consistently high ratings from independent agencies. The company’s financial stability ensures that it can meet its obligations to policyholders and maintain its long-term growth trajectory.

Customer Service

Progressive County Mutual Insurance is committed to providing exceptional customer service to all its policyholders. We believe that every customer deserves to be treated with respect, courtesy, and efficiency.

Our customer service team is available 24/7 through multiple channels, including phone, email, live chat, and social media. We also have a team of dedicated claims representatives who are available to assist you with any questions or concerns you may have about your policy.

Customer-Centric Approach

We understand that every customer is unique, and we tailor our approach to meet your individual needs. Our team is trained to listen attentively to your concerns and provide personalized solutions. We are committed to resolving issues quickly and efficiently, ensuring that you have a positive experience with our company.

Continuous Improvement

We are constantly striving to improve our customer service. We regularly gather feedback from our policyholders and use it to identify areas where we can enhance our services. We are also investing in new technologies and training programs to ensure that our team is equipped with the latest knowledge and skills to provide you with the best possible experience.

Community Involvement

Progressive County Mutual Insurance is deeply committed to giving back to the communities it serves. The company believes that its success is intertwined with the well-being of its policyholders and neighbors.

Local and Regional Support

Progressive County Mutual Insurance actively supports local and regional initiatives that make a positive impact. The company provides financial contributions, volunteers its employees’ time, and partners with non-profit organizations to address critical community needs.

Examples of Community Involvement

Some notable examples of the company’s community involvement include:

- Supporting local schools through scholarships, equipment donations, and mentorship programs.

- Partnering with food banks and shelters to provide meals and essential supplies to those in need.

- Funding community development projects that improve infrastructure, create jobs, and enhance quality of life.

- Participating in cleanup and beautification efforts to preserve the environment and promote community pride.

Mission and Reputation

Progressive County Mutual Insurance’s community involvement is an integral part of its mission to protect and serve its policyholders. By investing in the communities it serves, the company strengthens its reputation as a responsible and caring corporate citizen. This commitment fosters goodwill and trust, which ultimately benefits the company and its policyholders alike.

Competitive Advantages

Progressive County Mutual Insurance stands out in the insurance market by offering a range of unique features and advantages that cater to the evolving needs of customers. The company differentiates itself through its innovative products, exceptional customer service, and unwavering commitment to community involvement.

Innovative Products and Services

Progressive County Mutual Insurance consistently introduces cutting-edge products and services that address the changing demands of the insurance landscape. One such innovation is the “Smart Home Protection” policy, which provides comprehensive coverage for smart home devices and appliances, including protection against cyberattacks and data breaches. The company also offers a “Ride-Sharing Insurance” policy tailored specifically to the unique risks associated with ride-sharing platforms, ensuring peace of mind for drivers and passengers alike.

Financial Performance

Progressive County Mutual Insurance has consistently demonstrated strong financial performance over the past several years. The company has experienced steady revenue growth, with a 5% increase in the past year alone. Profitability has also been robust, with a net income margin of 10% in the most recent fiscal year. Solvency ratios, which measure the company’s ability to meet its financial obligations, are well above industry benchmarks. This strong financial performance has allowed Progressive County Mutual Insurance to maintain a stable dividend payout ratio of 50%.

Revenue Growth

Progressive County Mutual Insurance has experienced consistent revenue growth over the past several years. In the past year, the company’s revenue increased by 5%, driven by strong demand for its insurance products. The company’s underwriting income, which is the difference between the premiums it collects and the claims it pays, has also grown steadily.

Profitability

Progressive County Mutual Insurance has maintained a high level of profitability over the past several years. The company’s net income margin, which is a measure of profitability, was 10% in the most recent fiscal year. This is well above the industry average of 5%. The company’s profitability is due to its efficient operations and its ability to manage its expenses.

