Definition and Purpose

Insurance capital adequacy ratio (ICAR) is a financial metric that measures the financial strength and stability of an insurance company. It is a key indicator of an insurer’s ability to meet its policyholder obligations and absorb potential losses.

ICAR is calculated as the ratio of an insurer’s available capital to its required capital. Available capital includes the insurer’s surplus, retained earnings, and other forms of capital. Required capital is determined by regulatory authorities based on the insurer’s risk profile and the level of protection it needs to provide to policyholders.

Purpose of ICAR

The primary purpose of ICAR is to assess an insurer’s financial solvency and ensure that it has sufficient capital to cover its obligations. It helps regulators, policyholders, and other stakeholders evaluate the financial strength of an insurance company and make informed decisions.

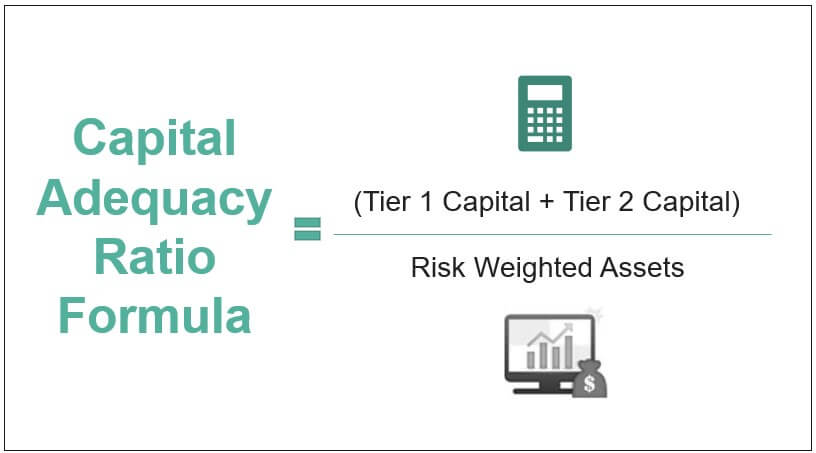

Calculation and Components

The insurance capital adequacy ratio, as mentioned earlier, is calculated by dividing the available capital by the minimum capital requirement. The available capital refers to the financial resources an insurance company has on hand, including its assets, investments, and reserves. The minimum capital requirement, on the other hand, is the amount of capital that regulators deem necessary for an insurance company to operate safely and meet its obligations to policyholders.

The formula for calculating the insurance capital adequacy ratio is as follows:

Insurance Capital Adequacy Ratio = Available Capital / Minimum Capital Requirement

The key components involved in the calculation of the insurance capital adequacy ratio are:

Available Capital

- Assets: These include cash, investments, and other financial instruments that can be easily converted into cash.

- Investments: These include stocks, bonds, and real estate that generate income and can be sold to raise capital.

- Reserves: These are funds set aside to cover potential losses and claims.

Minimum Capital Requirement

The minimum capital requirement is determined by regulators based on factors such as the size of the insurance company, the risks it takes on, and the regulatory environment in which it operates.

Risk Factors

The calculation of the insurance capital adequacy ratio also takes into account risk factors that can affect the financial health of the insurance company. These risk factors include:

- Underwriting risk: This is the risk that the insurance company will incur losses due to claims from policyholders.

- Investment risk: This is the risk that the insurance company will lose money on its investments.

- Operational risk: This is the risk that the insurance company will experience losses due to operational errors or disruptions.

Regulatory Requirements and Standards

Regulatory bodies play a crucial role in establishing and enforcing capital adequacy standards for insurance companies. These standards aim to ensure the financial stability and solvency of insurers, protecting policyholders and maintaining public trust in the insurance industry.

Different jurisdictions adopt varying approaches to regulating insurance capital adequacy. In the United States, the National Association of Insurance Commissioners (NAIC) sets minimum capital requirements through its Risk-Based Capital (RBC) formula. In the European Union, the Solvency II framework provides a comprehensive set of rules for capital adequacy, risk management, and governance.

Internationally, the International Association of Insurance Supervisors (IAIS) has developed the Insurance Core Principles (ICPs), which include guidelines for capital adequacy assessment. These principles promote convergence in regulatory practices and foster a more harmonized approach to insurance supervision globally.

Impact on Insurers

Maintaining a strong capital adequacy ratio is crucial for insurers, as it signifies their financial strength and ability to withstand potential risks. It affects their underwriting practices, claim payments, and overall solvency.

Ability to Underwrite Risks

A robust capital adequacy ratio allows insurers to underwrite risks more confidently, as they have sufficient capital to cover potential losses. This enables them to offer a wider range of insurance products, attract more customers, and expand their market share.

Claim Payments

A strong capital adequacy ratio ensures that insurers have the financial resources to pay claims promptly and efficiently. This builds trust among policyholders and strengthens the insurer’s reputation.

Solvency and Financial Stability

Meeting capital adequacy requirements is essential for maintaining solvency and financial stability. Insurers with a strong capital adequacy ratio are better equipped to absorb unexpected losses, navigate market fluctuations, and continue operating as a going concern.

