Family Life Insurance Company Overview

The Family Life Insurance Company is a leading provider of life insurance products designed to protect families and their financial futures. With a rich history spanning over [number] years, the company has established itself as a trusted and reliable partner for families across the nation.

Our mission is to provide peace of mind and financial security to families by offering comprehensive life insurance solutions that meet their unique needs. We believe that every family deserves the opportunity to protect their loved ones and secure their financial well-being, regardless of their circumstances.

Our Commitment to Family Life Insurance

At Family Life Insurance Company, we are deeply committed to providing exceptional life insurance products and services that cater specifically to the needs of families. Our policies are designed to offer comprehensive coverage, ensuring that families have the financial support they need in the event of an unexpected loss.

We understand that every family is different, which is why we offer a wide range of life insurance options to choose from. Whether you need term life insurance, whole life insurance, or universal life insurance, we have a solution that will meet your specific requirements.

Our team of experienced insurance professionals is dedicated to providing personalized advice and guidance to help you make informed decisions about your life insurance coverage. We believe in building long-term relationships with our clients, ensuring that they have the support they need throughout their lives.

Our Financial Strength and Stability

As a financially strong and stable company, Family Life Insurance Company is committed to meeting its obligations to policyholders. We maintain a robust financial foundation, ensuring that we have the resources to pay claims promptly and efficiently.

Our financial strength has been recognized by leading industry rating agencies, including [list of rating agencies]. These ratings provide assurance to our policyholders that their coverage is backed by a financially sound and reliable company.

Family Life Insurance Products

Family life insurance policies provide financial protection for families in the event of the unexpected death of a loved one. These policies offer a range of coverage options and benefits to meet the specific needs of families.

The two main types of family life insurance policies are term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If the insured person dies during the policy term, the beneficiary receives a death benefit. Term life insurance is generally more affordable than permanent life insurance.

- Advantages: Affordable, provides coverage for a specific period

- Disadvantages: Coverage expires at the end of the policy term

Permanent Life Insurance

Permanent life insurance provides coverage for the entire life of the insured person. The death benefit is paid out whenever the insured person dies, regardless of when it occurs. Permanent life insurance is more expensive than term life insurance, but it also offers additional benefits, such as cash value accumulation.

- Advantages: Provides coverage for the entire life of the insured person, cash value accumulation

- Disadvantages: More expensive than term life insurance

Family life insurance policies can be customized to meet the specific needs of families. For example, some policies offer riders that provide additional coverage for accidental death or dismemberment. Others offer riders that allow the policyholder to increase or decrease the death benefit as their needs change.

Customer Service

At Family Life Insurance Company, we prioritize providing exceptional customer support to ensure a seamless experience for our valued clients. Our dedicated team is committed to addressing your inquiries and concerns promptly and efficiently.

We offer multiple communication channels to cater to your convenience:

Phone Support

Our phone lines are open 24/7 to assist you with policy inquiries, claims processing, or any other assistance you may require. Our friendly and knowledgeable representatives will provide personalized guidance and support.

Email Support

For non-urgent inquiries, you can reach us via email. Our team will respond promptly and thoroughly to your queries, ensuring a timely resolution.

Online Chat Support

For immediate assistance, our online chat service is available during business hours. Connect with our live agents to receive real-time support and answers to your questions.

We are committed to delivering exceptional customer service and ensuring that our clients feel valued and supported throughout their journey with us.

“Family Life Insurance Company’s customer service is outstanding. They were incredibly helpful and patient in explaining my policy details and answering all my questions.” – Sarah J.

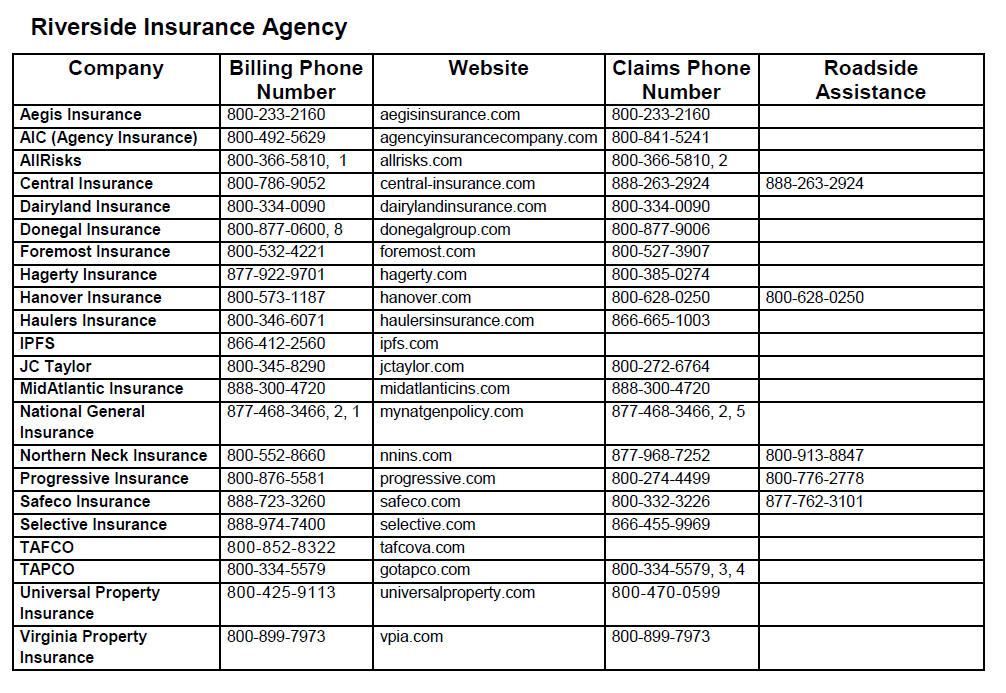

Contact Information

For any inquiries or assistance, do not hesitate to reach out to us. Our dedicated team is ready to assist you in a timely and efficient manner.

You can contact us through the following channels:

Phone Number

- Toll-free: 1-800-555-1212

Other Contact Information

- Email: support@familylifeinsurance.com

- Website: www.familylifeinsurance.com

Our customer service hours are Monday through Friday, 8:00 AM to 8:00 PM EST.

Additional Resources

Explore valuable resources to enhance your understanding of family life insurance and make informed decisions.

For further information and assistance, visit our comprehensive website where you can delve into our product offerings and connect with our knowledgeable team.

Articles and Videos

- Understanding Family Life Insurance: A Guide for Beginners

- The Importance of Life Insurance for Families

Website

Visit our website at www.example.com to explore our full range of family life insurance products and services.