Company Overview

Mesa Underwriters Speciality Insurance Company (Mesa Underwriters) is a leading provider of specialty insurance products and services to businesses and individuals throughout the United States. Founded in 2001, the company has a proven track record of providing innovative and customized insurance solutions to meet the unique needs of its clients.

Mesa Underwriters’ mission is to provide its clients with peace of mind by offering comprehensive and tailored insurance coverage. The company’s vision is to be the most trusted and respected specialty insurance provider in the industry. Mesa Underwriters’ core values include integrity, innovation, customer focus, and financial strength.

Financial Performance and Market Position

Mesa Underwriters has consistently achieved strong financial performance. The company has a solid capital base and a track record of profitability. Mesa Underwriters is well-positioned in the specialty insurance market and has a growing market share.

Insurance Products and Services

Mesa Underwriters Speciality Insurance Company offers a comprehensive suite of insurance products and services tailored to meet the unique needs of businesses and individuals. The company’s product portfolio encompasses a wide range of coverage options, including:

Commercial Insurance

Mesa Underwriters provides a range of commercial insurance solutions designed to protect businesses from financial risks and liabilities. These include:

- Commercial General Liability Insurance: Protects businesses against claims for bodily injury, property damage, and other liabilities arising from their operations.

- Commercial Property Insurance: Covers business property, including buildings, equipment, and inventory, against damage or loss due to fire, theft, or other covered perils.

- Business Interruption Insurance: Provides coverage for lost income and expenses incurred during a business interruption caused by a covered event.

- Cyber Liability Insurance: Protects businesses from financial losses resulting from data breaches, cyber attacks, and other cyber-related incidents.

Personal Insurance

Mesa Underwriters also offers a variety of personal insurance products to safeguard individuals and families. These include:

- Homeowners Insurance: Provides coverage for homes and personal belongings against damage or loss due to fire, theft, and other covered perils.

- Renters Insurance: Protects renters against financial losses resulting from damage to their personal belongings or liability for injuries to others within the rented property.

- Auto Insurance: Provides coverage for vehicles against damage or loss due to accidents, theft, or other covered perils.

- Life Insurance: Provides financial protection for loved ones in the event of the insured’s death.

Specialty Insurance

In addition to its commercial and personal insurance offerings, Mesa Underwriters specializes in providing unique and customized insurance solutions for niche markets. These include:

- Professional Liability Insurance: Protects professionals, such as doctors, lawyers, and accountants, against claims of negligence or errors and omissions in their professional services.

- Directors and Officers Liability Insurance: Protects directors and officers of companies against claims for breach of fiduciary duty or other wrongful acts.

- Event Insurance: Provides coverage for special events, such as concerts, festivals, and sporting events, against financial losses due to cancellation, weather-related incidents, or other unforeseen circumstances.

- Surety Bonds: Guarantees the performance of specific obligations, such as construction contracts or court appearances.

Risk Management and Underwriting

Mesa Underwriters Speciality Insurance Company adopts a comprehensive risk management and underwriting process to ensure accurate risk assessment and optimal pricing. This process involves thorough evaluation of potential risks and their potential financial impact.

Factors Considered in Risk Evaluation

When evaluating risks, Mesa Underwriters considers various factors, including:

- Nature of the Risk: Identifying the inherent hazards and potential causes of loss associated with the insured property or activity.

- Loss History: Analyzing past claims data to assess the frequency and severity of losses experienced by similar risks.

- Underwriting Guidelines: Adhering to established criteria and industry best practices to ensure consistency in risk assessment.

- External Factors: Considering environmental conditions, economic trends, and regulatory changes that may impact the risk profile.

Pricing of Risks

Based on the risk evaluation, Mesa Underwriters determines appropriate premiums that reflect the potential financial exposure. This pricing process considers factors such as:

- Expected Loss: Estimating the average amount of loss that may occur over a specific period.

- Expense Loading: Covering administrative and operating expenses associated with underwriting and claims handling.

- Profit Margin: Providing a reasonable return on investment for shareholders.

Claims Management

Mesa Underwriters employs a dedicated claims team to handle claims efficiently and effectively. The claims process involves:

- Prompt Investigation: Investigating claims promptly to determine coverage and extent of loss.

- Fair Settlement: Negotiating fair and equitable settlements that comply with policy terms and legal requirements.

- Subrogation: Pursuing recovery from third parties responsible for causing losses, reducing the financial impact on policyholders.

Customer Service and Support

Mesa Underwriters Speciality Insurance Company prioritizes exceptional customer service and support. Our dedicated team is available through various channels to provide prompt and personalized assistance.

Customers can access support via phone, email, or live chat. Our representatives are knowledgeable, courteous, and committed to resolving inquiries efficiently.

Support Channels

- Phone: Customers can call our toll-free number for immediate assistance.

- Email: Inquiries can be submitted via our dedicated email address, ensuring timely responses.

- Live Chat: Our website offers a convenient live chat feature for real-time support.

Testimonials

“I was impressed by the prompt and helpful service I received from Mesa Underwriters. My agent was patient and answered all my questions thoroughly.” – Satisfied Customer

Mesa Underwriters Speciality Insurance Company is committed to delivering an exceptional customer experience, ensuring that every interaction is positive and supportive.