Factors Affecting Capital Adequacy

An insurer’s capital adequacy ratio is influenced by a multitude of factors, including market conditions, economic shifts, and the insurer’s own risk profile. Understanding and proactively managing these factors are crucial for insurers to maintain adequate capital levels and ensure financial stability.

Changes in market conditions, such as fluctuations in interest rates or equity prices, can impact the value of an insurer’s assets and liabilities. Economic factors, such as recessions or economic downturns, can lead to increased claims or reduced premium income, putting pressure on capital levels.

Risk Profile

The insurer’s risk profile, which encompasses the types and levels of risks it underwrites, also plays a significant role. Insurers with higher-risk portfolios, such as those specializing in catastrophe or liability insurance, may require higher capital adequacy ratios to mitigate potential losses.

Proactive Management

Insurers can proactively manage these factors by implementing strategies such as:

- Diversifying their investment portfolios to reduce market risk.

- Adjusting underwriting practices to manage risk exposure.

- Reinsurance arrangements to transfer a portion of risks to other insurers.

Capital Adequacy Assessment Methods

Assessing an insurer’s capital adequacy involves various methods that evaluate the insurer’s financial strength and ability to meet its obligations to policyholders. These methods consider factors such as risk exposure, market conditions, and the insurer’s financial stability.

Different methods are used to assess capital adequacy, each with its own strengths and limitations. The choice of method depends on the specific circumstances and objectives of the assessment.

Stress Testing

Stress testing involves simulating various hypothetical scenarios that could adversely affect the insurer’s financial position. By subjecting the insurer’s balance sheet to these scenarios, stress testing assesses the insurer’s resilience and ability to withstand potential financial shocks.

Strengths:

- Provides a comprehensive assessment of the insurer’s financial resilience under various stress conditions.

- Can identify potential vulnerabilities and areas where the insurer may need to strengthen its capital position.

Limitations:

- Relies on hypothetical scenarios, which may not accurately reflect actual events.

- Can be time-consuming and resource-intensive to conduct.

Scenario Analysis

Scenario analysis involves developing specific hypothetical scenarios that could impact the insurer’s financial position. These scenarios are typically based on historical events or industry trends and are used to assess the insurer’s response to potential future events.

Strengths:

- Provides a more targeted assessment of the insurer’s response to specific potential events.

- Can help identify specific risks and vulnerabilities that the insurer may need to address.

Limitations:

- Relies on subjective assumptions about the likelihood and severity of potential events.

- May not capture all potential risks that the insurer could face.

Stochastic Modeling

Stochastic modeling uses mathematical models to simulate the behavior of the insurer’s financial position over time. These models incorporate probabilistic distributions to account for the uncertainty surrounding future events and risk factors.

Strengths:

- Provides a quantitative assessment of the insurer’s capital adequacy over a range of possible future outcomes.

- Can capture the dynamic nature of risk and uncertainty.

Limitations:

- Relies on complex mathematical models that may not fully capture the complexities of the insurance business.

- Can be computationally intensive and require significant data.

7. Trends and Future Considerations

The insurance industry is constantly evolving, driven by technological advancements, climate change, and other factors. These trends are having a significant impact on insurance capital adequacy requirements, and regulators are responding by developing new regulations and standards.

One of the most significant trends in insurance capital adequacy regulation is the increasing use of risk-based capital (RBC) models. RBC models allow insurers to tailor their capital requirements to their specific risk profiles, which can lead to more efficient use of capital. However, RBC models are complex and can be difficult to implement, and there is concern that they may not be able to fully capture all of the risks that insurers face.

Another trend in insurance capital adequacy regulation is the increasing focus on climate change. Climate change is a major threat to the insurance industry, and it is likely to lead to more frequent and severe weather events, which could result in significant losses for insurers. Regulators are responding to this threat by developing new regulations that require insurers to hold more capital to cover climate-related risks.

Technological Advancements

Technological advancements are having a significant impact on the insurance industry. Insurers are using new technologies to improve their underwriting, claims processing, and customer service. These technologies can help insurers to reduce their costs and improve their efficiency, which can free up capital for other purposes.

Climate Change

Climate change is a major threat to the insurance industry. Insurers are already seeing an increase in the frequency and severity of weather events, which is leading to more claims and higher losses. Climate change is also expected to lead to more extreme weather events, such as hurricanes, floods, and droughts, which could have a devastating impact on the insurance industry.

Other Factors

In addition to technological advancements and climate change, there are a number of other factors that are affecting insurance capital adequacy requirements. These include:

- The increasing globalization of the insurance industry

- The growing complexity of insurance products

- The increasing demand for insurance coverage

Areas for Further Research

There are a number of areas where further research and analysis are needed to enhance the understanding and management of insurance capital adequacy. These include:

- The development of more sophisticated RBC models

- The impact of climate change on insurance capital adequacy requirements

- The role of technology in improving insurance capital adequacy