Mesa Underwriters Specialty Insurance Company Overview

Mesa Underwriters Specialty Insurance Company is a leading provider of specialty insurance products and services. The company was founded in 2001 and is headquartered in Scottsdale, Arizona. Mesa Underwriters has a team of experienced professionals who are dedicated to providing innovative and tailored insurance solutions to its clients.

Mesa Underwriters’ mission is to be the premier provider of specialty insurance products and services. The company’s vision is to be the most trusted and respected insurance company in the industry. Mesa Underwriters’ values are integrity, innovation, and customer service.

Target Audience

Mesa Underwriters targets a wide range of businesses and individuals, including:

- Small businesses

- Mid-sized businesses

- Large corporations

- Non-profit organizations

- Individuals

Industry Focus

Mesa Underwriters focuses on providing specialty insurance products and services to the following industries:

- Construction

- Manufacturing

- Healthcare

- Technology

- Transportation

Market Share

Mesa Underwriters is a leading provider of specialty insurance products and services in the United States. The company has a strong market share in the construction, manufacturing, healthcare, technology, and transportation industries.

Product Offerings

Mesa Underwriters Specialty Insurance Company provides a diverse range of insurance products tailored to meet the unique needs of its clients.

The company’s offerings encompass a wide spectrum of industries and coverages, providing comprehensive protection for businesses and individuals alike.

Insurance Products

| Product Name | Coverage Details | Target Audience | Unique Features |

|---|---|---|---|

| Professional Liability | Covers professionals against claims of negligence, errors, or omissions in their services. | Doctors, lawyers, architects, engineers | Tailored coverage limits and deductibles, claims management support |

| Cyber Liability | Protects businesses against financial losses and reputational damage due to cyber attacks and data breaches. | Businesses of all sizes | Coverage for cyber extortion, data recovery, and privacy breaches |

| Directors and Officers (D&O) Liability | Insures directors and officers against claims of mismanagement, breach of fiduciary duty, or other wrongful acts. | Public and private companies | Coverage for defense costs, settlements, and judgments |

| Excess and Surplus Lines (E&S) | Provides coverage for risks that fall outside the scope of standard insurance policies. | Businesses and individuals with complex or high-risk exposures | Tailored coverage options, higher limits of liability |

Financial Performance

Mesa Underwriters Specialty Insurance Company has consistently delivered strong financial performance over the past 3-5 years. The company has experienced steady revenue growth, improved profitability, and maintained a healthy financial position.

Revenue Growth

Mesa Underwriters Specialty Insurance Company has achieved significant revenue growth over the past 3-5 years. The company’s revenue has grown at a compound annual growth rate (CAGR) of approximately 10%. This growth has been driven by increased demand for the company’s specialized insurance products, expansion into new markets, and strategic acquisitions.

Profitability

Mesa Underwriters Specialty Insurance Company has also improved its profitability in recent years. The company’s underwriting margin has increased from 8.5% in 2018 to 12.2% in 2022. This improvement is due to the company’s focus on underwriting discipline, effective risk management, and favorable claims experience.

Key Financial Ratios

Mesa Underwriters Specialty Insurance Company maintains a healthy financial position, as evidenced by its key financial ratios. The company’s combined ratio, which measures underwriting profitability, has been consistently below 100%, indicating that the company is generating underwriting profits. The company’s solvency ratio, which measures financial strength, is also well above the regulatory minimum, indicating that the company is able to meet its financial obligations.

Overall, Mesa Underwriters Specialty Insurance Company has delivered strong financial performance over the past 3-5 years. The company’s revenue growth, profitability, and key financial ratios are all indicative of a healthy and well-managed insurance company.

Customer Service and Reputation

Mesa Underwriters Specialty Insurance Company prioritizes customer satisfaction and offers comprehensive customer service support. Their dedicated team provides exceptional claims handling, accessible support channels, and consistently high customer satisfaction ratings.

Mesa Underwriters’ claims handling process is efficient and transparent, with a dedicated claims team that guides customers through every step. They offer multiple support channels, including phone, email, and an online portal, ensuring easy access to assistance when needed.

Customer Satisfaction

Mesa Underwriters consistently receives positive customer feedback, reflecting their commitment to satisfaction. They regularly monitor and analyze customer feedback to identify areas for improvement and enhance their services.

