Motorcycle Insurance Regulations in Florida

In the Sunshine State, operating a motorcycle comes with specific legal responsibilities, including carrying adequate insurance coverage. Florida law mandates that all motorcycle owners and operators maintain financial responsibility to protect themselves and others on the road.

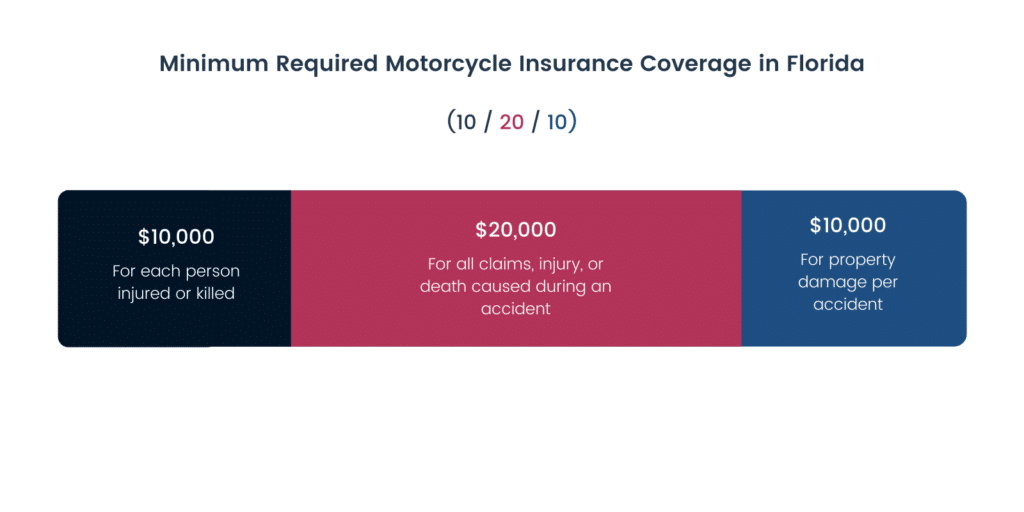

The minimum insurance coverage required by Florida law for motorcycles includes:

- Bodily Injury Liability: $10,000 per person, $20,000 per accident

- Property Damage Liability: $10,000 per accident

These minimum coverage amounts provide basic protection in the event of an accident, but riders may choose to purchase additional coverage for more comprehensive protection.

Exceptions and Exemptions

There are a few exceptions and exemptions to the motorcycle insurance mandate in Florida:

- Antique Motorcycles: Motorcycles that are at least 30 years old and primarily used for hobby or exhibition purposes may be exempt from insurance requirements.

- Military Members: Active-duty military members with valid military identification may be exempt from insurance requirements while operating a motorcycle on a military installation.

- Temporary Permits: Individuals with a valid temporary motorcycle permit may operate a motorcycle without insurance for up to 30 days while obtaining permanent insurance coverage.

Penalties for Uninsured Motorcyclists

Riding a motorcycle without insurance in Florida is a serious offense that carries significant consequences. Uninsured motorists face hefty fines, legal penalties, and potential impacts on their driver’s license and vehicle registration.

Fines and Legal Penalties

First-time offenders caught riding a motorcycle without insurance face a fine of up to $152. Subsequent offenses within three years of the initial violation result in higher fines, ranging from $304 to $506. Additionally, uninsured motorists may be charged a $150 surcharge on their vehicle registration renewal.

Driver’s License Suspension

Uninsured motorcyclists who are involved in an accident may have their driver’s license suspended for up to three years. This suspension applies even if the accident was not the uninsured driver’s fault.

Vehicle Impoundment

In some cases, uninsured motorcycles may be impounded by law enforcement. The motorcycle will be held until the owner provides proof of insurance or pays the impoundment fees.

Legal Implications

Uninsured motorists who cause an accident may be held liable for all damages, including medical expenses, property damage, and pain and suffering. They may also face criminal charges, such as reckless driving or leaving the scene of an accident.

Benefits of Motorcycle Insurance

Motorcycle insurance not only fulfills legal obligations but also provides a safety net for riders. It financially protects them in the event of an accident, covering expenses related to medical bills, property damage, and legal liability.

Coverage Options

Motorcycle insurance offers various coverage options to cater to different needs and budgets. These include:

– Liability Insurance: Covers bodily injury and property damage caused to others in an accident.

– Collision Insurance: Covers damage to the rider’s motorcycle, regardless of fault.

– Comprehensive Insurance: Provides coverage for non-collision-related incidents, such as theft, vandalism, and natural disasters.

Factors Influencing Motorcycle Insurance Costs

Several factors play a significant role in determining motorcycle insurance premiums in Florida. Understanding these variables can help you make informed decisions to potentially reduce your insurance costs.

The key factors that influence motorcycle insurance rates include:

Rider Age and Experience

Younger riders, especially those under the age of 25, typically pay higher insurance premiums due to their perceived higher risk profile and lack of experience on the road. As riders gain more experience and maintain a clean driving record, their insurance costs may decrease.

Driving History

Riders with a history of accidents, traffic violations, or other driving offenses may face higher insurance premiums. Insurance companies view these factors as indicators of increased risk, leading to higher rates.

Motorcycle Type and Usage

The type of motorcycle you ride can impact your insurance costs. Sports bikes and high-performance motorcycles often carry higher premiums due to their perceived higher risk of accidents and theft. Additionally, riders who use their motorcycles for commuting or long-distance travel may pay more than those who use them primarily for leisure or weekend rides.

Location

The location where you live can also affect your motorcycle insurance rates. Areas with higher rates of motorcycle accidents and theft tend to have higher insurance premiums. Urban areas, in particular, often have more congested traffic and a greater likelihood of accidents, resulting in higher insurance costs.

Tips for Finding Affordable Motorcycle Insurance

When searching for motorcycle insurance, it’s crucial to compare policies and shop around to find the most affordable options. Getting multiple quotes from different insurers allows you to evaluate coverage and premiums.

Negotiating Lower Premiums

Negotiating with insurance companies can help reduce premiums. Explain your riding history, safety precautions, and any discounts you qualify for. Be prepared to provide documentation to support your claims.

Discounts

Many insurers offer discounts for safety features like anti-theft devices, completing safety courses, and maintaining a clean driving record. Inquire about these discounts and take advantage of them to lower your premiums.

Bundling Policies

Bundling motorcycle insurance with other policies, such as auto or homeowners insurance, can result in significant savings. By combining coverage under one insurer, you can qualify for multi-policy discounts.

Increasing Deductibles

Increasing your deductible, the amount you pay out-of-pocket before insurance coverage kicks in, can lower your premiums. However, ensure you choose a deductible you can afford to pay if needed.

Seasonal Riding

If you only ride your motorcycle seasonally, consider suspending coverage during the off-season. This can result in substantial savings on premiums.