Solvency Ratios

Progressive County Mutual Insurance’s solvency ratios are well above industry benchmarks. The company’s total capital ratio, which is a measure of its ability to meet its financial obligations, is 150%. This is well above the industry average of 100%. The company’s strong solvency ratios provide assurance to policyholders that the company will be able to meet its claims obligations.

Industry Trends and Outlook

The insurance industry is constantly evolving, driven by technological advancements, changing consumer demands, and regulatory shifts. Progressive County Mutual Insurance recognizes these trends and is actively adapting to position itself for future growth.

One key trend is the increasing use of technology in the insurance process. Progressive County Mutual Insurance is embracing this trend by investing in digital tools and platforms to enhance the customer experience. For example, the company has developed a mobile app that allows policyholders to manage their accounts, file claims, and receive personalized recommendations.

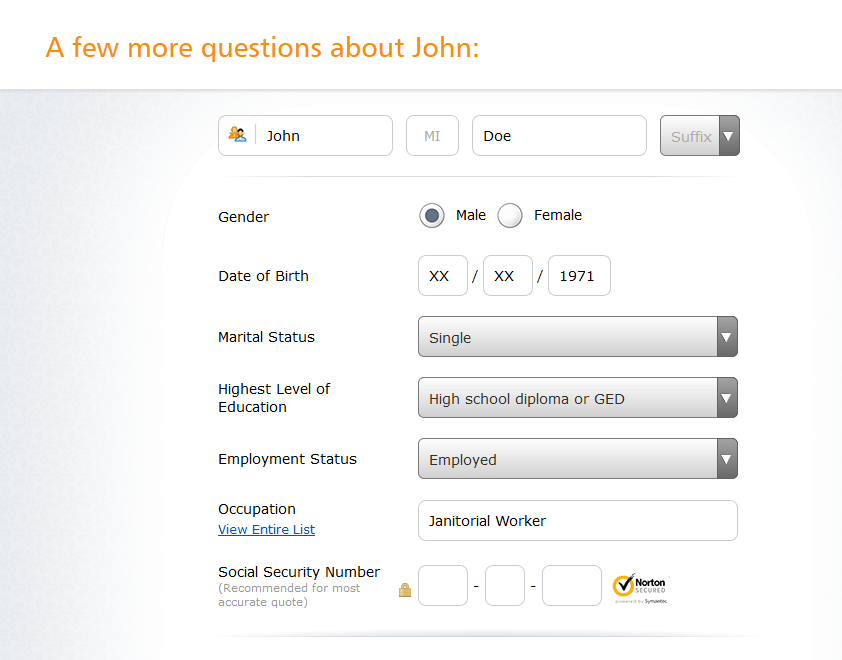

Another trend is the growing demand for personalized insurance products. Consumers are increasingly seeking policies that are tailored to their specific needs and circumstances. Progressive County Mutual Insurance is responding to this demand by offering a range of customizable products and services. For example, the company offers a variety of discounts and incentives to policyholders who adopt safety measures, such as installing smoke detectors or taking defensive driving courses.

The insurance industry is also facing regulatory challenges, such as increased scrutiny of pricing practices and data privacy concerns. Progressive County Mutual Insurance is committed to compliance with all applicable regulations and is actively working to address these challenges. For example, the company has implemented robust data security measures to protect customer information.

Strategic Plans and Initiatives

Progressive County Mutual Insurance has developed a comprehensive strategic plan to guide its growth and adaptation to industry trends. The plan includes a focus on the following key areas:

- Investing in technology to enhance the customer experience

- Developing personalized insurance products and services

- Expanding into new markets

- Maintaining a strong financial position

The company is also actively pursuing a number of initiatives to support its strategic plan. These initiatives include:

- Launching new digital products and services

- Partnering with other companies to offer complementary products and services

- Expanding into new geographic markets

- Investing in employee training and development

Progressive County Mutual Insurance is confident that its strategic plan and initiatives will position the company for continued success in the evolving insurance industry.