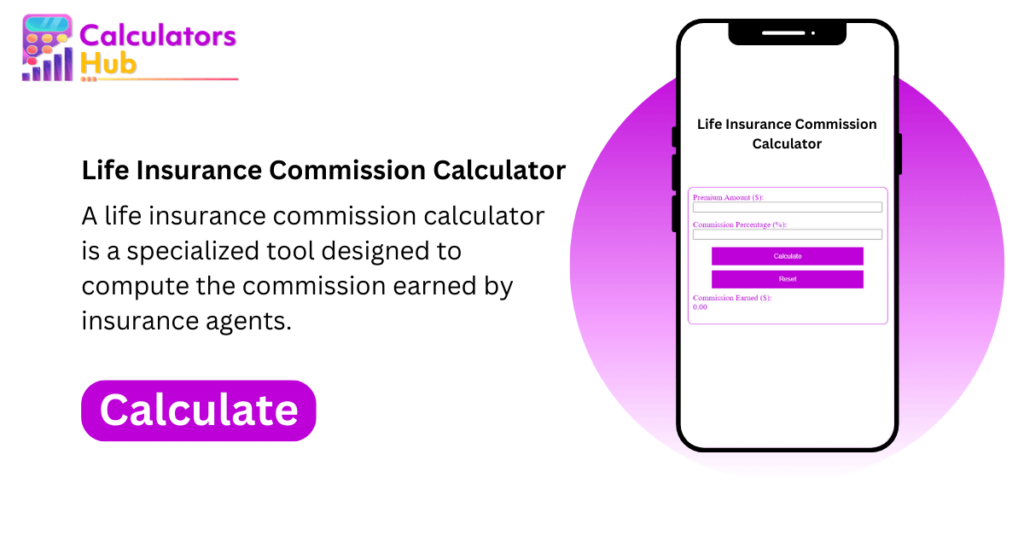

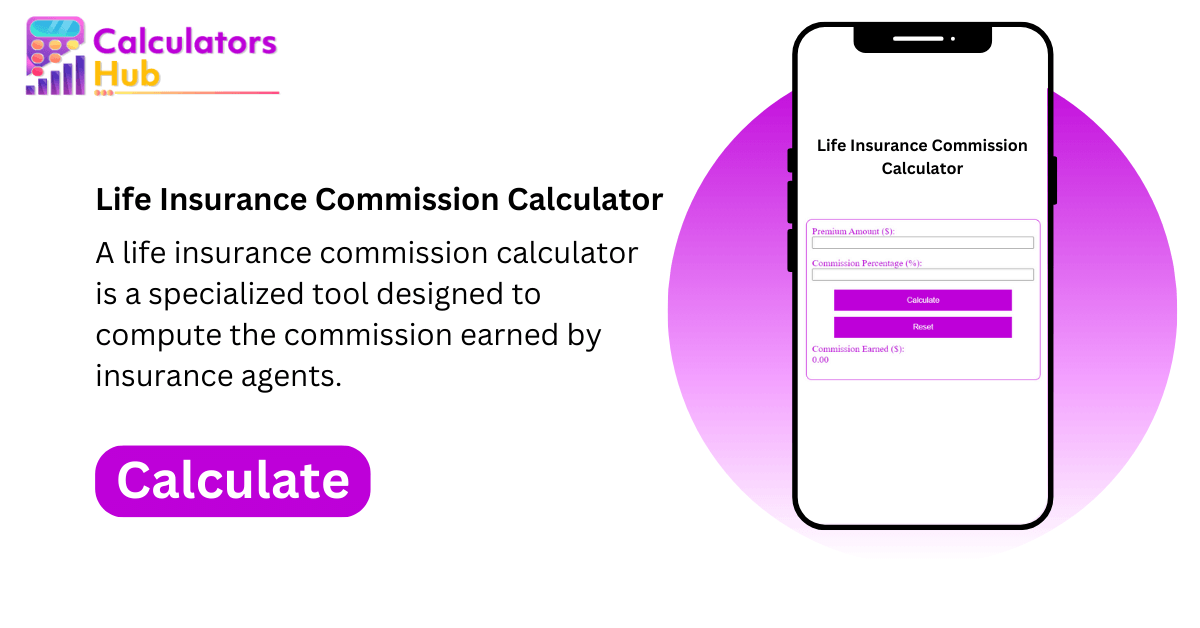

Overview of Life Insurance Commission Calculators

Life insurance commission calculators are tools that help life insurance agents estimate the potential commission they can earn from selling life insurance policies.

