Farmers Insurance Overview

Farmers Insurance, established in 1928, is an American insurance group providing a comprehensive range of insurance products and services to individuals, families, and businesses across the United States.

The company offers a diverse portfolio of insurance solutions, including auto, home, renters, life, business, and specialty insurance. Farmers Insurance is known for its commitment to providing personalized and tailored insurance solutions to meet the unique needs of its customers.

Market Share and Industry Position

Farmers Insurance holds a significant market share in the U.S. insurance industry, consistently ranking among the top insurance providers in the country. The company’s strong brand recognition, extensive distribution network, and focus on customer satisfaction have contributed to its success in the highly competitive insurance market.

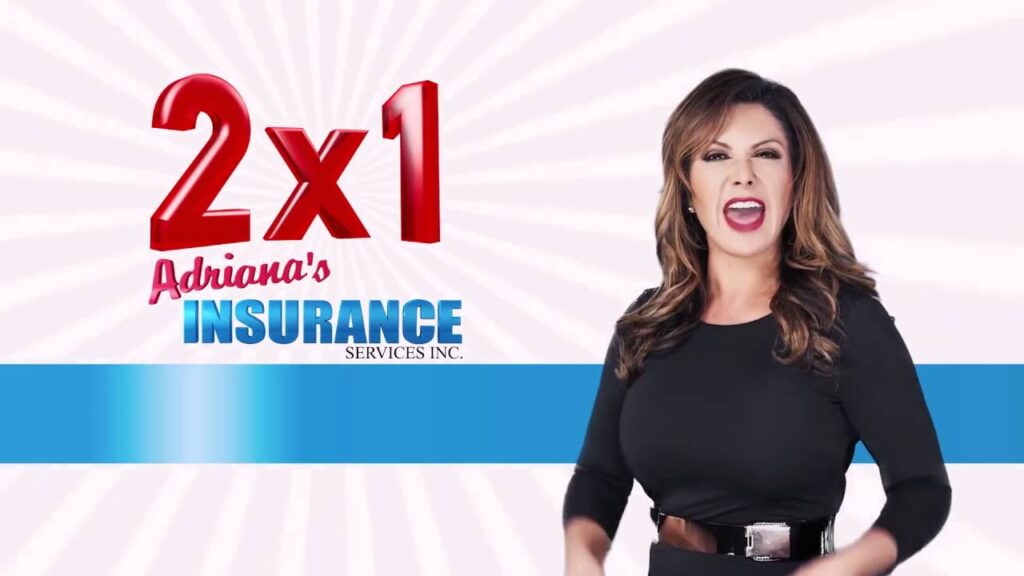

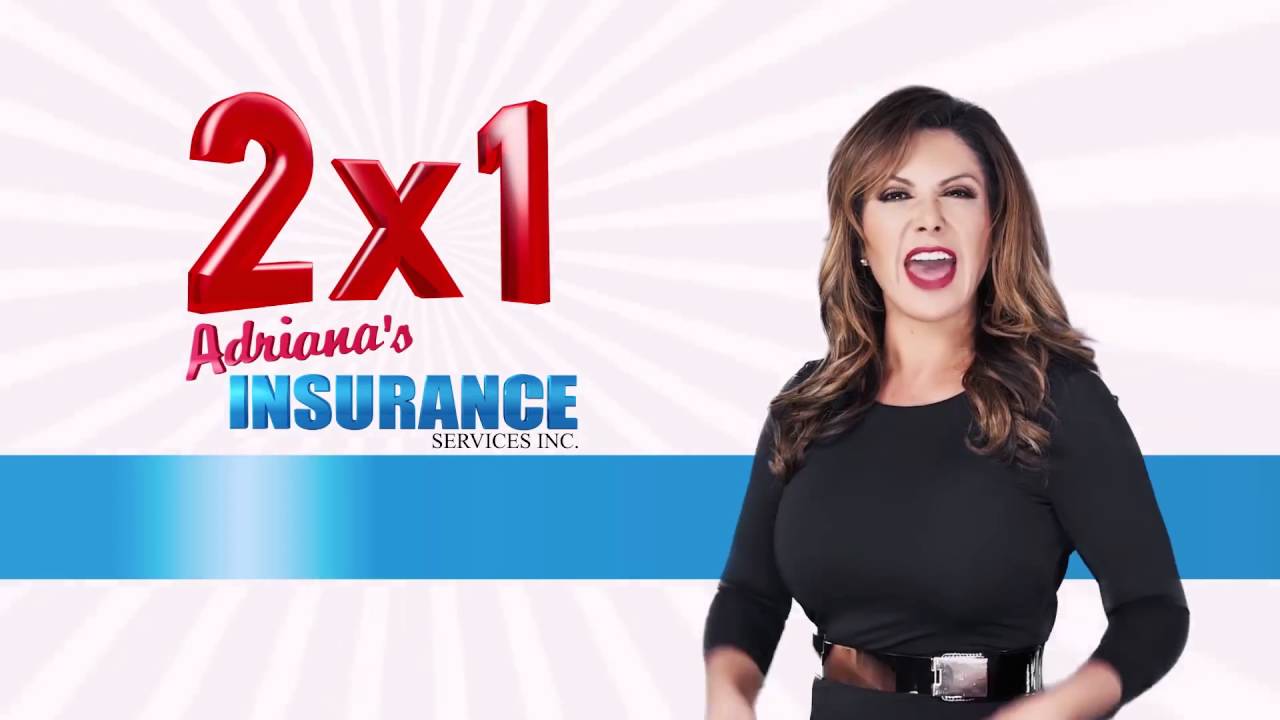

Adriana Fregoso

Adriana Fregoso, a seasoned professional in the insurance industry, joined Farmers Insurance in 2021 as the Chief Executive Officer (CEO). With over two decades of experience in various leadership roles within the insurance sector, she brings a wealth of knowledge and expertise to the company.

