Industry Overview

The insurance industry plays a pivotal role in mitigating financial risks and providing financial security for individuals and businesses. It encompasses a wide range of insurance products, including health insurance, property and casualty insurance, life insurance, and other specialized insurance policies.

Account managers serve as the primary point of contact between insurance companies and their clients. They are responsible for developing and maintaining relationships with clients, understanding their insurance needs, and providing tailored insurance solutions. They play a crucial role in ensuring that clients have adequate insurance coverage to protect their assets and financial well-being.

Role of Account Managers in the Insurance Industry

Account managers in the insurance industry perform various essential functions, including:

- Identifying and assessing client insurance needs through in-depth analysis and consultations.

- Developing and presenting customized insurance plans that meet the unique requirements of each client.

- Negotiating and securing insurance coverage from insurance carriers on behalf of clients.

- Providing ongoing support and guidance to clients throughout the policy term, including claims assistance and policy renewal.

- Monitoring industry trends and regulatory changes to ensure that clients’ insurance coverage remains up-to-date and compliant.

Job Description

Insurance account managers are responsible for managing relationships with insurance clients and ensuring that their insurance needs are met. They typically work with businesses and individuals to assess their insurance risks, develop and implement insurance plans, and provide ongoing support and advice.

Insurance account managers typically have a strong understanding of the insurance industry and the different types of insurance products available. They must also be able to communicate effectively with clients, understand their needs, and develop solutions that meet those needs.

Skills and Qualifications

To be successful in this role, insurance account managers typically need the following skills and qualifications:

- Strong understanding of the insurance industry and the different types of insurance products available

