Company Overview

Hallmark County Mutual Insurance Company is a leading provider of property and casualty insurance in the Midwest. The company was founded in 1875 by a group of farmers who wanted to protect their homes and businesses from the risks of fire and other perils.

Today, Hallmark County Mutual Insurance Company offers a wide range of insurance products, including homeowners, auto, farm, and business insurance. The company is committed to providing its customers with quality insurance products at competitive prices.

Mission, Vision, and Values

Hallmark County Mutual Insurance Company’s mission is to provide peace of mind to its customers by protecting them from the financial risks of life.

The company’s vision is to be the leading provider of insurance products in the Midwest.

Hallmark County Mutual Insurance Company’s values are:

- Integrity

- Customer focus

- Excellence

- Teamwork

- Innovation

Products and Services

Hallmark County Mutual Insurance Company offers a comprehensive suite of insurance products tailored to meet the diverse needs of individuals, families, and businesses.

Our products are designed to provide peace of mind and financial protection against a wide range of risks.

Personal Insurance

- Homeowners Insurance: Protects your home, personal belongings, and liability in the event of covered losses such as fire, theft, or natural disasters.

- Renters Insurance: Provides coverage for your personal property and liability while renting a home or apartment.

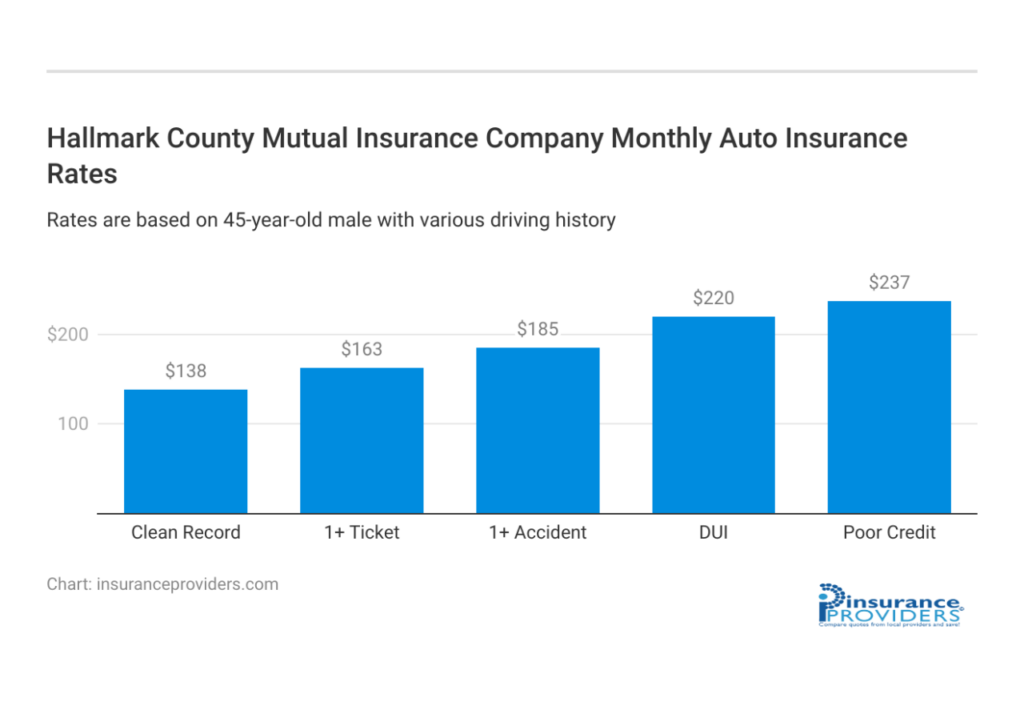

- Auto Insurance: Covers your vehicle and provides liability protection in the event of an accident.

- Life Insurance: Offers financial protection for your loved ones in the event of your untimely demise.

- Health Insurance: Helps cover the costs of medical expenses and provides access to healthcare services.

Business Insurance

- Commercial Property Insurance: Protects your business property, including buildings, equipment, and inventory, from covered losses such as fire, theft, or natural disasters.

- Commercial Liability Insurance: Provides coverage for your business against claims of bodily injury or property damage caused to others.

- Business Interruption Insurance: Helps cover lost income and expenses if your business is forced to close due to a covered event.

