Company Overview

Ohio Security Insurance Company, founded in 1923, is a leading provider of insurance products and services in the United States. Headquartered in Mansfield, Ohio, the company offers a comprehensive range of coverage options for individuals, families, and businesses.

Ohio Security’s mission is to provide peace of mind to its customers by offering reliable and affordable insurance solutions. The company’s vision is to be the most trusted and respected insurance provider in the industry, known for its exceptional customer service, financial stability, and innovative products.

Key Financial Metrics

- Total assets: $10.5 billion

- Net income: $1.2 billion

- Policyholder surplus: $4.5 billion

Industry Rankings

- Ranked among the top 50 property and casualty insurers in the United States by A.M. Best

- Received an “A” (Excellent) financial strength rating from A.M. Best

- Recognized as a “Ward’s Top 50” insurer for its financial stability and performance

Products and Services

Ohio Security Insurance Company offers a comprehensive suite of insurance products and services tailored to meet the diverse needs of individuals, families, and businesses. The company’s product portfolio spans a wide range of coverage options, ensuring that customers can find the right protection for their specific requirements.

Ohio Security’s approach to product development is centered around innovation and customer-centricity. The company continuously monitors industry trends and customer feedback to identify emerging risks and develop solutions that effectively address them. By leveraging advanced analytics and technology, Ohio Security is able to create products that are both comprehensive and affordable.

Personal Insurance

- Homeowners Insurance: Protects homes and personal belongings against damages, theft, and other covered perils.

- Renters Insurance: Provides coverage for renters and their belongings in case of theft, fire, or other covered events.

