Understanding Insurance Coverage for Massage Therapy

Determining insurance coverage for massage therapy requires understanding the specific terms and conditions of your policy. Different types of insurance policies may offer varying levels of coverage, and the specific conditions and diagnoses covered can also vary.

Typically, massage therapy may be covered for conditions such as chronic pain, muscle spasms, and rehabilitation from injuries. However, it’s important to note that some policies may exclude coverage for massage therapy if it is considered a “wellness” or “maintenance” service.

Limitations and Exclusions

Insurance policies may have certain limitations or exclusions that apply to massage therapy coverage. These may include:

- A maximum number of sessions covered per year

- A requirement for a doctor’s referral or prescription

- Exclusions for certain types of massage therapy, such as sports massage or deep tissue massage

- Coverage only for massage therapy provided by licensed and certified therapists

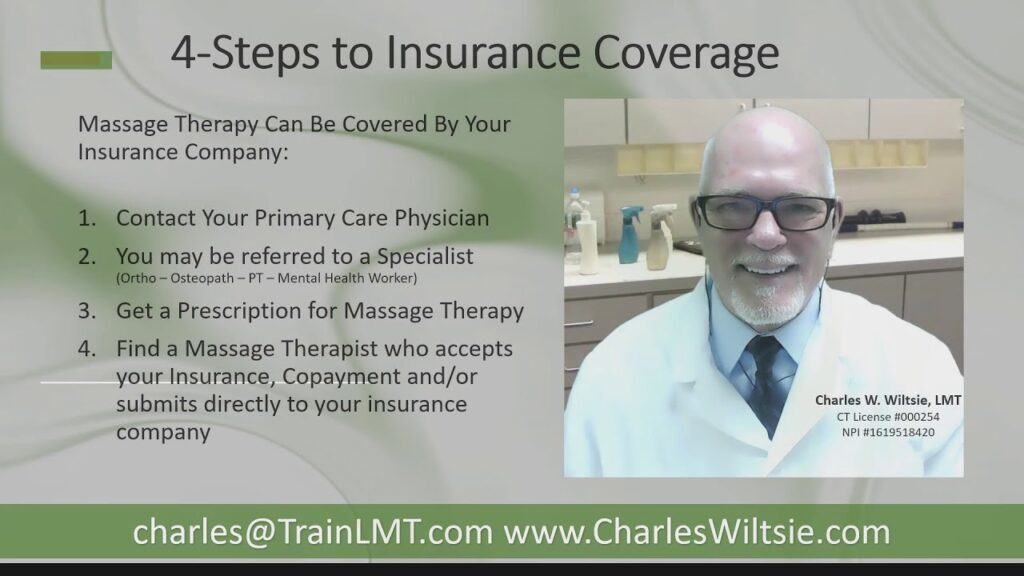

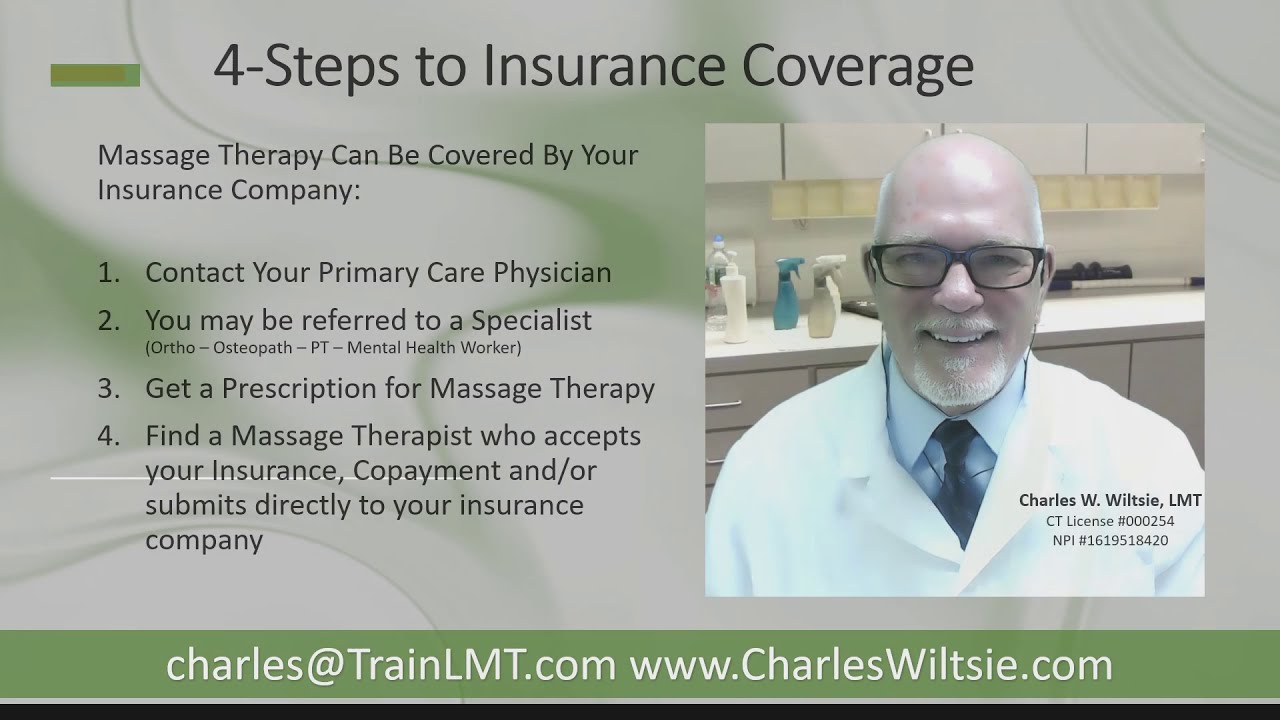

Obtaining a Doctor’s Referral

Obtaining a doctor’s referral is crucial for insurance coverage of massage therapy. A referral from a medical professional establishes the medical necessity of the treatment, increasing the likelihood of approval by the insurance provider.

To approach a doctor for a referral, schedule an appointment and clearly state the reason for the visit. Explain the symptoms or conditions that necessitate massage therapy and provide any relevant medical records. The doctor will assess your condition and determine if massage therapy is medically appropriate.

Required Documentation

To support the referral, the doctor may require documentation, such as:

– Medical history and physical examination findings

– Diagnosis or medical condition that warrants massage therapy

– Expected benefits and goals of massage therapy

Filing an Insurance Claim for Massage Therapy

Filing an insurance claim for massage therapy requires careful attention to documentation and communication. Understanding the process can help you navigate the system efficiently.

Submitting a Claim

To submit a claim, gather the necessary documentation, including:

- Doctor’s referral or prescription

- Medical records supporting the need for massage therapy

- Itemized receipt from the massage therapist

Complete an insurance claim form (available online or from your insurance company). Provide accurate information about your diagnosis, treatment plan, and expenses.

