Gap Insurance in New York

Definition and Overview

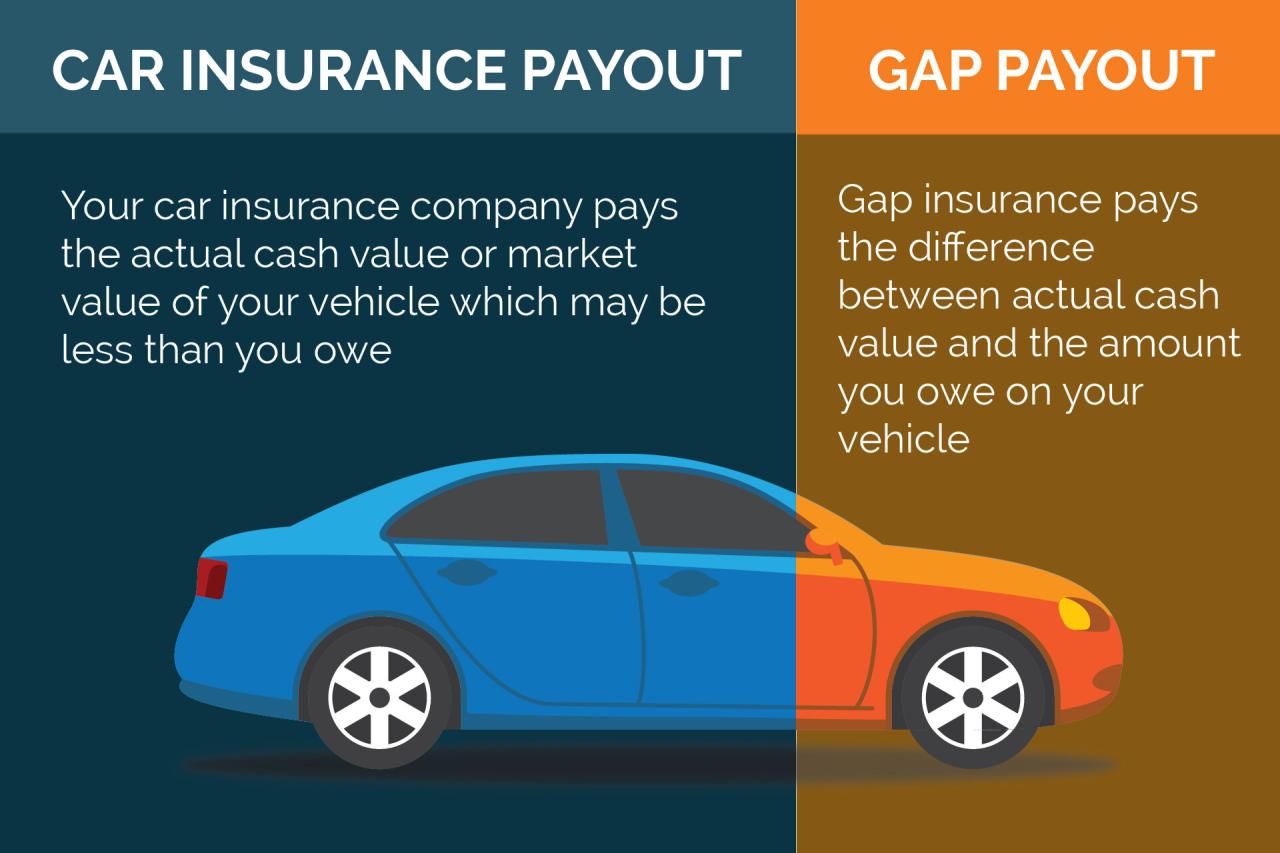

Gap insurance is an optional auto insurance coverage that helps protect you from financial loss if your car is totaled or stolen and the amount you owe on your loan or lease is greater than the actual cash value (ACV) of the car.

In New York, gap insurance is not required by law, but it can be a valuable investment for drivers who have financed or leased their vehicles.

How Gap Insurance Works

When you purchase gap insurance, you are essentially buying protection against the “gap” between the ACV of your car and the amount you owe on your loan or lease.

If your car is totaled or stolen, your primary auto insurance policy will pay up to the ACV of the car. If the ACV is less than the amount you owe on your loan or lease, gap insurance will cover the difference.

Benefits of Gap Insurance

There are several benefits to having gap insurance, including:

- Peace of mind knowing that you are protected from financial loss if your car is totaled or stolen.