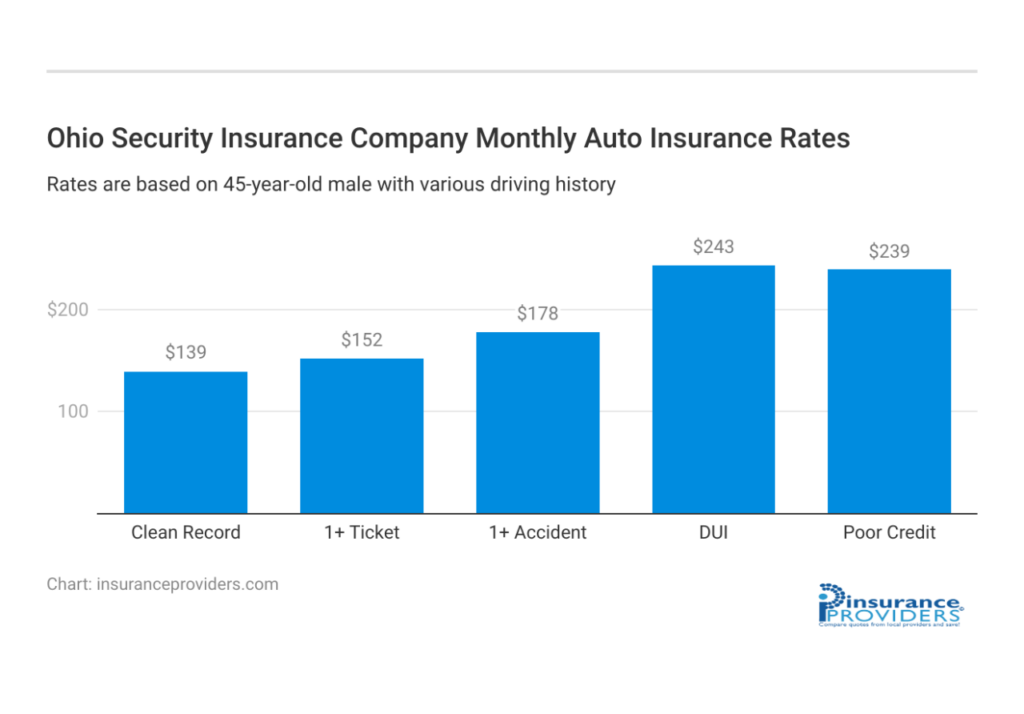

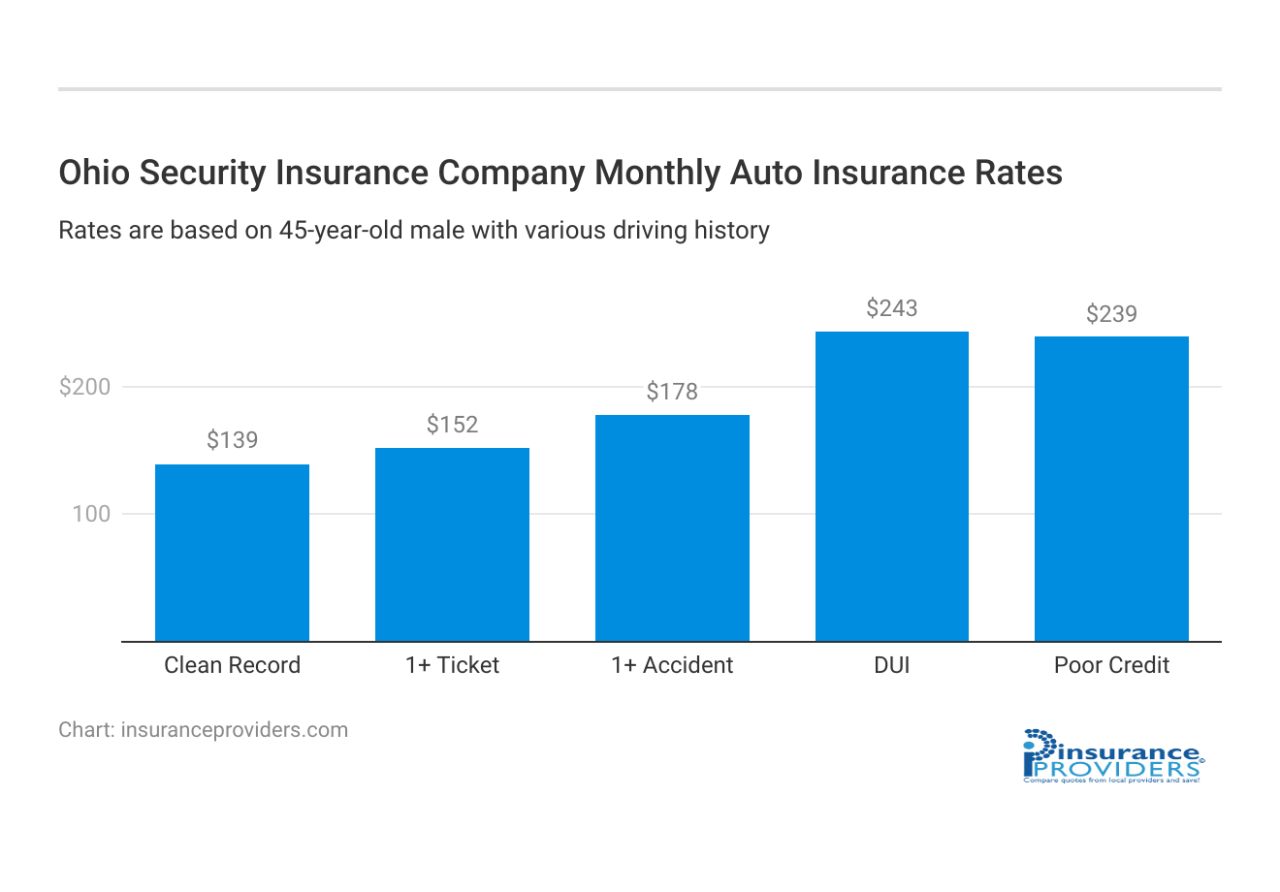

- Auto Insurance: Offers liability, collision, and comprehensive coverage options for personal vehicles.

- Umbrella Insurance: Extends liability coverage beyond the limits of other policies, providing additional protection against catastrophic events.

- Life Insurance: Provides financial support to loved ones in the event of the policyholder’s death.