Tracking and Follow-Up

Once submitted, track the status of your claim online or by phone. Contact your insurance company if there are any delays or issues.

Be prepared to provide additional information or documentation if requested. Regular follow-ups can help ensure timely processing and payment.

Appealing a Denied Claim

Insurance claims for massage therapy can be denied for various reasons, including:

* Lack of a valid medical diagnosis

* Massage therapy not being considered medically necessary

* Exceeding the number of sessions covered by the policy

* Failure to obtain prior authorization

Filing an Appeal

To appeal a denied claim, follow these steps:

* Review the Explanation of Benefits (EOB) to understand the reason for the denial.

* Gather supporting documentation, such as:

* Doctor’s referral

* Medical records documenting the condition being treated

* Evidence of medical necessity, such as a letter from the doctor

* Write a letter of appeal, explaining why the claim should be reconsidered. Include:

* The reason for the massage therapy

* The medical condition being treated

* The documentation supporting your claim

* Submit the appeal to the insurance company within the specified timeframe.

Tips for Success

* Be thorough in your documentation and provide as much evidence as possible.

* Be clear and concise in your letter of appeal.

* Follow up with the insurance company regularly to track the status of your appeal.

* If necessary, consider seeking assistance from a healthcare advocate or attorney.

Other Considerations for Getting Insurance to Pay for Massage Therapy

In addition to exploring coverage through insurance, consider these alternative options for financing massage therapy:

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

FSAs and HSAs are tax-advantaged accounts that allow you to set aside pre-tax dollars for healthcare expenses, including massage therapy. Contributions to these accounts are typically made through payroll deductions. HSAs are available to individuals with high-deductible health plans (HDHPs), while FSAs are available to employees of companies that offer them.

Payment Plans and Discounts

Some massage therapy clinics offer payment plans or discounts for patients who pay out-of-pocket. Inquire with local clinics about their payment options.

Massage Therapy Membership Programs

Joining a massage therapy membership program can provide access to discounted rates and other benefits, such as priority scheduling and exclusive promotions.