Remote Insurance Verification Process

Remote insurance verification involves checking the accuracy and validity of insurance information remotely, without in-person contact. It streamlines the verification process, reduces turnaround time, and enhances convenience for both insurance providers and policyholders.

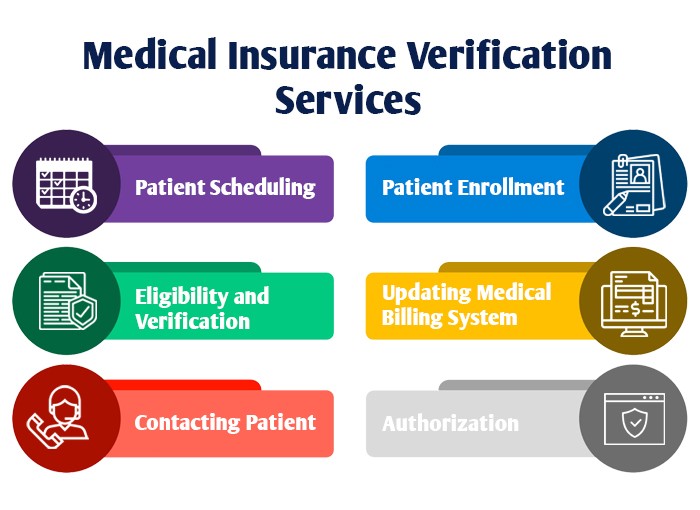

The typical steps involved in remote insurance verification include:

– Receiving the insurance verification request and gathering necessary information

– Contacting the insurance company or relevant third parties to obtain insurance details

– Verifying the policyholder’s identity and eligibility

– Reviewing policy coverage, benefits, and limitations

– Confirming the accuracy of the insurance information provided

– Documenting and reporting the verification results

– Communicating the verification status to the requesting party

Various tools and technologies are employed for remote verification, such as:

– Secure online portals for submitting and accessing verification requests

– Electronic signature platforms for authentication

– Phone or video conferencing for real-time communication

– Data analytics and fraud detection tools to identify suspicious activity

Best practices for efficient and accurate remote insurance verification include:

– Establishing clear communication channels and protocols

– Utilizing technology to streamline the process and reduce errors

– Maintaining confidentiality and security of sensitive information

– Training staff on proper verification procedures and regulatory requirements

– Regularly reviewing and updating verification processes to ensure compliance and efficiency

Job Requirements and Skills

Remote insurance verification jobs require a combination of technical proficiency, insurance knowledge, and interpersonal skills. Here are the essential requirements and qualifications:

Technical Skills:

- Proficiency in insurance verification software and databases

- Strong understanding of insurance policies and coverage

- Excellent communication skills (written and verbal)

- Ability to work independently and manage time effectively

Experience and Training:

- Previous experience in insurance verification or a related field

- Training or certification in insurance verification procedures

- Knowledge of HIPAA regulations and data privacy laws

Personal Attributes:

- Strong attention to detail

- Ability to handle sensitive information confidentially

- Positive attitude and willingness to learn

- Self-motivated and organized

Work Style:

Remote insurance verification jobs require individuals who are comfortable working independently and have a strong work ethic. They should be able to manage their time effectively and prioritize tasks, while also being adaptable and able to handle unexpected situations.

Job Market and Industry Trends

The job market for remote insurance verification positions is experiencing a surge in demand, driven by the growing need for efficient and cost-effective insurance claim processing. The rise of technology, particularly cloud-based software and automation tools, has enabled insurance companies to streamline their operations and expand their remote workforce.

Factors contributing to the growth of this industry include:

- Increased adoption of digital technologies in the insurance sector

- Rising demand for remote work options due to the COVID-19 pandemic

- Growing awareness of the benefits of remote insurance verification, such as cost savings and improved accuracy

Projected Job Outlook and Career Advancement Opportunities

The job outlook for remote insurance verification positions is highly positive. According to industry projections, the demand for skilled insurance verification professionals is expected to grow significantly in the coming years. This growth is driven by the increasing volume of insurance claims and the need for efficient and accurate claim processing.

Career advancement opportunities for remote insurance verification professionals include:

- Promotions to lead or managerial roles within the insurance verification department

- Specialization in specific areas of insurance verification, such as medical or property claims

- Transition to related roles in the insurance industry, such as claims adjuster or underwriter

Resume and Interview Tips

Crafting a compelling resume and preparing for remote job interviews are crucial steps in securing an insurance verification job. This section provides tips and guidance to help you showcase your skills and land the role you desire.

Resume Tips

– Highlight relevant skills and experience: Emphasize your proficiency in insurance terminology, data entry, and customer service.

– Quantify your accomplishments: Use numbers and metrics to demonstrate the impact of your contributions in previous roles.

– Use s: Incorporate industry-specific s throughout your resume to increase its visibility to potential employers.

– Proofread carefully: Ensure your resume is free of errors and inconsistencies before submitting it.

Tools and Resources for Remote Workers

Remote insurance verification professionals rely on a range of software and tools to enhance their productivity and streamline their workflow. Here’s a comparative table outlining some popular options:

| Tool | Features | Pricing | Recommendation |

|---|---|---|---|

| Case Management System | Case management, document storage, communication, and reporting | Varies based on provider | Essential for organizing and tracking cases |

| OCR Software | Optical Character Recognition for document processing | Free or paid options available | Saves time and improves accuracy in data extraction |

| Communication Tools | Video conferencing, instant messaging, and email | Free or paid options available | Facilitates collaboration and communication with colleagues and clients |

| Project Management Software | Task management, project planning, and collaboration | Varies based on provider | Helps manage multiple projects and track progress |

| Training and Certification | Online courses, workshops, and certifications | Varies based on provider | Enhances skills and knowledge in insurance verification |