Insurance Coverage of Noom

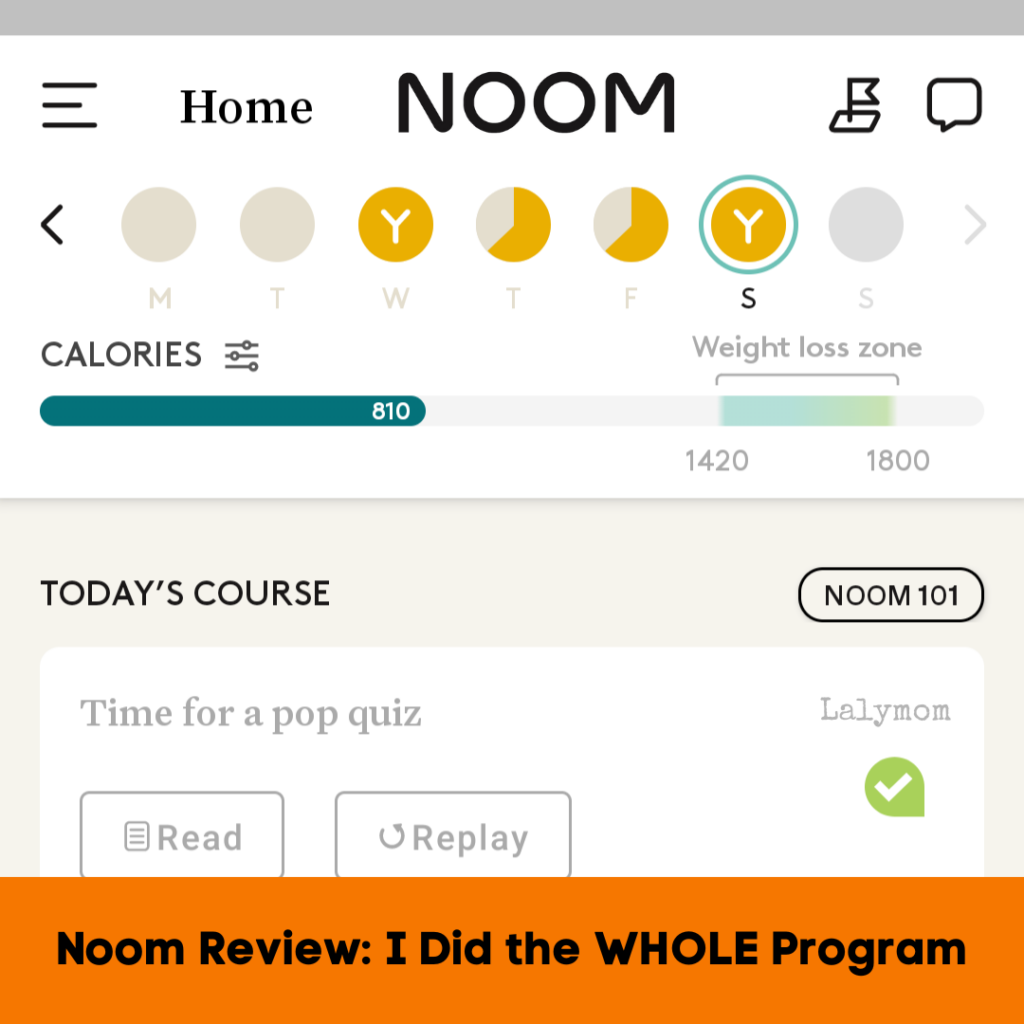

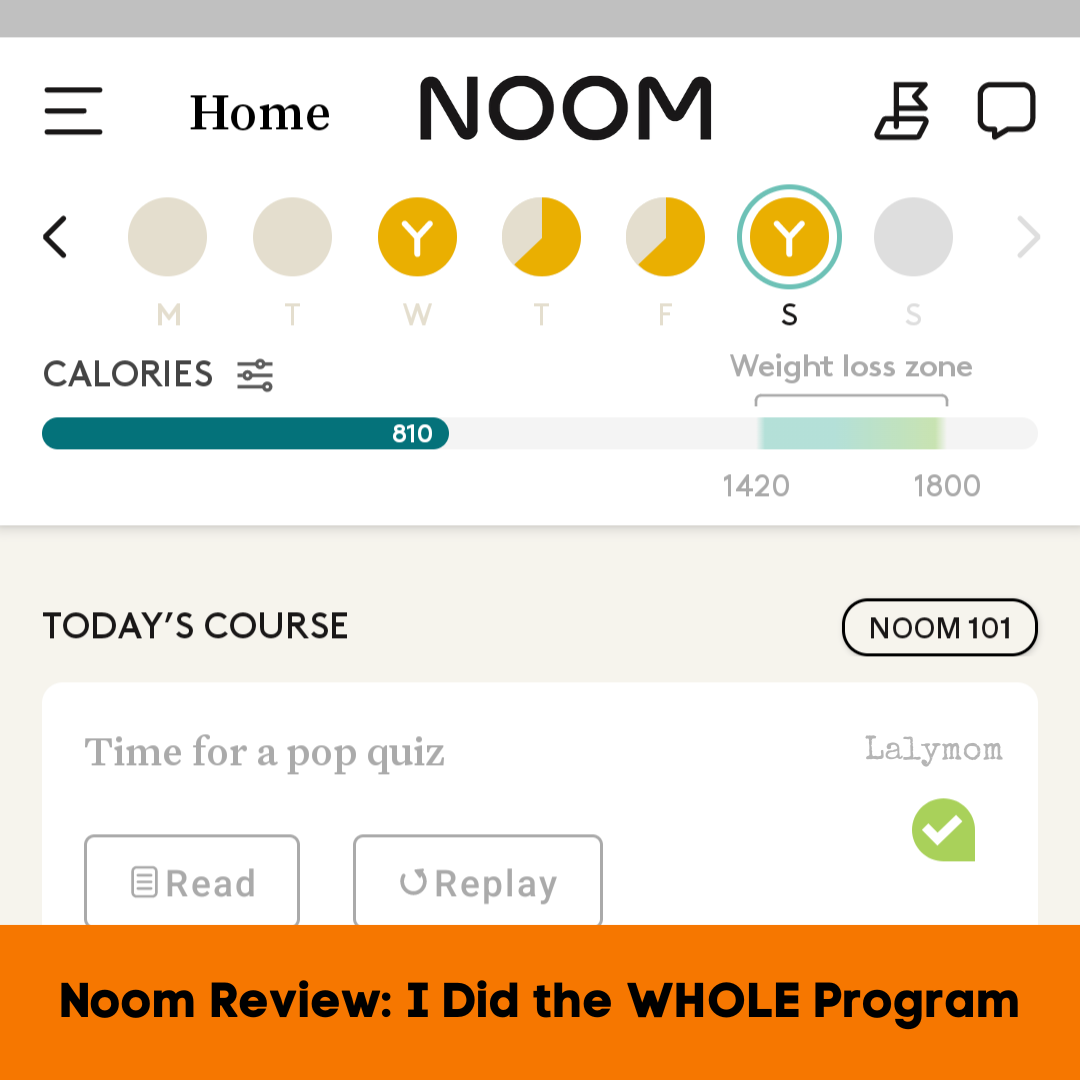

Noom is a weight loss program that provides personalized meal plans, activity tracking, and support from coaches and community members. Some insurance plans may cover the cost of Noom, depending on the type of plan and the specific benefits it offers.

There are several types of insurance plans that may cover Noom, including:

- Health insurance plans

- Wellness programs offered by employers

- Medicare and Medicaid

To determine if your insurance plan covers Noom, you can check your plan documents or contact your insurance provider directly. If your plan does cover Noom, you may need to meet certain criteria, such as having a qualifying medical condition or being enrolled in a specific wellness program.

Examples of Insurance Providers that Offer Coverage for Noom

Some insurance providers that offer coverage for Noom include:

- Blue Cross Blue Shield

- Cigna

- Humana

- UnitedHealthcare

Again, it’s important to check with your specific insurance provider to confirm coverage and any eligibility requirements.