- Excellent communication and interpersonal skills

- Ability to assess insurance risks and develop insurance plans

- Ability to provide ongoing support and advice to clients

- Bachelor’s degree in business, finance, or a related field

- Insurance license

Salary Range

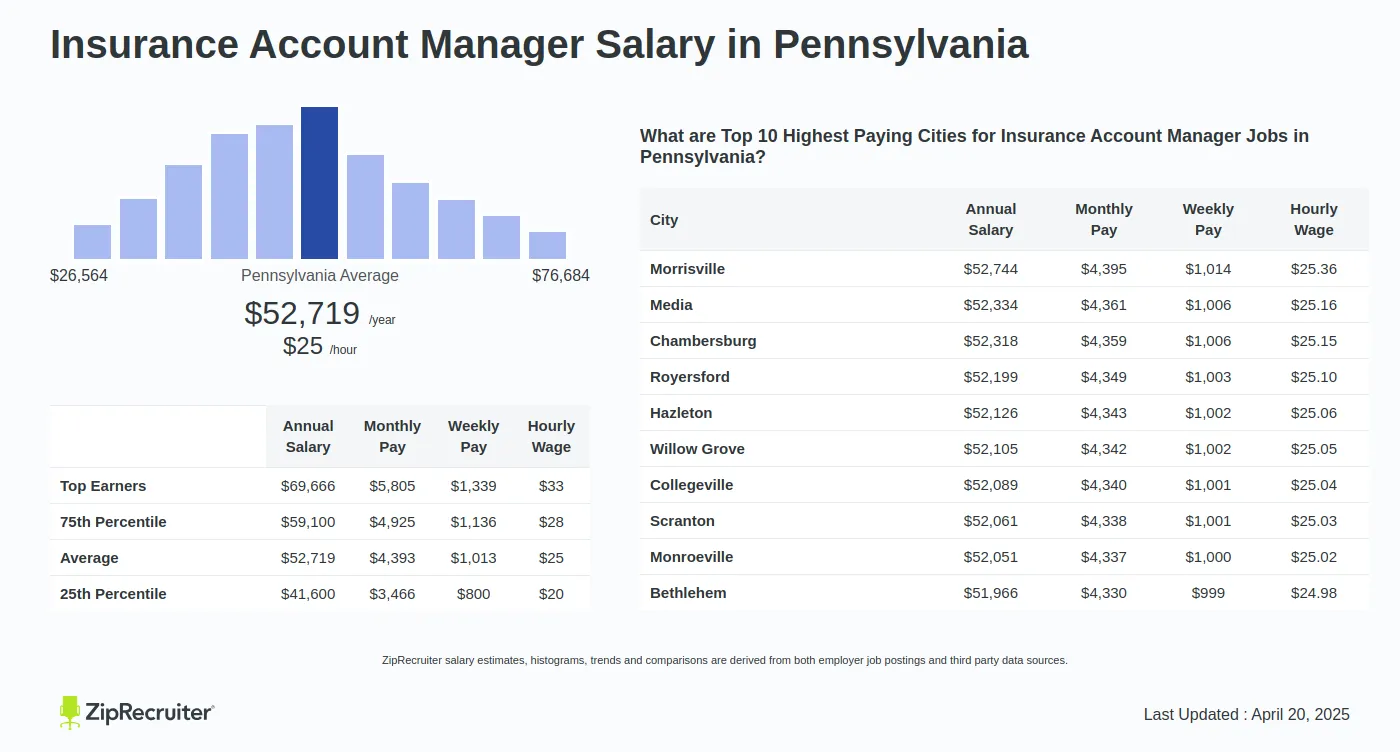

Insurance account managers can expect to earn a competitive salary, with compensation varying depending on several factors. These factors include experience, location, and company size.

Experience

As insurance account managers gain experience, they can expect to see their salaries increase. Entry-level managers with less than five years of experience can expect to earn an average salary of around $50,000 per year. Mid-level managers with five to ten years of experience can expect to earn an average salary of around $75,000 per year. Senior-level managers with more than ten years of experience can expect to earn an average salary of around $100,000 per year.

Location

The location of an insurance account manager’s job can also affect their salary. Insurance account managers who work in large metropolitan areas, such as New York City or Los Angeles, can expect to earn higher salaries than those who work in smaller cities or rural areas.

Company Size

The size of the company that an insurance account manager works for can also affect their salary. Insurance account managers who work for large companies can expect to earn higher salaries than those who work for small companies.

Compensation Structure

The compensation structure for insurance account managers typically comprises a combination of base salary, bonuses, and other incentives. The base salary forms the fixed component of their earnings and is determined based on factors such as experience, qualifications, and industry norms.

Bonuses

Bonuses are performance-based incentives that are awarded to insurance account managers who meet or exceed specific targets. These targets may include sales quotas, customer satisfaction ratings, or other performance metrics. The amount of the bonus is usually calculated as a percentage of the base salary or as a lump sum.

Other Incentives

In addition to base salary and bonuses, insurance account managers may also receive other incentives such as:

– Commissions: These are performance-based incentives that are paid on a per-sale basis.

– Fringe benefits: These include benefits such as health insurance, paid time off, and retirement plans.

– Professional development opportunities: These may include training programs, conferences, and certifications that enhance the skills and knowledge of the account manager.

Career Advancement

Insurance account managers can progress in their careers by taking on additional responsibilities, developing new skills, and seeking promotions.

Advancement Paths

– Senior Account Manager: With experience and strong performance, account managers can advance to senior roles with increased responsibilities and management of larger accounts.

– Account Executive: Account managers with a proven track record of success may transition to account executive positions, focusing on acquiring new clients and managing key relationships.

– Sales Manager: Account managers with leadership skills and a deep understanding of the industry can move into sales management roles, overseeing a team of account managers and driving sales growth.

Job Market Outlook

The job market for insurance account managers is expected to grow in the coming years. The demand for these professionals is driven by the increasing complexity of insurance policies and the need for businesses to manage their risk effectively.

Industry Trends

The insurance industry is undergoing a number of changes that are impacting the job market for account managers. These trends include:

- The increasing use of technology in the insurance industry

- The globalization of the insurance market

- The aging of the population

These trends are creating new opportunities for insurance account managers who are able to adapt to the changing landscape.

Company Comparison

Insurance account managers’ salaries vary depending on the company they work for. Factors such as company size, location, and industry specialization can influence salary ranges.

The following table compares the salary ranges for insurance account managers at different companies:

Company Size

- Small companies: Typically offer lower salaries, ranging from $40,000 to $70,000 per year.

- Mid-sized companies: Offer salaries in the range of $50,000 to $80,000 per year.

- Large companies: Pay the highest salaries, ranging from $60,000 to $100,000 per year or more.

Location

- Metropolitan areas: Generally offer higher salaries due to a higher cost of living.

- Rural areas: Typically offer lower salaries due to a lower cost of living.

Industry Specialization

- Property and casualty insurance: Typically pays higher salaries than other insurance sectors.

- Health insurance: Offers competitive salaries, with a focus on customer service and regulatory compliance.

- Life insurance: Generally pays lower salaries than other insurance sectors.