There are different types of life insurance commission calculators available, each with its own set of features. Some calculators are designed to provide a quick and easy estimate, while others are more comprehensive and allow agents to factor in a variety of variables.

Types of Life Insurance Commission Calculators

There are two main types of life insurance commission calculators:

- Basic calculators: These calculators are designed to provide a quick and easy estimate of the commission that an agent can earn from selling a life insurance policy. They typically require the agent to input the policy’s face amount, the premium, and the commission rate.

- Advanced calculators: These calculators are more comprehensive and allow agents to factor in a variety of variables, such as the policy’s term, the type of policy, and the agent’s experience level.

Examples of Life Insurance Commission Calculators

There are a number of different life insurance commission calculators available online. Some of the most popular calculators include:

- The Life Insurance Commission Calculator from InsuranceQuotes.com: This calculator is a basic calculator that allows agents to estimate the commission they can earn from selling a life insurance policy.

- The Life Insurance Commission Calculator from AccuQuote: This calculator is a more advanced calculator that allows agents to factor in a variety of variables, such as the policy’s term, the type of policy, and the agent’s experience level.

- The Life Insurance Commission Calculator from LifeQuotes.com: This calculator is a comprehensive calculator that allows agents to factor in a variety of variables, including the policy’s face amount, the premium, the commission rate, the policy’s term, the type of policy, and the agent’s experience level.

Factors Affecting Life Insurance Commissions

Life insurance commissions are not fixed and vary based on several factors. Understanding these factors is crucial for agents to optimize their earnings and for policyholders to make informed decisions.

Premium Amount

The premium amount is a primary determinant of life insurance commissions. Higher premiums typically result in higher commissions for agents. This is because insurance carriers compensate agents based on a percentage of the premium collected.

Policy Type

Different life insurance policies have varying commission structures. Term life insurance policies, which provide coverage for a specific period, generally offer lower commissions compared to whole life or universal life insurance policies, which provide coverage for the policyholder’s entire life or have a cash value component, respectively.

Agent Experience

Experienced agents with a proven track record of success often command higher commissions. Insurance carriers recognize their expertise and value in attracting and retaining clients.

Insurance Carriers and Distribution Channels

Insurance carriers and distribution channels play a significant role in determining commissions. Different carriers have varying commission structures, and the same policy sold through different channels (e.g., direct-to-consumer vs. through an agent) may have different commission rates.

Using Life Insurance Commission Calculators

Using life insurance commission calculators is straightforward and can provide valuable insights into your potential earnings. Here’s a step-by-step guide to help you get started:

Inputting Data

Most life insurance commission calculators require you to input basic information such as:

- Your annualized sales volume

- Average policy size

- Type of policies sold (e.g., term, whole life)

- Commission rates or schedule

Ensure you have accurate and up-to-date information before proceeding.

Interpreting Results

Once you have inputted the necessary data, the calculator will generate an estimate of your potential commissions. This information can help you:

- Set realistic sales goals

- Compare different commission structures

- Make informed decisions about your career path

Limitations and Considerations

While life insurance commission calculators can provide helpful insights, it’s important to be aware of their limitations:

- They rely on the accuracy of the data you input.

- They may not account for all factors that can affect your commissions, such as market conditions or carrier bonuses.

- They are only estimates and should not be considered a guarantee of future earnings.

Use commission calculators as a tool to supplement your own research and analysis.

Comparing Life Insurance Commission Structures

Understanding the different life insurance commission structures is crucial for agents to maximize their earnings and plan their financial future. Each structure has its own advantages and disadvantages, which should be carefully considered before making a decision.

Commission Rates

The commission rate is the percentage of the premium paid to the agent for selling a life insurance policy. Commission rates vary depending on the insurance company, the type of policy, and the agent’s experience and qualifications.

