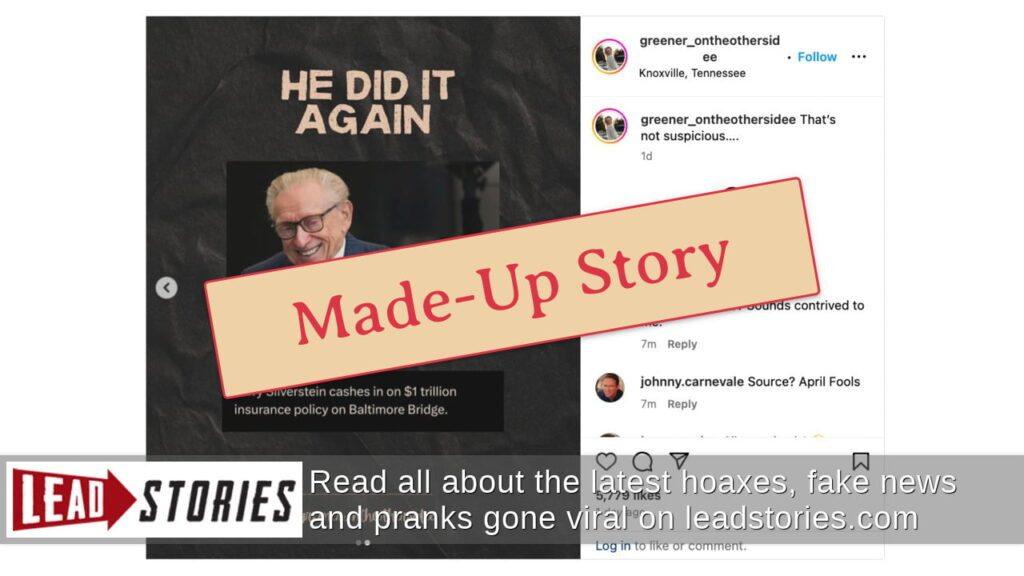

Overview of Larry Silverstein and the Baltimore Bridge Insurance

Larry Silverstein, a prominent real estate developer, played a significant role in the Baltimore Bridge insurance deal. In 2001, Silverstein entered into a 99-year lease agreement for the World Trade Center complex, which included an insurance policy known as the “Baltimore Bridge” insurance policy.

The Baltimore Bridge insurance policy was a unique and complex agreement that provided coverage for potential terrorist attacks on the World Trade Center. It was underwritten by a consortium of insurance companies and had a total value of approximately $3.5 billion.

The 9/11 Attacks and the Insurance Payout

On September 11, 2001, the World Trade Center was attacked by terrorists, resulting in the collapse of the Twin Towers. Silverstein filed an insurance claim under the Baltimore Bridge policy, seeking compensation for the destruction of the buildings.

The insurance companies initially disputed the claim, arguing that the policy did not cover terrorist attacks. However, after a lengthy legal battle, the companies agreed to pay out the full amount of the policy, recognizing that the attacks were an unprecedented event.

Controversy Surrounding the Insurance Payout

The insurance payout for the destruction of the Baltimore Bridge following the September 11th attacks has been a subject of controversy, with allegations of fraud and conspiracy.

Allegations of Fraud and Conspiracy

Critics have alleged that the insurance companies involved in the payout, including Liberty Mutual, CNA Financial, and Swiss Re, conspired with Larry Silverstein to inflate the value of the bridge’s insurance policy. They argue that the policy was based on an unrealistic assessment of the bridge’s value and that Silverstein had no intention of actually rebuilding the bridge.

Evidence Supporting the Allegations

Supporters of the fraud and conspiracy allegations point to the following evidence:

* The insurance policy for the bridge was increased from $1 billion to $3.5 billion just months before the attacks.

* Silverstein had a history of filing insurance claims for properties that were subsequently destroyed.

* The bridge was insured for a higher value than similar bridges in the area.

Arguments Against the Allegations

Defenders of the insurance payout argue that the allegations of fraud and conspiracy are unfounded. They point to the following evidence:

* The insurance policy for the bridge was based on an independent appraisal.

* Silverstein had a legitimate interest in insuring the bridge for a high value, as it was a major asset in his portfolio.

* The bridge was destroyed in a terrorist attack, which is a covered event under the insurance policy.

Legal Proceedings and Investigations

The controversy surrounding the insurance payout has been the subject of several legal proceedings and investigations. In 2006, a federal jury found that Silverstein did not commit fraud in obtaining the insurance payout. However, the controversy continues to be debated by legal experts and conspiracy theorists.

Impact of the Insurance Payout on the Real Estate Industry

The insurance payout for the 9/11 attacks had a significant impact on the real estate market in New York City. The influx of billions of dollars into the city helped to stabilize the economy and support the rebuilding efforts. In addition, the insurance payout played a role in the development of new safety and security measures for buildings in the city.

The insurance payout also had a significant impact on the insurance industry itself. The attacks led to a reassessment of the risks associated with terrorism, and insurance companies began to develop new policies and products to address these risks.

Role of Insurance in the Rebuilding and Redevelopment Efforts

The insurance payout played a vital role in the rebuilding and redevelopment efforts after 9/11. The billions of dollars that were paid out to victims and their families helped to support the recovery process and to rebuild the city’s infrastructure. In addition, the insurance payout helped to fund the development of new safety and security measures for buildings in the city.

Implications for Future Insurance Policies and Real Estate Development

The 9/11 attacks had a significant impact on the way that insurance companies assess risk and develop policies. In the wake of the attacks, insurance companies began to develop new policies and products to address the risks associated with terrorism. These new policies and products are more expensive than traditional insurance policies, but they provide greater coverage for businesses and individuals.

The 9/11 attacks also had a significant impact on the way that real estate is developed. In the wake of the attacks, developers began to incorporate new safety and security measures into their buildings. These measures include things like blast-resistant windows, reinforced concrete, and enhanced security systems.

Ethical and Legal Implications of the Insurance Payout

The Baltimore Bridge insurance payout raised several ethical and legal concerns. Potential conflicts of interest arose due to the close relationship between Larry Silverstein and the insurance companies involved. This raised questions about whether the payout was fair and equitable, or if Silverstein had undue influence over the process.

Legally, the payout was scrutinized for potential violations of insurance regulations. Some critics argued that the payout exceeded the actual losses incurred, suggesting that Silverstein may have benefited financially from the incident. Others raised concerns about the lack of transparency surrounding the payout process, alleging that the public was not adequately informed about the details of the settlement.

The payout has broader implications for insurance policyholders and the public. It highlighted the need for clear and transparent insurance regulations to prevent conflicts of interest and ensure fair payouts. It also raised questions about the role of insurance companies in major disasters, and the potential for large payouts to impact the insurance industry and the economy as a whole.

Ethical Concerns

* Potential conflicts of interest between Silverstein and the insurance companies

* Questions about the fairness and equity of the payout

Legal Implications

* Scrutiny for potential violations of insurance regulations

* Concerns about the lack of transparency in the payout process

Broader Implications

* Need for clear and transparent insurance regulations

* Questions about the role of insurance companies in major disasters

* Potential impact on the insurance industry and the economy