- Workers’ Compensation Insurance: Provides coverage for employees who are injured or become ill on the job.

- Cyber Liability Insurance: Protects your business against financial losses resulting from cyber attacks, data breaches, or privacy violations.

Unique and Specialized Offerings

- Antique and Collectibles Insurance: Provides specialized coverage for valuable items such as antiques, artwork, and collectibles.

- Flood Insurance: Covers damage caused by flooding, which is not typically covered by homeowners insurance.

- Umbrella Insurance: Provides additional liability coverage beyond the limits of your other insurance policies.

Financial Performance

Hallmark County Mutual Insurance Company has consistently demonstrated strong financial performance, reflecting its prudent underwriting practices and sound investment strategies. The company’s financial health is evident in its robust revenue growth, solid profitability, and exceptional solvency ratios.

Revenue Growth

Hallmark County Mutual Insurance Company has experienced steady revenue growth over the past several years, driven by an increase in policyholders and a rise in average premiums. The company’s diversified product portfolio and focus on niche markets have contributed to its ability to generate a stable and growing revenue stream.

Profitability

Hallmark County Mutual Insurance Company maintains a healthy profit margin, indicating its ability to control expenses and generate underwriting profits. The company’s underwriting income is supported by a conservative underwriting approach and a focus on risk management. Additionally, the company’s investment income provides a consistent source of revenue, further contributing to its overall profitability.

Solvency Ratios

Hallmark County Mutual Insurance Company’s solvency ratios exceed industry benchmarks, demonstrating its financial strength and ability to meet its obligations to policyholders. The company’s capital adequacy ratio, which measures its ability to absorb potential losses, is consistently well above the regulatory minimum. This strong solvency position provides policyholders with confidence in the company’s ability to fulfill its financial commitments.

Customer Service

Hallmark County Mutual Insurance Company prioritizes customer satisfaction by offering a comprehensive range of support channels. Customers can connect with the company through phone, email, live chat, and in-person appointments. The customer service team is known for its responsiveness, professionalism, and willingness to go the extra mile.

Customer Service Channels

– Phone: Customers can reach a dedicated customer service representative 24/7 by calling the company’s toll-free number.

– Email: Inquiries can be submitted via email, with a typical response time of within one business day.

– Live Chat: Real-time support is available through the company’s website during business hours.

– In-Person: Customers can schedule an appointment to visit a local office for personalized assistance.

Quality and Responsiveness

Hallmark County Mutual Insurance Company’s customer service team consistently receives high ratings for its quality and responsiveness. Representatives are knowledgeable, courteous, and committed to resolving customer issues efficiently. The company uses advanced technology to streamline processes and ensure timely responses.

Positive Customer Experiences

Customers have expressed their satisfaction with the company’s customer service in numerous testimonials. One customer praised the “exceptional” support they received after filing a claim, while another commended the “friendly and helpful” staff who provided clear and concise explanations.

Market Share and Competition

Hallmark County Mutual Insurance Company holds a significant market share in its target market, which comprises homeowners and small businesses in the Midwest. The company’s strong local presence, competitive pricing, and tailored insurance solutions have contributed to its market dominance.

Major Competitors

Hallmark County Mutual Insurance Company faces competition from several established players in the insurance industry, including:

– Nationwide Insurance: A leading provider of personal and commercial insurance products with a vast network of agents. Strengths: Strong brand recognition, comprehensive coverage options. Weaknesses: Higher premiums compared to some competitors.

– State Farm Insurance: Another major insurer with a focus on auto and homeowners insurance. Strengths: Extensive agent network, customer loyalty. Weaknesses: Limited coverage options for specialty insurance needs.

– Progressive Insurance: Known for its innovative insurance products and competitive pricing. Strengths: Unique offerings like Snapshot and Name Your Price, targeted marketing campaigns. Weaknesses: Limited agent network, fewer customization options.

– Geico Insurance: A popular insurer known for its low-cost auto insurance. Strengths: Aggressive pricing, simplified coverage options. Weaknesses: Limited coverage options for non-auto insurance needs.

Competitive Landscape and Market Trends

The insurance industry is highly competitive, with companies vying for market share through various strategies. Key trends shaping the competitive landscape include:

– Increased use of technology: Insurers are leveraging technology to streamline processes, offer personalized policies, and improve customer service.

