Overview of Motorcycle Insurance in Texas

In the Lone Star State, motorcycle riders are legally required to carry liability insurance. This coverage helps protect you financially if you cause an accident that results in injuries or property damage to others.

Beyond the minimum requirements, there are various types of motorcycle insurance coverage available in Texas. These include:

Collision Coverage

This coverage pays for repairs or replacement of your motorcycle if it is damaged in an accident, regardless of who is at fault.

Comprehensive Coverage

This coverage protects your motorcycle from non-collision related incidents, such as theft, vandalism, or damage caused by natural disasters.

Uninsured/Underinsured Motorist Coverage

This coverage provides protection if you are injured in an accident caused by a driver who does not have insurance or who does not have enough insurance to cover your damages.

Personal Injury Protection (PIP)

This coverage pays for medical expenses and lost wages if you are injured in a motorcycle accident, regardless of who is at fault.

Table of Coverage Options and Costs

| Coverage Type | Coverage Limit | Average Annual Premium |

|—|—|—|

| Liability | $30,000/$60,000 | $200-$400 |

| Collision | $10,000 | $100-$200 |

| Comprehensive | $10,000 | $100-$200 |

| Uninsured/Underinsured Motorist | $30,000/$60,000 | $50-$100 |

| PIP | $5,000 | $50-$100 |

Factors Affecting Motorcycle Insurance Premiums

The cost of motorcycle insurance premiums is not set in stone and can vary significantly depending on several factors. Insurance companies carefully assess these factors to determine the risk associated with insuring a particular rider and motorcycle, which in turn influences the premium amount.

Understanding these factors can help riders make informed decisions to potentially lower their insurance costs.

Age

Younger riders, typically those under the age of 25, generally pay higher premiums due to their perceived higher risk of accidents and inexperience on the road. As riders gain experience and age, their premiums tend to decrease.

Driving History

A rider’s driving history is a crucial factor in determining premiums. Riders with clean driving records, free of accidents and traffic violations, are likely to qualify for lower premiums compared to those with a history of accidents or traffic violations.

Type of Motorcycle

The type of motorcycle a rider owns can also impact premiums. Sport bikes, known for their high speeds and performance, often carry higher premiums than cruisers or touring motorcycles. This is because sport bikes are statistically more likely to be involved in accidents.

Discounts and Surcharges

Insurance companies offer discounts for certain factors that can reduce premiums. These discounts may include:

- Safe driving courses

- Multi-policy discounts (e.g., bundling motorcycle and auto insurance)

- Motorcycle safety gear (e.g., helmet use)

Conversely, surcharges may be applied for factors that increase risk, such as:

- Accidents or traffic violations

- Riding without a helmet

- Riding under the influence of alcohol or drugs

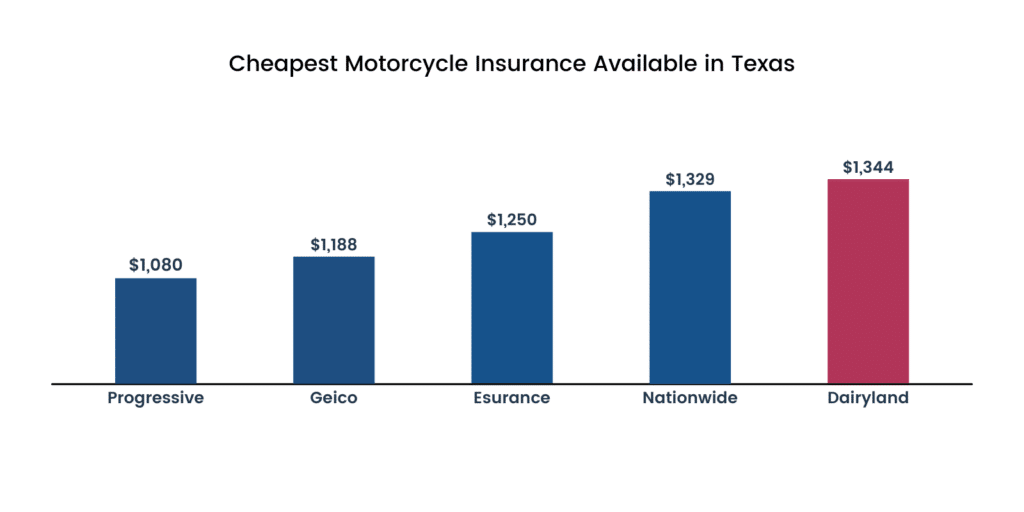

Shopping for Motorcycle Insurance in Texas

Finding the best motorcycle insurance policy in Texas involves comparing quotes from multiple insurance companies and carefully reviewing the policy details before making a purchase. Here are some tips to help you navigate the shopping process:

Compare Quotes

Obtain quotes from at least three different insurance companies to compare coverage options and premiums. Use an online insurance comparison tool or contact insurance agents directly to gather quotes.

Review Coverage Options

Consider your individual needs and risk tolerance when selecting coverage options. Basic coverage typically includes liability, collision, and comprehensive coverage. Additional coverage options, such as uninsured/underinsured motorist coverage and roadside assistance, may be available.

Read and Understand the Policy

Before purchasing a policy, thoroughly read and understand the terms and conditions. Pay attention to the coverage limits, deductibles, and exclusions. Ensure you fully comprehend the policy’s provisions to avoid surprises in the event of a claim.

Making a Claim

In the unfortunate event of a motorcycle accident, filing an insurance claim is crucial. Understanding the steps involved can help ensure a smooth and efficient process.

To initiate a claim, contact your insurance provider promptly and provide details of the incident, including the time, location, and circumstances.

Required Documentation

To support your claim, you will typically need to provide:

- Police report (if applicable)

- Medical records (if injuries occurred)

- Photographs of the accident scene and damage

- Contact information for witnesses (if any)

Claims Process

Once you have submitted your claim, an insurance adjuster will be assigned to assess the damages and determine the settlement amount.

- The adjuster will inspect the motorcycle and review the documentation you provided.

- They may also interview you and other parties involved in the accident.

- Based on their findings, the adjuster will make a settlement offer.

You have the right to negotiate the settlement amount if you believe it is insufficient. If an agreement cannot be reached, you may need to pursue legal action.