Understanding Total Loss and Liability Coverage

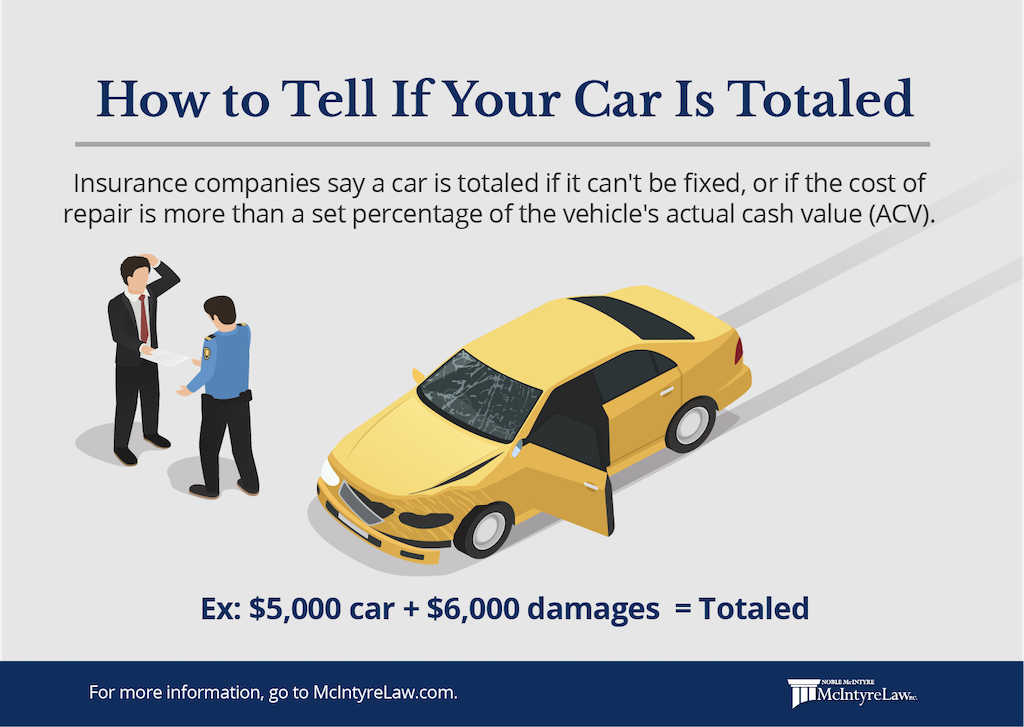

When a car is damaged in an accident, it is assessed to determine the extent of the damage. If the cost of repairs exceeds a certain percentage of the car’s value, it is considered a total loss. This means that the insurance company will pay the insured the actual cash value of the car, minus any deductible.

Liability insurance is a type of insurance that covers the insured for damages caused to others. It does not cover damages to the insured’s own vehicle. If a car is totaled and the insured only has liability insurance, they will not receive any compensation for the loss of their vehicle.

Options for Recovering Financial Losses

When your car is totaled and you only have liability insurance, it’s natural to feel frustrated and financially burdened. However, there are still options available to help you recover some of your losses.

Exploring alternative methods of recovering financial losses is crucial in this situation. One option is to sell your totaled vehicle for salvage or parts. This involves selling the remaining parts of your car to a salvage yard or to individuals who may need them for repairs or other purposes. While you may not get the full value of your car, it can still provide some financial compensation.

Another option to consider is pursuing legal action against the at-fault party. If the accident was caused by another driver’s negligence, you may be entitled to compensation for your losses. Consulting with an attorney can help you determine if you have a valid case and guide you through the legal process.

Selling the Totaled Vehicle for Salvage or Parts

Selling your totaled vehicle for salvage or parts can be a practical way to recoup some of your financial losses. Salvage yards typically purchase totaled vehicles for a fraction of their pre-accident value, based on factors such as the make, model, year, and extent of damage.

You can also sell individual parts of your totaled vehicle to individuals or businesses that need them for repairs or other purposes. This option requires more effort, as you’ll need to remove and sell the parts yourself. However, it can potentially yield a higher return than selling the entire vehicle to a salvage yard.

Pursuing Legal Action Against the At-Fault Party

If the accident that totaled your car was caused by another driver’s negligence, you may have the right to pursue legal action to recover your losses. This involves filing a claim with the at-fault driver’s insurance company or taking legal action if the insurance company denies your claim.

To pursue legal action, you’ll need to prove that the other driver was negligent and that their negligence caused the accident. You may also need to provide evidence of your damages, such as repair or replacement costs, medical expenses, and lost wages.

Pursuing legal action can be a complex and time-consuming process, but it can be worthwhile if you have a strong case and are determined to recover your financial losses.

Legal Considerations and Responsibilities

In the unfortunate event of a totaled vehicle, the driver holds certain legal obligations. Understanding these responsibilities is crucial to ensure compliance with the law and protect oneself from potential legal consequences.

Upon being involved in an accident, it is imperative to report it to the relevant authorities promptly. Failure to do so may result in legal penalties. Furthermore, cooperating fully with the insurance company is essential for a smooth claims process and to obtain fair compensation.

Potential Legal Recourse

If the other driver involved in the accident is uninsured or underinsured, the victim may have legal recourse to recover compensation for damages. This could involve filing a lawsuit against the at-fault driver or exploring other legal options available in the specific jurisdiction.

Preventing Future Financial Loss

To avoid financial hardship in the event of a totaled vehicle, it is crucial to take proactive measures. Maintaining adequate insurance coverage, practicing safe driving habits, and reducing the risk of accidents can significantly mitigate potential financial losses.

Maintaining Adequate Insurance Coverage

Having comprehensive and collision insurance coverage provides financial protection against the total loss of a vehicle. These coverages reimburse the policyholder for the actual cash value of the vehicle, minus the deductible. It is advisable to assess one’s financial situation and risk tolerance to determine the appropriate coverage limits.

Reducing the Risk of Accidents

- Defensive Driving: Practicing defensive driving techniques, such as anticipating potential hazards, maintaining a safe following distance, and avoiding distractions, can help prevent accidents.

- Vehicle Maintenance: Regularly servicing and maintaining the vehicle, including inspections, fluid changes, and tire rotations, can reduce the likelihood of mechanical failures and accidents.

- Safe Driving Habits: Adhering to traffic laws, avoiding speeding, and refraining from driving under the influence of alcohol or drugs significantly reduces the risk of accidents.