Before joining Farmers Insurance, Adriana held executive positions at several renowned insurance organizations. She served as the CEO of SiriusPoint, a global specialty insurer and reinsurer, where she led the company’s strategic direction and operations. Prior to that, she held leadership roles at AIG, where she was responsible for the company’s global property and casualty businesses.

Contributions to Farmers Insurance

Since joining Farmers Insurance, Adriana has made significant contributions to the company’s growth and success. Under her leadership, Farmers Insurance has strengthened its financial performance, expanded its product offerings, and enhanced its customer service. She has also implemented various initiatives to improve the company’s operational efficiency and risk management practices.

Role and Responsibilities

As the CEO of Farmers Insurance, Adriana is responsible for the overall strategic direction and management of the company. Her key responsibilities include:

- Setting the company’s strategic vision and goals

- Leading the company’s executive team

- Managing the company’s financial performance

- Overseeing the company’s operations and risk management

- Representing the company to external stakeholders

Adriana Fregoso’s expertise and leadership have been instrumental in driving Farmers Insurance’s continued success and growth. She is widely recognized as a respected leader in the insurance industry and her contributions to the company have been highly valued.

Leadership and Management Style

Adriana Fregoso’s leadership style is characterized by her strong work ethic, dedication to her team, and commitment to innovation. She is known for her ability to motivate and inspire her employees, and for her collaborative and inclusive approach to management.

Fregoso’s decision-making process is based on a combination of data analysis, stakeholder input, and her own experience and intuition. She is known for her ability to make quick and decisive decisions, even in complex and challenging situations.

Employee Engagement and Motivation

Fregoso believes that engaged and motivated employees are the key to a successful organization. She has implemented a number of initiatives to foster employee engagement, including regular performance reviews, employee recognition programs, and opportunities for professional development.

Customer Service and Claims Handling

Farmers Insurance prioritizes customer satisfaction and retention by streamlining its customer service and claims handling processes. Under Adriana Fregoso’s leadership, the company has implemented initiatives that enhance customer experiences and foster long-term relationships.

Claims Handling Efficiency

Farmers Insurance employs a team of experienced claims adjusters who are dedicated to providing prompt and efficient claims resolution. The company has invested in technology that enables real-time claim reporting, automated damage assessments, and expedited payment processing. This streamlined approach reduces claim processing times and improves customer satisfaction.

Customer-Centric Approach

Farmers Insurance has adopted a customer-centric approach that focuses on understanding and addressing individual customer needs. The company employs empathetic and knowledgeable customer service representatives who are empowered to resolve issues promptly and effectively. Farmers Insurance also offers personalized insurance solutions tailored to each customer’s unique requirements.

Data and Case Studies

Data from J.D. Power’s 2023 U.S. Auto Insurance Customer Satisfaction Study shows that Farmers Insurance consistently ranks among the top performers in customer satisfaction. Case studies highlight the effectiveness of the company’s customer-centric approach:

– In 2022, Farmers Insurance resolved a complex homeowners claim within 48 hours, providing the customer with a quick and satisfactory resolution.

– The company’s mobile app allows customers to easily report claims, track progress, and receive updates, leading to increased customer convenience and satisfaction.

Industry Trends and Challenges

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements, changing customer expectations, and increasing regulatory pressures.

Farmers Insurance, under the leadership of Adriana Fregoso, is responding to these challenges by investing in innovation, embracing data analytics, and focusing on customer-centricity. The company is also exploring new partnerships and acquisitions to expand its product offerings and reach new markets.

Technology and Innovation

The insurance industry is being reshaped by the rapid adoption of new technologies, such as artificial intelligence (AI), machine learning, and blockchain. These technologies are being used to automate tasks, improve underwriting accuracy, and enhance customer experiences.

Farmers Insurance is investing heavily in technology to stay ahead of the curve. The company has developed a number of innovative products and services, such as its Smart Home Assistant, which uses AI to help customers prevent and mitigate risks.

Changing Customer Expectations

Customers are increasingly expecting their insurance providers to offer personalized and convenient experiences. They want to be able to access their policies and file claims online or through mobile apps. They also want their insurers to be transparent and responsive to their needs.

Farmers Insurance is responding to these changing expectations by investing in digital channels and improving its customer service. The company has launched a new website and mobile app that make it easier for customers to manage their policies and file claims.

Regulatory Pressures

The insurance industry is also facing increasing regulatory pressures. Regulators are requiring insurers to be more transparent about their pricing and practices. They are also requiring insurers to do more to protect consumers from fraud and abuse.

Farmers Insurance is committed to complying with all applicable regulations. The company has implemented a number of measures to protect consumers, such as its Fraud Detection Unit and its Customer Bill of Rights.

Social Responsibility and Community Involvement

Farmers Insurance is committed to social responsibility and actively participates in community involvement initiatives. Adriana Fregoso, as the CEO, has made diversity, equity, and inclusion (DEI) a top priority for the company and the industry.

DEI Initiatives

Fregoso has implemented various programs to promote DEI within Farmers Insurance, including:

– Employee Resource Groups (ERGs) for underrepresented communities

– Leadership development programs for women and minorities

– Partnerships with organizations that focus on increasing diversity in the insurance industry