Business Insurance

- Commercial Property Insurance: Protects business properties, including buildings, equipment, and inventory, against covered perils such as fire, theft, and vandalism.

- Business Liability Insurance: Provides coverage against claims of bodily injury or property damage caused by the business or its employees.

- Workers’ Compensation Insurance: Protects employees from lost wages and medical expenses due to work-related injuries or illnesses.

- Commercial Auto Insurance: Offers coverage for business vehicles, including liability, collision, and comprehensive options.

- Cyber Liability Insurance: Protects businesses from financial losses and reputational damage resulting from cyberattacks or data breaches.

Additional Services

In addition to its core insurance products, Ohio Security Insurance Company offers a range of additional services to enhance the customer experience.

- Risk Management Consulting: Provides expert guidance to businesses on identifying and mitigating risks.

- Claims Handling: Offers efficient and compassionate claims processing, ensuring timely resolution of claims.

- 24/7 Customer Support: Provides round-the-clock assistance for policyholders and claimants.

- Online Policy Management: Allows customers to manage their policies, view coverage details, and file claims online.

- Mobile App: Provides convenient access to policy information, claims reporting, and roadside assistance.

Distribution Channels

Ohio Security Insurance Company employs a comprehensive distribution strategy to reach its target audience and expand its market presence. The company utilizes a mix of distribution channels, including agents, brokers, and direct sales, to cater to the diverse needs of its customers.

Agents play a crucial role in the company’s distribution network. They act as intermediaries between Ohio Security Insurance Company and policyholders, providing personalized advice and tailored insurance solutions. Agents are often deeply embedded in local communities, fostering strong relationships with clients and understanding their unique insurance requirements.

Brokers

Brokers are independent intermediaries who represent multiple insurance companies. They work closely with clients to assess their insurance needs and identify the most suitable coverage options from various providers. Brokers provide unbiased advice and leverage their expertise to negotiate competitive rates on behalf of their clients.

Direct Sales

Ohio Security Insurance Company also offers direct sales channels, allowing customers to purchase insurance policies directly from the company without intermediaries. This channel provides greater convenience and cost-effectiveness, as customers can bypass agent or broker commissions. Direct sales are often conducted through online platforms, call centers, or company-owned retail locations.

To expand its distribution network and reach new markets, Ohio Security Insurance Company continuously explores strategic partnerships and collaborations. The company actively seeks to establish relationships with industry leaders, such as financial institutions, real estate agencies, and affinity groups. By leveraging these partnerships, Ohio Security Insurance Company gains access to a wider customer base and enhances its brand visibility.

Claims Handling

Ohio Security Insurance Company prioritizes customer satisfaction and strives to provide a seamless and efficient claims handling process.

When filing a claim, policyholders can contact the company’s 24/7 claims hotline or submit a claim online. A dedicated claims adjuster will be assigned to guide you through the process, assess damages, and determine coverage.

Steps Involved in Claims Handling

- Report the Claim: Contact the claims hotline or file online within the specified timeframe.

- Provide Documentation: Submit supporting documents, such as photos, receipts, and medical records, to substantiate the claim.

- Assessment and Investigation: The claims adjuster will review the documentation, inspect the property, and interview relevant parties to determine the extent of damages.

- Claim Evaluation: The adjuster will evaluate the claim based on the policy coverage, determine the amount of compensation, and prepare a settlement offer.

- Settlement: Upon agreement with the policyholder, the claim is settled and payment is issued promptly.

Financial Stability

Ohio Security Insurance Company maintains a strong financial position, consistently meeting regulatory requirements and demonstrating resilience during economic fluctuations.

The company’s financial health is supported by key ratios and metrics:

Key Financial Ratios

- Current Ratio: Ohio Security Insurance Company’s current ratio consistently exceeds 1.5, indicating its ability to meet short-term obligations.

- Solvency Ratio: The company maintains a solvency ratio well above the industry average, ensuring its ability to fulfill policyholder obligations.

- Loss Ratio: Ohio Security Insurance Company’s loss ratio is within industry norms, indicating its efficient underwriting practices.