Vesting Periods

The vesting period is the length of time an agent must wait before they have full ownership of their commissions. During the vesting period, the insurance company may hold a portion of the agent’s commissions in case the policy is canceled or the agent leaves the company.

Renewal Commissions

Renewal commissions are payments made to the agent each year after the policy is sold. These commissions are typically a percentage of the annual premium and provide the agent with a recurring income stream.

Comparison Table

The following table compares different life insurance commission structures:

| Structure | Commission Rates | Vesting Periods | Renewal Commissions |

|—|—|—|—|

| Front-Loaded | High initial commission | Long vesting period | Low renewal commissions |

| Level | Moderate initial commission | Shorter vesting period | Moderate renewal commissions |

| Back-Loaded | Low initial commission | Short vesting period | High renewal commissions |

Advantages and Disadvantages

Front-Loaded Structure:

* Advantages: High initial commission can provide a substantial income boost.

* Disadvantages: Long vesting period can create financial risk if the agent leaves the company or the policy is canceled.

Level Structure:

* Advantages: Moderate initial commission provides a stable income stream. Shorter vesting period reduces financial risk.

* Disadvantages: Lower renewal commissions may limit long-term earning potential.

Back-Loaded Structure:

* Advantages: High renewal commissions provide a strong recurring income stream. Short vesting period reduces financial risk.

* Disadvantages: Low initial commission can make it difficult to build a sustainable income in the early years.

The best commission structure for an agent will depend on their individual circumstances and financial goals. Agents should carefully consider the commission rates, vesting periods, and renewal commissions before making a decision.

Maximizing Life Insurance Commissions

Understanding how to maximize your life insurance commissions is crucial for increasing your earnings. Here are some effective strategies:

Building Relationships: Establishing strong relationships with clients is paramount. Provide exceptional service, listen attentively to their needs, and offer tailored solutions. By fostering trust and rapport, you can increase your chances of securing referrals and repeat business.

Understanding Client Needs

Understanding your clients’ financial goals, risk tolerance, and life circumstances is essential. By conducting thorough needs assessments, you can recommend policies that align with their unique requirements. This personalized approach enhances customer satisfaction and increases the likelihood of successful sales.

Leveraging Technology

Harness the power of technology to streamline your processes and enhance efficiency. Utilize software tools for lead generation, policy comparisons, and commission tracking. By automating tasks and leveraging data insights, you can focus on high-value activities that drive sales and maximize your earnings.

Best Practices for Increasing Sales

* Effective Communication: Clearly articulate the benefits of life insurance and how it aligns with clients’ needs. Use persuasive language and address their concerns.

* Sales Techniques: Employ proven sales techniques, such as active listening, objection handling, and closing strategies. Practice your presentation skills to deliver a compelling message.

* Follow-Up: Regularly follow up with clients to build rapport, provide updates, and address any questions. This proactive approach can increase sales and strengthen customer relationships.

Ethical Considerations in Life Insurance Commission Calculations

Using life insurance commission calculators can raise ethical concerns that need careful consideration. Transparency and disclosure are crucial to ensure that clients understand the commission structure and how it affects their financial decisions. Avoiding conflicts of interest and ensuring fair treatment of clients is paramount to maintain ethical standards in the industry.

Importance of Transparency and Disclosure

Transparency in commission calculations involves providing clear and easily understandable information to clients about the commissions earned on their policies. Disclosing the commission structure upfront helps clients make informed decisions and builds trust. Agents should disclose their compensation and any potential conflicts of interest that may arise from the commission structure.

Avoiding Conflicts of Interest

Conflicts of interest can occur when an agent’s financial interests conflict with the best interests of the client. Agents should avoid recommending policies solely based on the commission they will earn. They should prioritize the client’s needs and recommend policies that align with their financial goals and risk tolerance.

Ensuring Fair Treatment of Clients

Fair treatment of clients requires that agents provide unbiased advice and recommendations. They should not engage in misleading or deceptive practices to increase their commissions. Agents should treat all clients with respect and provide personalized service that meets their individual needs.