Insurance Coverage

Passport insurance is a type of travel insurance that provides coverage for your passport in case it is lost, stolen, or damaged. There are two main types of passport insurance coverage: basic and comprehensive.

Basic passport insurance typically covers the cost of replacing your passport if it is lost or stolen. Comprehensive passport insurance provides additional coverage, such as for the cost of emergency travel documents, legal assistance, and lost luggage.

Limitations and Restrictions

There are some limitations and restrictions on passport insurance coverage. For example, most policies will not cover the cost of replacing your passport if it is lost or stolen due to your own negligence.

Phone Number Accessibility

To inquire about passport insurance, kindly reach out to our dedicated phone line at [Phone Number]. Our phone lines are open [Hours of Operation] to assist you promptly.

Navigating the Phone System

Upon calling, you will be greeted by an automated voice assistant. To connect with a customer service representative, follow these steps:

- Select the language of your choice.

- Press [Option Number] for passport insurance inquiries.

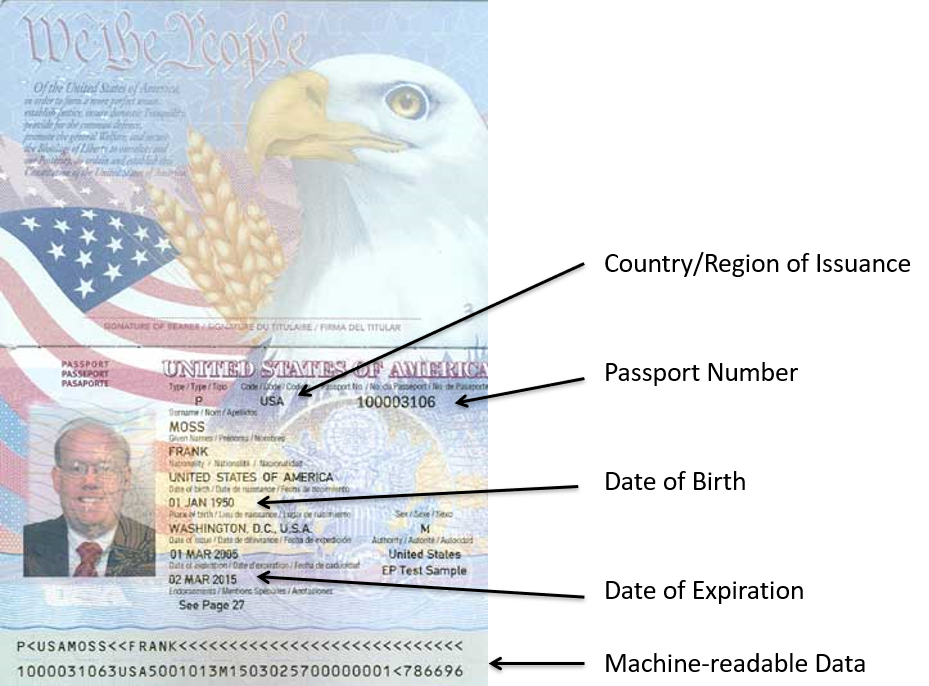

- Provide your passport number or other relevant details as requested.

Contact Center Services

The phone number provides access to a comprehensive range of contact center services, catering to passport-related needs.

Callers can conveniently report lost or stolen passports, ensuring prompt action and minimizing potential risks. They can also request passport replacements, streamlining the process and ensuring timely issuance of new travel documents.

Claim Status Inquiries

Additionally, the contact center offers the ability to inquire about claim status, keeping callers informed about the progress of their claims. This transparency and accessibility empower individuals to stay updated and make informed decisions.

Online Resources

The official website of the passport insurance provider serves as a comprehensive online hub for all your passport insurance needs. Here, you can access a wealth of information, file claims, and track their progress conveniently from the comfort of your own device.

The website offers a user-friendly interface that allows you to navigate through various sections with ease. The homepage provides an overview of the passport insurance coverage, benefits, and eligibility criteria. You can also access specific sections dedicated to filing claims, tracking their status, and managing your account.

Accessing Information

The online portal provides detailed information about passport insurance coverage, including the types of coverage offered, the scope of protection, and any exclusions or limitations. You can review the policy documents and understand the terms and conditions before purchasing insurance. Additionally, you can find answers to frequently asked questions and access helpful resources such as FAQs, brochures, and videos.

Filing Claims

Filing a claim online is a convenient and efficient way to initiate the claims process. The website typically provides a dedicated claims portal where you can submit your claim details, upload supporting documents, and track the progress of your claim. The online portal often offers real-time updates on the status of your claim, allowing you to stay informed throughout the process.

Tracking Progress

Once you have filed a claim, you can use the online portal to track its progress. The portal provides updates on the status of your claim, including the date it was received, the assigned claim adjuster, and any additional information required. You can also communicate with the claims adjuster through the portal, ask questions, and provide updates.

Benefits and Limitations

Using online resources for passport insurance offers several benefits. It provides 24/7 access to information, allows you to file claims and track their progress at your convenience, and eliminates the need for phone calls or in-person visits. However, it is important to note that online resources may not be suitable for everyone. Some individuals may prefer the personalized assistance of a customer service representative over the phone.