Criteria and Eligibility Requirements for Insurance Coverage of Noom

The criteria and eligibility requirements for insurance coverage of Noom can vary depending on the insurance plan. However, some common criteria include:

- Having a qualifying medical condition, such as obesity or diabetes

- Being enrolled in a specific wellness program

- Meeting certain weight loss or activity goals

If you are interested in using Noom and are unsure if your insurance plan covers it, be sure to contact your insurance provider for more information.

Benefits of Insurance Coverage

Insurance coverage for Noom offers a range of financial and health-related benefits, making it a valuable investment for individuals seeking to improve their overall well-being.

Insurance coverage can significantly reduce the financial burden associated with Noom’s services. Noom offers a comprehensive program that includes personalized meal plans, exercise tracking, and support from health coaches. These services can be costly, especially for individuals who require long-term support. Insurance coverage can help offset these costs, making Noom more accessible and affordable.

Improved Access to Healthcare Services

Insurance coverage can improve access to healthcare services by providing financial assistance for medical expenses. This can include coverage for doctor’s visits, diagnostic tests, and prescription medications. By reducing the financial barriers to healthcare, insurance coverage can help individuals get the care they need to manage their weight and improve their overall health.

Positive Impact on Health Outcomes

Insurance coverage can have a positive impact on overall health outcomes by providing access to preventive care and early intervention. Preventive care, such as regular check-ups and screenings, can help identify and address health issues before they become more serious. Early intervention can also help individuals manage their weight and reduce the risk of developing chronic diseases, such as heart disease and diabetes.

Challenges to Insurance Coverage

Despite the potential benefits of insurance coverage for Noom, obtaining coverage can present certain challenges and barriers. These include:

One significant challenge lies in the role of pre-existing conditions in determining coverage eligibility. Pre-existing conditions are medical conditions that an individual had before enrolling in an insurance plan. Insurance companies may consider pre-existing conditions when assessing coverage for Noom, and they may deny coverage if they determine that Noom is primarily intended to treat or manage a pre-existing condition.

Appeals Process for Denied Insurance Claims

In the event that an insurance claim related to Noom is denied, individuals may have the right to appeal the decision. The appeals process typically involves submitting additional documentation and evidence to support the claim, such as medical records or a letter from a healthcare provider explaining the medical necessity of Noom. It is important to note that the appeals process can be complex and time-consuming, and there is no guarantee that the appeal will be successful.

Alternative Payment Options

If insurance coverage is unavailable, Noom offers alternative payment options to accommodate different financial situations. These options provide flexibility and accessibility to individuals seeking the program’s weight loss and wellness services.

Subscription Plans

Noom offers various subscription plans with varying durations and costs:

- Monthly Plan: The most flexible option, billed monthly with no long-term commitment.

- Quarterly Plan: Billed every three months, offering a discounted rate compared to the monthly plan.

- Annual Plan: The most cost-effective option, billed once a year with the highest discount.

The choice of plan depends on individual preferences, budget, and commitment level. The annual plan offers the greatest savings, but requires a longer upfront payment. Monthly plans provide flexibility and allow users to adjust their subscription as needed.

Potential Impact on Adherence

Payment plans can influence long-term adherence to Noom. Choosing a plan that aligns with financial capabilities and commitment level can increase the likelihood of sticking to the program.

For example, individuals who select a monthly plan may have greater flexibility to adjust their subscription based on changing circumstances. This can prevent financial strain and support ongoing engagement with Noom.

On the other hand, selecting an annual plan with a significant upfront cost can create a sense of commitment and accountability. This may motivate individuals to adhere to the program for the entire year to maximize their investment.

Resources for Individuals

Seeking information about insurance coverage for Noom can be overwhelming. This section provides a comprehensive list of resources to assist individuals in navigating the complexities of insurance and accessing the support they need.

Contact Information

– Insurance Providers: Contact your insurance provider directly to inquire about coverage for Noom. They can provide specific details regarding your policy and eligibility.

– Healthcare Professionals: Consult with your doctor or other healthcare providers who may have experience with Noom and insurance coverage. They can provide guidance on the medical necessity of the program and support your request for coverage.

Online Resources

– Noom Website: The Noom website provides information about insurance coverage, including a list of participating insurance providers.

– Online Forums and Support Groups: Join online forums and support groups for individuals using Noom. These communities can provide valuable insights, experiences, and support from others navigating insurance coverage.