– Rising demand for specialty insurance: Businesses and individuals are seeking specialized insurance solutions tailored to their unique needs.

– Consolidation: The insurance industry has seen a trend towards consolidation, with larger insurers acquiring smaller companies to expand their market reach.

Hallmark County Mutual Insurance Company is well-positioned to navigate the competitive landscape by leveraging its local expertise, strong financial performance, and commitment to customer satisfaction.

Marketing and Advertising

Hallmark County Mutual Insurance Company employs a multifaceted marketing and advertising strategy to reach target audiences effectively. The company leverages various channels, including traditional advertising, digital marketing, and community engagement, to promote its products and services.

Hallmark County Mutual Insurance Company’s advertising campaigns are designed to resonate with specific customer segments. The company uses a mix of television, radio, and print advertising to reach a broad audience. Its advertisements often feature real-life stories of policyholders who have benefited from the company’s coverage. This approach helps build trust and credibility with potential customers.

Digital Marketing

In addition to traditional advertising, Hallmark County Mutual Insurance Company also invests heavily in digital marketing. The company maintains a robust online presence through its website and social media channels. Hallmark County Mutual Insurance Company uses these platforms to provide valuable content to potential customers, such as insurance tips, safety advice, and information about its products and services.

The company also utilizes search engine optimization () and pay-per-click (PPC) advertising to improve its visibility in search engine results. This helps ensure that potential customers can easily find Hallmark County Mutual Insurance Company when they are searching for insurance information.

Community Engagement

Hallmark County Mutual Insurance Company is deeply involved in its local communities. The company supports a variety of charitable organizations and events, which helps build goodwill and raise awareness of its brand. Hallmark County Mutual Insurance Company also participates in local festivals and community gatherings, providing an opportunity to connect with potential customers on a personal level.

Hallmark County Mutual Insurance Company’s marketing and advertising strategies have been successful in reaching target audiences and generating leads. The company’s advertising campaigns have won numerous awards for their creativity and effectiveness. Hallmark County Mutual Insurance Company’s digital marketing efforts have also been successful in driving traffic to its website and generating leads.

Examples of Successful Marketing Campaigns

One of Hallmark County Mutual Insurance Company’s most successful marketing campaigns was its “Real Stories” campaign. This campaign featured real-life stories of policyholders who had benefited from the company’s coverage. The campaign was highly effective in building trust and credibility with potential customers and resulted in a significant increase in sales.

Hallmark County Mutual Insurance Company has also had success with its digital marketing campaigns. The company’s website is a valuable resource for potential customers, providing a wealth of information about insurance products and services. Hallmark County Mutual Insurance Company’s social media channels are also a great way for the company to connect with potential customers and generate leads.

Technology and Innovation

Hallmark County Mutual Insurance Company leverages a robust technology platform to enhance its operations and customer experience. The company invests in cutting-edge infrastructure and digital solutions to drive innovation and efficiency.

Technology Platform

Hallmark County Mutual Insurance Company utilizes a comprehensive technology stack that includes:

- Cloud-based infrastructure for scalability, flexibility, and security.

- Proprietary underwriting system for automated risk assessment and policy issuance.

- Customer relationship management (CRM) system for personalized communication and support.

Innovation and Digital Transformation

The company embraces innovation and actively explores emerging technologies to improve its products and services. Its digital transformation initiatives include:

- Implementing artificial intelligence (AI) for fraud detection and claims processing.

- Developing mobile apps for convenient policy management and claims reporting.

- Integrating with third-party platforms to enhance customer convenience.

Improved Customer Experience

Hallmark County Mutual Insurance Company’s technology investments have significantly enhanced the customer experience:

- Online self-service portals provide 24/7 access to policy information and claims.

- Automated underwriting processes reduce processing times and improve policy issuance speed.

- Mobile apps enable customers to manage their insurance on the go.

Operational Efficiency

Technology has also driven operational efficiency within the company:

- AI-powered fraud detection reduces manual investigations and improves accuracy.

- Automated claims processing accelerates claim settlements and reduces administrative costs.

- Integrated systems streamline communication and data sharing between departments.

Social Responsibility and Sustainability

Hallmark County Mutual Insurance Company places great importance on its role as a socially responsible corporate citizen. The company is committed to conducting its business in a sustainable and ethical manner, while contributing positively to the communities it serves.

