Homeowners Insurance Market Trends

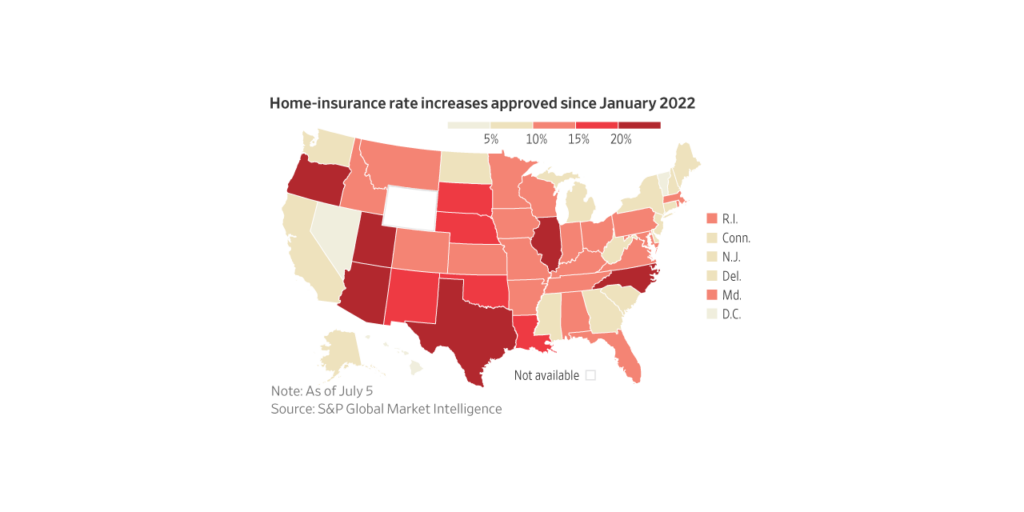

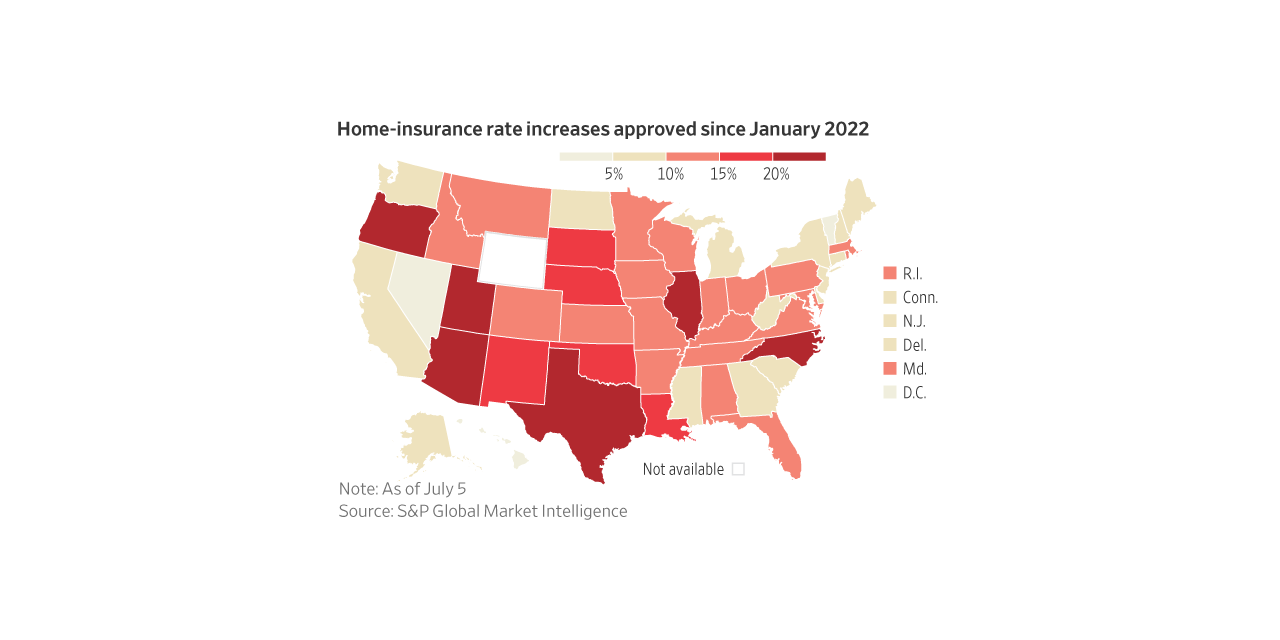

The homeowners insurance market has experienced significant shifts in recent years, primarily characterized by rising premiums and reduced coverage. Several factors have contributed to this trend, including inflation, an increase in natural disasters, and rising reinsurance costs.

According to the Insurance Information Institute, the average annual homeowners insurance premium in the United States increased by 5.2% in 2022, reaching $1,312. This marks the highest increase in premiums since 2017.

Inflation

Inflation has played a significant role in the rise of homeowners insurance premiums. The increasing cost of labor, materials, and other expenses associated with home repairs and replacements has led insurance companies to adjust their premiums accordingly.

