Business Liability Coverage in Alabama

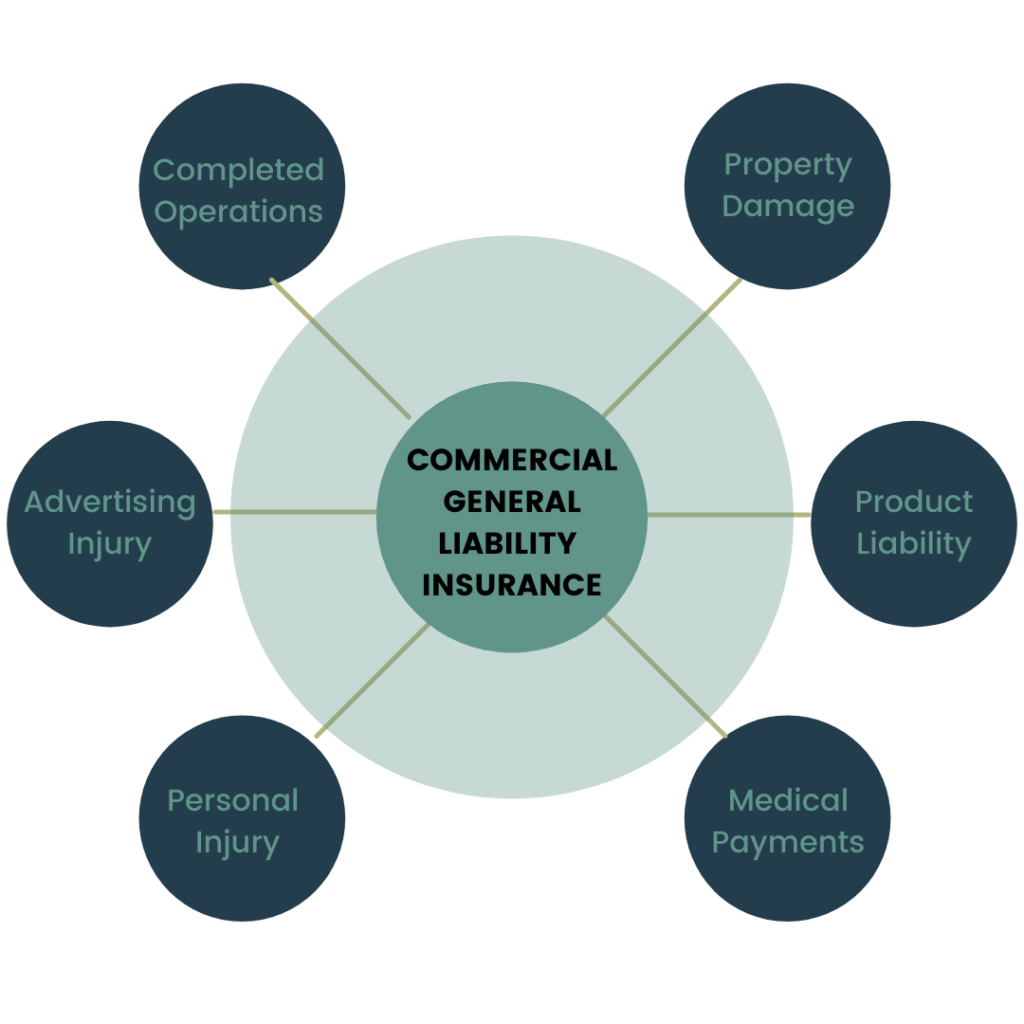

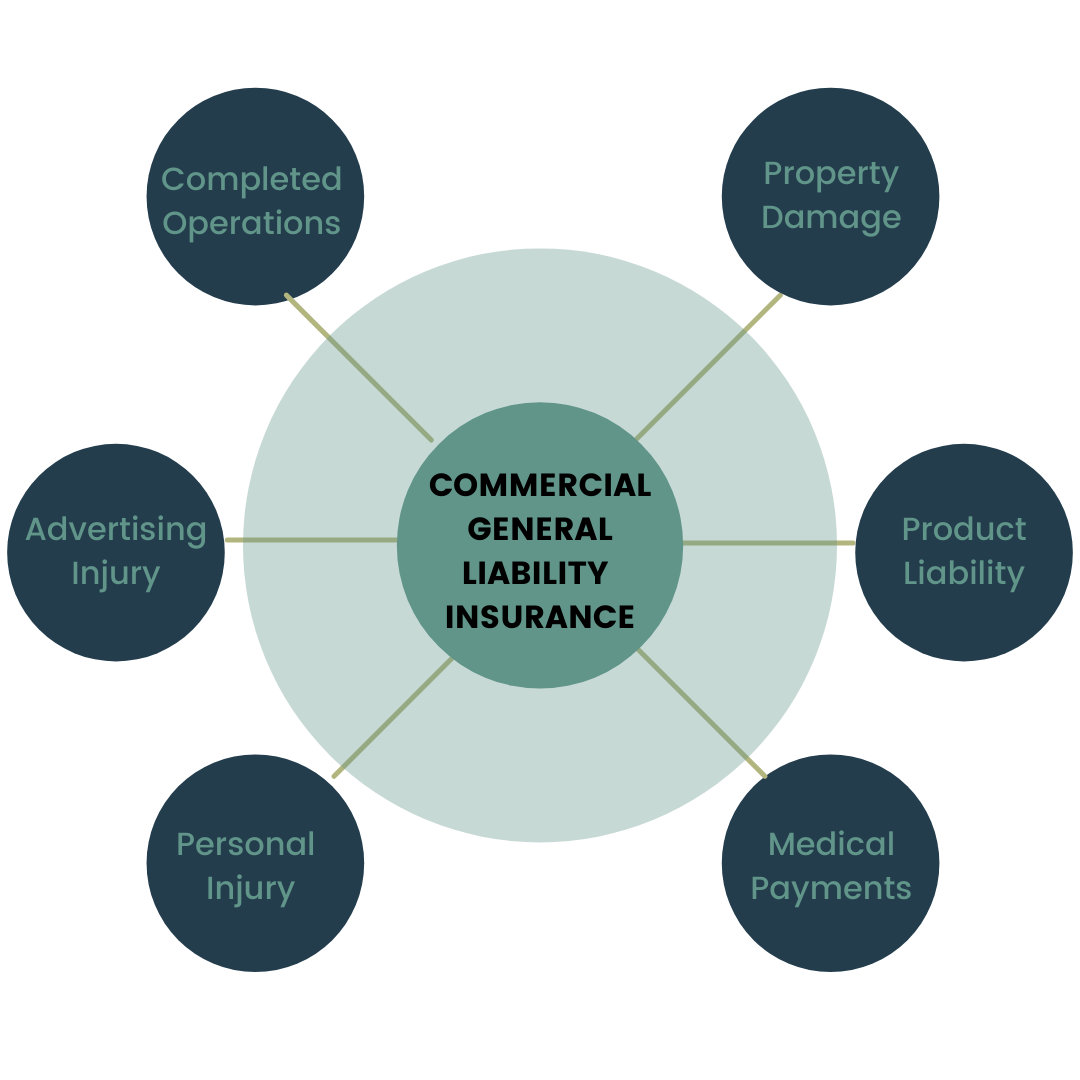

General liability insurance is essential for businesses operating in Alabama. It provides financial protection against claims arising from bodily injury, property damage, or personal injury caused by the business’s operations, products, or services.

Common risks covered by general liability insurance in Alabama include:

- Bodily injury or property damage caused by the business’s premises, products, or operations

- Libel, slander, or defamation

- Advertising injuries

- Medical expenses for non-employees

Alabama law does not mandate businesses to carry general liability insurance. However, many businesses choose to do so to protect themselves financially and maintain customer confidence.

