Coverage Options

New York automobile insurance plans offer a range of coverage options to meet the diverse needs of drivers. These options provide financial protection in the event of accidents, property damage, or other covered incidents.

Understanding the different types of coverage available is crucial for choosing a plan that adequately protects you and your vehicle. Let’s explore the key coverage options and their benefits:

Liability Coverage

Liability coverage protects you financially if you are found legally responsible for causing an accident that results in bodily injury or property damage to others. It covers expenses such as medical bills, lost wages, and repairs.

Collision Coverage

Collision coverage protects your vehicle from damage sustained in a collision with another vehicle or object. It covers repairs or replacement of your car, regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, fire, or weather events. It provides financial reimbursement for repairs or replacement of your car.

Personal Injury Protection (PIP)

PIP coverage provides medical and other expenses for you and your passengers, regardless of who is at fault in an accident. It covers costs such as medical bills, lost wages, and funeral expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or has insufficient coverage to cover your damages.

Minimum Coverage Requirements in New York

New York state law requires all drivers to maintain a minimum level of liability coverage. The minimum limits are:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $10,000 per accident

Factors Affecting Premiums

The cost of automobile insurance in New York is determined by several factors. Understanding these factors can help you make informed decisions about your coverage and find ways to reduce your premiums.

Here are some of the key factors that influence insurance premiums in New York:

