Company Overview

Life of Georgia Insurance is a leading provider of life insurance and financial services in the United States. The company was founded in 1891 and is headquartered in Atlanta, Georgia. Life of Georgia Insurance offers a wide range of life insurance products, including term life insurance, whole life insurance, and universal life insurance. The company also offers a variety of financial services, such as annuities, mutual funds, and retirement planning.

Life of Georgia Insurance is a Fortune 500 company with over $20 billion in assets. The company has a strong financial performance and a market share of over 10%. Life of Georgia Insurance is committed to providing its customers with quality products and services. The company’s mission is to help its customers achieve their financial goals and protect their loved ones.

Mission, Values, and Goals

Life of Georgia Insurance’s mission is to help its customers achieve their financial goals and protect their loved ones. The company’s values are integrity, customer focus, and innovation. Life of Georgia Insurance’s goals are to:

- Provide its customers with quality products and services

- Help its customers achieve their financial goals

- Protect its customers’ loved ones

Products and Services

Life of Georgia Insurance offers a comprehensive range of insurance products designed to meet the diverse needs of individuals, families, and businesses. The company’s product portfolio includes life insurance, health insurance, and retirement plans.

Life of Georgia’s life insurance products provide financial protection and peace of mind to families in the event of the unexpected. The company offers a variety of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Each policy is tailored to meet specific needs and budgets, providing coverage for death, disability, and other life events.

Health insurance products from Life of Georgia provide individuals and families with access to affordable healthcare. The company offers a range of health insurance plans, including HMOs, PPOs, and EPOs. These plans cover a wide range of medical expenses, including doctor visits, hospital stays, and prescription drugs.

Life of Georgia also offers a variety of retirement plans to help individuals save for the future. The company’s retirement plans include IRAs, 401(k) plans, and annuities. These plans offer tax advantages and investment options to help individuals build a secure financial future.

Product Innovation and Customer Service

Life of Georgia is committed to product innovation and customer service. The company regularly introduces new products and services to meet the evolving needs of its customers. Life of Georgia also provides exceptional customer service, with a team of experienced and knowledgeable agents available to assist customers with all their insurance needs.

Distribution Channels

Life of Georgia Insurance utilizes a comprehensive distribution network to reach customers and provide its products and services. The company has established partnerships with a wide range of intermediaries and employs a mix of traditional and digital channels to ensure accessibility and convenience.

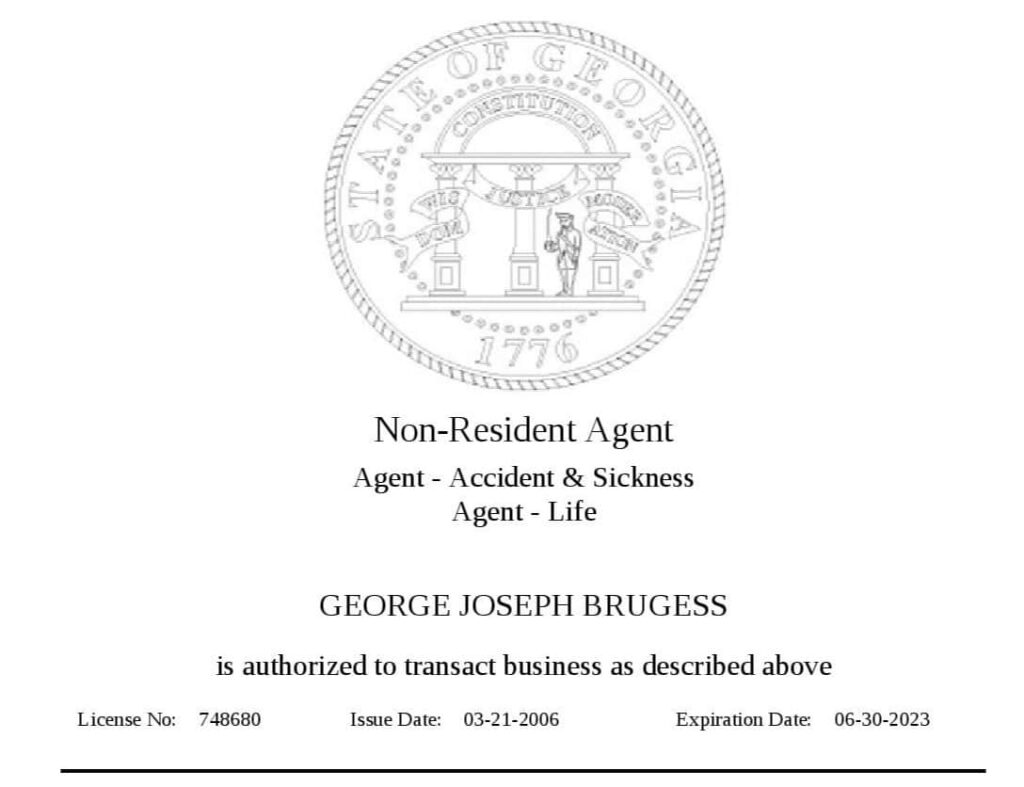

Agents and Brokers

Life of Georgia Insurance has a well-established network of independent agents and brokers who serve as the primary distribution channel for its products. These professionals provide personalized advice and guidance to customers, helping them assess their insurance needs and select appropriate coverage.