Types of General Liability Insurance Policies

General liability insurance policies in Alabama come in various forms, each tailored to specific business needs. Understanding the different types of policies and their coverage limits and exclusions is crucial for businesses seeking adequate protection.

The main types of general liability insurance policies available in Alabama include:

Occurrence-Based Policies

- Occurrence-Based Policies: Provide coverage for claims arising from incidents that occur during the policy period, regardless of when the claim is filed.

- Claims-Made Policies: Only cover claims filed during the policy period, even if the incident occurred before the policy was purchased.

Coverage Limits and Exclusions

Coverage limits refer to the maximum amount an insurance company will pay for covered claims. Exclusions are specific events or circumstances that are not covered by the policy. Common exclusions in general liability policies include:

- Intentional acts

- Criminal acts

- Pollution

- Professional negligence

Choosing the Right Policy

Selecting the right general liability insurance policy for a specific business involves considering factors such as the nature of the business, potential risks, and financial resources. Businesses should carefully review the coverage limits, exclusions, and policy type to ensure they have adequate protection.

Cost of General Liability Insurance in Alabama

General liability insurance premiums in Alabama vary depending on several factors, including the size of the business, industry, and claims history. On average, businesses in Alabama can expect to pay between $500 and $1,500 annually for general liability coverage.

Larger businesses with more employees and higher revenue typically pay higher premiums than smaller businesses. Additionally, businesses operating in high-risk industries, such as construction or manufacturing, may also face higher premiums.

Tips to Reduce Insurance Premiums

Businesses can take several steps to reduce their general liability insurance premiums, including:

- Maintaining a good claims history.

- Implementing risk management strategies.

- Bundling insurance policies.

- Negotiating with insurance providers.

Finding an Insurance Provider in Alabama

To secure general liability insurance in Alabama, businesses should explore reputable providers. Obtain quotes from multiple insurers to compare coverage options and premiums. Negotiating favorable rates involves understanding coverage needs, presenting a strong risk profile, and exploring discounts and payment plans.

Reputable Insurance Providers

Alabama businesses can consider the following providers for general liability insurance:

– The Hartford

– Liberty Mutual

– Travelers

– CNA

– Nationwide

Obtaining Quotes and Comparing Coverage

To obtain quotes, businesses can contact insurance providers directly or use an insurance broker. Provide insurers with information about the business’s operations, revenue, and claims history. Compare quotes carefully, considering coverage limits, deductibles, and exclusions.

Negotiating Rates

To negotiate the best rates, businesses should:

– Maintain a clean claims history.

– Implement risk management measures.

– Consider increasing deductibles to lower premiums.

– Explore discounts for safety programs, employee training, and bundling policies.

– Pay premiums annually or in advance to secure potential discounts.

Filing a General Liability Claim in Alabama

Filing a general liability claim in Alabama involves several key steps. Understanding the process and documentation requirements is crucial to ensure a smooth and successful claim experience.

Steps Involved in Filing a Claim

* Report the Incident: Immediately report the incident to your insurance provider. Provide detailed information, including the date, time, location, and circumstances of the event.

* Gather Documentation: Collect all relevant documentation, such as police reports, witness statements, medical records, and property damage estimates.

* Submit a Formal Claim: Complete and submit a formal claim form to your insurance company. Include a comprehensive description of the incident, the damages sustained, and the documentation you have gathered.

* Investigation and Settlement: The insurance company will investigate the claim and determine liability. They may request additional information or documentation during this process. Once liability is established, the insurance company will offer a settlement amount based on the damages incurred.

Time Limits for Filing a Claim

In Alabama, the statute of limitations for filing a general liability claim is two years from the date of the incident. It is important to report the incident and file a claim promptly to avoid missing this deadline.

Settling a Claim

The settlement process involves negotiating with the insurance company to reach a mutually acceptable amount of compensation. It is advisable to consult with an attorney if you have any questions or concerns regarding the settlement offer.