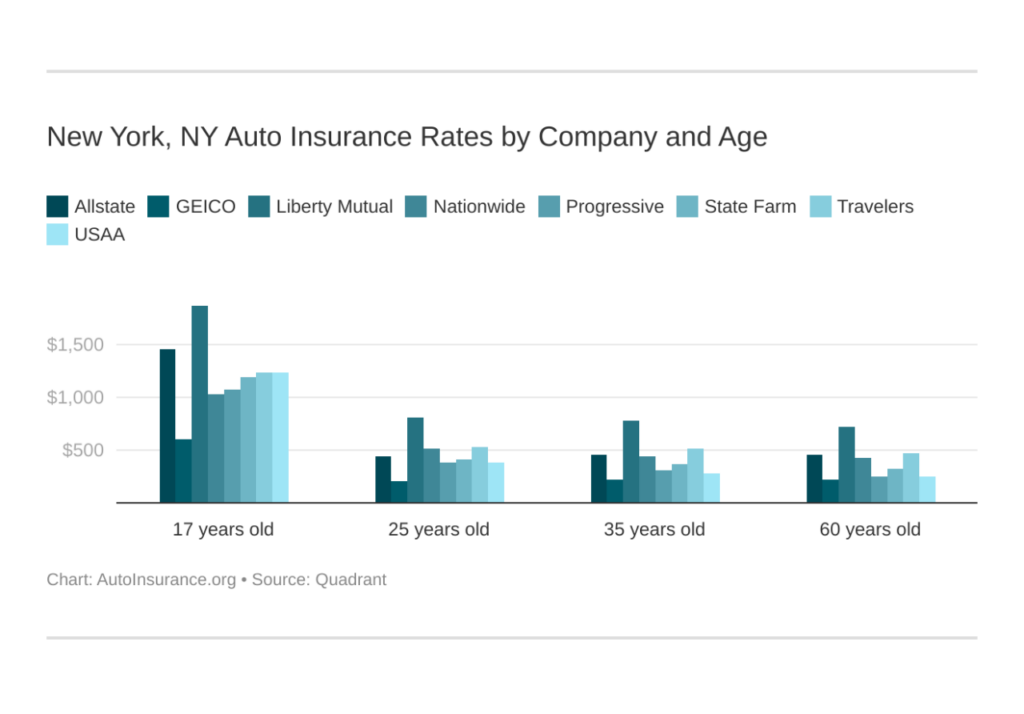

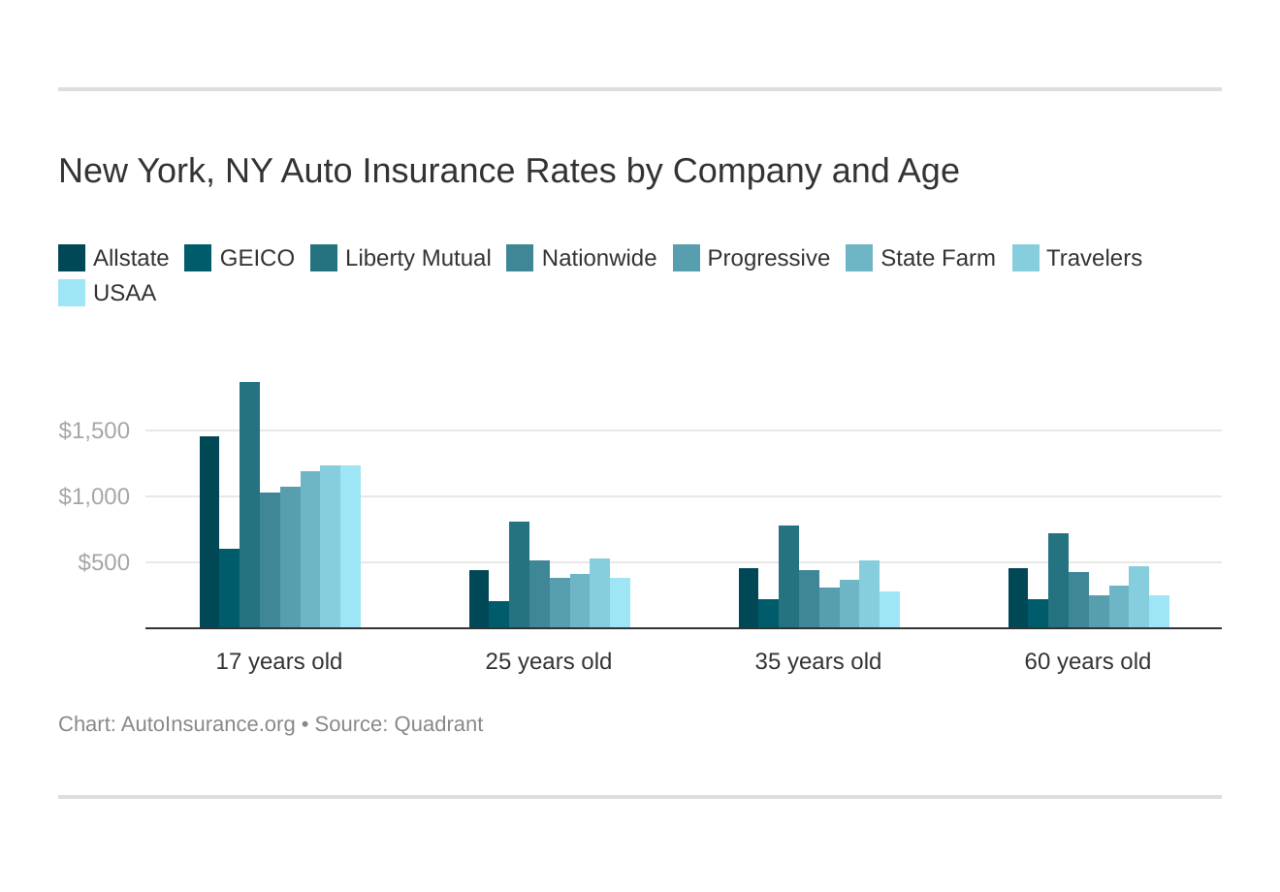

Age and Experience

Younger drivers, particularly those under the age of 25, typically pay higher premiums due to their higher risk of accidents. Drivers with more years of experience behind the wheel generally qualify for lower rates.

Driving History

Your driving record plays a significant role in determining your insurance premiums. Drivers with a clean driving record, free of accidents or violations, are likely to receive lower rates than those with multiple infractions.

Vehicle Type

The type of vehicle you drive also affects your insurance costs. Sports cars, luxury vehicles, and high-performance models typically come with higher premiums due to their higher risk of theft and accidents.

Location

Where you live can also impact your insurance rates. Drivers in urban areas with higher traffic density and crime rates generally pay more for insurance than those in rural areas.

Coverage Level

The amount of coverage you choose also affects your premiums. Higher levels of coverage, such as comprehensive and collision, will result in higher premiums than basic liability coverage.

Deductible

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it also means you will be responsible for more expenses in the event of an accident.

Credit Score

In some states, insurance companies may use your credit score as a factor in determining your premiums. Drivers with higher credit scores are generally considered to be lower-risk drivers and may qualify for lower rates.

Tips for Reducing Premiums

- Maintain a clean driving record.

- Consider raising your deductible.

- Shop around for insurance quotes from multiple companies.

- Take advantage of discounts, such as those for safe driving or good students.

- Consider insuring multiple vehicles with the same company.

Insurance Companies in New York

New York is home to a wide range of automobile insurance companies, each offering a variety of coverage options and rates. Choosing the right insurer is essential to ensuring you have the protection you need at a price you can afford.

The following table provides an overview of some of the major automobile insurance companies operating in New York, along with their market share, customer ratings, and unique offerings:

Major Automobile Insurance Companies in New York

| Company | Market Share | Customer Ratings | Unique Offerings |

|---|---|---|---|

| State Farm | 20% | A+ (AM Best) | Drive Safe & Save program, accident forgiveness |

| Geico | 15% | A++ (AM Best) | Low rates for good drivers, mobile app |

| Progressive | 12% | A+ (AM Best) | Name Your Price tool, Snapshot program |

| Allstate | 10% | A+ (AM Best) | Accident forgiveness, Drivewise program |

| Nationwide | 8% | A+ (AM Best) | SmartRide program, pet insurance |

Pros and Cons of Different Insurance Companies

Each insurance company has its own strengths and weaknesses. When choosing an insurer, it is important to consider your individual needs and budget.

- State Farm: Known for its low rates and excellent customer service. However, it may not offer the most comprehensive coverage options.

