Beneficiary Designation

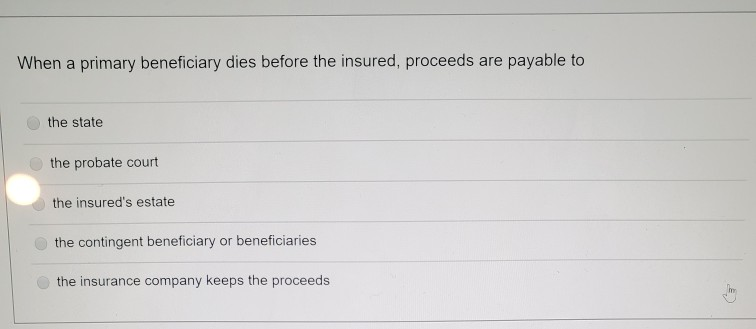

Life insurance policies allow policyholders to designate beneficiaries who will receive the death benefit in the event of their passing. The order of beneficiary designation typically follows a hierarchy, with a primary beneficiary being the first to receive the benefit, followed by contingent beneficiaries if the primary beneficiary is deceased or unable to receive the benefit.

Primary and Contingent Beneficiaries

The primary beneficiary is the individual or entity designated by the policyholder to receive the death benefit in the first instance. Contingent beneficiaries are individuals or entities who will receive the death benefit if the primary beneficiary is deceased or unable to receive the benefit. For example, a policyholder may designate their spouse as the primary beneficiary and their children as contingent beneficiaries.

Impact of a Simultaneous Death

In the event of a simultaneous death, where the policyholder and the primary beneficiary die at the same time or under circumstances where it is difficult to determine the order of death, the contingent beneficiaries will typically receive the death benefit. However, the specific rules governing simultaneous death may vary depending on the jurisdiction and the terms of the insurance policy.

Policy Proceeds Distribution

In the event that both the insured and the primary beneficiary pass away simultaneously, the distribution of life insurance proceeds can become more complex. Several factors come into play, including the terms of the policy and any applicable state laws.

Contingent Beneficiaries

Most life insurance policies allow the insured to designate one or more contingent beneficiaries who will receive the proceeds if the primary beneficiary predeceases the insured. In the case of a simultaneous death, the contingent beneficiaries will typically receive the proceeds.

Simultaneous Death Laws

Some states have enacted simultaneous death laws that govern the distribution of property when two or more people die at the same time. These laws typically presume that the insured and the primary beneficiary died simultaneously, and the proceeds will be distributed as if the insured survived the primary beneficiary.

Case Study

For example, consider a life insurance policy with a $1 million death benefit. The insured names their spouse as the primary beneficiary and their child as the contingent beneficiary. If the insured and the spouse die in a car accident, the child will receive the $1 million death benefit under the terms of the policy and the applicable simultaneous death law.

Legal Implications

When the insured and primary beneficiary die simultaneously, legal implications arise due to the need to determine the distribution of policy proceeds. This situation raises complex legal questions, particularly when there is no clear designation of a contingent beneficiary or when the policy does not address simultaneous deaths.

Applicable Laws and Regulations

In many jurisdictions, the Uniform Simultaneous Death Act (USDA) governs the distribution of policy proceeds in cases of simultaneous deaths. The USDA presumes that both parties died at the same time, regardless of the actual order of death, and distributes the proceeds accordingly.

Estate Planning Considerations

The simultaneous death of the insured and primary beneficiary can significantly impact estate planning. Without clear instructions in place, the distribution of the policy proceeds may not align with the deceased’s wishes.

It is crucial to have a will or trust in place to address such contingencies. These legal documents allow you to specify how your assets, including life insurance policies, should be distributed after your death. By clearly outlining your intentions, you can ensure that your wishes are carried out, even if you and your primary beneficiary pass away simultaneously.

Drafting Estate Planning Documents

When drafting estate planning documents, consider the following:

– Designate a contingent beneficiary: In the event of a simultaneous death, the contingent beneficiary will receive the policy proceeds. Choose someone you trust to manage the funds according to your wishes.

– Establish a trust: A trust can provide greater flexibility and control over the distribution of the policy proceeds. You can specify the age at which beneficiaries receive their inheritance and set conditions for their use of the funds.

– Review your documents regularly: As your life circumstances change, it is essential to review and update your estate planning documents to ensure they reflect your current wishes.

Insurance Company Procedures

When both the insured and primary beneficiary pass away simultaneously, insurance companies have established procedures to determine the distribution of policy proceeds. These procedures vary depending on the insurance company and the specific terms of the policy.

Typically, the insurance company will first attempt to locate any contingent beneficiaries named on the policy. If no contingent beneficiaries are designated, the proceeds may be distributed to the insured’s estate.

Documentation and Requirements

In order to process a claim under these circumstances, the insurance company will typically require the following documentation:

- Death certificates for both the insured and the primary beneficiary

- A copy of the insurance policy

- Proof of identity for the claimant

Alternative Beneficiary Options

In the unfortunate event of a simultaneous death, it is crucial to consider alternative beneficiary arrangements to ensure that the policy proceeds are distributed according to your wishes.

There are several options available for designating alternative beneficiaries:

Contingent Beneficiaries

Contingent beneficiaries are individuals or entities who receive the policy proceeds if the primary beneficiary predeceases the insured or dies simultaneously.

- Advantages: Ensures that the proceeds are distributed according to your wishes, even if the primary beneficiary is deceased.

- Disadvantages: May lead to disputes if the contingent beneficiary is not clearly designated or is not eligible to receive the proceeds.

Revocable Beneficiaries

Revocable beneficiaries allow the insured to change the beneficiary designation at any time, even after the policy has been issued.

- Advantages: Provides flexibility and control over the distribution of the proceeds.

- Disadvantages: May lead to confusion or disputes if the insured fails to update the beneficiary designation before their death.

Irrevocable Beneficiaries

Irrevocable beneficiaries cannot be changed by the insured once the policy has been issued.

- Advantages: Ensures that the proceeds are distributed according to the insured’s original wishes.

- Disadvantages: Lacks flexibility and may not be suitable if the insured’s circumstances change.

Trusts

Trusts are legal entities that can be designated as beneficiaries of life insurance policies.

- Advantages: Provides professional management of the proceeds, protects the proceeds from creditors, and allows for specific distribution instructions.

- Disadvantages: Can be complex and expensive to establish and administer.