Life Insurance Series Overview

Life insurance series are financial products designed to provide financial protection to individuals and their families in the event of the policyholder’s death. They offer a lump sum payment to the designated beneficiaries, which can be used to cover various expenses such as funeral costs, outstanding debts, or future income replacement.

There are different types of life insurance series available, each with its unique features and benefits. The most common types include:

Term Life Insurance

- Provides coverage for a specific period, such as 10, 20, or 30 years.

- Typically has lower premiums compared to other types of life insurance.

- No cash value accumulation.

Whole Life Insurance

- Provides coverage for the entire life of the insured.

- Has higher premiums than term life insurance.

- Accumulates cash value over time, which can be borrowed against or withdrawn.

Universal Life Insurance

- A flexible type of life insurance that allows policyholders to adjust their coverage and premium payments.

- Has a cash value component that grows tax-deferred.

- Offers more investment options compared to other types of life insurance.

Benefits of Life Insurance Series

Life insurance series offers a wide range of benefits that can provide financial security and peace of mind to individuals and families. These benefits encompass financial protection, estate planning advantages, and tax benefits.

Financial protection is a cornerstone of life insurance series. The death benefit can provide a substantial financial cushion for beneficiaries, ensuring they have the resources to cover unexpected expenses, such as funeral costs, outstanding debts, or mortgage payments. This financial protection can help families maintain their standard of living and avoid financial hardship in the event of the policyholder’s passing.

Estate planning is another significant advantage of life insurance series. By designating beneficiaries, policyholders can control the distribution of their assets after their death. This allows them to ensure that their loved ones receive the financial support they need, even if the policyholder’s estate is subject to probate or other legal proceedings.

Finally, life insurance series can offer tax benefits. The death benefit is generally tax-free for beneficiaries, providing a significant financial advantage. Additionally, in some cases, policyholders may be able to deduct life insurance premiums from their taxable income, further reducing their tax burden.

Considerations for Choosing Life Insurance Series

When selecting a life insurance series, consider the following factors:

* Coverage Amount: Determine the amount of coverage you need based on your income, debts, dependents, and future financial goals.

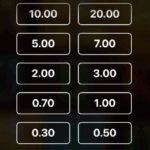

* Premium Costs: Factor in the monthly or annual premiums you can afford, considering your budget and financial obligations.

* Riders and Endorsements: These optional additions provide additional coverage or benefits, such as disability or long-term care, at an extra cost.

Coverage Amount

The coverage amount should be sufficient to provide financial protection for your loved ones in case of your untimely demise. Consider the following:

* Income Replacement: Coverage should cover your annual income for several years to ensure your family can maintain their lifestyle.

* Debt Coverage: Ensure coverage is sufficient to pay off any outstanding debts, such as mortgages or student loans.

* Funeral Expenses: Coverage should include funds for funeral costs and other end-of-life expenses.

Premium Costs

Premiums vary based on your age, health, and coverage amount. It’s crucial to find a balance between affordability and adequate coverage.

* Consider Your Budget: Premiums should not strain your financial situation.

* Shop Around: Compare quotes from multiple insurance companies to find the best rates.

* Negotiate: Discuss premium discounts or payment plans with the insurance provider.

Riders and Endorsements

Riders and endorsements enhance your life insurance policy by providing additional coverage. Some common options include:

* Disability Rider: Provides income protection if you become disabled and unable to work.

* Long-Term Care Rider: Covers expenses related to long-term care, such as nursing home stays or assisted living.

* Accidental Death Benefit: Provides an additional payout in case of accidental death.

Comparison of Life Insurance Series

Different life insurance series offer varying levels of coverage, premiums, and features. Understanding these differences is crucial for selecting the series that aligns with your specific needs and financial situation.

The following table compares key aspects of common life insurance series:

Table: Life Insurance Series Comparison

| Coverage Type | Premium Costs | Key Features |

|---|---|---|

| Term Life Insurance | Lower premiums | Provides coverage for a specific period (term), typically 10, 20, or 30 years. |

| Whole Life Insurance | Higher premiums | Provides lifelong coverage and includes a cash value component that grows over time. |

| Universal Life Insurance | Flexible premiums | Offers flexibility in premium payments and coverage amounts, with a cash value component that earns interest. |

| Variable Life Insurance | Market-linked premiums | Premiums and cash value are linked to market performance, providing potential for higher returns but also greater risk. |

| Indexed Universal Life Insurance | Premiums tied to an index | Premiums and cash value are tied to an index, offering some protection from market volatility while providing growth potential. |

Summary: Term life insurance offers affordable coverage for a limited period, while whole life insurance provides lifelong coverage but with higher premiums. Universal life insurance offers flexibility, while variable life insurance is market-linked and carries higher risk. Indexed universal life insurance provides a balance between protection and growth potential.

Tips for Getting the Most from Life Insurance Series

Life insurance series can be a valuable tool for protecting your loved ones and ensuring their financial security in the event of your passing. Here are some tips to help you get the most from your life insurance series:

Review your coverage regularly: Your life insurance needs can change over time, so it’s important to review your coverage regularly to make sure you have the right amount of protection. Consider factors such as your age, income, family situation, and financial goals when determining your coverage needs.

Consider a term life insurance policy: Term life insurance is a type of life insurance that provides coverage for a specific period of time, such as 10, 20, or 30 years. Term life insurance is typically more affordable than whole life insurance, and it can be a good option if you need coverage for a specific period of time, such as while you’re raising a family or paying off a mortgage.

Shop around for the best rates: There are many different life insurance companies out there, so it’s important to shop around for the best rates. Be sure to compare quotes from multiple companies before you make a decision.

Take advantage of discounts: Many life insurance companies offer discounts for things like being a non-smoker, having a healthy lifestyle, or being a member of a professional organization. Be sure to ask about any discounts that you may be eligible for.

Consider using a life insurance broker: A life insurance broker can help you find the right life insurance policy for your needs and budget. A broker can also help you compare quotes from multiple companies and negotiate the best rates.