- Lower monthly payments on your loan or lease.

- Increased value of your car if you sell it or trade it in.

Cost and Benefits of Gap Insurance in New York

The cost of gap insurance in New York varies depending on several factors, including the make and model of your vehicle, the amount of coverage you choose, and your driving history. Generally, gap insurance is more expensive for newer vehicles and vehicles with higher loan-to-value ratios.

However, the potential benefits of gap insurance can outweigh the costs. If your vehicle is totaled or stolen, gap insurance can help you pay off the remaining balance on your loan, even if the insurance company’s payout is less than the amount you owe. This can provide you with financial protection and peace of mind in the event of a covered loss.

Weighing the Costs and Benefits

When considering whether or not to purchase gap insurance, it’s important to weigh the costs and benefits carefully. If you have a newer vehicle or a vehicle with a high loan-to-value ratio, gap insurance may be a worthwhile investment. However, if you have an older vehicle or a vehicle with a low loan-to-value ratio, you may be able to save money by opting out of gap insurance.

Eligibility and Requirements for Gap Insurance in New York

To be eligible for gap insurance in New York, you must meet certain criteria. These include:

* Financing a vehicle: Gap insurance is only available for financed vehicles. If you own your vehicle outright, you are not eligible for gap insurance.

* Loan-to-value ratio: The loan-to-value (LTV) ratio of your vehicle must be greater than 80%. This means that you must owe more on your vehicle than it is worth.

* Term of the loan: The term of your loan must be at least 60 months.

In addition to meeting these criteria, you will also need to provide the following documentation to obtain gap insurance:

* Proof of income: This can include a pay stub, bank statement, or tax return.

* Proof of insurance: You will need to provide proof of your current auto insurance policy.

* Vehicle registration: You will need to provide a copy of your vehicle registration.

If you meet the eligibility criteria and have the required documentation, you can apply for gap insurance through your lender or an insurance company.

Determining if You Qualify for Gap Insurance

If you are unsure whether you qualify for gap insurance, you can contact your lender or an insurance company. They can review your financial situation and determine if you are eligible for coverage.

Choosing the Right Gap Insurance Provider in New York

Gap insurance is offered by various types of providers in New York, including auto insurance companies, credit unions, and independent insurance agencies. Each provider offers different features, coverage options, and costs. It’s essential to compare these factors to choose the right gap insurance provider for your needs.

Types of Gap Insurance Providers

– Auto Insurance Companies: Many auto insurance companies offer gap insurance as an add-on to their policies. The coverage is typically comprehensive, and the cost is often competitive.

– Credit Unions: Some credit unions offer gap insurance to their members. The coverage may be limited compared to auto insurance companies, but the cost may be lower.

– Independent Insurance Agencies: Independent insurance agencies represent multiple insurance companies, allowing you to compare different gap insurance policies and choose the one that best suits your needs.

Factors to Consider

– Coverage Options: Compare the coverage options offered by different providers, such as the maximum amount of coverage, the deductible, and any exclusions.

– Cost: Get quotes from multiple providers to compare the costs of gap insurance. The cost may vary depending on the coverage options you choose and your vehicle’s value.

– Reputation and Customer Service: Research the reputation of different providers by reading online reviews and talking to other customers. Consider the quality of their customer service and how easy it is to file a claim.

Tips for Choosing a Gap Insurance Provider

– Shop around: Compare quotes from multiple providers to find the best coverage and price.

– Read the policy carefully: Understand the coverage options, exclusions, and any other important details before purchasing gap insurance.

– Consider your needs: Determine the amount of coverage you need based on the value of your vehicle and your financial situation.

– Ask questions: If you have any questions about gap insurance, don’t hesitate to ask your insurance agent or provider for clarification.

Claiming Gap Insurance in New York

Filing a gap insurance claim in New York is a straightforward process that typically involves the following steps:

- Contact your gap insurance provider promptly after an accident or theft.

- Provide the insurance company with the necessary documentation, including the police report, accident report, and proof of ownership.

- Cooperate with the insurance company’s investigation into the claim.

- Submit a signed claim form and provide any additional information requested by the insurance company.

The insurance company will review the claim and determine the amount of coverage available. The payment will typically be sent directly to the lender, who will use it to pay off the remaining balance on the loan.

Timelines and Procedures

The claims process typically takes several weeks to complete. The insurance company will investigate the claim and determine the amount of coverage available. The payment will typically be sent directly to the lender, who will use it to pay off the remaining balance on the loan.