Media Liability Insurance Coverage Basics

Media liability insurance is a crucial protection for businesses and individuals involved in media-related activities. It provides coverage against financial losses arising from claims related to defamation, copyright infringement, and other media-related risks.

Types of Risks Covered

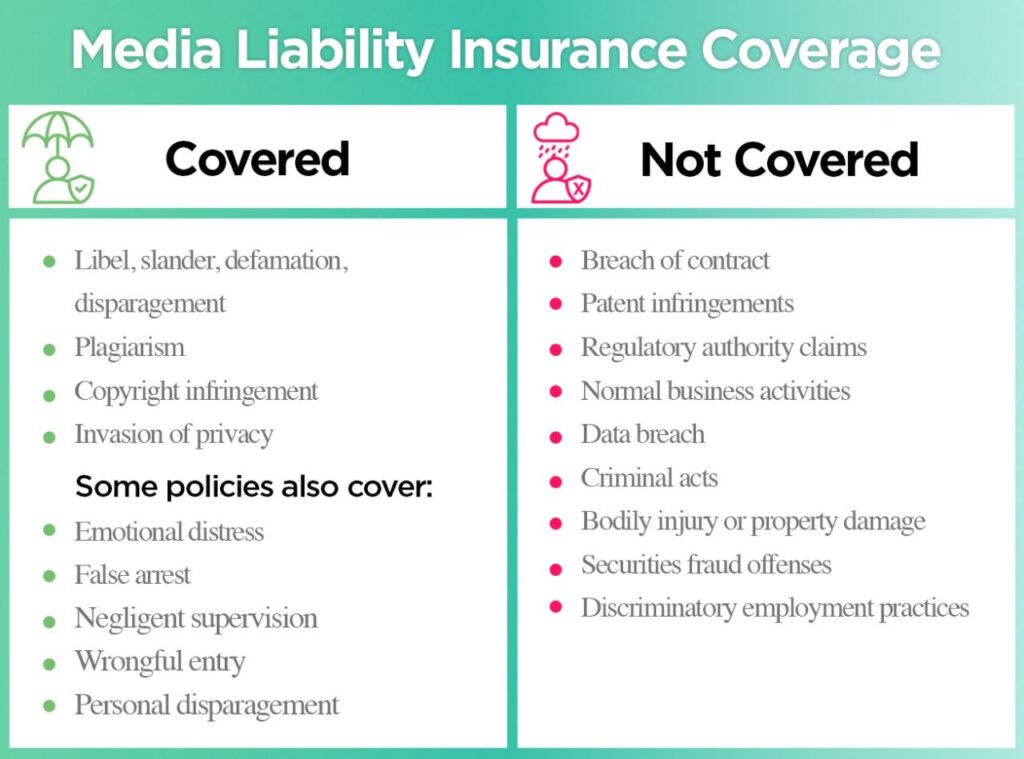

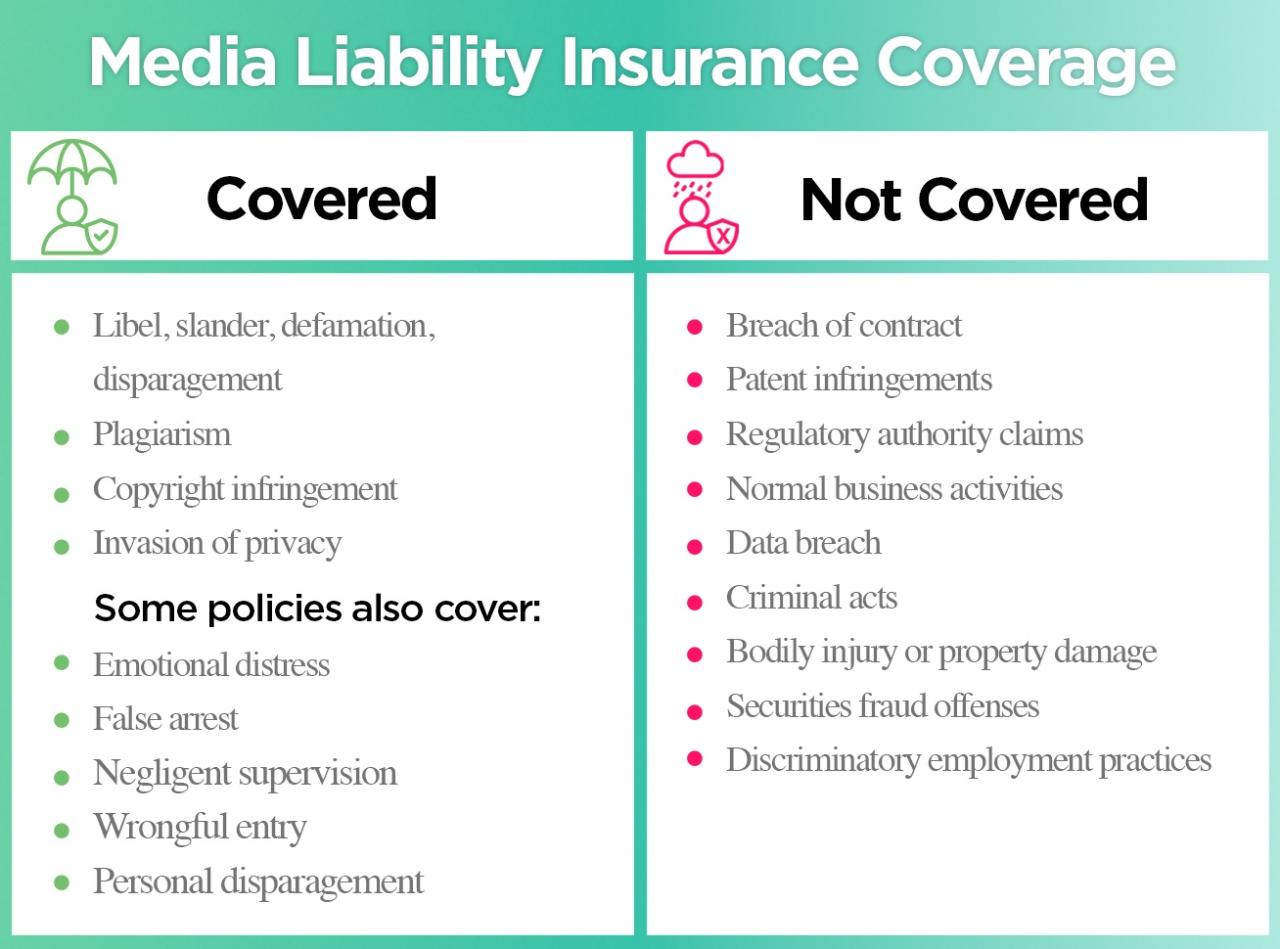

Media liability insurance typically covers a wide range of risks, including:

- Libel: Written or published statements that damage a person’s reputation.

- Slander: Spoken statements that damage a person’s reputation.

- Copyright Infringement: Unauthorized use of copyrighted material, such as images, music, or text.

- Invasion of Privacy: Unauthorized disclosure of private information.

- Emotional Distress: Causing emotional harm to an individual through media content.

Importance of Adequate Coverage Limits

Obtaining adequate coverage limits is essential to ensure sufficient protection against potential claims. Factors to consider when determining coverage limits include:

- Nature of the Media Activities: The higher the risk of potential claims, the higher the coverage limits required.

- Financial Resources: The business or individual should have enough coverage to cover potential legal costs and damages.

- Industry Standards: Coverage limits should be comparable to industry standards to maintain credibility and protect against lawsuits.

Claims Process and Coverage Considerations

In the unfortunate event of a media liability claim, it is crucial to follow the proper steps and provide the necessary documentation to ensure a smooth and successful claims process.

The claims process typically involves the following steps:

- Promptly notify your insurer: It is essential to report the claim as soon as possible to allow your insurer to initiate the investigation process.

- Provide detailed information: Submit a comprehensive written description of the incident, including the date, time, location, and individuals involved.

- Gather supporting documentation: Collect and submit relevant evidence such as emails, contracts, and any other materials that support your claim.

- Cooperate with the insurer’s investigation: Provide any requested information and participate in interviews or examinations as necessary.

- Negotiate a settlement: If liability is established, the insurer will negotiate a settlement with the claimant on your behalf.

Factors Affecting Claim Outcome

The outcome of a media liability claim can be influenced by several factors, including:

- Strength of evidence: The more compelling the evidence supporting your claim, the stronger your position will be.

- Insurer’s assessment of liability: The insurer will assess the facts of the case and determine the extent of your liability, if any.