Natural Disasters

The increasing frequency and severity of natural disasters, such as hurricanes, wildfires, and floods, have also contributed to the rise in premiums. These events have resulted in significant insurance claims, which have put a strain on the industry’s resources and led to higher premiums for homeowners.

Reinsurance Costs

Reinsurance is a type of insurance that insurance companies purchase to protect themselves against large claims. As the cost of reinsurance has increased, insurance companies have passed on these costs to homeowners in the form of higher premiums.

Reasons for Reduced Coverage

Homeowners insurance companies are offering less coverage for the same premiums due to several factors, including rising costs and increased claims frequency.

Specific coverage reductions include lower limits on personal property, reduced coverage for certain perils such as flooding or earthquakes, and higher deductibles.

Impact on Homeowners

These reductions impact homeowners’ financial protection by increasing their out-of-pocket expenses in the event of a covered loss.

For example, a lower limit on personal property coverage could mean that homeowners are not fully reimbursed for the value of their belongings after a fire or theft.

Reduced coverage for certain perils can leave homeowners vulnerable to financial losses if their property is damaged by an excluded event.

Impact on Homeowners

The recent increase in homeowners insurance premiums and reduction in coverage have significant financial implications for homeowners. The higher premiums can strain household budgets, while the reduced coverage leaves homeowners more vulnerable to financial losses in the event of a covered event.

The following table compares the cost of homeowners insurance before and after the recent increases:

| Year | Average Premium |

|---|---|

| 2020 | $1,200 |

| 2021 | $1,400 |

| 2022 | $1,600 |

As the table shows, homeowners insurance premiums have increased by an average of 13.3% in the past two years. This increase can be a significant financial burden for homeowners, especially those on fixed incomes or who are already struggling to make ends meet.

In addition to the financial burden, the reduced coverage offered by homeowners insurance policies can also have serious consequences for homeowners. If a homeowner’s home is damaged or destroyed in a covered event, they may not be able to recover the full cost of their losses if their policy does not provide adequate coverage.

Homeowners who cannot afford the increased premiums or who are underinsured should consider exploring other options, such as increasing their deductibles or shopping around for a more affordable policy. They should also make sure to have a comprehensive inventory of their belongings and to keep their policy up to date.

Strategies for Managing Costs

The escalating cost of homeowners insurance can be a significant financial burden. Fortunately, there are several strategies homeowners can employ to manage these costs effectively.

Shopping for Lower Premiums

Comparing quotes from multiple insurance companies can help homeowners secure the most competitive premiums. Online comparison tools and independent insurance agents can facilitate this process. Consider factors such as coverage limits, deductibles, and discounts.

Increasing Deductibles

Raising the deductible, or the amount homeowners pay out-of-pocket before insurance coverage kicks in, can lower premiums. While this may increase the financial responsibility in the event of a claim, it can be a cost-effective strategy for low-risk homeowners.

Reducing Risk of Claims

Homeowners can proactively reduce the likelihood of filing claims, which can lead to lower premiums in the long run. Measures include:

- Maintaining the property regularly

- Installing security systems

- Taking steps to prevent water damage

Government Programs and Initiatives

Certain government programs may provide assistance with homeowners insurance costs, such as:

- Federal Emergency Management Agency (FEMA) flood insurance

- Low-income homeowner insurance programs

- State-sponsored FAIR plans (Fair Access to Insurance Requirements)

Future Outlook

The homeowners insurance market is constantly evolving, influenced by various factors such as natural disasters, economic conditions, and regulatory changes. Forecasting future trends can be challenging, but industry experts anticipate certain developments that may shape the insurance landscape in the coming years.

Factors Influencing Future Premiums and Coverage Levels

- Climate Change: Increasing frequency and severity of natural disasters, such as hurricanes, wildfires, and floods, may lead to higher premiums in affected areas.

- Economic Conditions: Economic downturns can impact homeowners’ ability to pay premiums, leading to reduced coverage levels.

- Technological Advancements: Innovations like smart home devices and predictive analytics may provide insurers with more data to assess risk, potentially leading to more tailored and affordable policies.

- Regulatory Changes: Government regulations can influence coverage requirements and premium rates, impacting homeowners’ insurance costs.

Preparing for Potential Changes in the Insurance Landscape

Homeowners can proactively prepare for potential changes in the homeowners insurance market by:

- Regularly Reviewing Coverage: Regularly assessing insurance needs and making necessary adjustments to coverage levels and deductibles can help ensure adequate protection.

- Exploring Discounts and Savings: Taking steps to mitigate risks, such as installing security systems or making home improvements, can qualify homeowners for discounts on premiums.

- Shopping Around for Quotes: Comparing quotes from multiple insurance companies can help homeowners find the best coverage at competitive rates.

- Building an Emergency Fund: Having an emergency fund can provide a financial cushion in case of unexpected events, reducing the impact of potential insurance costs.