Understanding Gap Insurance

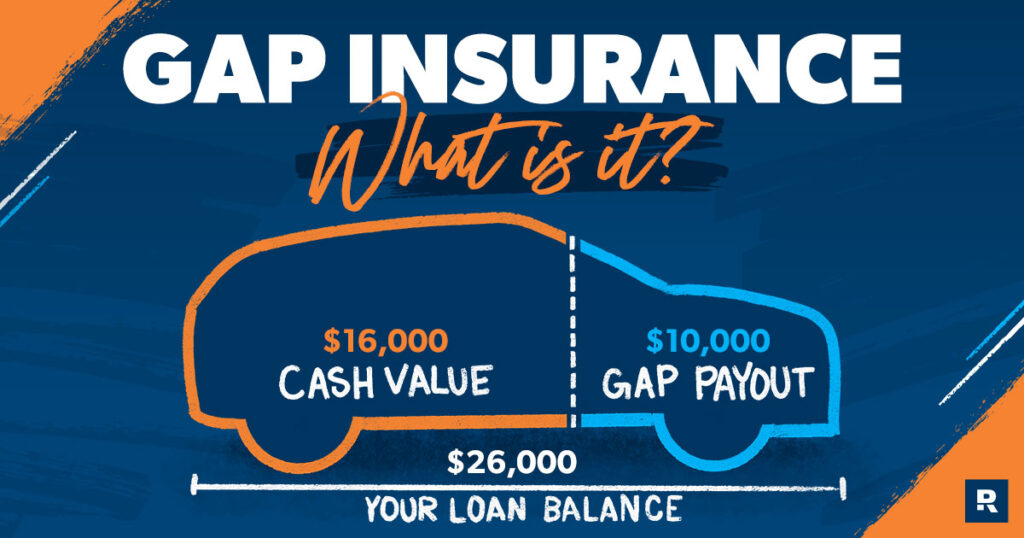

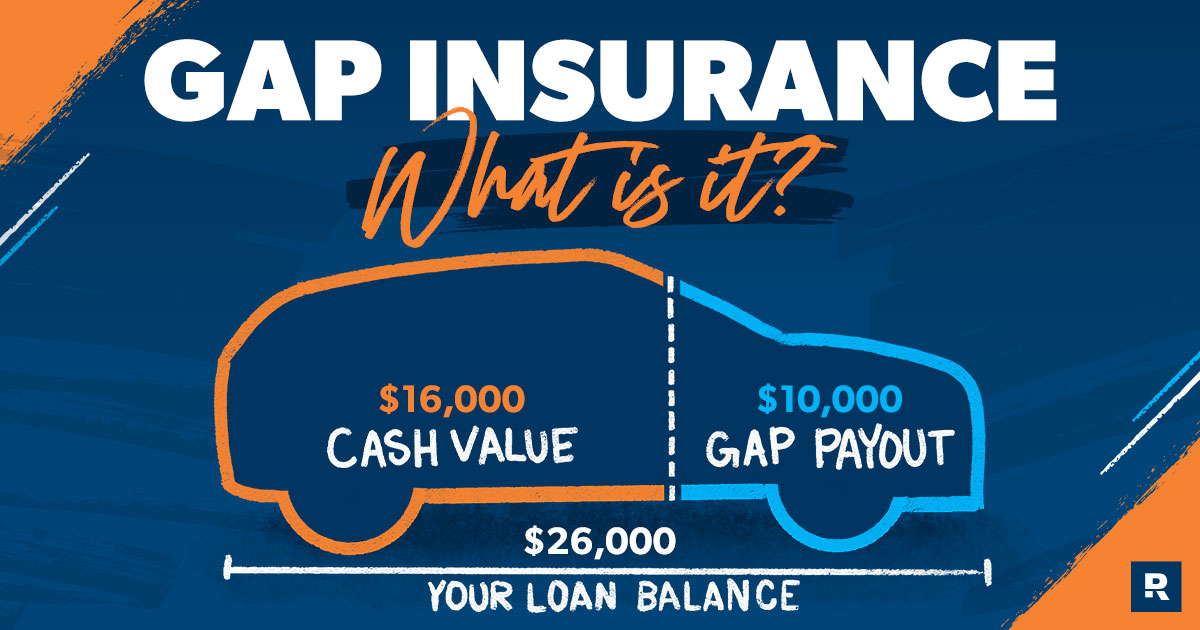

Gap insurance is an optional type of auto insurance that covers the difference between the actual cash value (ACV) of your vehicle and the amount you owe on your loan or lease. This can be beneficial in situations where your vehicle is totaled or stolen, and the ACV is less than the amount you owe.