Technology and Innovation

Mesa Underwriters Speciality Insurance Company has made significant investments in technology and innovation to enhance its operations and improve the customer experience.

These initiatives have enabled the company to streamline its processes, improve underwriting accuracy, and provide faster and more personalized service to its clients.

Data Analytics and Machine Learning

Mesa Underwriters Speciality Insurance Company utilizes data analytics and machine learning algorithms to analyze large volumes of data, identify patterns, and make informed underwriting decisions.

This technology helps the company to assess risk more accurately, price policies more competitively, and detect fraud.

Customer Relationship Management (CRM) System

The company has implemented a robust CRM system that provides a centralized platform for managing customer interactions, tracking policy information, and generating personalized communications.

This system enables Mesa Underwriters Speciality Insurance Company to provide tailored service to each client, based on their individual needs and preferences.

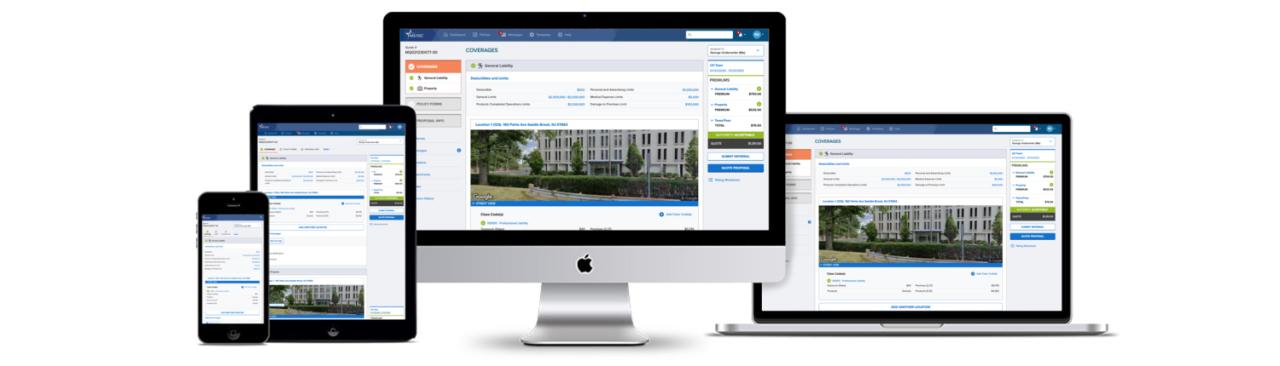

Online Policy Management

Mesa Underwriters Speciality Insurance Company offers its clients a convenient online portal where they can manage their policies, view policy documents, make payments, and report claims.

This portal provides clients with 24/7 access to their insurance information, empowering them to manage their policies with ease.

Artificial Intelligence (AI) Chatbot

The company has deployed an AI-powered chatbot to assist customers with general inquiries, provide policy information, and resolve common issues.

This chatbot is available 24/7 and can handle a wide range of questions, offering clients quick and convenient support.

Industry Trends and Challenges

The insurance industry is constantly evolving, driven by technological advancements, changing regulatory landscapes, and evolving customer expectations. Mesa Underwriters Speciality Insurance Company is keenly aware of these trends and challenges and is proactively adapting to stay ahead of the curve.

One of the most significant trends shaping the industry is the rise of digitalization. Customers increasingly expect seamless and convenient online experiences, and insurers are investing heavily in technology to meet this demand. Mesa Underwriters Speciality Insurance Company has embraced digitalization, offering online policy management, claims processing, and customer support.

Regulatory Changes

The insurance industry is also subject to constant regulatory changes, both domestically and internationally. These changes can impact everything from product offerings to pricing. Mesa Underwriters Speciality Insurance Company closely monitors regulatory developments and works closely with regulators to ensure compliance and minimize the impact on its customers.

Climate Change

Climate change is another major challenge facing the insurance industry. Increasingly frequent and severe natural disasters are leading to higher claims costs and making it more difficult for insurers to assess risk. Mesa Underwriters Speciality Insurance Company is investing in research and development to better understand and mitigate the risks associated with climate change.

Cybersecurity

Cybersecurity is a growing concern for businesses of all sizes, and the insurance industry is no exception. Mesa Underwriters Speciality Insurance Company offers a range of cyber insurance products to help businesses protect themselves from the financial consequences of cyberattacks.

Company Culture and Values

Mesa Underwriters Speciality Insurance Company fosters a collaborative and inclusive work environment that values integrity, innovation, and customer-centricity. These core values guide every aspect of the company’s operations, from underwriting decisions to customer interactions.

The company believes that its employees are its most valuable asset, and it invests heavily in their professional development and well-being. Mesa Underwriters offers a comprehensive benefits package, including health insurance, paid time off, and tuition reimbursement. The company also promotes a work-life balance by encouraging employees to take advantage of flexible work arrangements and paid parental leave.

Community Involvement

Mesa Underwriters Speciality Insurance Company is committed to giving back to the communities it serves. The company supports a variety of charitable organizations, including those that focus on education, healthcare, and the arts. Mesa Underwriters also encourages its employees to volunteer their time to local causes.