Hallmark County Mutual has established a comprehensive Environmental, Social, and Governance (ESG) framework to guide its sustainability efforts. This framework encompasses a wide range of initiatives focused on environmental stewardship, social responsibility, and corporate governance.

Environmental Stewardship

Hallmark County Mutual recognizes the importance of protecting the environment and minimizing its carbon footprint. The company has implemented several initiatives to reduce its environmental impact, including:

* Using renewable energy sources to power its offices and operations

* Investing in energy-efficient technologies to reduce energy consumption

* Recycling and composting waste to minimize landfill contributions

* Promoting sustainable practices among its employees and customers

Social Responsibility

Hallmark County Mutual is committed to supporting the communities it serves. The company actively engages in philanthropic initiatives and partnerships that address local needs, such as:

* Supporting educational programs for underprivileged youth

* Providing financial assistance to disaster relief efforts

* Volunteering and participating in community clean-ups and beautification projects

Corporate Governance

Hallmark County Mutual adheres to the highest standards of corporate governance to ensure transparency, accountability, and ethical decision-making. The company has a strong Board of Directors that provides oversight and guidance on ESG matters. The company also regularly reviews and updates its policies and procedures to ensure compliance with ethical and legal requirements.

Through its commitment to social responsibility and sustainability, Hallmark County Mutual Insurance Company strives to be a positive force in the communities it serves. The company’s ESG initiatives demonstrate its dedication to environmental protection, social progress, and ethical business practices.

Awards and Recognition

Hallmark County Mutual Insurance Company has received numerous awards and recognitions for its exceptional performance and commitment to customer satisfaction.

These accolades serve as a testament to the company’s dedication to providing superior insurance products and services, maintaining a strong financial position, and fostering a positive reputation within the industry.

Awards and Significance

- J.D. Power Award for Customer Satisfaction: Hallmark County Mutual Insurance Company has consistently ranked among the top insurers in J.D. Power’s annual customer satisfaction survey. This award recognizes the company’s ability to meet and exceed customer expectations through its exceptional service and support.

- A.M. Best “A” (Excellent) Financial Strength Rating: A.M. Best is a leading global credit rating agency that evaluates the financial strength of insurance companies. Hallmark County Mutual Insurance Company’s “A” (Excellent) rating indicates its strong financial stability and ability to meet its obligations to policyholders.

- Ward’s Top 50 Performing Property/Casualty Insurers: Ward Group is a leading provider of financial information and analysis for the insurance industry. Hallmark County Mutual Insurance Company’s inclusion in the Ward’s Top 50 Performing Property/Casualty Insurers list highlights its strong financial performance and operational efficiency.

Future Outlook

Hallmark County Mutual Insurance Company has a bright future ahead, with many opportunities for growth and expansion. The company is well-positioned to take advantage of these opportunities and continue its success.

The company’s strong financial performance and customer base provide a solid foundation for future growth. Hallmark County Mutual Insurance Company has a long history of profitability and has consistently outperformed its competitors. The company also has a loyal customer base that is highly satisfied with its products and services.

Growth Opportunities

Hallmark County Mutual Insurance Company has a number of growth opportunities in the coming years. One opportunity is to expand into new markets. The company currently operates in a limited number of states, but it has the potential to expand into new markets both within the United States and internationally.

Another growth opportunity is to develop new products and services. The company currently offers a wide range of insurance products, but it can expand its offerings to meet the needs of its customers. For example, the company could develop new products that are tailored to the needs of specific customer segments, such as small businesses or high-net-worth individuals.

Challenges

Hallmark County Mutual Insurance Company also faces a number of challenges in the coming years. One challenge is the increasing competition in the insurance industry. The insurance industry is becoming increasingly competitive, and Hallmark County Mutual Insurance Company will need to find ways to differentiate itself from its competitors.

Another challenge is the changing regulatory environment. The insurance industry is heavily regulated, and Hallmark County Mutual Insurance Company will need to keep up with the changing regulations.

Recommendations

Hallmark County Mutual Insurance Company can maintain its success and adapt to future trends by taking the following steps:

- Continue to focus on providing high-quality products and services.

- Expand into new markets.

- Develop new products and services.

- Invest in technology.

- Maintain a strong financial position.

By taking these steps, Hallmark County Mutual Insurance Company can continue to be a leading provider of insurance products and services for years to come.