Gap insurance is particularly beneficial for vehicles that depreciate quickly, such as luxury cars, sports cars, and trucks. These vehicles tend to lose value more rapidly than other types of vehicles, so the gap between the ACV and the loan amount can be significant.

Signs of Having Gap Insurance

Recognizing the signs of having gap insurance can provide you with peace of mind. Here are key indicators to look for:

Loan or Lease Agreement

Examine your loan or lease agreement thoroughly. Gap insurance is often listed as a separate line item or within the coverage section.

Contact Your Lender or Insurance Provider

If you’re unsure about your coverage status, don’t hesitate to reach out to your lender or insurance provider. They can verify whether gap insurance is included in your policy.

Benefits of Gap Insurance

Gap insurance offers a range of advantages that can provide peace of mind and financial protection for vehicle owners.

One of the primary benefits is financial protection in the event of a total loss. If your vehicle is declared a total loss, the insurance company will typically pay the actual cash value of the vehicle, which may be less than the amount you owe on your loan or lease. Gap insurance covers the difference between the actual cash value and the amount you still owe, ensuring that you are not left with a substantial financial burden.

Reduced Financial Burden After an Accident

Gap insurance can also reduce the financial burden after an accident. If your vehicle is damaged and the cost of repairs exceeds the actual cash value, gap insurance can help cover the remaining balance. This can prevent you from having to pay out of pocket for expensive repairs or having to take on additional debt.

Peace of Mind Knowing Your Vehicle is Fully Covered

Gap insurance provides peace of mind knowing that your vehicle is fully covered in the event of a total loss or major damage. This can give you the confidence to drive your vehicle without the worry of being left with a large financial obligation.

Drawbacks of Gap Insurance

Gap insurance, while beneficial in certain situations, also has some potential drawbacks that you should consider before purchasing it:

Additional Cost

Gap insurance is not free, and the cost is added to your loan or lease. This can increase your monthly payments or the total amount you pay for your vehicle. The cost of gap insurance varies depending on the lender, the type of vehicle you have, and the amount of coverage you choose.

Coverage Limitations

Gap insurance may not cover all types of vehicles. For example, some lenders may not offer gap insurance for older vehicles or vehicles with high mileage. Additionally, gap insurance may not cover certain types of losses, such as if your vehicle is stolen or totaled in an accident that is your fault.

Limitations on Coverage Amounts

Gap insurance typically has a maximum coverage amount, which is the most the insurer will pay if your vehicle is totaled. This coverage amount may not be enough to cover the entire amount you owe on your loan or lease, especially if you have a long loan term or a high-interest rate.

Considerations for Gap Insurance

Before purchasing gap insurance, consider the following factors:

-

The value of your vehicle

Gap insurance is most beneficial for vehicles that depreciate quickly or are financed for a long period.

-

The length of your loan or lease term

If you have a short loan or lease term, you may not need gap insurance as your vehicle is less likely to depreciate significantly.

-

Your financial situation

Gap insurance can provide peace of mind if you are unable to make up the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease.

Alternatives to Gap Insurance

If gap insurance is not the right choice for you, there are other options to protect your vehicle in case of a total loss.

Excess Wear and Tear Coverage

Excess wear and tear coverage is an add-on to your auto insurance policy that covers damages that exceed the normal wear and tear of a vehicle. This can include things like dents, scratches, and upholstery stains. Excess wear and tear coverage can help you get a higher payout from your insurance company if your car is totaled.

Guaranteed Asset Protection (GAP)

Guaranteed asset protection (GAP) is a type of insurance that covers the difference between the amount you owe on your car loan and the actual cash value of your car. This can be helpful if your car is totaled and you still owe money on the loan. GAP insurance is typically offered by dealerships and can be added to your auto insurance policy.

Extended Warranties

Extended warranties are contracts that extend the coverage of your vehicle’s manufacturer’s warranty. This can cover repairs for mechanical breakdowns, electrical problems, and other issues. Extended warranties can help you save money on repairs if your car breaks down after the manufacturer’s warranty expires.