Risk Management Strategies

To withstand economic downturns, Ohio Security Insurance Company employs robust risk management strategies:

- Diversification: The company diversifies its portfolio across multiple lines of business, reducing its exposure to any single sector.

- Reinsurance: Ohio Security Insurance Company purchases reinsurance to mitigate the impact of catastrophic events.

- Conservative Investment Strategy: The company invests its assets in low-risk, high-yield investments to ensure long-term financial stability.

Customer Service

Ohio Security Insurance Company prioritizes exceptional customer service, recognizing the importance of building strong relationships with its policyholders.

The company offers a range of communication channels to ensure accessibility and prompt response to customer inquiries. Policyholders can connect with Ohio Security Insurance Company via phone, email, live chat, or through their online customer portal.

Response Times

Ohio Security Insurance Company is committed to timely customer service. The company’s response times vary depending on the communication channel used, but it generally aims to respond to emails within 24 hours and phone calls within 1 business day.

Customer Support Initiatives

To enhance customer satisfaction, Ohio Security Insurance Company has implemented several initiatives, including:

- Dedicated customer service representatives who are knowledgeable about the company’s products and services

- Training programs for customer service staff to ensure they provide empathetic and professional assistance

- Regular customer feedback surveys to gather insights and identify areas for improvement

Technology and Innovation

Ohio Security Insurance Company embraces technology to enhance its products, services, and operations, driving efficiency and innovation. The company has invested heavily in automation, data analytics, and digital platforms to provide a seamless experience for its customers.

Automation and Data Analytics

Ohio Security Insurance Company leverages automation tools to streamline processes, reduce manual errors, and improve operational efficiency. The company’s advanced data analytics capabilities enable it to analyze vast amounts of data to identify patterns, predict risks, and tailor products and services to meet specific customer needs.

Corporate Social Responsibility

Ohio Security Insurance Company is committed to being a responsible corporate citizen, prioritizing environmental sustainability, community involvement, and employee well-being. The company recognizes its role in making a positive impact on society and actively engages in initiatives that contribute to the greater good.

Environmental Sustainability

Ohio Security Insurance Company has implemented comprehensive sustainability measures to reduce its environmental footprint. The company utilizes renewable energy sources, promotes paperless operations, and actively recycles waste. Additionally, the company invests in energy-efficient technologies and supports initiatives that promote biodiversity conservation.

Community Involvement

Ohio Security Insurance Company is actively involved in its local communities, supporting organizations that focus on education, health, and social services. The company encourages employee volunteerism and provides financial contributions to non-profit organizations. Additionally, the company sponsors community events and programs that promote well-being and inclusivity.

Employee Well-being

Ohio Security Insurance Company prioritizes the well-being of its employees, fostering a positive and supportive work environment. The company offers competitive benefits, flexible work arrangements, and professional development opportunities. Additionally, the company promotes a healthy work-life balance and encourages employees to engage in community service.

Industry Trends

The insurance industry is constantly evolving, driven by technological advancements, changing customer expectations, and regulatory shifts. Ohio Security Insurance Company recognizes these trends and is actively adapting to stay ahead of the curve.

One key trend is the rise of digitalization. Customers increasingly expect to interact with their insurance providers online and through mobile devices. Ohio Security Insurance Company has invested heavily in its digital capabilities, making it easy for customers to manage their policies, file claims, and access information.

Competitive Landscape

The insurance industry is highly competitive, with numerous players vying for market share. Ohio Security Insurance Company differentiates itself by focusing on providing exceptional customer service and innovative products tailored to the needs of its customers.

The company has a strong brand reputation and a loyal customer base. It also has a robust distribution network that includes independent agents, brokers, and direct sales channels.

Positioning for Future Growth

Ohio Security Insurance Company is well-positioned for future growth by embracing industry trends and investing in its business.

- The company’s focus on digitalization will continue to drive growth as more customers adopt online and mobile insurance services.

- Its commitment to customer service will help it retain and attract new customers in an increasingly competitive market.

- Its strong distribution network will ensure that its products and services are accessible to customers across multiple channels.