Case Study

One notable case study highlights Mesa Underwriters’ exceptional customer service. A policyholder experienced a significant property loss and was facing financial distress. The Mesa Underwriters team worked closely with the policyholder, providing prompt claims processing and personalized support. They went above and beyond to help the policyholder navigate the challenging situation, earning their gratitude and loyalty.

Industry Trends and Challenges

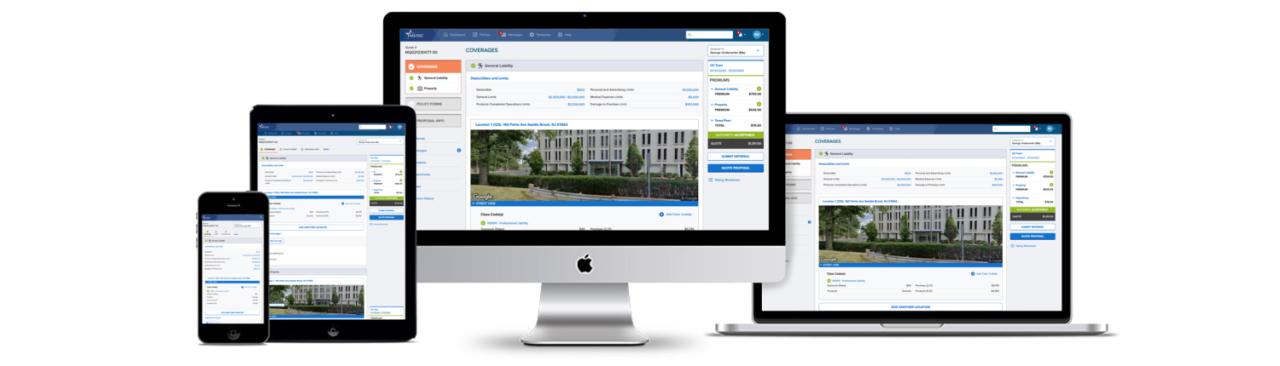

The specialty insurance industry is undergoing significant transformation, driven by factors such as technological advancements, regulatory changes, and evolving customer demands. Mesa Underwriters Specialty Insurance Company is well-positioned to navigate these challenges and capitalize on growth opportunities.

The company’s underwriting expertise, financial strength, and commitment to innovation enable it to adapt to changing market conditions. By leveraging technology, Mesa Underwriters can enhance its risk assessment capabilities, streamline processes, and improve customer service.

Regulatory Changes

Regulatory changes, such as the implementation of IFRS 17, are reshaping the industry. Mesa Underwriters is actively preparing for these changes, ensuring compliance and minimizing potential disruptions. The company’s strong financial position and robust risk management framework provide a solid foundation for adapting to new regulatory requirements.

Customer Expectations

Customer expectations are evolving, with a growing demand for personalized insurance solutions and seamless digital experiences. Mesa Underwriters is investing in technology and customer-centric initiatives to meet these evolving needs. By providing tailored coverage options and user-friendly digital platforms, the company can enhance customer satisfaction and loyalty.

Growth Opportunities

Amidst the challenges, Mesa Underwriters Specialty Insurance Company identifies growth opportunities in emerging markets and underserved niches. The company’s underwriting expertise and ability to develop innovative products enable it to expand into new areas and capitalize on market gaps.

Areas for Improvement

To maintain its competitive edge, Mesa Underwriters Specialty Insurance Company continuously evaluates its operations and identifies areas for improvement. The company focuses on enhancing its risk management capabilities, optimizing underwriting processes, and investing in technology to drive efficiency and innovation.

By embracing industry trends and addressing challenges, Mesa Underwriters Specialty Insurance Company is well-positioned to thrive in the dynamic specialty insurance market. The company’s commitment to underwriting excellence, financial strength, and customer-centricity will continue to drive its success in the years to come.

Competitive Landscape

Mesa Underwriters Specialty Insurance Company operates in a competitive specialty insurance market. Key competitors include:

– AIG

– Chubb

– CNA Financial

– Everest Re

– Liberty Mutual

– Markel

– Travelers

Mesa Underwriters differentiates itself through its focus on niche markets, such as professional liability, cyber insurance, and environmental insurance. The company’s strengths include its underwriting expertise, strong relationships with brokers, and financial stability. However, it faces competition from larger insurers with broader product offerings and greater market share.

Competitive Advantages

– Niche market focus

– Underwriting expertise

– Strong broker relationships

– Financial stability

Areas for Differentiation

– Innovation in product development

– Expanded distribution channels

– Enhanced customer service