- Policy limits: The amount of coverage available under your policy will impact the settlement amount.

- Legal fees: If the claim proceeds to litigation, the costs of legal representation will be covered by your policy, up to the policy limits.

Risk Management and Loss Prevention

Media organizations can mitigate their risk of media liability claims by implementing robust risk management and loss prevention strategies. These strategies should focus on identifying potential risks, developing protocols to address them, and providing training to staff on media law and ethics.

Legal Counsel Review

Legal counsel plays a crucial role in mitigating media liability risks. By reviewing content before publication, legal counsel can identify potential legal issues and advise on appropriate revisions to minimize the risk of claims. This review should be thorough and should consider all potential legal implications, including defamation, privacy, and copyright infringement.

Staff Training

Training staff on media law and ethics is essential for preventing media liability claims. This training should cover the basics of media law, including defamation, privacy, and copyright law. It should also cover ethical considerations, such as the importance of accuracy, fairness, and objectivity. By providing staff with this training, media organizations can help to ensure that their employees are aware of the legal and ethical risks associated with their work.

Market Trends and Industry Developments

The media liability insurance landscape is constantly evolving, driven by emerging trends in technology, social media, and regulatory changes.

One significant trend is the increasing use of social media, which has created new risks and challenges for businesses. Social media platforms can amplify content quickly, potentially leading to reputational damage, defamation, or copyright infringement. As a result, businesses need to be aware of the potential liabilities associated with social media and ensure they have adequate insurance coverage in place.

Technology and Coverage Needs

Technology is another major factor shaping the media liability insurance landscape. The rise of artificial intelligence (AI) and machine learning (ML) has led to concerns about potential biases or discrimination in content creation. Businesses need to be aware of these risks and ensure they have coverage for potential liabilities arising from AI-generated content.

Role of Insurance Regulators

Insurance regulators play a crucial role in shaping the media liability insurance landscape. Regulators set guidelines and standards for insurance policies, ensuring that they provide adequate coverage for policyholders. They also work to protect consumers from unfair or deceptive practices by insurance companies.