They check-in with us weekly law office bookkeeping or more, and they maintain and upgrade our financial systems as our firm continues to grow. We manage your firm’s day-to-day accounting with precision and legal industry experience. Essentially, an IOLTA account is used for client funds that, if they had their own account, wouldn’t generate enough interest to cover the costs of opening and maintaining that account. By pooling the money with other client funds, enough interest is generated to fund public service programs. While the specifics can vary by jurisdiction, when using an IOLTA account, any interest earned on the account is collected and forwarded to the state bar (usually to funds for social justice). Granted, if your bookkeeper and accountant are on board with it, and you take care to flag transactions properly, using your business account for personal transactions (or vice versa) isn’t the end of the world.

- These are formal contracts between the law firm and the client, outlining the scope of legal services to be provided, fee arrangements, and other terms of engagement.

- It is crucial to never commingle trust funds with the law firm’s operating funds and to promptly disburse funds as required.

- Implementing legal technology solutions such as Clio Manage can help manage client funds and conduct reconciliations, mitigating the risk of data entry errors.

- An essential aspect of law firm accounting is addressing the firm’s tax obligations.

- This means taking steps to ensure data security (using legal accounting software that maintains robust security standards can help with this).

- Picking an invoicing solution that automates the legwork can save you time and money.

Neglecting expense tracking

Generally Accepted Accounting Principles (GAAP) are common accounting rules, standards, and procedures developed by the Financial Accounting Standards Board (FASB). GAAP often serves as the foundation of the framework used by many law firms to help guide proper financial accounting and the preparation of financial statements. The overarching goal of GAAP is to ensure all companies, including law firms, consistently craft financial statements that are complete and comparable. And although accrual accounting gives you a good idea of your future income and expenses, it does not provide as clear a picture of your cash flow situation as cash basis accounting. This is a more appropriate accounting method for large firms with high client turnover. It is crucial to maintain meticulous record-keeping and to keep separate accounts, especially for trust accounting as required by state bar association rules.

- Ask your bank about payroll services and if they partner with payroll services to help you get started.

- It’s important to note that lawyers are not permitted to collect interest on money held in trust for their clients.

- In the legal field, where transparency and accountability are paramount, maintaining meticulous records becomes a cornerstone of client trust.

- Business Wire reports that 80% of businesses experience higher efficiency when outsourcing accounting tasks.

- Your law firm’s financial health and law firm’s cash flow depend on sound bookkeeping practices.

- In the episode, Sasha and Molly delve into revolutionary methods for improving law firm finances.

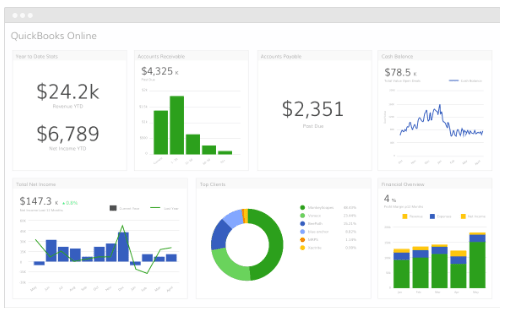

Q2: Can I use QuickBooks for my law firm, or do I need specialized software?

Allocating expenses between different clients and matters can be complex, especially with multiple attorneys or clients involved. Depending on other requirements, certain documents may need to be kept longer. For example, Accounts Payable Management the IRS recommends keeping tax-related documents and bank statements for seven years. However, the process can become tedious if you haven’t kept up with transactions throughout the month and don’t have statements handy. Your bookkeeper, CPA, and the IRS all require you to keep documents proving your income, credits, and tax deductions.

Law firm accounting: All you need to know

Commingling is when a law firm mixes client fixed assets funds with firm funds, either intentionally or by mistake. It’s a serious ethical violation that can result in bar sanctions, fines, and even disbarment. To avoid unintentional commingling, you must keep meticulous records, separate trust accounts, and regularly reconcile accounts.

How Accounting for Law Firm Can Benefit Your Business?

It’s particularly useful for managing cash flow and assessing the firm’s ability to meet short-term and long-term obligations. Meticulous record-keeping and regular audits help prevent errors and ensure compliance with bar association rules. Accurate, up-to-date bookkeeping gives your firm more than just clean records, it provides clarity, control, and the confidence to grow. Whether you’re looking to streamline operations, plan for expansion, or simply stay audit-ready, having a dedicated legal bookkeeping team behind you makes all the difference. Understanding financial performance, identifying profitable practice areas, and making informed business decisions becomes challenging without reliable bookkeeping.

Key Principles of Legal Accounting

Without the time-consuming burden of reconciling accounts and painstakingly double-checking costs and expenses, you can devote more time to activities you could bill your clients for. The basic principles of accounting and bookkeeping are no doubt easily understood by lawyers. Especially for CPA lawyers, these tasks may present no challenge at all—knowledge-wise, at least. With QuickBooks, lawyers can easily conduct three-way reconciliations, saving time and reducing errors. Moreover, QuickBooks automates the invoicing process for attorneys, which not only saves time but also ensures accuracy.

- Clear financial data reporting and analysis provides confidence in operational decision, management, transparency, and partner trust.

- This separation helps prevent errors like misapplying filing and service fees or recording a trust deposit as income.

- Cash accounting makes it easy to determine when a transaction has occurred (the money is either in the bank or out of the bank) and there’s no need to track receivables or payables.

- If there are any differences between the three, your trust reconciliation report should show the reason for the discrepancy.

With QuickBooks, we can keep accrual-based books and best accounting books for internal management and cash-basis reports for tax reasons. For compliance, financial clarity, and business growth, it’s important to have a bookkeeping system that is clear and uniform. Whether you do your own bookkeeping or work with Irvine Bookkeeping’s professional team, your system needs to put accuracy and dependability first.

Moreover, using legal-friendly services like LawPay and LawCharge can help avoid these unnecessary expenses while ensuring compliance with trust accounting laws. Each month, a team of professional bookkeepers with experience in legal accounting gathers your data for you and turns it into accurate financial statements. You also get smart software to help you monitor your finances and stay in control of cash flow. It’s essential for law firms to be aware of information reporting requirements and special issues affecting multinational firms. Compliance with tax regulations includes not only filing a timely tax return but also providing necessary documentation and maintaining transparent financial records.

Commingle operating and Client Trust Account funds

Some accountants record financial transactions, and some bookkeepers assist with business decisions and prepare financial statements. Aside from revenue and income, tracking billable hours can also be challenging for busy lawyers and law firms. Tracking billable time is a time-consuming and error-prone task that can significantly disrupt workflow without good record-checking practices. As an essential component of law firm success, use law practice management software to track billable time in real-time from any device and maintain confidence that all billable hours have been documented. Law firm accounting services bridge the gap, catering expert guidance tailored to the intricacies of the legal industry’s financial management.