Insurance Coverage for Lamborghinis

Insurance coverage for Lamborghinis is designed to protect these high-value vehicles and their owners from financial losses in the event of accidents, theft, or other covered events. There are several types of insurance coverage available for Lamborghinis, each with its own benefits and limitations.

Comprehensive Insurance

Comprehensive insurance provides coverage for a wide range of events, including theft, vandalism, and damage caused by natural disasters such as floods or hail. It also covers damage to the Lamborghini caused by collision with another vehicle or object. Comprehensive insurance is typically more expensive than other types of coverage, but it offers the most comprehensive protection for your Lamborghini.

Collision Insurance

Collision insurance covers damage to the Lamborghini caused by a collision with another vehicle or object. It does not cover theft, vandalism, or damage caused by natural disasters. Collision insurance is typically less expensive than comprehensive insurance, but it offers less coverage.

Liability Insurance

Liability insurance covers the Lamborghini owner’s legal liability for injuries or property damage caused to others in an accident. It does not cover damage to the Lamborghini itself. Liability insurance is required by law in most states, and it is typically the least expensive type of insurance coverage.

The cost of insurance for a Lamborghini will vary depending on a number of factors, including the model and year of the vehicle, the driver’s age and driving record, and the amount of coverage desired. It is important to compare quotes from several different insurance companies to find the best coverage at the best price.

Insurance Costs

The cost of insuring a Lamborghini can vary significantly depending on several factors, including the driver’s age, driving history, the specific Lamborghini model, and the location where the vehicle is registered. According to data from the National Association of Insurance Commissioners (NAIC), the average annual insurance premium for a Lamborghini is around $2,500. However, this average can vary widely depending on the factors mentioned above.

Breakdown of Insurance Costs by State or Region

The cost of insurance for a Lamborghini can also vary significantly by state or region. For example, drivers in states with higher rates of car accidents or theft may pay more for insurance than drivers in states with lower rates. Some of the states with the highest average insurance premiums for Lamborghinis include California, Florida, and Texas. In contrast, some of the states with the lowest average insurance premiums for Lamborghinis include Maine, New Hampshire, and Vermont.

Factors that Influence Insurance Costs

Several factors can influence the cost of insurance for a Lamborghini. These factors include:

- The driver’s age: Younger drivers typically pay more for insurance than older drivers because they are considered to be a higher risk.

- The driver’s driving history: Drivers with a clean driving record will typically pay less for insurance than drivers with a history of accidents or traffic violations.

- The specific Lamborghini model: Some Lamborghini models are more expensive to insure than others. For example, the Lamborghini Aventador is typically more expensive to insure than the Lamborghini Huracan.

- The location where the vehicle is registered: As mentioned above, the cost of insurance for a Lamborghini can vary significantly by state or region.

Insurance Providers

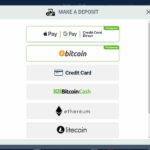

Choosing the right insurance provider is crucial to ensure adequate coverage and competitive premiums for your Lamborghini. Several reputable insurance companies offer specialized coverage for high-performance vehicles like Lamborghinis.

To assist in your decision-making, we have compiled a table comparing the coverage options, premiums, and customer service ratings of some of the leading insurance providers:

Reputable Insurance Providers for Lamborghinis

| Insurance Provider | Coverage Options | Premiums | Customer Service Rating |

|---|---|---|---|

| AIG Private Client Group | Comprehensive, Collision, Liability, Personal Injury Protection | Higher than average | Excellent |

| Chubb Personal Risk Services | Comprehensive, Collision, Liability, Agreed Value | Very high | Exceptional |

| Hagerty | Comprehensive, Collision, Liability, Collector Car Coverage | Specialized for classic and collectible vehicles | Good |

| Liberty Mutual Private Client | Comprehensive, Collision, Liability, Personal Umbrella | Competitive | Average |

| Nationwide Private Client | Comprehensive, Collision, Liability, Roadside Assistance | Mid-range | Above average |

Advantages and Disadvantages of Different Insurance Providers:

- AIG Private Client Group offers comprehensive coverage and excellent customer service, but its premiums tend to be higher.

- Chubb Personal Risk Services provides exceptional coverage and service but comes with very high premiums.

- Hagerty specializes in classic and collectible vehicles, providing tailored coverage but may not offer the most competitive premiums.

- Liberty Mutual Private Client offers competitive premiums and a wide range of coverage options but has an average customer service rating.

- Nationwide Private Client provides mid-range premiums and good coverage but may not have the same level of specialization as other providers.

Reducing Insurance Costs

Minimizing insurance costs for Lamborghinis requires a combination of responsible driving practices, security enhancements, and smart financial strategies.

Implement the following tips to lower your insurance premiums:

Safe Driving Habits

- Maintain a clean driving record by avoiding traffic violations and accidents.

- Participate in defensive driving courses to improve your skills and demonstrate your commitment to safe driving.

Security Systems

- Install an anti-theft system, such as a car alarm, immobilizer, or GPS tracker, to deter theft and reduce the risk of damage.

- Consider parking your Lamborghini in a secure location, such as a garage or a gated community.

Bundling Insurance Policies

- Bundle your Lamborghini insurance with other insurance policies, such as home or renter’s insurance, to qualify for discounts.

- Inquire about loyalty discounts for long-term customers or for insuring multiple vehicles with the same provider.

Additional Strategies

- Increase your deductible to lower your premiums, but be prepared to pay more out-of-pocket in the event of a claim.

- Consider usage-based insurance programs that track your driving habits and reward safe drivers with lower rates.

- Compare quotes from multiple insurance providers to find the best coverage at the most competitive price.