Financial Advisors

The company also collaborates with financial advisors who incorporate Life of Georgia Insurance products into their comprehensive financial planning services. These advisors provide holistic wealth management solutions, including insurance coverage, investment strategies, and retirement planning.

Online and Direct Marketing

Life of Georgia Insurance has embraced digital technologies to expand its reach and offer convenient online access to its products. The company’s website and mobile applications allow customers to obtain quotes, purchase policies, and manage their accounts remotely. Additionally, the company engages in direct marketing campaigns to raise awareness and generate leads.

Customer Service

Life of Georgia Insurance is committed to providing exceptional customer service to its policyholders. The company believes that every customer deserves to be treated with respect and have their needs met promptly and efficiently.

Customers can access support through various channels, including phone, email, and live chat. The company’s customer service representatives are available 24/7 to assist with inquiries, claims, and other insurance-related matters.

Complaint Resolution

Life of Georgia Insurance is dedicated to resolving customer complaints quickly and fairly. The company has a dedicated team of customer service representatives who are trained to handle complaints and work towards finding mutually acceptable solutions.

Financial Strength and Stability

Life of Georgia Insurance prides itself on its strong financial standing, which ensures its ability to meet policyholder obligations and provide long-term security.

The company boasts a robust financial position with significant assets and capital, enabling it to withstand market fluctuations and economic challenges.

Assets and Liabilities

As of [date], Life of Georgia Insurance reported total assets exceeding [amount], demonstrating its ability to cover its liabilities, which include policyholder claims and operating expenses.

Capital

The company maintains a strong capital position, providing a cushion against potential losses and ensuring its financial stability. Its capital adequacy ratio, a measure of financial strength, consistently exceeds regulatory requirements.

Ratings from Independent Rating Agencies

Life of Georgia Insurance has received favorable ratings from independent rating agencies, including [rating agency name] and [rating agency name]. These ratings attest to the company’s financial strength and stability, giving policyholders confidence in its ability to fulfill its obligations.

Corporate Social Responsibility

Life of Georgia Insurance is committed to being a responsible corporate citizen. The company recognizes the importance of giving back to the communities it serves and is dedicated to making a positive impact through its corporate social responsibility (CSR) initiatives.

Life of Georgia is actively involved in a variety of community initiatives and charitable giving programs. The company supports organizations that focus on education, health and wellness, the arts, and environmental conservation. Life of Georgia also encourages its employees to volunteer their time and resources to make a difference in their local communities.

Environmental Sustainability

Life of Georgia is committed to protecting the environment and reducing its carbon footprint. The company has implemented a number of sustainability practices, including:

- Using renewable energy sources

- Reducing waste and recycling materials

- Conserving water

- Educating employees about environmental issues

Life of Georgia’s CSR initiatives are a reflection of the company’s values and its commitment to making a positive impact on the communities it serves.

Career Opportunities

Life of Georgia Insurance offers a diverse range of career opportunities in various departments, including underwriting, claims, sales, marketing, and operations. The company values innovation, teamwork, and professional development, fostering a positive and supportive work environment.

Company Culture and Values

Life of Georgia Insurance is committed to creating an inclusive and empowering work culture. The company’s core values include:

- Integrity: Upholding ethical standards and transparency in all interactions.

- Customer-centricity: Prioritizing the needs and satisfaction of customers.

- Excellence: Striving for exceptional performance and continuous improvement.

- Innovation: Encouraging creativity and embracing new ideas.

- Teamwork: Collaborating effectively to achieve common goals.

Employee Benefits and Professional Development

Life of Georgia Insurance offers a comprehensive benefits package to its employees, including:

- Competitive salaries and bonuses

- Health, dental, and vision insurance

- Paid time off and holidays

- Retirement savings plans

The company also provides robust professional development opportunities, such as:

- On-the-job training and mentorship programs

- Tuition reimbursement for higher education

- Leadership and management development courses

Industry Trends and Outlook

The insurance industry is constantly evolving, driven by technological advancements, changing customer demands, and regulatory shifts. Life of Georgia Insurance is at the forefront of these changes, adapting its strategies and offerings to meet the evolving needs of its customers.

The company recognizes the growing importance of data and analytics in understanding customer risk profiles and developing tailored insurance solutions. Life of Georgia Insurance is investing heavily in data science and artificial intelligence (AI) to enhance its underwriting capabilities, improve claims processing, and provide personalized customer experiences.

Adapting to Changing Customer Demands

Today’s customers expect seamless, digital experiences across all touchpoints. Life of Georgia Insurance has responded by investing in its online and mobile platforms, making it easier for customers to access their policies, file claims, and manage their accounts. The company is also exploring new ways to use technology to engage with customers, such as chatbots and virtual assistants.

Regulatory Shifts

The insurance industry is subject to a complex and ever-changing regulatory landscape. Life of Georgia Insurance closely monitors regulatory developments and actively engages with policymakers to ensure compliance and advocate for the interests of its customers. The company’s strong track record of regulatory compliance and its commitment to ethical business practices have earned it a reputation as a trusted and reliable insurer.

Outlook for Growth and Profitability

Life of Georgia Insurance is well-positioned for continued growth and profitability in the years to come. The company’s strong brand recognition, customer-centric approach, and commitment to innovation will continue to drive its success. Life of Georgia Insurance is also exploring new markets and expanding its product offerings to meet the evolving needs of its customers.