- Geico: Offers very competitive rates, especially for good drivers. However, its customer service has been known to be slow at times.

- Progressive: Provides a wide range of coverage options and discounts. However, its rates can be higher than some other insurers.

- Allstate: Offers a variety of discounts and unique coverage options, such as accident forgiveness. However, its rates can be higher than some other insurers.

- Nationwide: Known for its strong financial stability and customer service. However, its rates may be higher than some other insurers.

Filing Claims

Filing an automobile insurance claim in New York is a crucial process that can help you recover compensation for damages and losses after an accident. Here’s a step-by-step guide to assist you:

Reporting the Accident

– Contact the police immediately to report the accident. They will file a report that serves as an official record of the incident.

– Notify your insurance company about the accident promptly. They will assign a claims adjuster to handle your case.

Documenting the Accident

– Take photos of the accident scene, including damage to vehicles, injuries, and any other relevant details.

– Obtain contact information from all parties involved, including drivers, passengers, and witnesses.

– Gather medical records and bills related to any injuries sustained in the accident.

Filing the Claim

– Complete and submit the insurance claim form provided by your insurance company.

– Provide all necessary documentation, including the police report, photos, and medical records.

– Cooperate with the claims adjuster during the investigation and provide any additional information they may request.

Negotiating the Settlement

– Once the claims adjuster has reviewed your claim, they will determine the amount of compensation you are entitled to.

– You may negotiate the settlement with the insurance company to ensure it covers all your damages and losses.

Receiving the Payment

– After the settlement is finalized, the insurance company will issue payment to you. This payment can be used to cover medical expenses, vehicle repairs, lost wages, and other related costs.

Remember, it’s essential to be accurate and thorough when filing a claim to ensure you receive the maximum compensation you deserve.

5. Recent Changes in New York Automobile Insurance Laws

In recent years, New York State has implemented several changes to its automobile insurance laws. These changes aim to improve consumer protection, reduce insurance costs, and streamline the claims process.

Policyholder Protections

One significant change is the expansion of coverage for non-fault drivers involved in accidents with uninsured or underinsured motorists. Previously, non-fault drivers were only eligible for limited benefits, leaving them vulnerable to significant financial losses. The new law requires insurers to provide more comprehensive coverage, ensuring that non-fault drivers have access to fair compensation for their injuries and damages.

Insurance Premium Reforms

Another important change is the implementation of insurance premium reforms. These reforms aim to reduce insurance costs for low-risk drivers while ensuring that high-risk drivers pay their fair share. The new law establishes a risk-based pricing system that considers factors such as driving history, claims experience, and vehicle type. This system is designed to reward safe drivers with lower premiums while deterring reckless behavior.

Claims Process Enhancements

The recent changes to New York automobile insurance laws also include enhancements to the claims process. These enhancements aim to make the process more efficient and less stressful for policyholders. The new law requires insurers to provide clear and timely communication to policyholders throughout the claims process. Additionally, the law establishes a new dispute resolution process that provides policyholders with an independent mechanism to resolve disputes with their insurers.

Potential Impact on Premiums

The recent changes to New York automobile insurance laws are likely to have a mixed impact on insurance premiums. The expansion of coverage for non-fault drivers may lead to slightly higher premiums for all drivers, as insurers spread the cost of these additional benefits across their policyholders. However, the premium reforms aimed at low-risk drivers may offset these increases, resulting in lower premiums for safe drivers. Ultimately, the impact on individual premiums will depend on a variety of factors, including driving history, claims experience, and vehicle type.

Unique Features of New York Automobile Insurance

New York automobile insurance has several unique features that distinguish it from other states. These features include:

- No-fault insurance: New York is one of only 12 states that has a no-fault insurance system. This means that, regardless of who is at fault for an accident, each driver’s own insurance company will pay for their medical expenses and lost wages, up to certain limits.

- Mandatory minimum coverage: New York has some of the highest mandatory minimum coverage requirements in the country. All drivers must carry at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage.

- Accident surcharge: Drivers who are found at fault for an accident will be subject to an accident surcharge, which is an additional fee that is added to their insurance premium. The surcharge will remain on the driver’s record for three years.

These unique features are designed to protect New York drivers and ensure that they have adequate insurance coverage. However, they can also make New York automobile insurance more expensive than in other states.

No-Fault Insurance

New York’s no-fault insurance system is designed to reduce the number of lawsuits filed after an accident. Under this system, each driver’s own insurance company will pay for their medical expenses and lost wages, regardless of who is at fault. This can help to reduce the cost of insurance for all drivers, and it can also help to speed up the claims process.

However, there are some drawbacks to New York’s no-fault system. For example, it can be difficult to recover non-economic damages, such as pain and suffering. Additionally, the no-fault system can lead to higher insurance premiums for drivers who are not at fault for an accident.

Despite these drawbacks, New York’s no-fault system is still seen as a valuable tool for protecting drivers and reducing the cost of insurance.